Dec 22, 2025

🍪 Today’s Snack

Crypto market gained +1.4% over the weekend, total cap climbing to $3.02T from Friday's $2.98T. Bitcoin rose +1.3% to $89,055 from $88,055, leading the quiet recovery with improved sentiment, though alts mixed and ETF outflows continued.

📈 24h Crypto Market Snapshot

Overview of key assets and capitalization

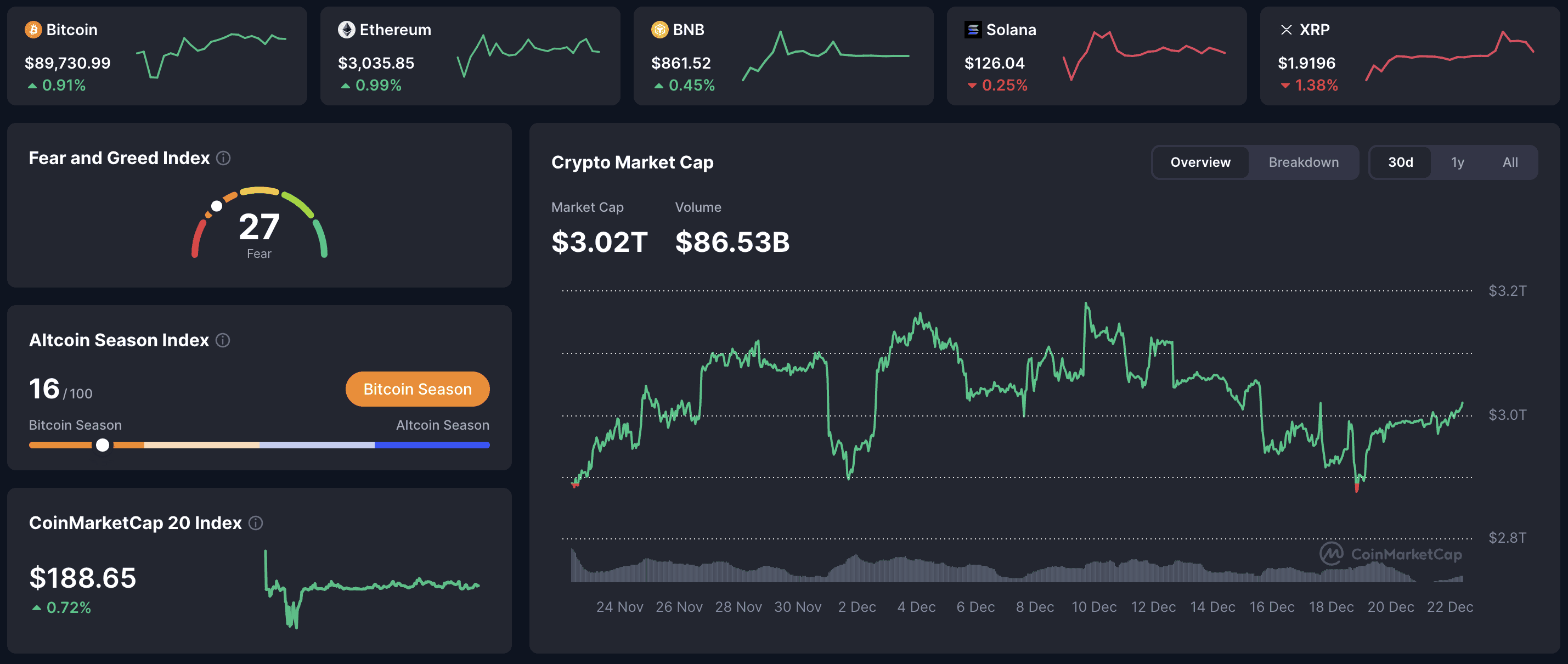

Total crypto market cap at $3.02T, up +1.4% over weekend from Friday's $2.98T. Fear & Greed Index at 27 - fear, up from Friday's 27, reflecting slight sentiment easing but still cautious mood.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 89055 | +0.56 | 1.78T |

ETH | 3035 | +0.99 | 365B |

BNB | 851 | -0.45 | 124B |

SOL | 126 | -2.38 | 60B |

XRP | 1.92 | +0.43 | 109B |

DOGE | 0.185 | +0.72 | 27B |

What does market cap mean? Total crypto market capitalization aggregates all coin values, serving as a sector health indicator in 'crypto market cap analysis'. Weekend rise from $2.98T to $3.02T shows resilience despite outflows.

🔥 Top 3 Movers & Shakers

Midnight (NIGHT): +9.9% in 24 hours. Privacy-focused project gained on protocol buzz and regulatory discussions. Takeaway: Niche privacy tokens spike on news - check wallet activity for real demand beyond hype.

Kaspa (KAS): +6.6% in 24 hours. Layer-1 chain with high throughput rose on mining efficiency updates. Takeaway: Scaling solutions attract in recovery - track TPS and energy metrics for long-term viability.

Sky (SKY): +6.1% in 24 hours. DeFi token boosted by yield farming incentives. Takeaway: DeFi rewards drive short-term gains - evaluate APR and TVL for sustainability in volatile periods.

How to spot sustainable gainers? Focus on volume relative to cap and ecosystem metrics in 'crypto top gainers analysis' - high percentage alone often fades without backing.

🌍 Macro Pulse

Fed steady, inflation monitoring ongoing. Unemployment stable at 4.6%, growth moderate. Neutral backdrop with trade tensions, similar to Friday - supportive for risk assets but cautious.

How does Fed affect crypto? Policy holds preserve liquidity for 'crypto macro ties' - supportive for BTC, though easing pauses add volatility.

💡 Market Trend Spotlight

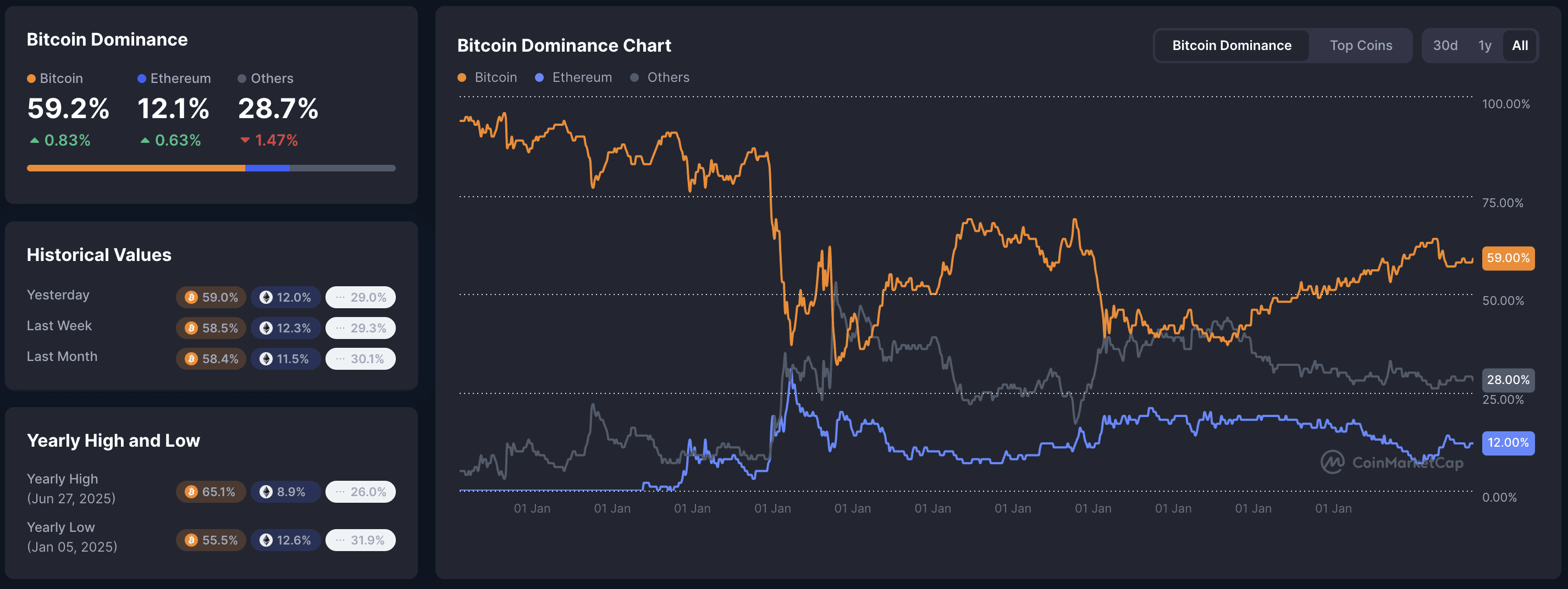

BTC share +0.46%, alts mixed with privacy spikes. Compared to Friday's 59.3%, dominance stable high. Observations: Capital favors BTC liquidity - levels indicate ongoing caution, potential alt delay.

How to read trends? Dominance rises signal risk aversion in 'crypto trend cycles' - watch for breaks on sentiment shifts.

📰 Top News

Citi raises BTC target to $143K on ETF and regulation: Boosts long-term institutional outlook.

JPMorgan expands tokenization funds: Deepens TradFi-Web3 integration.

Senate crypto bill delayed to 2026: Extends uncertainty, temporary sentiment hit.

Texas Bitcoin reserve advances: Strengthens government adoption narrative.

Lightning network breaks BTC locked record: Enhances Bitcoin scalability, positive for adoption.

📊 Daily Wrap-Up

Weekend pushed cap to $3.02T from Friday's $2.98T, BTC up $1K with fear easing to 27. Outflows slowed, privacy tokens added color. Neutral macro and on-chain stability anchor - watch regulation and flows for week ahead.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.