Feb 2, 2026

DeFi’s Survival of the Fittest – Why Staking and Lending Dominate 2026 (and What’s Getting Killed)

January 2026 looked risk-off for crypto prices, yet parts of DeFi looked oddly resilient.

That contradiction is the story – the market isn’t “coming back everywhere”, it’s concentrating into a few battle-tested primitives.

Want the daily version of this map? Subscribe to Web Snack – a quick daily crypto + macro rundown: what moved, why it mattered, and what to watch next. No hype, just signal.

TL;DR

DeFi capital is clustering in staking + lending (and now restaking), not chasing random farms.

The winners look boring on purpose: deep liquidity, audited code, and simple value props.

Restaking can boost yield, but it adds new slashing and complexity risks you must price in.

Use a “risk budget” framework – not vibes – to decide where DeFi fits in 2026.

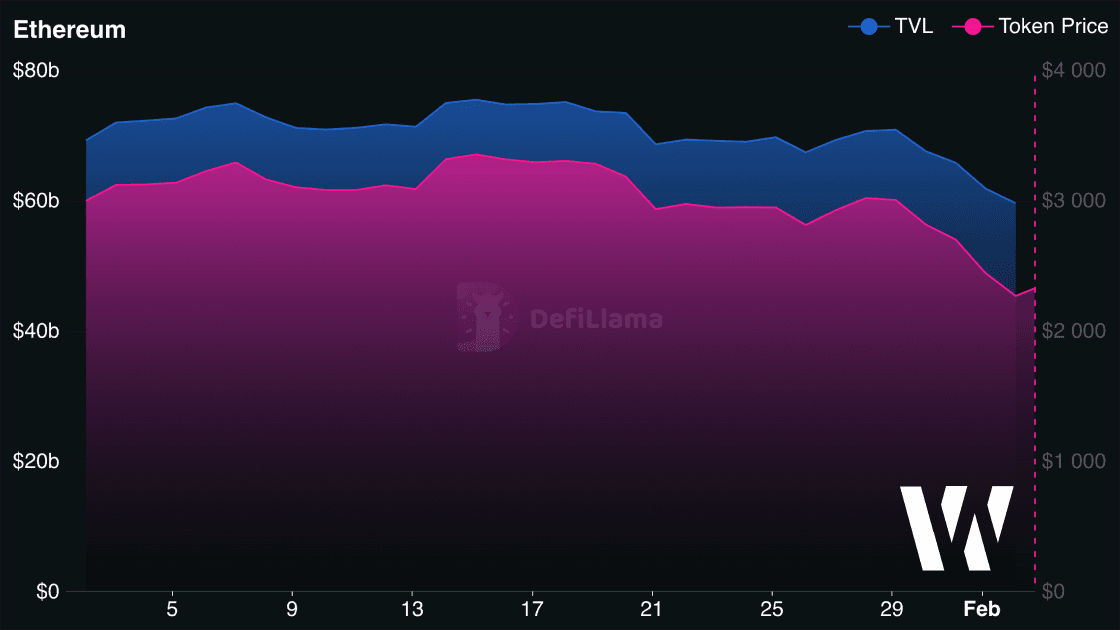

Why did DeFi TVL rise while prices fell in January 2026?

Because TVL can reflect where capital sits (and what it’s trying to do), not just market mood – and in a high-rate, risk-off environment, yield still attracts sticky capital.

What “TVL” really measures (and what it hides)

TVL is a useful headline, but it’s not a clean proxy for “more users” or “healthier DeFi” on its own.

It can move because incentives changed, because users rotated between protocols, or because leverage and composability created multiple layers of exposure to the same base assets.

A good skeptical reading is: TVL is a signal, then you ask what category gained, which chain gained, and what the risks are.

If you skip that second step, you’re basically trading a chart aesthetic.

The macro backdrop – high rates, risk-off, and why yield still pulls capital

In late January, macro conditions still felt tight, and crypto traded like a high-beta risk asset.

At the same time, ETH had a rough month, which makes any “DeFi resilience” story feel counterintuitive.

So if DeFi holds up (or rebounds) in that tape, it’s rarely “everyone got bullish again”.

More often it’s a rotation toward income-style positioning – or simply capital choosing the deepest venues because it doesn’t trust the rest.

The “stickiness” thesis – why some on-chain capital doesn’t leave with price

Some DeFi positions are operationally “sticky”: moving collateral and unwinding strategies costs time, fees, and attention, so capital doesn’t instantly exit just because price is red.

Also, not all participants are trying to time bottoms – some are trying to earn carry while surviving volatility.

One more nuance: TVL can swing inside the same month depending on the exact snapshot date.

Translation: even the “TVL comeback” needs timestamps, not vibes.

Why are staking and liquid staking taking over DeFi’s “base layer”?

Because staking is the simplest “default yield” in Ethereum’s ecosystem, and liquid staking makes that yield usable across DeFi instead of locked away.

Staking 101 – where rewards come from (issuance, fees, MEV)

At a high level, staking pays validators for securing the network, and those rewards typically come from protocol issuance plus transaction-related revenue.

The practical point isn’t the math – it’s that staking created an on-chain “base rate” people can build around.

When rates are high and markets feel fragile, a base-rate narrative tends to age better than “farm this new token for 3 days”.

That’s why you keep seeing staking at the center of modern DeFi.

Liquid staking (stETH etc.) – why it wins UX and composability

Liquid staking tokens exist for one reason: users want staking exposure and liquidity.

Once you have a liquid staking token, it can become collateral – which is where staking stops being a “set-and-forget” product and becomes DeFi plumbing.

If you’re quoting protocol rankings by TVL, treat them as “as-of” snapshots and keep your dataset consistent across protocols and timestamps.

Otherwise you’ll end up comparing different days and calling it analysis.

Hidden risks – depeg, smart contract risk, validator concentration

Liquid staking isn’t a free upgrade; it adds smart contract risk, liquidity risk (including depegs), and concentration questions.

Those risks tend to matter most in exactly the kind of market January 2026 was: volatile and risk-off.

If you’re allocating, the right question is not “what’s the APR?”.

It’s “what can break, how fast, and do I still like the trade if it breaks?”.

If you’re trying to stay on the right side of the risk curve, Web Snack helps. It’s a daily market snapshot with the few numbers and narratives that actually change positioning – so you don’t have to doomscroll Crypto Twitter.

Top DeFi Liquid Staking Protocols on Ethereum

Staking prolocol | TVL | 30d change | Key risk |

|---|---|---|---|

Lido | $22.031B | -21.2% | Validator/operator concentration; smart-contract risk. |

Rocket Pool | $1.327B | -29.7% | Smart-contract risk; rETH liquidity risk in stress. |

StakeWise V2 | $947.12M | -22.7% | Smart-contract + upgrade/module risk. |

mETH Protocol | $660.47M | -4,36% | Issuer/implementation risk; smart-contract risk. |

Liquid Collective | $650.08M | -28.4% | More permissioned/operational risk; smart-contract risk. |

Why is DeFi lending consolidating (Aave vs everyone), and what does “sustainable yield” look like now?

Because risk-off markets punish weaker collateral and thinner liquidity, and users migrate toward the most battle-tested lending venues.

“Sustainable yield” in 2026 looks more like boring rate curves and risk controls than like viral APY screenshots.

How lending yield is created – utilization, demand drivers, collateral quality

Lending yield ultimately comes from borrowers paying to borrow, which depends on demand, utilization, and collateral and risk parameters.

In volatile regimes, the risk engine matters as much as the headline rate, because liquidations are the real product.

This is one reason “TVL going up” can coexist with “prices going down”.

In a drawdown, investors often stop chasing upside and start paying for survivability.

Aave vs Compound vs Morpho – what’s actually different in 2026

At the journalist level: Aave is usually the “big tent” with deep liquidity, Compound is often the conservative baseline, and Morpho is positioned around capital efficiency.

For readers, the takeaway is simple: don’t pick a venue by vibes; pick it by how it behaves under stress.

If you’re publishing rankings, pull a consistent dataset for the same timestamp across protocols.

Otherwise you’re mixing snapshots and calling it a league table.

Real yield check – stablecoin lending vs money-market funds and Treasuries

When you lend stablecoins, you’re not competing with “zero”. In most readers’ heads, you’re competing with the simplest yield they can get in traditional finance.

Treasuries and money-market funds may look boring, but they also don’t come with smart contract risk.

This doesn’t make DeFi yield “bad”. It just means the yield spread has to pay for real risks: smart contracts, oracles, stablecoin depegs, and liquidity shocks.

If that spread is thin, the trade only works when you’re confident those risks are genuinely priced.

Case study (verifiable): “Risk-off month playbook” (no recommendations)

January 2026 works as a stress test because risk aversion tends to expose weak risk models fast.

The point isn’t to “prove” one protocol is best – it’s to show what happens to yields, utilization, and liquidity when conditions get uncomfortable.

If you want this case study to feel real, keep it simple: one day, one set of rates, one clear decision rule, and one risk limit.

Everything else is narrative.

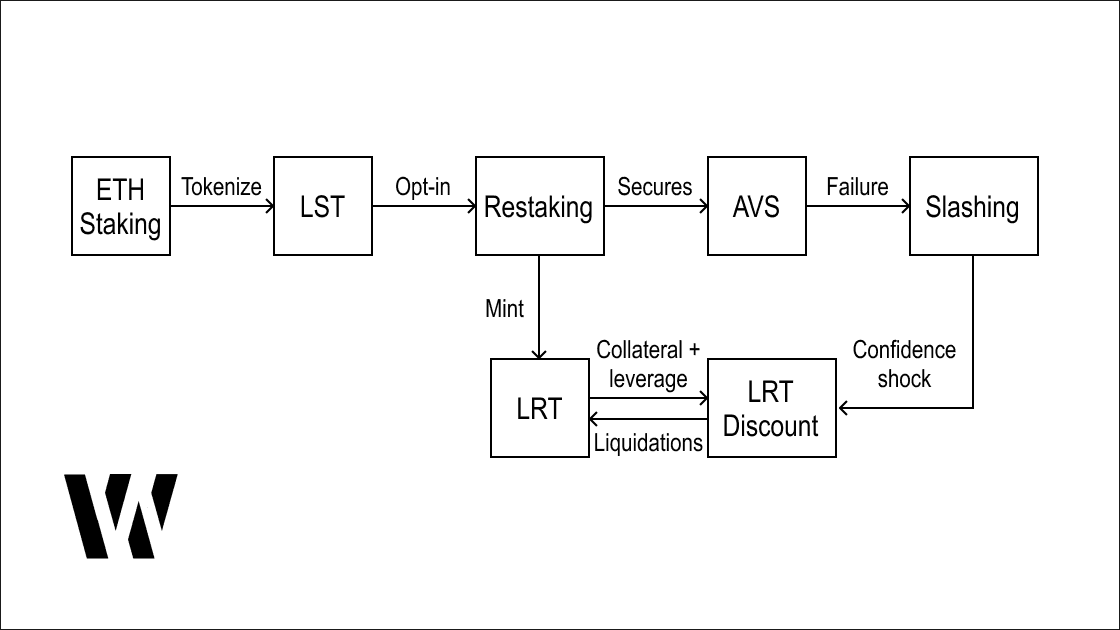

What is Ethereum restaking (EigenLayer), and what new risks did it introduce?

Restaking is the idea of reusing Ethereum’s staked security for additional services, aiming to earn extra yield – but it adds new slashing and complexity risks.

The core risk is dependency stacking: more links in the chain means more ways to break.

Restaking explained – AVSs, slashing, and why it’s not “free extra yield”

Restaking designs generally introduce extra conditions under which you can be penalized (slashed), which is why the yield exists in the first place.

If a UI makes it feel like “just click for extra APR”, you should assume you’re missing risk details.

So the fair framing is: restaking might be attractive, but it’s not a free lunch.

If you can’t describe what you can get slashed for, you’re not ready to size it meaningfully.

Liquid restaking tokens (LRTs) – liquidity, leverage, and contagion paths

LRTs try to make restaking liquid and composable, which is powerful – and also a fast path for contagion if collateral chains get stressed.

This is where “more yield” can quietly become “more correlation” in a drawdown.

Being skeptical here is rational, not Luddite.

Your job is to price the risk, not to fall in love with the narrative.

A risk framework – what you must validate before chasing restaking APY

Before allocating, validate: slashing conditions, operator set, withdrawal mechanics, audits, and where liquidity could vanish first.

Also separate “incentive APR” from “durable yield”, especially if rewards are paid in new tokens.

As with all rankings, treat TVL numbers as “reported at the time” unless you standardize the dataset and timestamp.

That one habit removes a lot of accidental misinformation.

Which DeFi categories are “getting killed” – and how do you spot the next losers early?

The categories that struggle most are the ones that can’t survive without constant incentives, heavy leverage, or thin-liquidity assumptions.

You spot them early by watching TVL decay, incentives cliffs, and dependency risk – not by staring at token candles.

The extinction list – high-leverage farms, unaudited forks, thin liquidity ecosystems

High-leverage farms tend to unwind violently when volatility spikes, because liquidations compress time.

Unaudited forks and thin-liquidity ecosystems also get punished in risk-off periods, because trust concentrates into venues with more battle-testing and deeper liquidity.

If your protocol’s TVL is “incentives in, incentives out”, it’s not a moat – it’s a campaign.

Campaigns end.

Security reality check – why hacks and phishing change user behavior (capital flight to blue chips)

Security incidents don’t just create losses – they also change user behavior, pushing capital toward simpler, more trusted venues.

Even if you ignore individual headlines, the market effect is predictable: trust concentrates.

When trust concentrates, TVL does too.

And that’s why the “winners” in DeFi often look boring.

Early warning dashboard – TVL decay, incentives cliffs, governance drama, oracle/bridge dependencies

An early warning dashboard for DeFi is mostly boring: TVL trend, fees and volume trend, incentive runway, concentration, and dependency map (bridges, oracles, major collateral).

If TVL is bleeding while incentives are still high, that’s a strong sign the market doesn’t trust the setup.

Also watch for governance drift – when parameters get loosened to defend TVL instead of defending solvency.

That’s how a “good yield venue” turns into a liquidation engine pointed at depositors.

The DeFi Survival Checklist – 12 questions to ask before depositing:

What is the actual source of yield (borrow demand, fees, incentives)?

What are the top risks you’re paying for (contracts, oracle, liquidity, governance)?

Is the project transparent about incidents and fixes?

What can trigger liquidations or cascades?

What’s the dominant collateral, and how does it behave in stress?

How concentrated is TVL (whales, single pools, single chain)?

How do withdrawals work (queues, delays, caps)?

Can you exit via contracts if the UI/provider fails?

What are the biggest dependencies (bridges/oracles/LST/LRT issuers)?

What is the incentive runway – and what happens when it ends?

Has the protocol survived a real drawdown without emergency chaos?

If this goes to zero tomorrow, is your portfolio still fine?

Practical takeaways

New to DeFi: Start with 1–2 blue-chip protocols only; cap position size; avoid restaking until you can explain slashing in one sentence.

Active DeFi user: Treat yields as a function of risk – track utilization, liquidity, and withdrawal queues weekly, not price candles.

Capital allocator (family office / fund): Build a policy – custody model, smart-contract risk process, and a protocol allowlist with dated review notes.

Builder / protocol team: If your TVL depends on emissions, assume it’s temporary – ship real fee-based demand, audits, and predictable risk controls.

Conclusion

DeFi’s 2026 story isn’t “number go up” – it’s natural selection under tighter liquidity: staking and lending fit the environment, and everything else has to evolve or die.

If you treat DeFi like infrastructure – risk budgets, verification, and boring diligence – you can participate in the upside without becoming exit liquidity for the next farm cycle.

Build your DeFi instincts one day at a time. Web Snack is a daily crypto market email – short, practical, and skeptical-but-fair. Subscribe and get tomorrow’s market overview in your inbox.

P.S. This article is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.