Dec 30, 2025

🍪 Today’s Snack

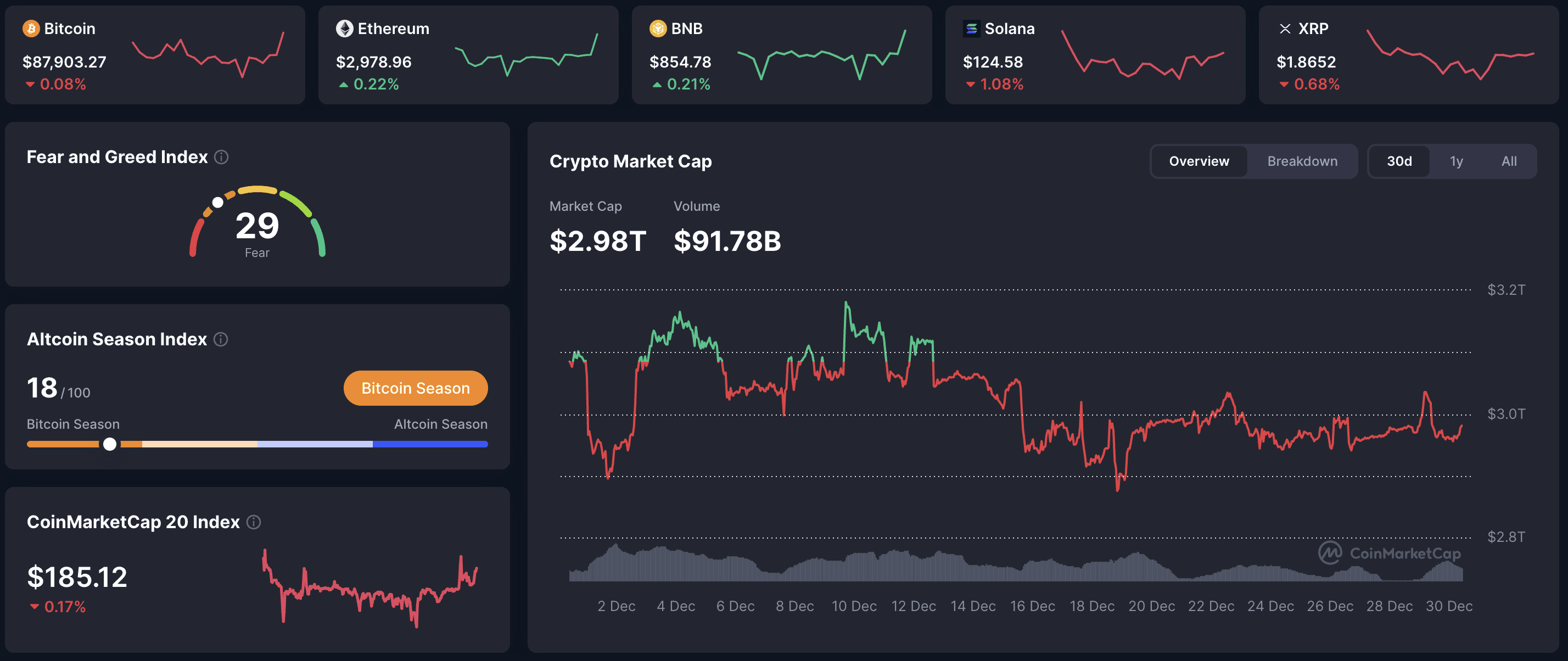

Crypto market remained stable over 24 hours, total cap at $2.98T. Bitcoin held steady around $88K with minor dip, while niche tokens like Canton CC led modest gains in low-volume holiday trading.

📈 24h Crypto Market Snapshot

Total crypto market cap at $2.98T. Fear & Greed Index at 29 - fear.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 87903 | -0.08 | 1.76T |

ETH | 2979 | +0.22 | 359B |

BNB | 854 | +0.21 | 117B |

SOL | 124 | -1.08 | 70B |

XRP | 1.86 | -0.68 | 112B |

DOGE | 0.124 | -0.62 | 20B |

What does low holiday volume mean? Reduced trading during holidays often amplifies moves in smaller assets in "crypto liquidity cycles" - majors consolidate while niches capture attention.

🔥 Top 3 Movers & Shakers

Canton CC: +6.8% in 24 hours. Community-driven token rallied on social hype and volume spike. Takeaway: Small-cap projects pump fast on buzz - check social sentiment and transfers to spot real vs short-term interest.

Zcash (ZEC): +3.2% in 24 hours. Privacy coin gained on renewed anonymity demand. Takeaway: Privacy narratives flare in uncertain times - monitor wallet activity for sustained traction.

Midnight (NIGHT): +2.9% in 24 hours. Privacy-focused project rose on protocol buzz. Takeaway: Niche privacy tokens spike on news - analyze wallet growth for real demand beyond hype.

How to spot sustainable gainers? Volume relative to cap and fundamentals matter in "crypto top gainers analysis" - hype-driven spikes often fade without backing.

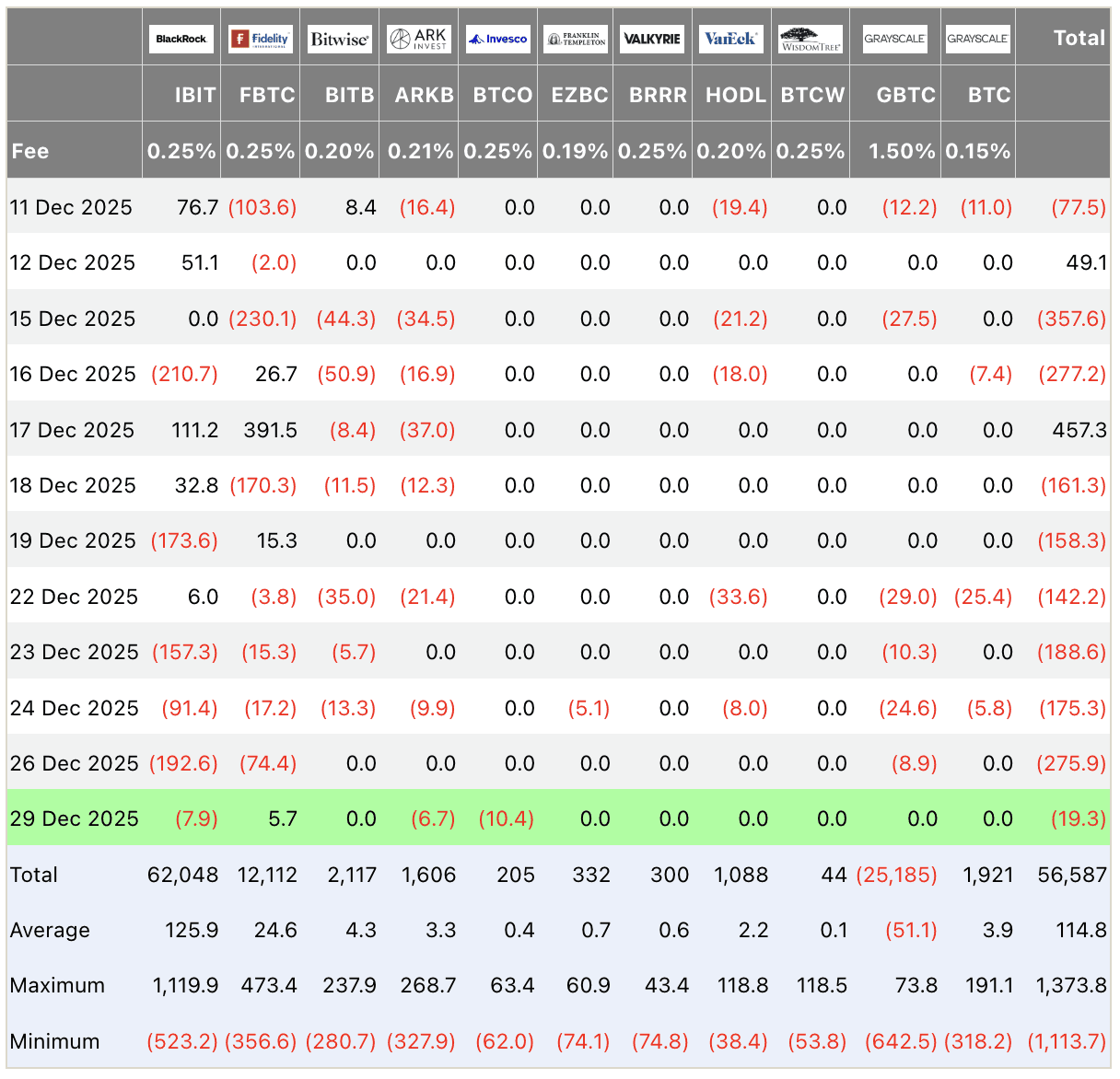

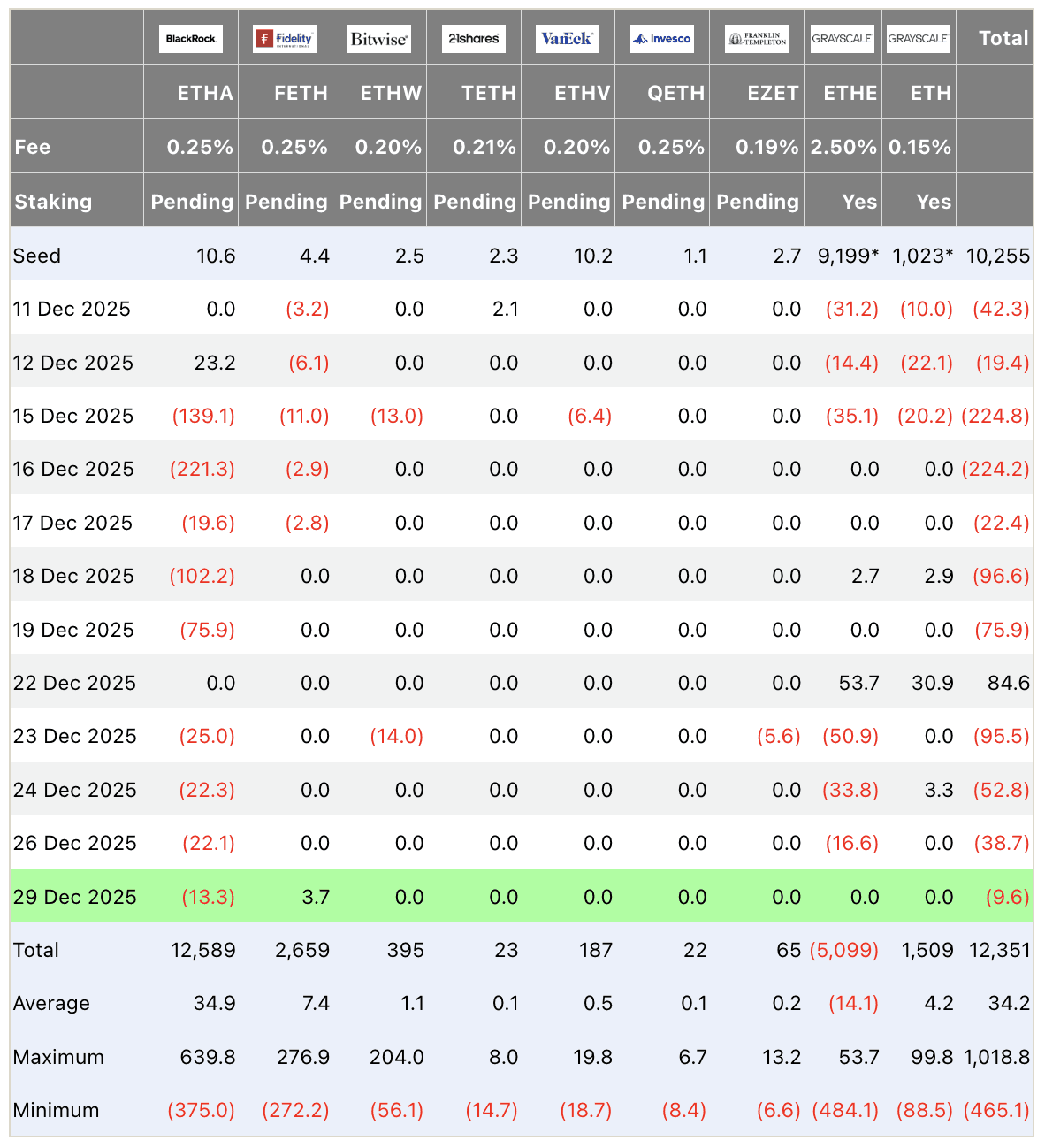

🏦 ETF & Institutional Flows

Net flows on December 29: Bitcoin ETFs -$19.3M (minor pullback, BlackRock -$7.9M leading), Ethereum ETFs neutral ($9.6M). Analysis: Small outflows reflect holiday lull, volumes low.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF flows matter? Spot ETFs channel "institutional crypto investments" - minor moves like today's highlight seasonal slowdown.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply stable at ~70%, whale activity low. Reserves steady, funding rates neutral. Takeaway: On-chain quiet in holiday period, limited pressure.

What is on-chain? Blockchain data tracks real transactions and holdings, essential for "on-chain crypto insights" beyond price action.

🌍 Macro Pulse

Quiet holiday day with no major releases. Fed steady, inflation monitoring ongoing. Trade tensions linger in background.

How does holiday trading affect crypto? Low volume amplifies volatility in "crypto seasonal patterns" - majors stable, niches move on thin liquidity.

💡 Market Trend Spotlight

Small-cap and privacy tokens leading gains

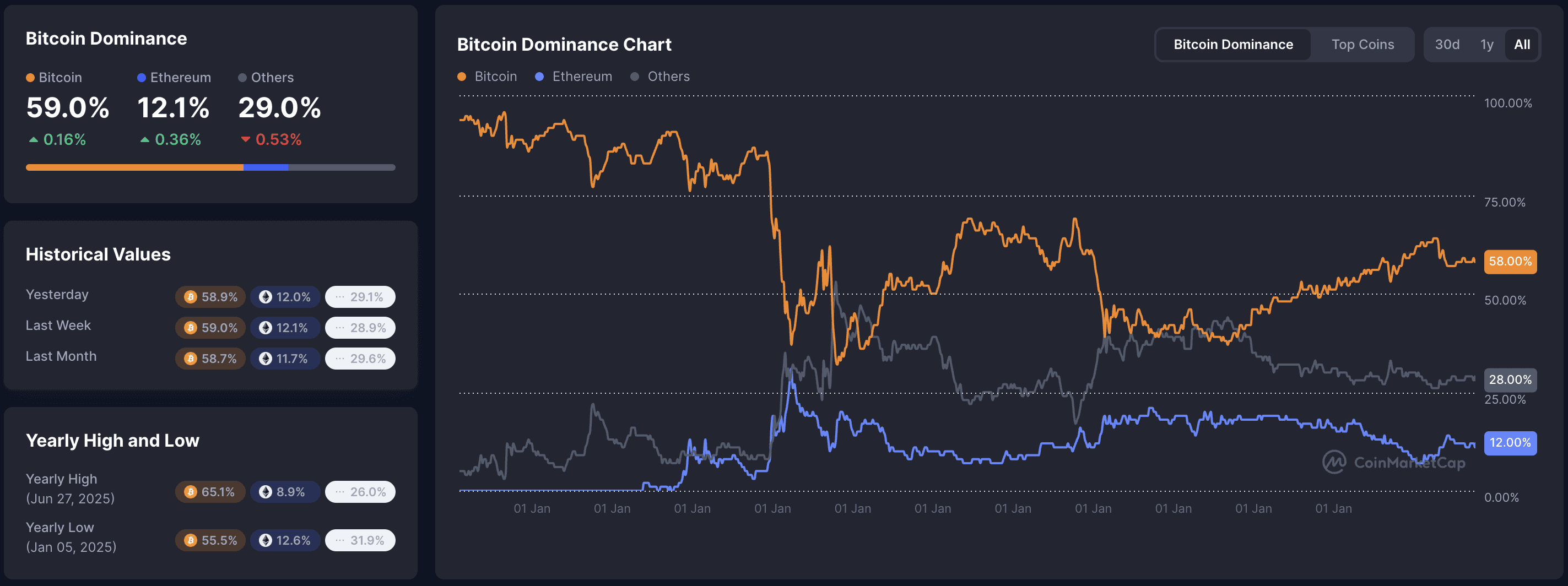

Canton CC +6.8%, Zcash +3.2%, Midnight +2.9% topped movers while majors mixed. Observations: Holiday low volume favors hype-driven small-caps - trend shows rotation to narratives, with dominance stable at 59.0%.

How to read holiday trends? Thin liquidity boosts niche moves in "crypto seasonal analysis" - watch volume return for confirmation.

📰 Top News

ETF minor outflows -19.3M BTC: Year-end lull with low activity.

Small-cap tokens like Canton CC pump +6.8%: Hype rotation in low-volume trading.

Privacy coins Zcash and Midnight gain traction: Renewed anonymity interest amid uncertainty.

Regulatory silence over holidays: Bill delays extend into 2026, sentiment steady.

Low volume day highlights niche plays: Typical holiday lull.

📊 Daily Wrap-Up

Market stable at $2.98T in low holiday volume, BTC flat. Minor outflows, small-cap hype led gains. Fear at 29 holds, macro quiet - watch volume return and institutional flows post-holidays for direction.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.