Dec 23, 2025

🍪 Today’s Snack

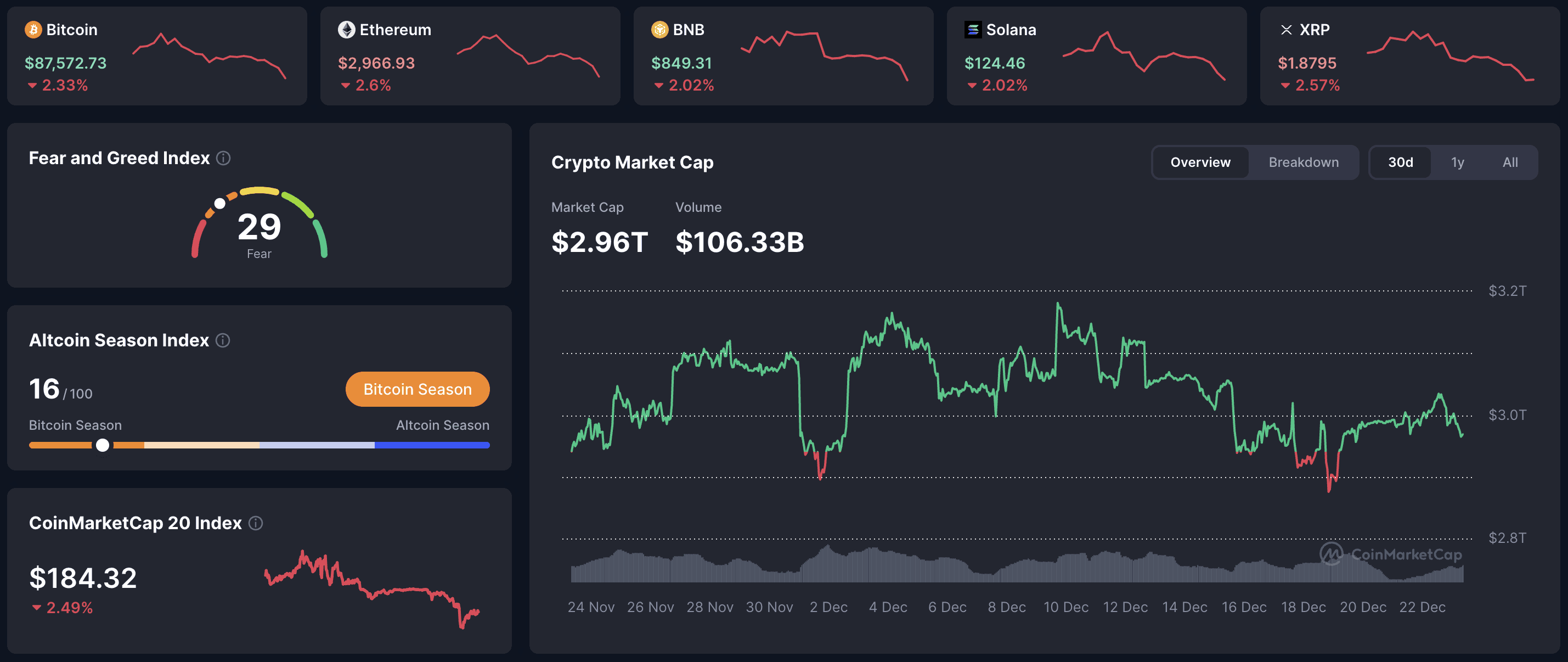

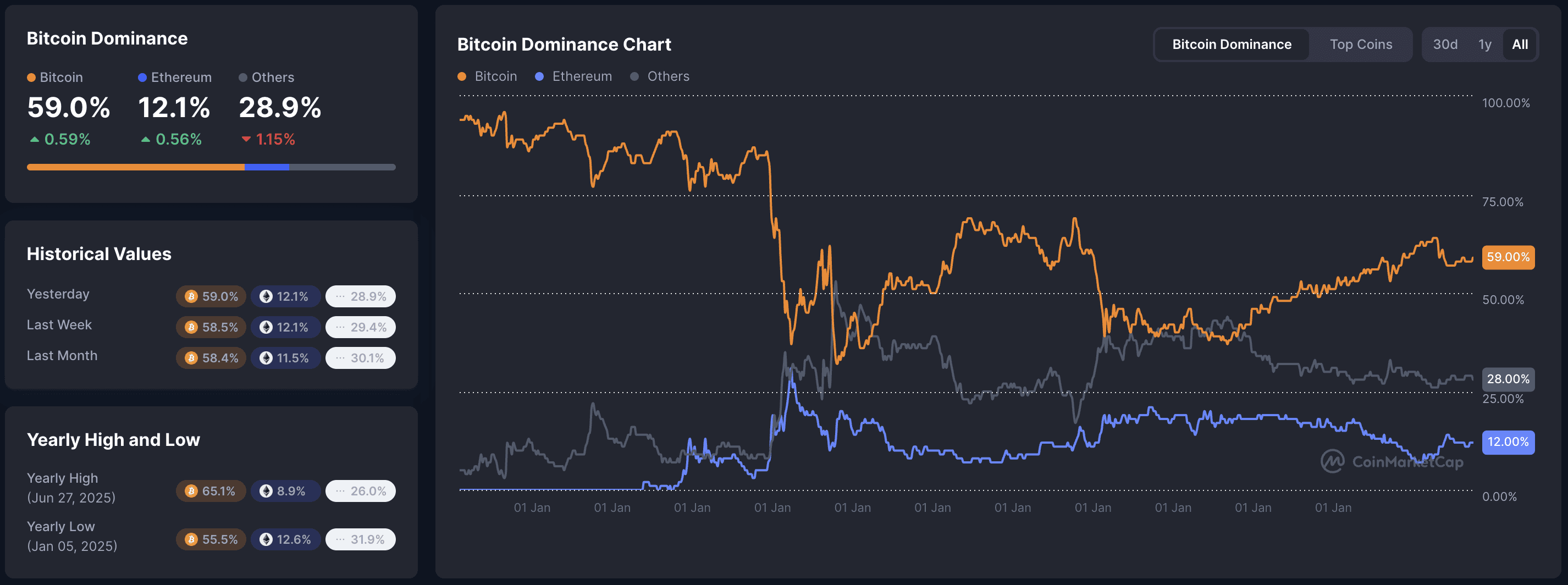

Crypto market dipped -2.5% over Monday, total cap falling to $2.96T from weekend's $3.02T. Bitcoin lost -2.3% to $87,573, while gold-backed stablecoins held best in risk-off move, with sentiment worsening amid outflows.

📈 24h Crypto Market Snapshot

Overview of key assets and capitalization

Total crypto market cap at $2.96T, down -2.5% in 24 hours. Fear & Greed Index at 29 - fear, up slightly but still signaling caution after weekend stability.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 87572.73 | -2.33 | ~1.74T |

ETH | 2966.93 | -2.60 | ~357B |

BNB | 849.31 | -2.02 | ~124B |

SOL | 124.46 | -2.02 | ~59B |

XRP | 1.8795 | -2.57 | ~107B |

DOGE | 0.1305 | -1.68 | ~19B |

What drives sentiment swings? The Fear & Greed Index reacts to volatility and volume in 'crypto sentiment tracking' - jumps like today's reflect short-term risk aversion, often creating oversold setups.

🔥 Top 3 Movers & Shakers

Tether Gold (XAUT): +2.1% in 24 hours. Gold-pegged stablecoin outperformed on safe-haven flows. Takeaway: Asset-backed tokens shine in dips - track gold price moves for correlation signals.

PAX Gold (PAXG): +1.9% in 24 hours. Similar gold-backed asset held gains amid market sell-off. Takeaway: Pegged stability attracts capital rotation - monitor redemption rates for backing confidence.

OKB (OKB): +0.9% in 24 hours. Exchange token resilient on platform incentives. Takeaway: Utility in trading ecosystems provides buffer - volume trends indicate user retention strength.

How to spot stablecoin trends? Gold-backed coins often counter crypto fear in 'hedging strategies' - useful for portfolio stability during volatility.

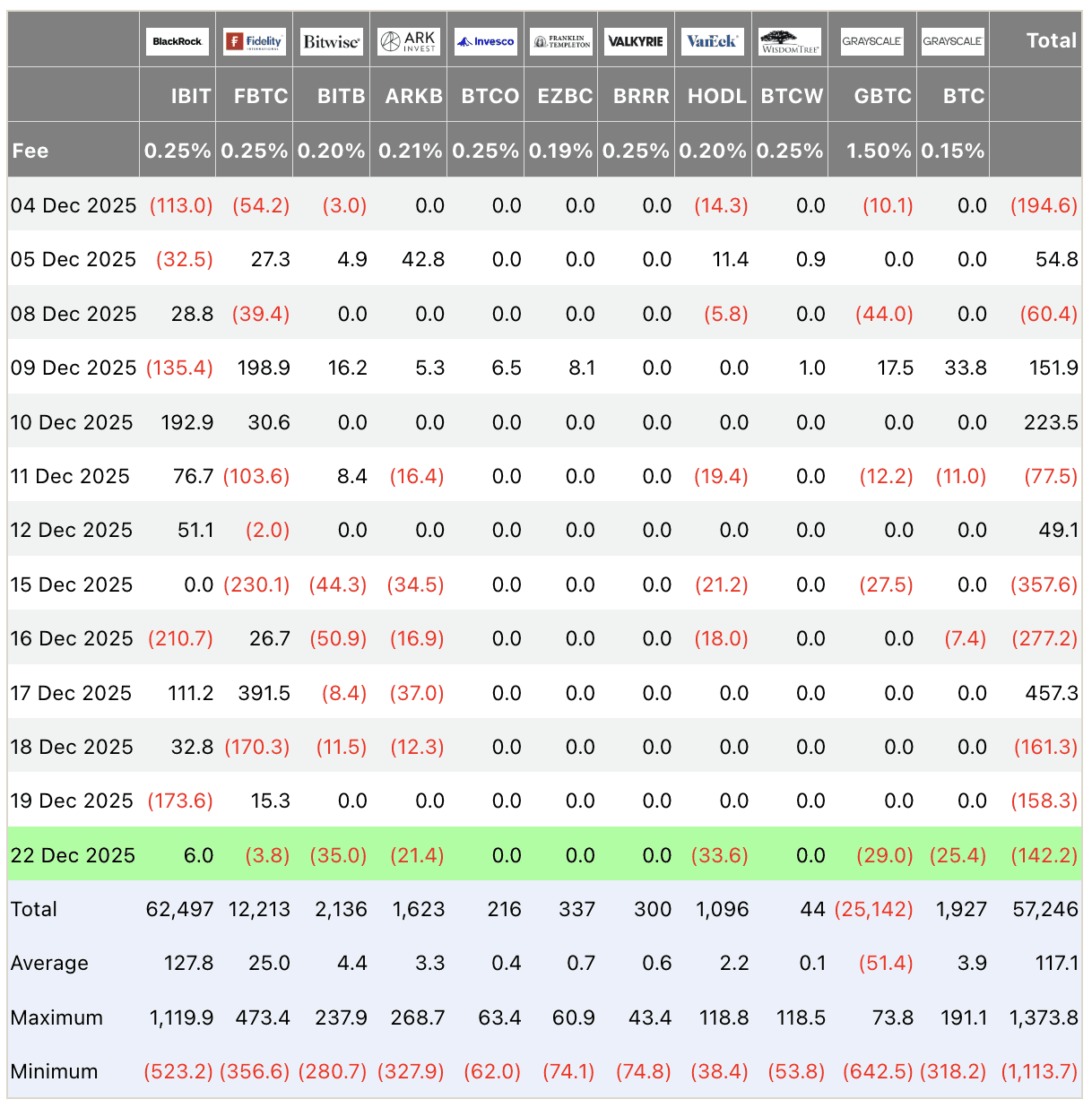

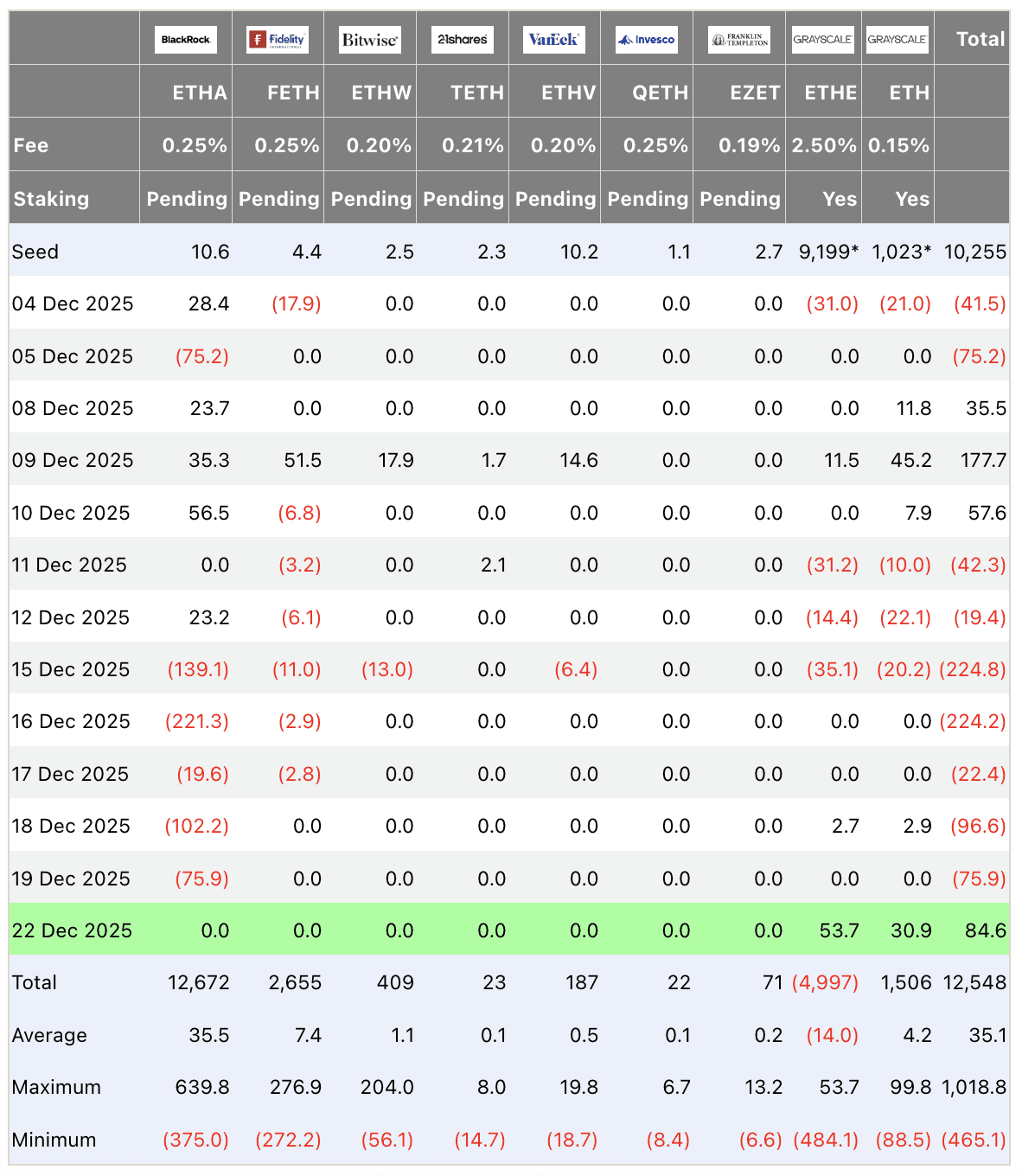

🏦 ETF & Institutional Flows

Net flows on December 22: Bitcoin ETFs -142.2M (outflows led by Fidelity -35M, Bitwise -21.4M), Ethereum ETFs +84.6M (positive contrast). Analysis: BTC sees continued caution, ETH minor support - weekend slowdown persists into Monday.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF flows matter? Spot ETFs channel 'institutional crypto investments', influencing liquidity and 'Bitcoin ETF price dynamics' in regulated markets.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply stable at ~70%, whale transfers moderate. Reserves low, funding rates negative.

Takeaway: On-chain quiet amid dip, suggesting limited panic selling.

What is on-chain? Blockchain data tracks real transactions and holdings, essential for 'on-chain crypto insights' beyond price action.

🌍 Macro Pulse

Fed steady, inflation monitoring ongoing with tariffs impact. Unemployment stable, growth moderate. Neutral backdrop but trade risks weigh on sentiment.

How does macro affect crypto? Global economic signals influence 'crypto risk appetite' - stable jobs support risk assets, but tariffs add uncertainty.

💡 Market Trend Spotlight

Gold-backed stablecoins resilient

XAUT and PAXG led gains while majors dipped. Observations: Safe-haven rotation evident in fear - trend highlights diversification into asset-backed crypto during risk-off.

How to read stablecoin trends? Pegged assets often counter market fear in 'crypto diversification strategies' - track premium/discount to underlying for demand signals.

📰 Top News

ETF flows turn mixed with BTC outflows -142M: Reflects selective caution after rebound.

Gold-backed stablecoins top gainers: Safe-haven demand rises in dip.

Citi maintains bullish BTC target amid volatility: Long-term institutional view intact.

Regulatory uncertainty lingers with bill delays: Temporary pressure on sentiment.

Low weekend volume extends into Monday: Typical post-holiday lull.

📊 Daily Wrap-Up

Monday brought -2.5% dip to $2.96T cap, BTC down -2.3% with fear at 29. Gold-backed stablecoins held best, ETF flows mixed. Neutral macro and low volume dominate - watch institutional return and gold correlation for direction.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.