Dec 27, 2025

🍪 Today’s Snack

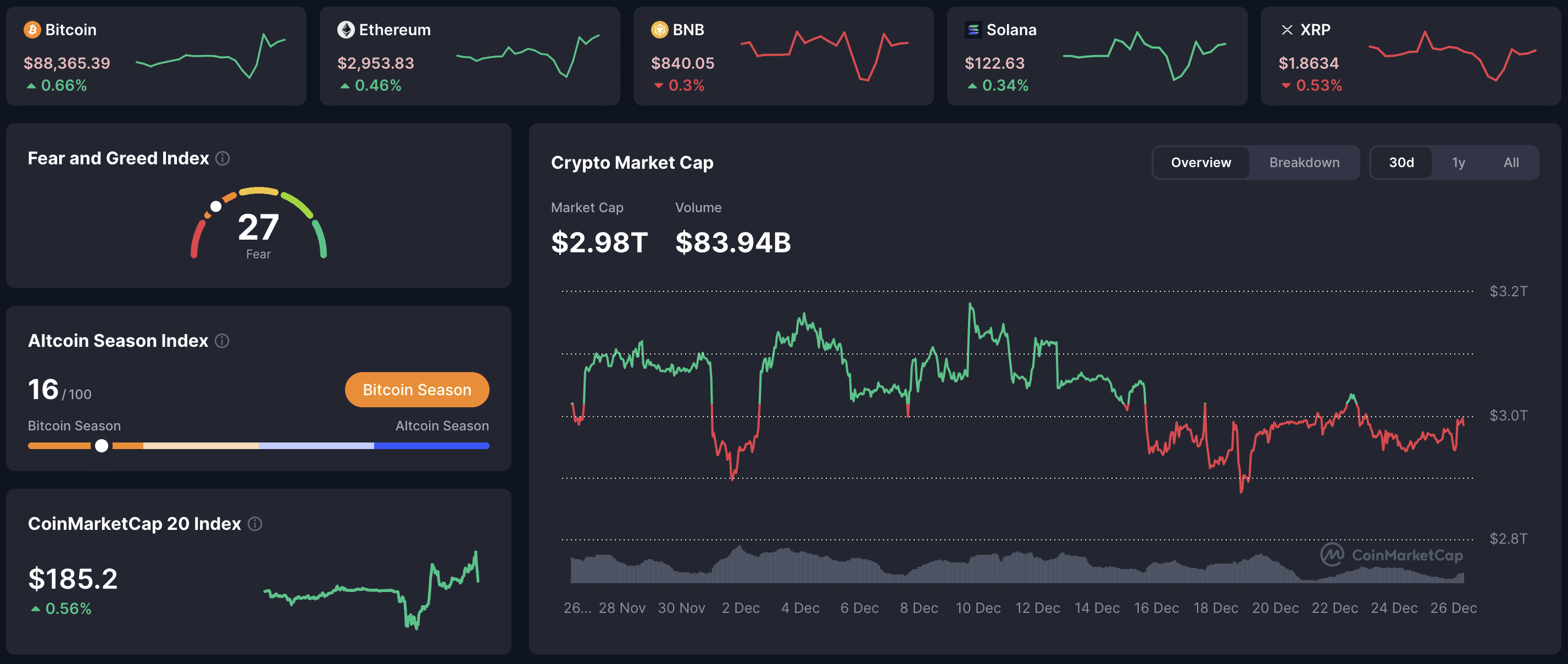

Crypto market remained flat over 24 hours, total cap at $2.98T. Bitcoin held steady around $88K with minor dip, while niche tokens like World Liberty Financial led gains in low-volume post-holiday trading.

📈 24h Crypto Market Snapshot

Total crypto market cap at $2.98T, minor change in 24 hours. Fear & Greed Index at 27 - fear, stable, reflecting ongoing caution in thin liquidity.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 88365 | +0.66 | 1.76T |

ETH | 2954 | +0.46 | 357B |

BNB | 840 | -0.30 | 115B |

SOL | 122 | +0.34 | 69B |

XRP | 1.86 | -0.53 | 112B |

DOGE | 0.125 | -1.97 | 21B |

What does stable fear mean? Consistent readings around 27 in 'crypto sentiment tracking' suggest market in wait-and-see mode - often precedes volume return or directional move.

🔥 Top 3 Movers & Shakers

World Liberty Financial (WLFI): +5.0% in 24 hours. Niche token rallied on community buzz and political ties. Takeaway: Hype-driven small-caps capture attention in quiet markets - monitor social volume for real vs fleeting interest.

Bitcoin Cash (BCH): +4.3% in 24 hours. Established fork gained on transaction activity. Takeaway: Legacy chains show resilience on usage - track block metrics for sustained demand signals.

Ethena (ENA): +3.2% in 24 hours. DeFi protocol token rose on yield updates. Takeaway: Yield-focused projects attract in low-vol periods - evaluate staking flows for continuation potential.

How to spot sustainable gainers? Volume relative to cap and fundamentals matter in 'crypto top gainers analysis' - hype-driven spikes often fade without backing.

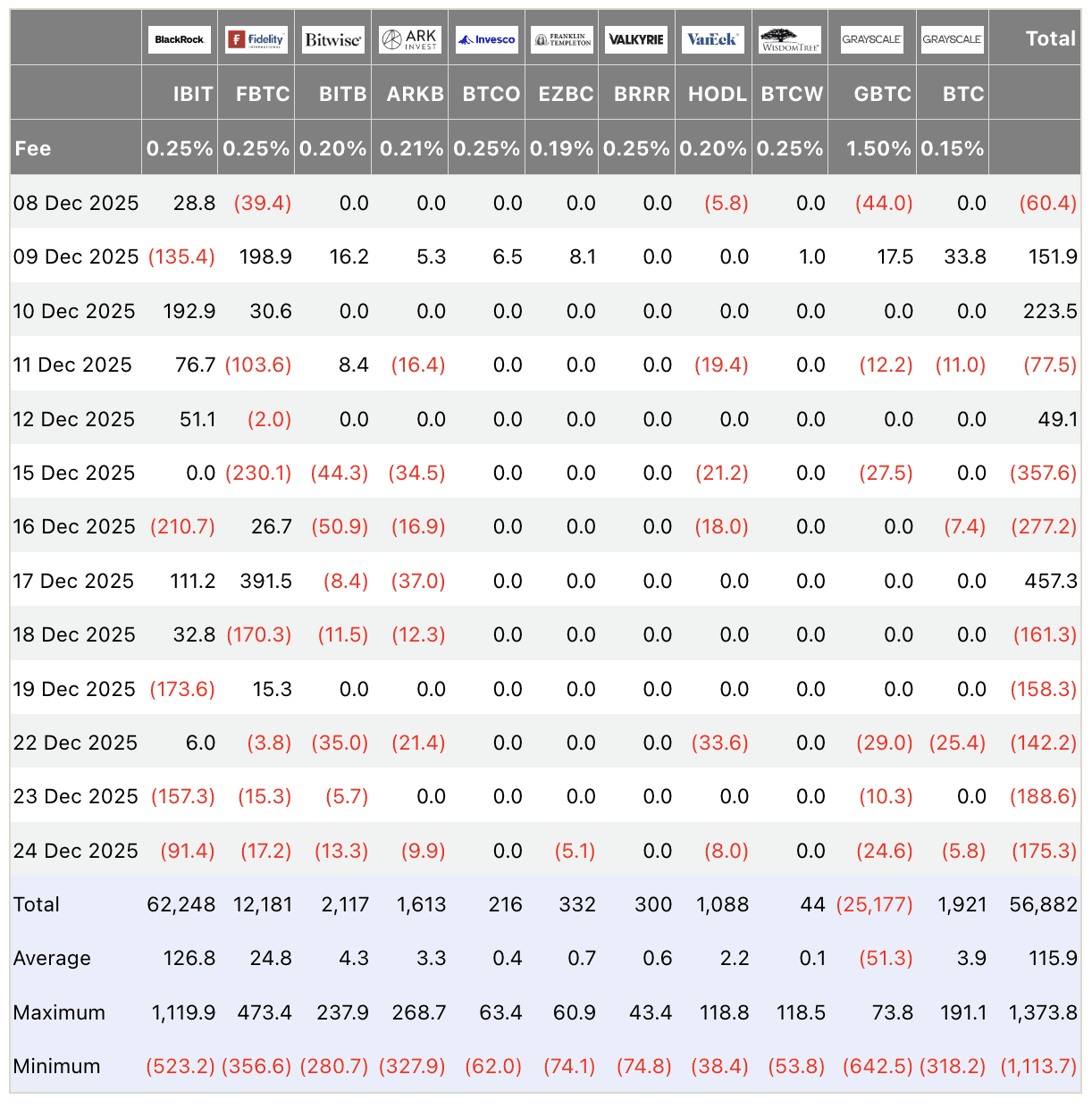

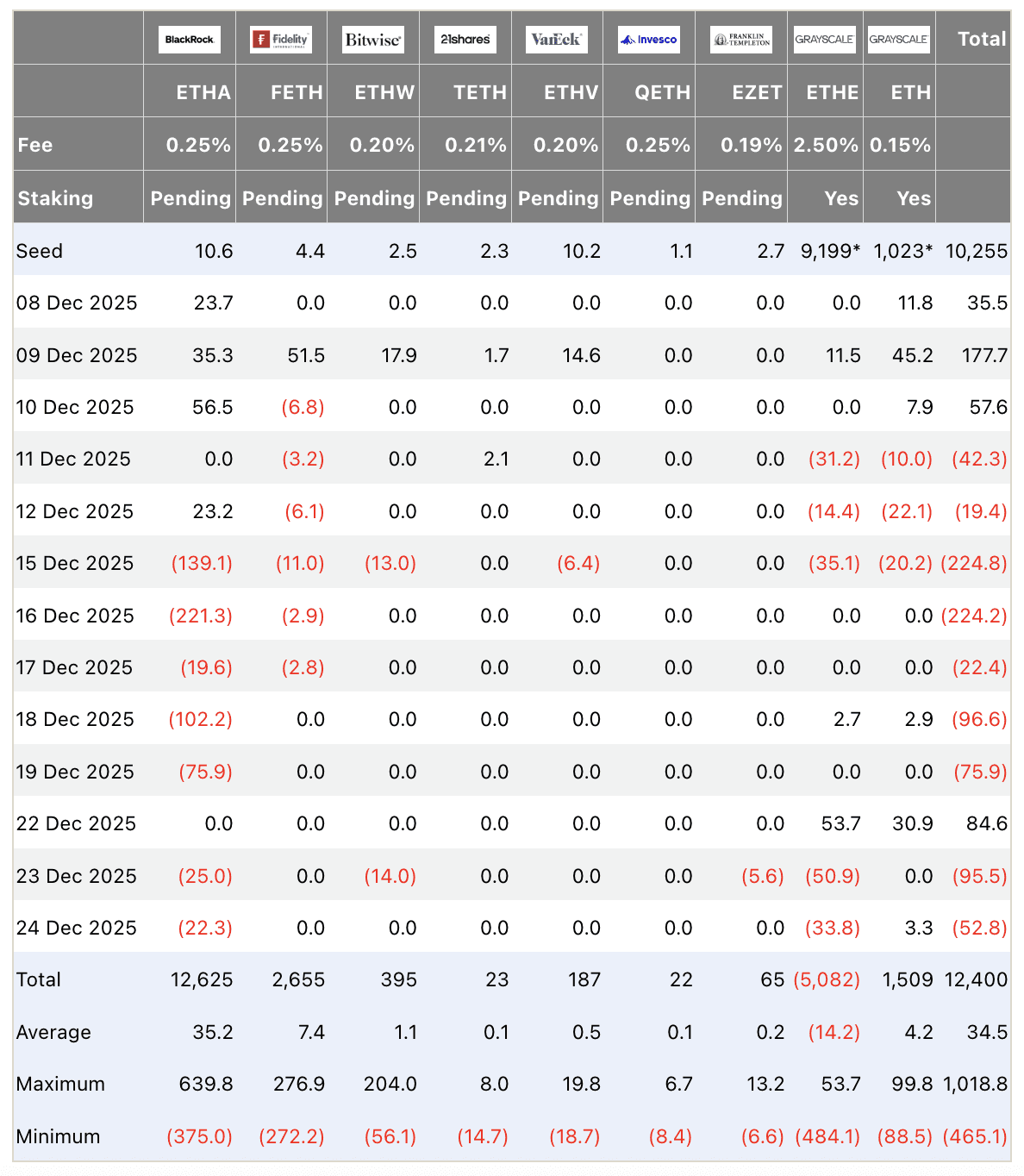

🏦 ETF & Institutional Flows

Net flows on December 25: Bitcoin ETFs mixed with minor outflows, Ethereum neutral. Analysis: Holiday lull continues with low activity - year-end positioning dominates.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF flows matter? Spot ETFs channel 'institutional crypto investments' - quiet flows reflect seasonal slowdown in regulated channels.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply stable at ~70%, whale activity low. Reserves steady, funding rates neutral. Takeaway: On-chain quiet in holiday period, limited pressure.

What is on-chain? Blockchain data tracks real transactions and holdings, essential for 'on-chain crypto insights' beyond price action.

🌍 Macro Pulse

Holiday quiet with no major releases. Fed steady, inflation monitoring ongoing. Trade tensions linger in background.

How does holiday trading affect crypto? Low volume amplifies volatility in 'crypto seasonal patterns' - majors stable, niches move on thin liquidity.

💡 Market Trend Spotlight

Niche tokens leading in low-volume day

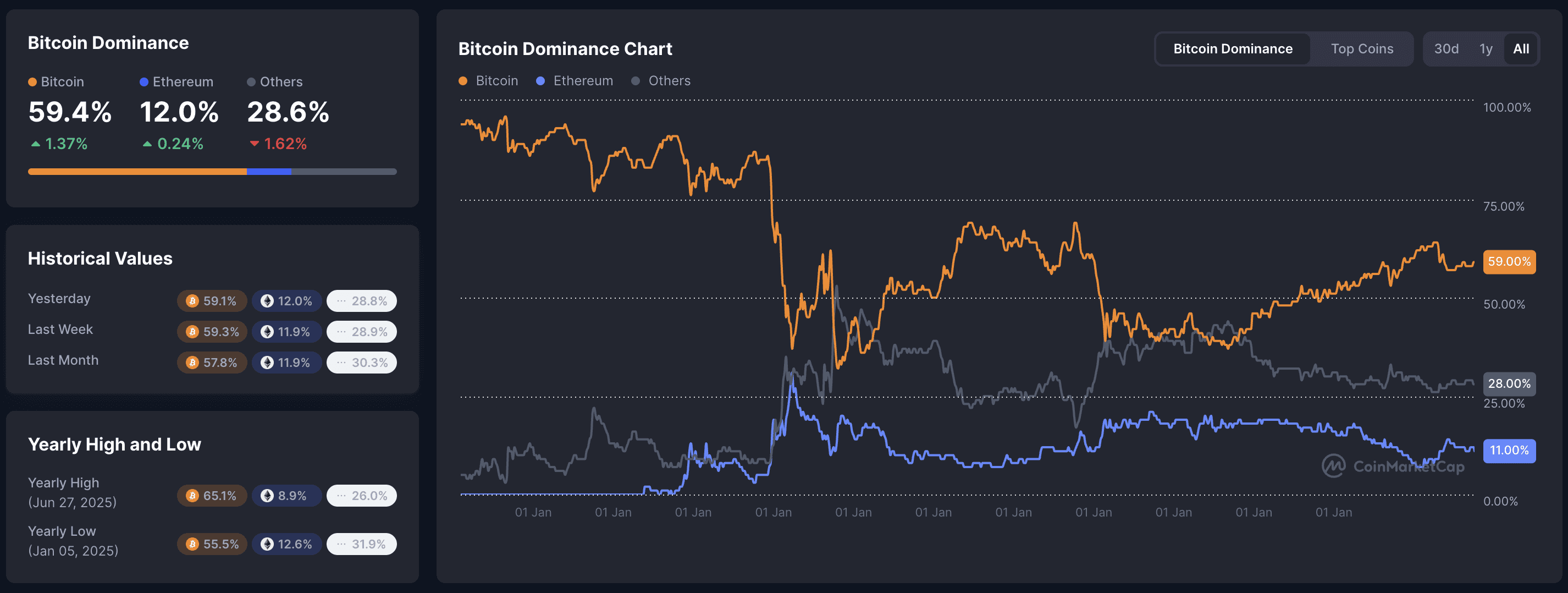

WLFI +5%, BCH +4.3%, ENA +3.2% topped movers while majors flat. Observations: Holiday quiet favors small-cap hype - trend shows rotation to narratives, dominance stable at 59%.

How to read holiday trends? Thin liquidity boosts niche moves in 'crypto seasonal analysis' - watch volume return for confirmation.

📰 Top News

Holiday low volume dominates: Majors stable, small-caps spike on hype.

ETF flows quiet with minor BTC outflows: Year-end positioning continues.

Privacy and niche tokens gain traction: Rotation in thin trading.

Regulatory silence over holidays: Bill delays extend uncertainty.

Sentiment steady in fear zone: Waiting for post-holiday catalysts.

📊 Daily Wrap-Up

Market flat at $2.98T in low holiday volume, BTC stable around $88K. Niche tokens led gains, ETF flows quiet. Fear at 27 holds, macro neutral - watch volume return and institutional positioning for next move.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.