Feb 3, 2026

🍪 Today's Snack

Crypto is trying to regain its footing after a capitulation-style flush that dragged Bitcoin into the mid-$70Ks and sparked a liquidation cascade. This morning’s tape is firmer, with BTC up and majors bouncing, but sentiment still screams “don’t get complacent.”

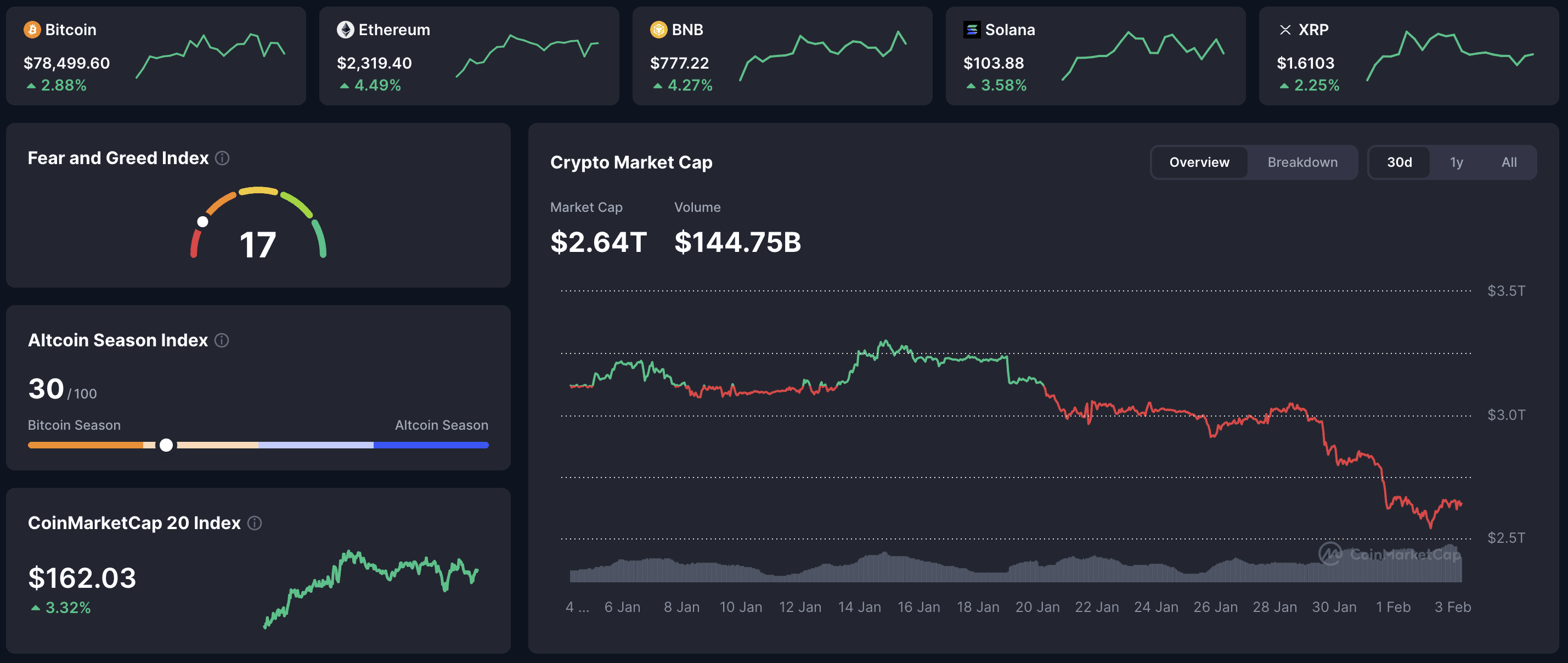

📈 24h Crypto Market Snapshot

Total crypto market cap hovered around $2.64T while Fear & Greed stayed at 17 (Extreme Fear), keeping positioning cautious despite the macro relief tone.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $78,499 | +2.88% | $1.56T |

ETH | $2,319 | +4.49% | $279B |

BNB | $777 | +4.27% | $105B |

SOL | $103 | +3.88% | $58B |

XRP | $1.61 | +2.25% | $98B |

Grind up, but it still feels like a post-capitulation bounce more than a clean trend shift.

🔥 Top 3 Movers & Shakers

Hyperliquid (HYPE) – +22.5%

HYPE jumped as Hyperliquid pushed deeper into tokenized trading via the HIP-3 upgrade, with buy-and-burn dynamics adding fuel.

Takeaway: It looks like a rare “utility bid” in a fragile tape – traders still pay up for real activity when the rest of the market is hesitant.Zcash (ZEC) – -4.7%

ZEC kept sliding after the ECC core team resignation hit sentiment, with technical damage piling up below $500.

Takeaway: This suggests narrative breaks plus broken structure can overwhelm “privacy coin” rotation, even when some holders try to step in.Zilliqa (ZIL) – +80.9%

ZIL ripped on what looked like pure speculative momentum, with volume jumping to $288.87 million.

Takeaway: Classic wildcard behavior – big upside fast, but the lack of a clear catalyst usually means a fast unwind is also on the table.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $561M in net inflows yesterday, while Ethereum ETFs saw $2.9M outflows. The flip in BTC flows suggests capitulation-style demand may be showing up, while ETH still looks like the weaker tape.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: U.S. equities rebounded on February 2 (S&P 500 +0.5%, Dow +1.1%, Nasdaq +1%) after a volatile overnight selloff in Asia tied to Kevin Warsh Fed nomination fears and AI bubble concerns. Gold and silver kept falling, reinforcing a tighter, risk-sensitive backdrop even as stocks stabilized.

On-Chain Highlights: Bitcoin’s entity-adjusted NUPL has shifted from “Belief” into “Anxiety,” with MVRV around 1.5, suggesting profits have compressed and positioning is still being worked off. DeFi TVL has dropped from $171.99B in early October 2025 to $115.13B by February 2, 2026, pointing to capital pulling back across major protocols.

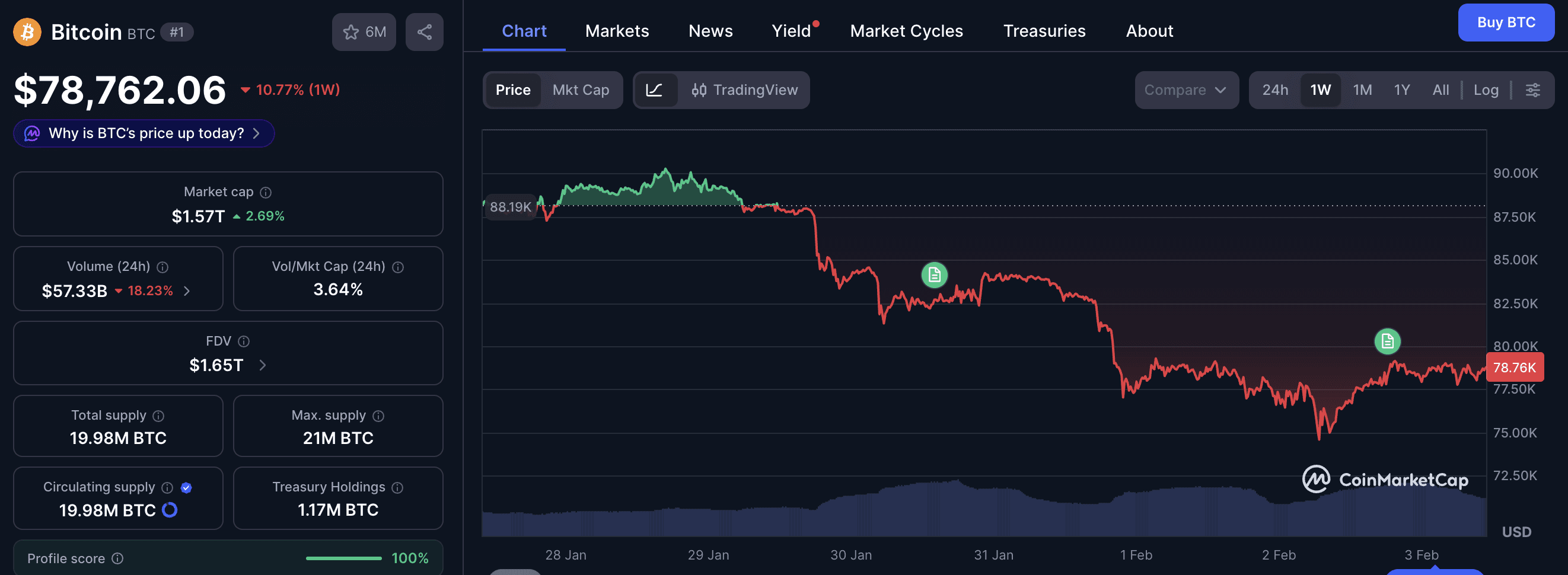

🔍 Deep Dive – Bitcoin’s $75K capitulation and what “reset” really means

Bitcoin’s sweep to $74,591 on February 2 was a forced unwind more than a “new information” day. Roughly $2.5615 billion in total crypto liquidations hit the tape, and the vast majority were longs – classic leverage getting flushed.

That fits the larger pattern: Bitcoin was down about 11% in January 2026, extending a four-month losing streak from October 2025 through January 2026, its longest run of monthly declines since 2018. In that kind of regime, bounces tend to be traded defensively until proven otherwise.

On-chain reads like a reset in progress, not a clean restart. Entity-adjusted NUPL moved from “Belief” to “Anxiety,” MVRV sits around 1.5, and the Puell Multiple at 0.9 points to miner margin compression – all consistent with a market clearing excess and repricing risk.

The February 2 divergence mattered too: BTC fell 2.1% while the S&P 500 rose 0.5% and the Nasdaq gained 1%, showing crypto-specific deleveraging can still overpower macro relief.

The simplest tell now is the same one everyone’s watching: hold the $73K–$75K zone and reclaim $80K without another cascade, or risk the downside path staying open.

📰 Top News

Nasdaq removes ETF options position limits: The SEC approved Nasdaq’s rule change on February 2, making it effective immediately for spot Bitcoin and Ethereum ETF options.

CrossCurve bridge exploit: CrossCurve said attackers spoofed cross-chain messages and drained about $3M, with a 72-hour deadline issued for fund return.

FTX distributions continue: The estate has completed $7.1B in payouts across three rounds, with the next distribution window set for January–March 2026 and a February 14, 2026 record date.

Tether scrutiny returns: S&P assigned USDT a “4” constrained assessment, citing limited disclosure around custodians and reserve structure despite public claims of large T-bill holdings.

Crypto crime data point: Chainalysis reported Chinese organized crime networks moved $16.1B in illicit crypto in 2025, largely using USDT and Telegram coordination.

📊 Daily Wrap-Up

Today reads like stabilization after a leverage purge, not a full mood shift. BTC is up, majors are bouncing, yet Extreme Fear at 17 keeps the market in “survive first” mode. The cleanest split is in flows: BTC ETFs turned sharply positive while ETH ETFs stayed slightly negative, reinforcing that BTC remains the primary liquidity magnet.

Today's Watch List: Whether Bitcoin can hold the $73K–$75K zone and reclaim $80K without another liquidation wave. Also watch if equities stay firm while BTC underperforms again – that divergence has been an important tell.

Read more on Web Snack – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.