Feb 4, 2026

🍪 Today's Snack

Crypto rolled over again after yesterday’s bounce, with BTC sliding and SOL taking the hardest hit. The vibe is still “deleveraging first, narratives later.”

📈 24h Crypto Market Snapshot

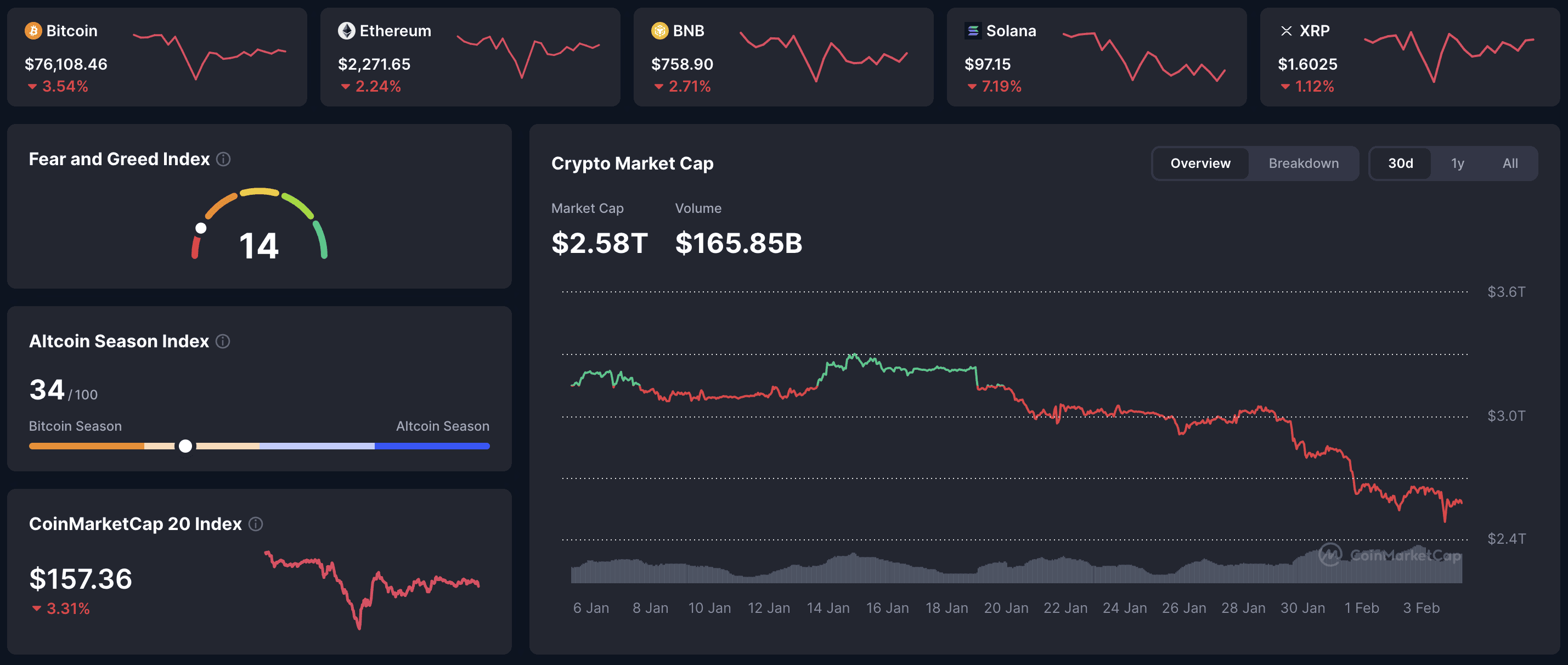

Total crypto market cap hovered around $2.58T while Fear & Greed stayed at 14 (Extreme Fear), keeping positioning cautious despite the macro relief tone.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $76,108 | -3.54% | $1.52T |

ETH | $2,271 | -2.24% | $274B |

BNB | $758 | -2.71% | $103B |

SOL | $97 | -7.19% | $55B |

TRX | $0.28 | +1.02% | $27B |

Selloff, with liquidation-flush hangover and unlock anxiety keeping dips sticky.

🔥 Top 3 Movers & Shakers

World Liberty Financial (WLFI) – +4.5%

WLFI rose as volume climbed to $140.8M amid governance debate about unlocking the remaining 80% of presale tokens and speculation around an undisclosed $500M UAE investment tied to the Trump family.

Takeaway: The bid looks speculative, and the governance overhang is part of the volatility.Hyperliquid (HYPE) – -11.8%

HYPE softened as attention stayed on the February 6, 2026 unlock of 9.92M HYPE tokens (about $303.55M, 2.79% of circulating supply).

Takeaway: In risk-off tape, predictable supply can matter more than product momentum.Solana (SOL) – -7.2%

SOL slid as ecosystem sentiment stayed pressured after the Step Finance treasury hack ($30M stolen on Jan 31), despite notes of whale accumulation and a double-bottom idea near $117.

Takeaway: Security headlines keep acting like a tax on SOL when liquidity is thin.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $272M outflows yesterday, while Ethereum ETFs saw $14M inflows. The divergence suggests risk-off rotation in BTC exposure, while modest ETH demand lines up with the record 2.82M ETH staking queue tightening liquid supply.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: U.S. stocks ended mixed on February 3, with the S&P 500 down 0.8% and the Nasdaq down 1.4% as Big Tech weighed on the tape, even with pockets of earnings strength. Gold rebounded sharply, which reads less like “all clear” and more like traders rebalancing fast in a volatility regime.

On-Chain Highlights: Bitcoin whale addresses (1,000+ BTC) added 46,000 BTC over the week ending February 3, while “dolphin” addresses reduced holdings to 589,000 BTC. In alts, whales increased holdings in SHIB, ADA, and AXS, which suggests selective risk-taking rather than broad appetite.

🔍 Deep Dive – DeFi’s “quality bid” in Extreme Fear

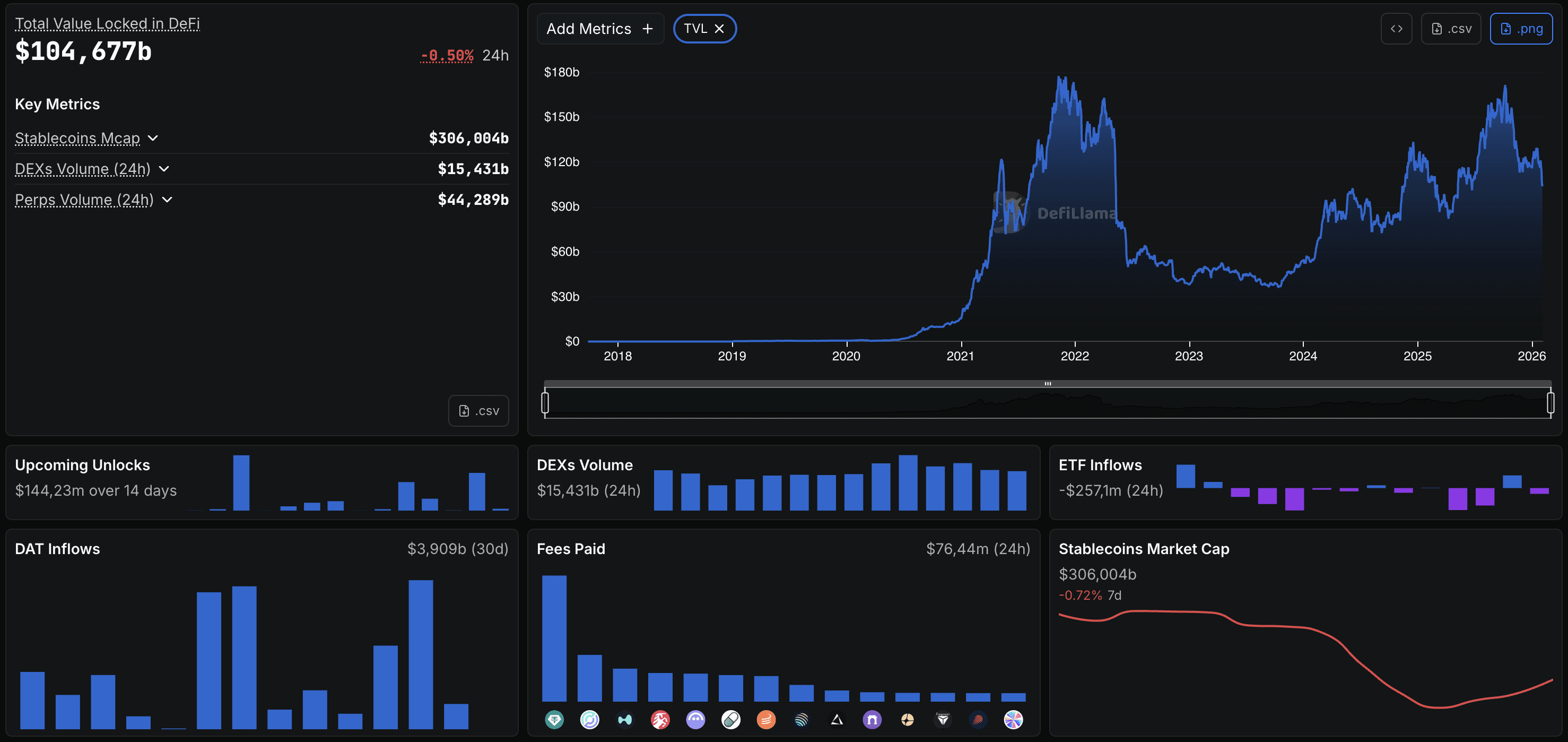

February 3 was a clean rotation day. DeFi tokens gained 3.53% while Bitcoin rose 3.75% and Ethereum gained 4.41%, even as Fear & Greed sat at 17 (Extreme Fear), and the only sectors that finished negative were NFT (-0.86%) and GameFi (-1.53%). That’s a pretty direct signal that, in stress, capital leans toward yield and infrastructure and away from collectibles and pure narrative beta.

The fact pack also points to a market that’s more “yield-shaped” than past cycles. DeFi TVL crossed $100B in early January 2026, and Ethereum liquid staking protocols managed about $30B, making defensive, productive exposure easier to justify during deleveraging. Meanwhile, weekly NFT sales dropped 38.25% to $74.88M even as buyers and sellers rose – participation without serious capital commitment.

If Extreme Fear lingers, this hierarchy can persist: DeFi and liquid staking act like the relative safe zone inside crypto, while the frothier corners struggle to keep bids.

📰 Top News

Ethereum staking queue hits a record: Validator entry queue reached about 2.82M ETH with ~45-day waits, while the exit queue fell to near-zero.

Story Protocol delays unlock: Story postponed its first major token unlock by six months, moving it to August 13, 2026.

GameStop moves BTC to Coinbase Prime: GameStop transferred its entire 4,710 BTC holdings, fueling speculation around its corporate treasury stance.

Ripple receives full EMI license in Luxembourg: Ripple can passport services across all 27 EU member states ahead of MiCA enforcement in 2026.

Trump Media sets token record date: February 2, 2026 was set as the record date for a blockchain-based shareholder token program minted via Crypto dot com.

📊 Daily Wrap-Up

The market still feels heavy: BTC and majors are red, SOL is bleeding harder, and sentiment is stuck in the kind of fear where rallies get sold quickly. ETF flows also aren’t giving a clean “buy the dip” signal today – BTC saw outflows while ETH printed inflows, which looks like repositioning rather than broad risk-on. And with unlock chatter and staking dynamics in the mix, price is trading like a liquidity problem first.

Today's Watch List: Token unlock headlines and how they affect near-term supply expectations, plus whether ETH staking demand stays one-way while broader risk appetite remains fragile.

Read more on Web Snack – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.