Feb 5, 2026

🍪 Today's Snack

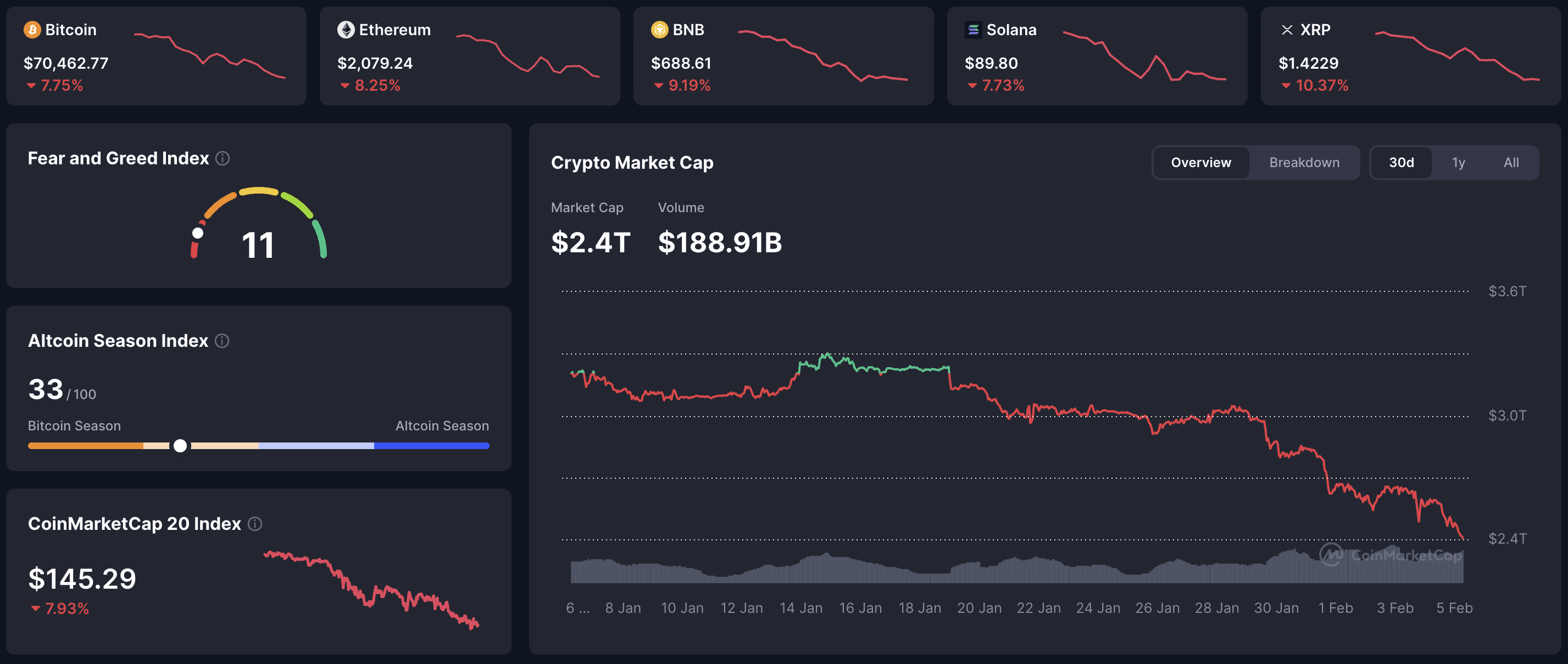

Crypto took another leg down, with BTC and majors sliding hard as Extreme Fear deepened. XRP was the standout on the board, but the broader tape still reads like forced de-risking, not a healthy rotation.

📈 24h Crypto Market Snapshot

Total crypto market cap hovered around $2.4T while Fear & Greed stayed at 11 (Extreme Fear), keeping positioning cautious despite the AI and funding-stress overhang.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $70,462 | -7.75% | $1.4T |

ETH | $2,079 | -8.25% | $251B |

BNB | $688 | -9.19% | $93B |

SOL | $89.8 | -7.73% | $50B |

XRP | $1.42 | +10.37% | $86B |

Selloff, with stress showing up across funding and high-beta positioning.

🔥 Top 3 Movers & Shakers

Monad (MON) – +5.0%

MON held a small bid, supported by ongoing attention to Monad as a high-throughput EVM L1 and anticipation around upcoming network upgrades.

Takeaway: This looks like narrative positioning, but it’s still trading at the mercy of broader risk-off.Zcash (ZEC) – -12.9%

ZEC broke below the $300 level as sentiment stayed in Extreme Fear and technicals turned “strong bearish,” extending the unwind of a prior winner.

Takeaway: In a weak tape, even accumulation-style signals don’t always stop the de-risking.Linea (LINEA) – -8.6%

LINEA slid with no single clear catalyst, looking more like general liquidity pressure than fresh protocol-specific bad news.

Takeaway: This reads as a market-driven move – when the tape is heavy, “fine fundamentals” often don’t matter intraday.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $175M outflows yesterday, while Ethereum ETFs saw $20M outflows. The read is straightforward risk-off: institutions trimmed both core exposures as AI-linked equity stress and stablecoin uncertainty kept the macro tone shaky.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: U.S. equities slipped on February 4 with tech under pressure, and the VIX moved back to 18 as “AI disruption” worries hit the Nasdaq 100 harder than the broader market. Interpretation: this kind of tech-led wobble tends to spill into crypto because it trades like a high-beta expression of the same risk appetite.

🔍 Deep Dive – Fireblocks + Stacks: Bitcoin DeFi that institutions can actually touch

Fireblocks integrating Stacks is a meaningful shift for “Bitcoin yield” because it changes the distribution, not just the narrative. Fireblocks serves over 2,400 institutional clients and processes more than $5T in digital asset transfers per year, and it already supports 150+ public blockchains – so adding Stacks effectively puts Bitcoin-native DeFi on a familiar institutional console.

What clients can do now is more concrete than “chain support.” Through Fireblocks, institutions can custody STX, mint or bridge sBTC, and access Stacks-based DeFi protocols like Dual Stacking, Bitflow, Hermetica, Zest, and Granite using their existing MPC keys, approval flows, and DeFi controls. For a bank or fund, that’s the difference between “a new wallet project” and “a new product toggle.”

Stacks’ pitch also fits a risk-committee story: after the Nakamoto upgrade in October 2024, Stacks is positioned as tightly anchored to Bitcoin finality, and it targets faster app behavior with blocks around five seconds. sBTC went live in December 2024 as a native BTC representation on Stacks, which matters for institutions that dislike the optics and counterparty surface area of “random wrapped BTC.”

The honest open question is product-market fit. Ethereum DeFi is battle-tested; Stacks DeFi is newer, and institutions already have off-chain yield and structured strategies that compete for BTC capital. What will decide whether this becomes real is measurable adoption: sBTC supply in circulation, TVL across the Stacks DeFi stack, and whether large-sized flows show up beyond retail-sized experimentation.

📰 Top News

AI shock hits software: Anthropic’s open-source Claude Cowork plugins helped trigger a roughly $285B selloff across software and data-heavy stocks, reinforcing risk-off across tech-linked trades.

Tether trims fundraising plans: Tether reportedly scaled back from a floated $15–20B raise to around $5B after pushback, while management downplayed the bigger figure.

Fireblocks integrates Stacks: Fireblocks added Stacks to let institutions deploy BTC into Bitcoin DeFi via sBTC and Stacks-based protocols through existing workflows.

BTC dominance back above 60%: A Feb 4 market review said many top-10 alts are 30–50% below highs while Bitcoin’s share of total market cap is back above 60%.

Rout deepens: Bitcoin traded as low as $72,096 intraday on Feb 4 as the selloff continued and crypto market value losses piled up over the past week.

📊 Daily Wrap-Up

This was a broad risk-off day: majors sold off hard, and the Fear & Greed print at 11 matches the price action. XRP’s jump is notable, but the overall structure still looks like forced trimming rather than a new bull leg. With both BTC and ETH ETF flows negative, the market is still treating crypto like a position to reduce when volatility spikes elsewhere.

Today's Watch List: Whether BTC can stabilize after this leg down, and whether “Bitcoin yield” narratives (like Fireblocks + Stacks) translate into real on-chain usage while risk appetite stays fragile.

Read more on Web Snack – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.