Jan 31, 2026

Ethereum Layer 2s in 2026 – Arbitrum vs Base vs Optimism: which should you use?

Ethereum L2s aren’t “cheap gas experiments” anymore – they’re production infrastructure with different trade-offs, depending on what you actually do on-chain.

Most guides are either pre-Dencun (so the fee reality is outdated) or ecosystem-biased, so this one is built as a decision tree: your use case → your constraints → the L2 that fits.

If you’re trying to pick an L2 based on real market conditions (fees, TVL shifts, risk events), you need fresh context – not a static guide. Subscribe to Web Snack – daily crypto market recap.

TL;DR

In 2026, there’s no single “best L2” – there’s the best fit for DeFi liquidity, consumer apps, building, payments, or NFTs.

Arbitrum tends to win on DeFi depth and liquidity, Base on distribution/onboarding and consumer apps, Optimism on OP Stack and the Superchain builder narrative.

Don’t compare gas fees alone – include bridging cost, slippage, withdrawal time, bridge risk, and sequencer trust assumptions.

If you’re unsure: start where your favorite apps and liquidity already are, then optimize for fees later.

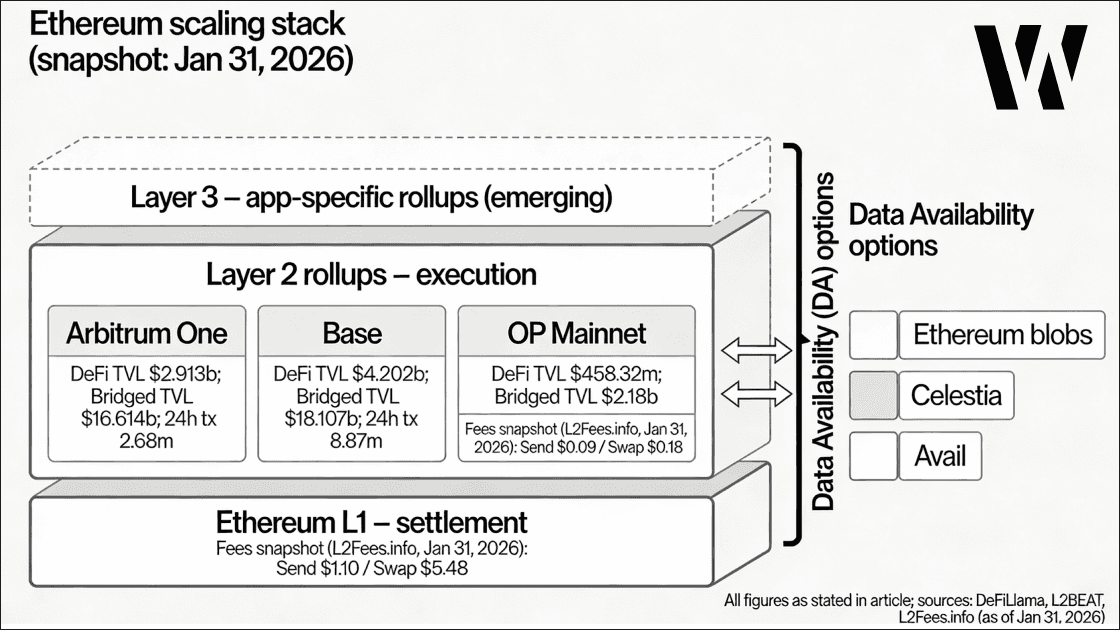

What is an Ethereum Layer 2 in 2026 – and why do you still need one after Dencun?

You still need an L2 in 2026 because it’s the easiest way to get Ethereum-grade settlement with a much better day-to-day UX (fees, speed, app usability).

Dencun made L2s cheaper, but it didn’t remove the core reason they exist: most activity is still too fee-sensitive to live comfortably on L1.

L1 vs L2: what changes for users (fees, UX, security assumptions)

On L1, you pay directly for scarce Ethereum blockspace and you get the “base layer” security model without extra moving parts.

On L2s, you usually get lower fees and smoother UX, but you accept extra assumptions around the sequencer, the bridge, and how or when withdrawals finalize.

One signal that L2s are “real usage” now: L2s hit about 1.9 million daily transactions in 2025.

Total L2 TVL is often shown in a roughly $38B–$47B range across late 2025 to early 2026, depending on the exact snapshot.

Optimistic rollups vs ZK rollups: the difference that matters in practice

Optimistic rollups and ZK rollups both push execution off L1 and anchor back to Ethereum, but they differ in how they prove correctness to L1.

For users, the practical differences usually show up in withdrawal mechanics, tooling maturity, and the exact bridge or sequencer trust model – not in marketing labels.

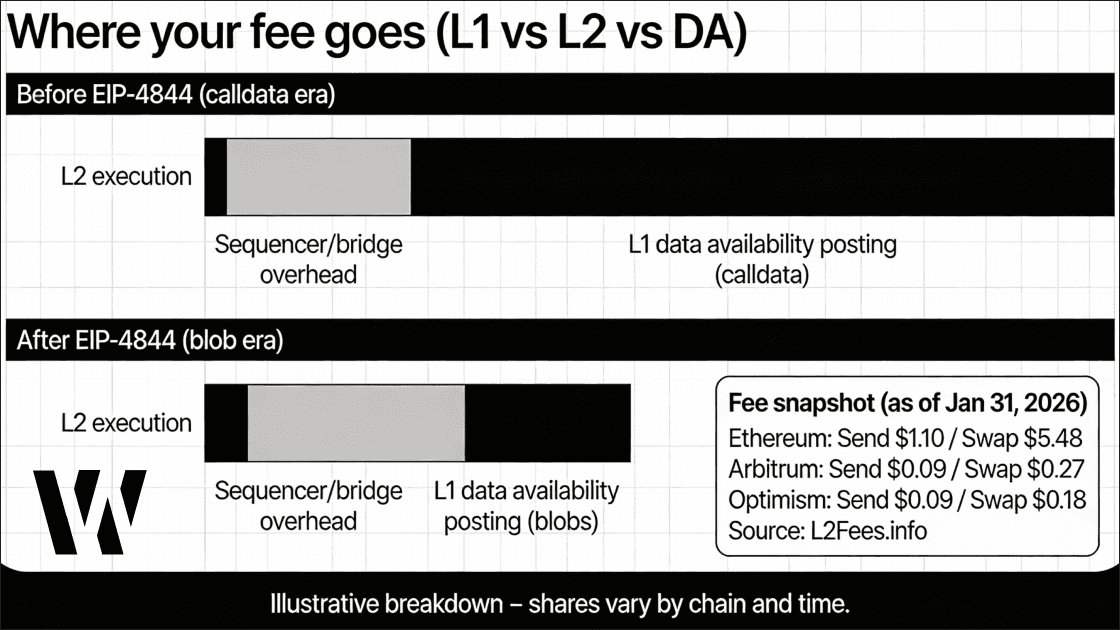

What EIP-4844 changed for costs (and what it didn’t)

EIP-4844 (activated in Dencun) is widely credited with slashing L2 fees, with reporting that some L2 fees fell as much as 98% in the immediate post-upgrade window.

One nuance worth keeping: DA can still be the dominant remaining cost component even after a major fee reduction, which is why fee comparisons stay time-sensitive.

Arbitrum, Base, and Optimism – what is each L2 best for (instead of “who wins”)?

Each of the big L2s is “best” at a different job, so the right question is what you’re optimizing for: liquidity depth, distribution/onboarding, or builder stack alignment.

If you force a single winner, you’ll usually pay the hidden tax somewhere else – like worse liquidity, riskier bridging, or clunkier UX.

Arbitrum: why liquidity and DeFi composability concentrate there

Arbitrum is consistently framed as the DeFi-heavy L2, and dashboard snapshots around the Dec 2025–Jan 2026 window show Arbitrum at roughly 44% L2 TVL share.

Depending on the TVL methodology (bridged vs DeFi-only vs other breakdowns), the exact dollar figure can vary across dashboards, so always confirm the definition before quoting it.

Base: distribution, onramps, consumer UX, and the Coinbase effect

Base is the L2 that keeps coming up when the goal is distribution and “consumer-friendly” onboarding rather than pure DeFi inertia.

Be precise with metrics here: “Base TVL” can mean different things, and some snapshots show Base at about $18.7B total bridged TVL in late January 2026.

Optimism: OP Stack, Superchain positioning, and why builders care

Optimism matters less as “one chain” and more as a stack strategy – OP Stack plus the broader Superchain idea is why builders pay attention.

Also be careful with labels: OP Mainnet’s share (often cited around 6% of L2 TVL) is not the same thing as “OP Stack ecosystem impact,” because multiple chains can share the same stack.

“Where do the apps live?”: a quick ecosystem map (Aave/Uniswap/Curve + more)

If you’re a user, “where are my apps and where is liquidity deepest” beats any abstract ranking.

If you’re validating it journalistically, map deployments and liquidity with time-stamped snapshots from public dashboards.

L2 Chain | Best for | Send ETH | Swap tokens | DeFi TVL | Bridged TVL | Daily tx | Active addresses (24h) |

|---|---|---|---|---|---|---|---|

Ethereum (L1) | Settlement layer, base security | $1.10 | $5.48 | 63,862b | $426,236b | 2.290m | 767,148 |

Arbitrum One | DeFi depth, large swaps, LP activity | $0.09 | $0.27 | $2.636b | $9,443b | 4.454m | 345,907 |

Base | Consumer apps, onboarding, payments | $0.003 | $0.009 | $4.4b | $3,008b | 11.514m | 483,939 |

Optimism (OP Mainnet) | Builders, OP Stack, Superchain | $0.09 | $0.18 | $256.46m | $609,09m | 2.412m | 82,130 avg |

L2 rankings change faster than narratives. TVL, dominant apps, and incentives rotate.

Get the daily ‘what changed’ email – Web Snack.

Which L2 is actually cheaper (and when) – a 2026 fees reality check

No L2 is “always cheapest” in 2026 – fees move with demand, data availability pricing, and each chain’s own congestion patterns.

So the only honest answer is “cheaper for what action, at what time, under what market conditions.”

Fees for common actions: swap, bridge, mint, simple transfer

If you want real numbers, use a live fee tracker and date-stamp the snapshot you’re quoting.

In this article, we’re not inserting point fee numbers because they become stale fast unless you pin them to a specific date and time.

Fee volatility: what happens during spikes

Fees can still rise when usage spikes – the magnitude varies by chain and by event, but “L2 fees are dynamic” is the right baseline assumption.

The practical move is boring but effective: check current fees before you move size, and batch actions when you can.

Hidden costs: slippage, MEV, and liquidity fragmentation

Low gas fees don’t automatically mean low total cost, especially if your trade routes through thin liquidity where price impact dominates.

Fragmentation across multiple L2s also adds “human overhead” – more approvals, more bridges, and more chances to click the wrong thing.

Network | Send ETH (USD) | Swap tokens (USD) |

|---|---|---|

Ethereum mainnet | 1.10 | 5.48 |

Arbitrum One | 0.09 | 0.27 |

Optimism (OP Mainnet) | 0.09 | 0.18 |

Base | $0.003 | $0.009 |

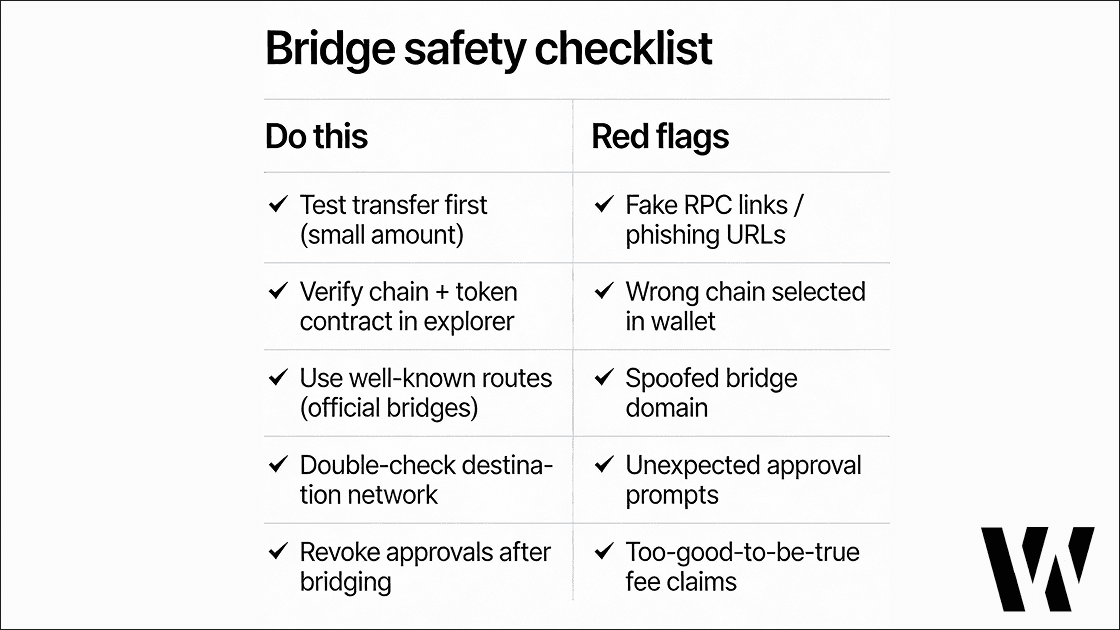

How do you bridge safely between Ethereum and L2s in 2026?

If you’re trying to avoid dumb losses, bridging safety matters more than shaving a few cents off gas.

The safest default is still: prefer well-known routes, verify the destination chain and token contract, and send a small test transaction first.

Canonical bridges vs liquidity bridges/aggregators: different risk profiles

Canonical bridges are tied to the L2’s own bridging design, while liquidity bridges/aggregators depend on third-party contracts and liquidity pools.

That’s not “good vs bad” – it’s a different set of risks, especially around smart contracts and liquidity availability.

The 5 failure modes: contract risk, operator risk, liquidity risk, UX mistakes, phishing

Most bridge incidents fall into a small number of buckets: code risk, operator risk, liquidity risk, user error, and phishing/spoofing.

If you treat bridging like wiring money – slow down, verify twice – you’ll dodge most avoidable mistakes.

A practical bridging checklist (test transfer, chain verification, explorer checks, approval hygiene)

Do a small test transfer, confirm you received the right token on the right chain in an explorer, and only then move meaningful size.

After you’re done, review and revoke unnecessary approvals to reduce future blast radius.

What’s next: Pectra, Layer 3s, and the data availability marketplace – what to watch in 2026–2027

The next wave isn’t just “more L2s” – it’s better wallet UX (Pectra), more app-specific scaling (Layer 3s), and serious competition in data availability.

If you’re choosing where to build or where to keep liquidity, these are the forces that can reshuffle the map again.

Pectra: which EIPs matter for wallets, UX, and L2 adoption

Pectra launched on May 7, 2025, and many summaries highlight EIP-7702 and EIP-7251 (raising validator stake limits to 2,048 ETH).

Rather than betting on hype, the practical lens is: does this reduce friction for users and builders enough to make L2 usage feel “default.”

Layer 3s: OP Stack L3s vs Arbitrum Orbit (what problems they solve)

Layer 3s are best understood as app-specific rollups on top of L2s, meant to customize execution environments, fees, and throughput for niche needs (games, social, high-frequency app logic).

Adoption metrics for L3s are still inconsistent across public dashboards, so be cautious with claims like “L3 is exploding” unless you can cite a specific dataset and timestamp.

DA choices: Ethereum DA vs Celestia vs Avail (cost, security, latency trade-offs)

Data availability is increasingly described as a marketplace where rollups choose between Ethereum DA and alternatives based on cost, security, and latency trade-offs.

This matters because DA costs can still dominate the cost structure after big upgrades, even when absolute fees are far lower than pre-Dencun.

Practical takeaways (by reader type)

If you’re new: pick the L2 with the simplest onboarding for you, do a tiny test bridge, and avoid unknown bridges and random tokens in week one.

If you’re DeFi-native: optimize for liquidity first (apps + pool depth), then fees, and keep one “home” L2 to reduce fragmentation and approval sprawl.

If you trade: watch stablecoin depth and slippage, not just gas, and always check “fee + price impact” before routing.

If you build: choose by stack compatibility (OP Stack vs Arbitrum tooling), distribution, and your tolerance for today’s sequencer/bridge trust model.

If you’re doing payments, NFTs, or consumer apps: prioritize UX and predictable fees, and don’t ship to five L2s on day one unless you have a clear reason.

Conclusion

In 2026, choosing an L2 is a product decision, not a micro-optimization for cheaper transactions.

If you frame it as a decision tree (use case → constraints → liquidity/apps → risk tolerance), the “L2 wars” turn into navigation – and that’s the reader value.

If this guide helped you choose an L2, Web Snack will help you stay on top of what changes after you choose.

Daily email – market recap, narratives, risks, and the 2–3 charts worth your time. Subscribe to Web Snack.

P.S. This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.