Dec 8, 2025

GM. This is Milk Road – the newsletter interrupting your Sunday to talk about desire…

Specifically: crypto consumer desire.

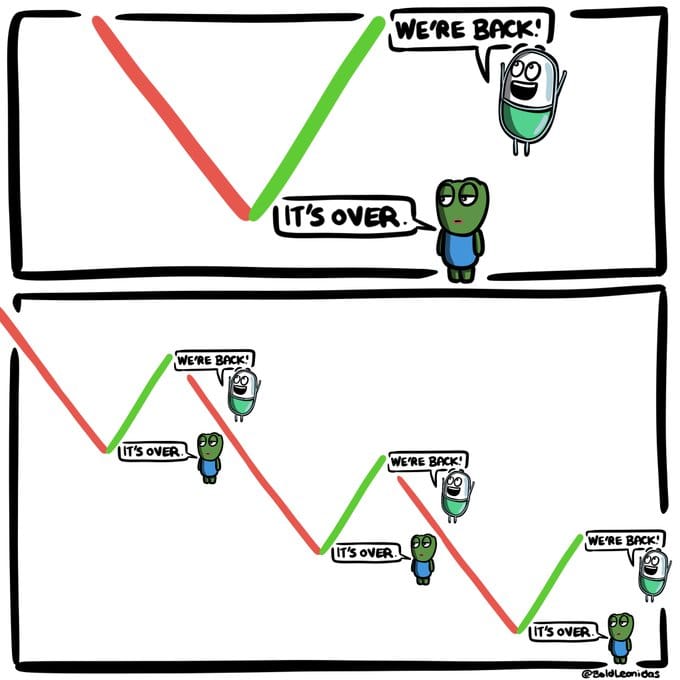

Because in crypto there are always two realities:

What users actually want

What developers think users want

These two are rarely the same.

Today, we're partnering with Paradex to talk about the former (what users actually want).

‘Cause most protocols pitch like users wake up every morning craving maximum decentralization, radical onchain transparency and World-War-3-resistant security…and that they’re happy to sacrifice speed, cost, and privacy to get it.

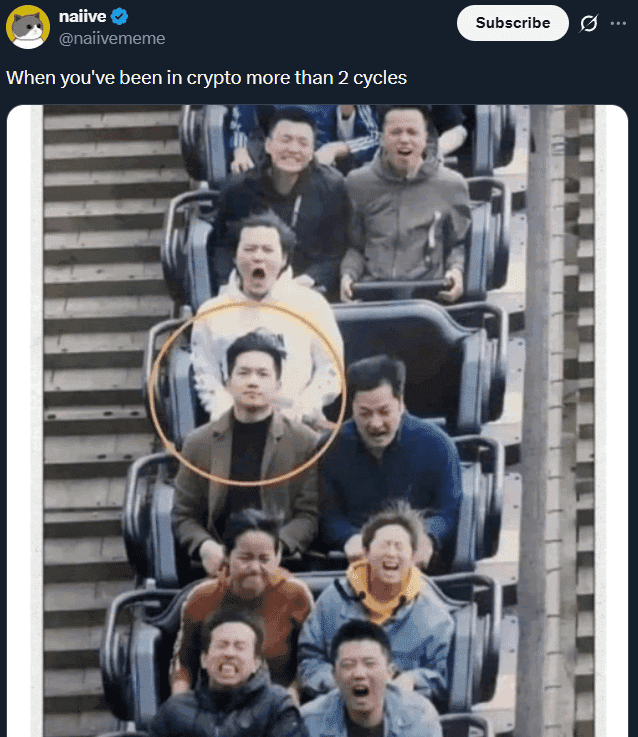

But 2025’s trends show something different…

Think about the big metas this year. Two jump out:

Perp DEXs

Privacy

And the data backs it up.

Perp DEX volume more than tripled this year, hitting $1.369T in October alone.

At the same time, while everything else was melting in October/November, Zcash – the OG privacy coin – ripped 900%+.

It’s not rocket science:

What people use and what they buy = what they actually want.

And if 2025’s metas say anything, it’s this:

People want to trade with leverage.

And they want to do it privately.

All of the major Perp DEXs offer leverage (duh), but none of them offer privacy.

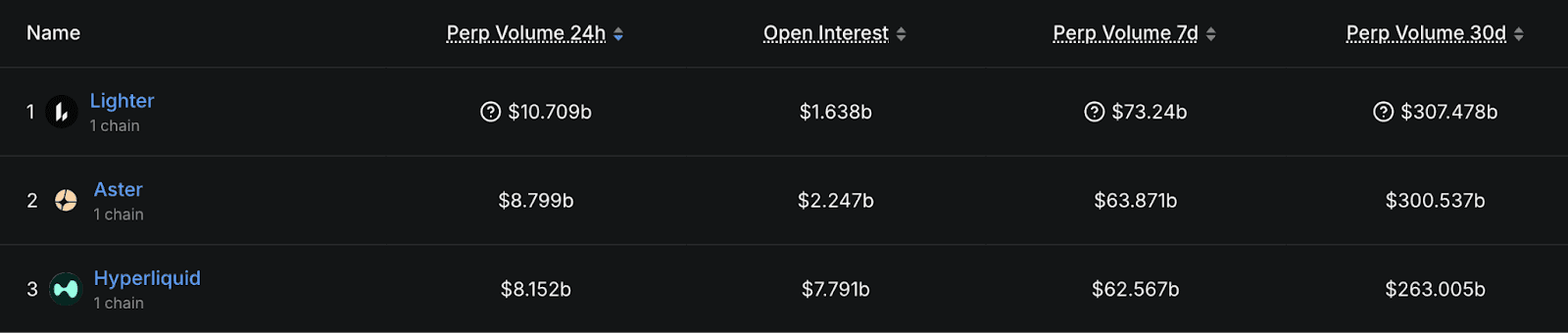

Right now, the big three in the perp wars (Lighter, Aster, and Hyperliquid) mainly compete on cost, speed and liquidity – enough to pull impressive numbers like this:

So, what would it take for a fourth player to come in and potentially knock them off their perches?

I think Paradex might have the right idea…

They’re aiming straight at both of 2025’s metas, combining a zero-fee perp DEX with institutional-grade privacy

On the perps side:

Users can trade 250+ markets with zero fees

With speeds to compete with the biggest names in the space

Incubated by Paradigm (the institutional liquidity network that trades ~$2.5B in daily options volume) – so fills feel more like a polished CEX than a janky DEX.

And on the privacy side, they hold similar weight:

Orders are visible but anonymous – they’re offchain and not linkable to any onchain account.

Positions and liquidation levels are onchain but encrypted – they require authentication on L2 and are encrypted on L1.

Point is: your trades are still verifiable, but they’re not legible to everyone in real time.

Why does that matter?

Because on transparent orderbooks, big traders get hunted.

Here’s how liquidation hunting works…

Say you’re bullish on Sky/Maker (SKY):

You put in $10k

Go 20x long

Now you’re running a $200k position

If SKY drops 5%, that position is worth $190k.

Your margin is gone, you get liquidated, and the platform uses the $190k to repay your lenders.

Now imagine everyone can see:

Your position size

Your liquidation level

Exactly where the pain starts

A large player can:

Borrow $90M of SKY, add $10M of their own, and sell $100M into the market →

Push the price down 5% →

Trigger your liquidation (and a bunch of others) →

Buy back lower, repay lenders, and pocket the difference…

This happens in traditional markets too, but in crypto, full transparency makes it way easier to target specific levels and positions.

Paradex’s bet is simple: you can’t scale finance onchain without privacy.

If you give traders CEX-like speed + DEX-level control + institutional-grade privacy, that’s enough of a wedge to pull serious size away from other platforms.

And zero fees are just the cherry on top.

Now, I know what you're thinking…

“My dude, this sounds cool and all, but I'm not trading in the millions – I'm not the target market for these kinds of platforms. Why’re you telling me about it?”

I hear you – and I felt the same way. But then I learned about their RPI feature…

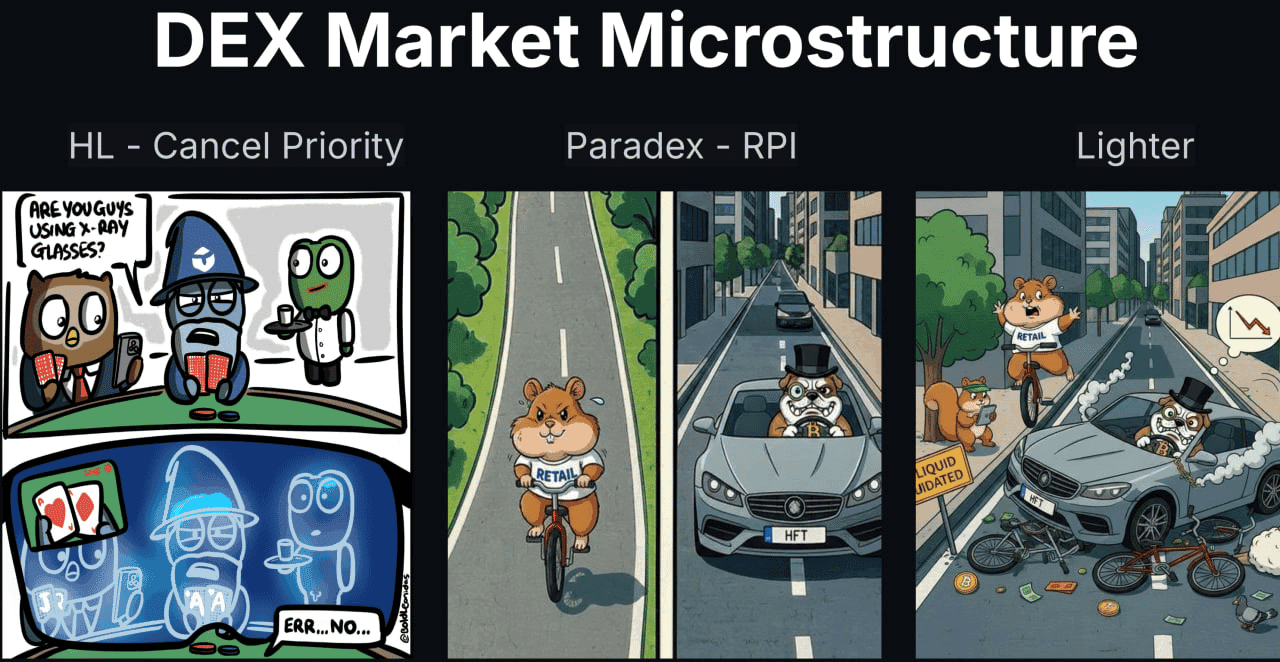

Paradex uses something called Retail Price Improvement (RPI) Orders (recently copied by Binance) to make trading fairer for everyday traders.

It carves out a retail-only lane, where retail trades are protected from high-speed, algorithmic players that have an unfair advantage.

The result is that retail can now trade at better prices than professional traders and with zero fees.

The way I’d frame it is they’ve essentially created a two lane highway:

One lane for Formula 1 cars (high frequency traders and bots) – a toll lane with fast access.

Another, safer lane for me (a retail trader) and my Toyota Camry – a protected lane with speed limits and no tolls.

Now, take all of that, bundle it with zero fees, deep liquidity, insane speeds, complete privacy…

And, shoot, these guys might be onto something!

👉 Click here to check out everything Paradex has to offer.

MILKY MEMES 🤣