Feb 2, 2026

🍪 Today's Snack

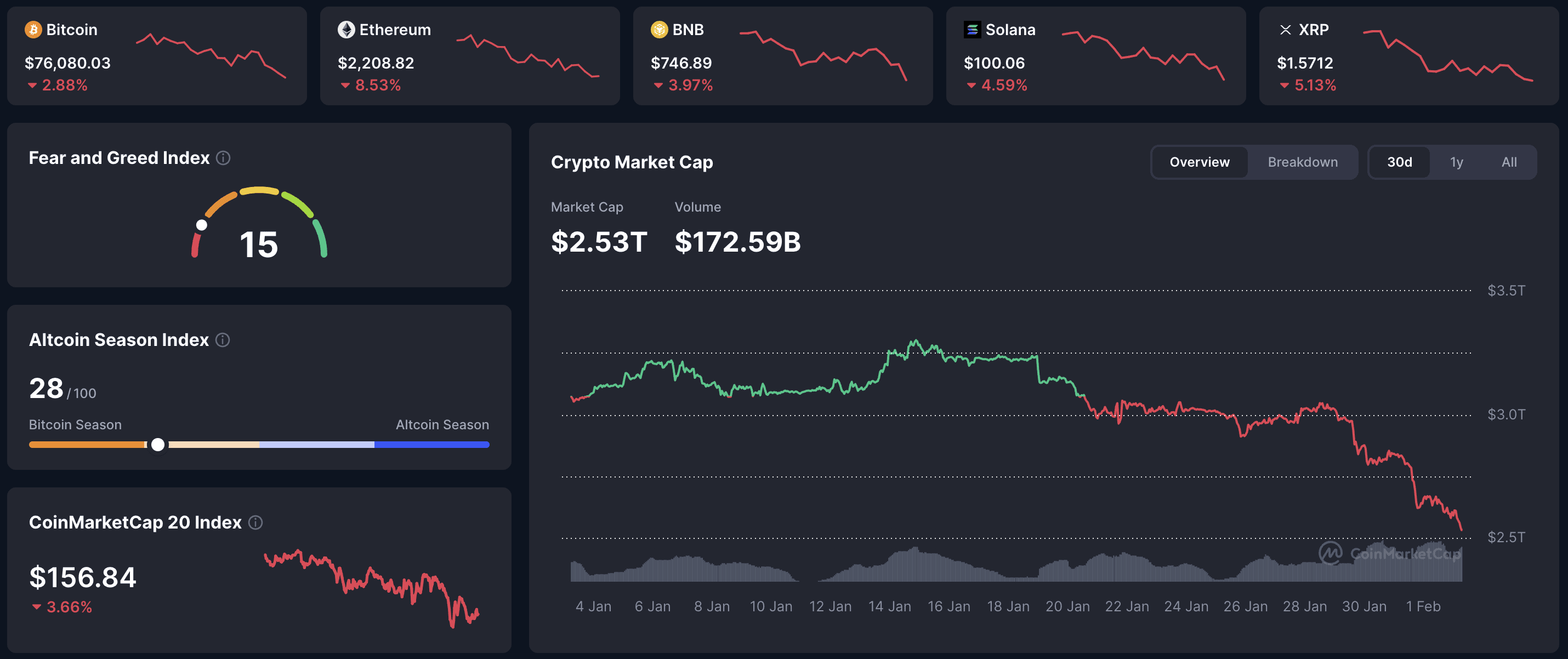

Crypto stayed under pressure as the Warsh nomination rewired macro expectations and the gold–silver crash spilled into everything. Sentiment is now in Extreme Fear, and bounces look fragile.

📈 24h Crypto Market Snapshot

Total crypto market cap fell to $2.53T while Fear & Greed dropped to 15 (Extreme Fear), reflecting a market still in de-risk mode.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $76,080 | -2.88% | $1.49T |

ETH | $2,208 | -8.53% | $266B |

BNB | $746 | -3.97% | $101B |

SOL | $100 | -4.59% | $56B |

ADA | $28 | -3.78% | $10.2B |

Selloff – not panic speed, but persistent risk-off pressure with buyers stepping back.

🔥 Top 3 Movers & Shakers

MYX Finance (MYX) – +8.5%

MYX bounced into February 1 despite broad weakness, helped by short-covering after a sharp drop and renewed interest in DeFi perps.

Takeaway: This looks like an oversold rotation into low-float beta, with the next test sitting at the $6.00–$6.50 resistance zone.Monero (XMR) – -9.7%

XMR extended its post-ATH unwind, slipping toward $405 after breaking below $500 support as the market repriced risk around Warsh.

Takeaway: The move looks like a narrative comedown plus technical damage, and it stays vulnerable unless broader sentiment flips.Bitcoin (BTC) – -2.5%

BTC continued grinding lower across the window as flows stayed heavy, liquidations piled up, and the $80K break changed the structure.

Takeaway: The key question now is whether the market can defend the October breakout zone ($72K–$75K) without a macro stabilization catalyst.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $509M in net outflows, while Ethereum ETFs saw $252M outflows.

Flow read: Institutional capitulation – the $1.33B Bitcoin ETF exodus (Jan 29–30) frames this as a ‘risk reset,’ with Warsh priced as a hawkish threat to liquidity.

🌍 Market Context

Macro Pulse: Trump nominated Kevin Warsh as the next Fed chair on January 30, and markets instantly repriced toward dollar strength and tighter policy credibility. Gold and silver then crashed hard, and crypto traded as a high-beta risk asset into that unwind.

🔍 Deep Dive – Warsh Day rewired the macro trade

The core story of this window is speed: Trump’s January 30 nomination of Kevin Warsh flipped the market from “debasement trade” to “higher-for-longer credibility” in hours. Gold dropped 9.7% in a day and silver collapsed 31.4%, while Bitcoin slid into the same risk-off air pocket instead of acting as a hedge.

Crypto’s damage looks structural, not just emotional. Bitcoin ETF flows showed a historic exit: $1.327B of outflows across Jan 29–30, with about $2.82B drained over the Jan 20–30. At the same time, ERC-20 stablecoin supply fell by $7B (from $162B to $155B), which reads like capital leaving the arena rather than rotating internally.

The final accelerant was leverage: liquidation cascades can gap price lower even without a big spike in exchange deposits.

What it suggests: The “digital gold” narrative didn’t just underperform – it failed the exact macro setup it’s supposed to thrive in, and the market is now trading BTC as correlated risk until liquidity conditions stabilize.

📰 Top News

Bitcoin: BTC fell to $78,621.11 on January 31 (intraday low $75,815.88), down 6.49% day-over-day and 18.1% from the January 14 peak of $96,000, extending to 37.7% below the October 2025 ATH of $126,198.

Market breadth: Total crypto market cap slid from $3.06T to roughly $2.95–$3.0T over January 30–31, with 95 of the top 100 tokens down as de-risking hit alts hard.

Security: Step Finance was hacked on January 31, with 261,854 SOL (about $30M) stolen via direct wallet compromise, and the STEP token dropped 90% from $0.037 to $0.003.

Ethereum: Vitalik Buterin withdrew 16,384 ETH (about $43–$45M) on January 29 to fund open-source work, as the Ethereum Foundation entered a “period of mild austerity” for the next five years.

Politics + crypto: World Liberty Financial sold a 49% stake to a UAE-linked firm for $500M, with the deal reportedly finalized by Eric Trump four days before Donald Trump’s January 2025 inauguration and two aides joining the board.

📚 Education Bits

💡 Pro Tip: In Extreme Fear, watch whether stablecoins are growing or shrinking – expansions often signal “dry powder,” contractions often signal cash leaving crypto entirely.

📊 Metric Explained: Liquidations can dominate a down day; when leverage unwinds, price can fall hard even if spot selling is muted.

📊 Daily Wrap-Up

This market is still digesting a macro regime shift: Warsh repricing, a violent metals unwind, and a crypto complex that couldn’t decouple. ETH is taking the brunt of the move, while BTC continues to search for a credible base after losing key structure.

Today's Watch List: Whether BTC can hold and reclaim levels without fresh ETF pressure, and whether stablecoin contraction slows – if not, bounces may keep getting sold.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.