Jan 16, 2026

🍪 Today's Snack

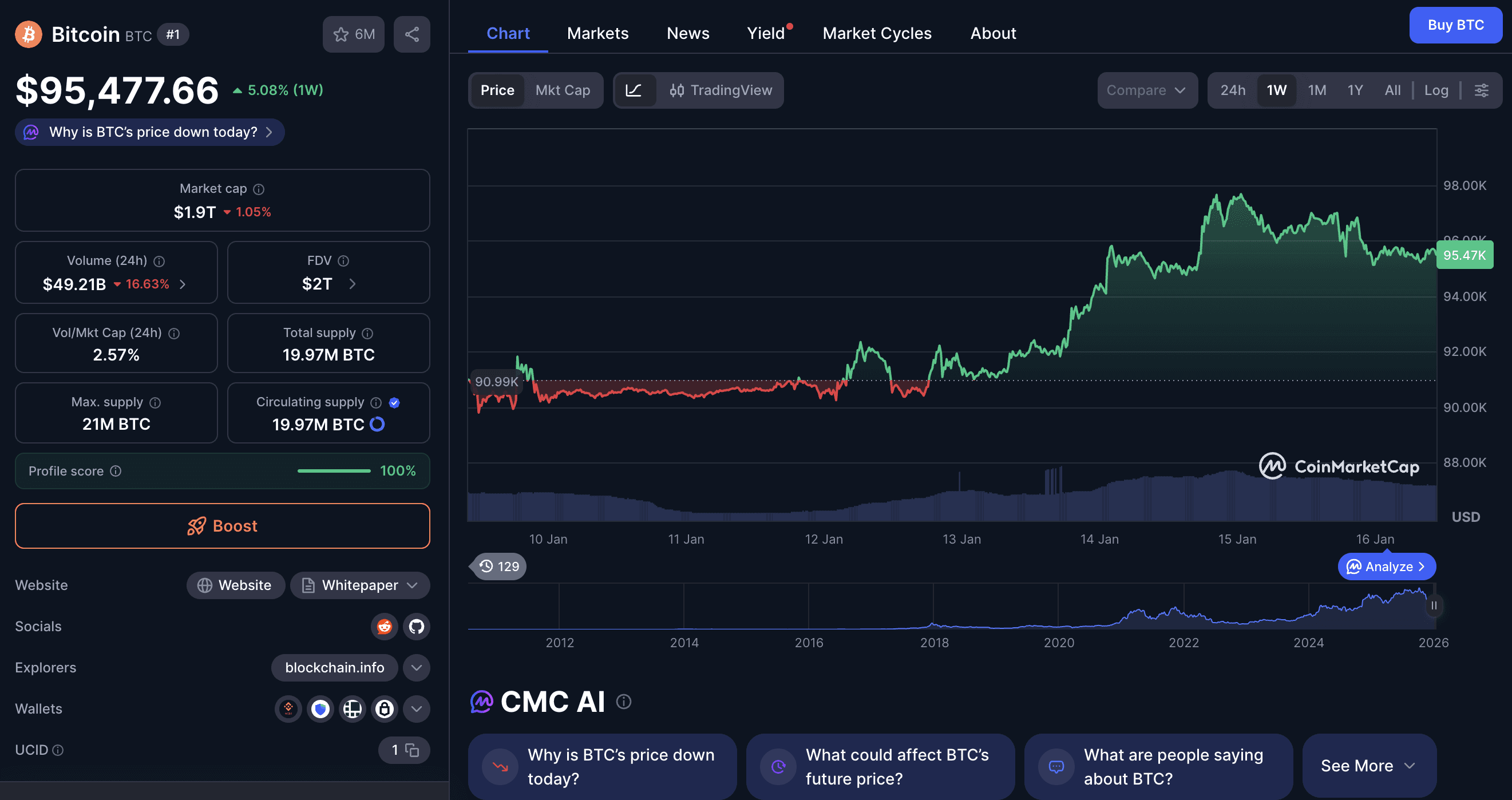

Bitcoin slipped below $96K on January 15 after the Senate Banking Committee canceled its Clarity Act vote, following Coinbase's last-minute withdrawal of support over stablecoin yield restrictions.

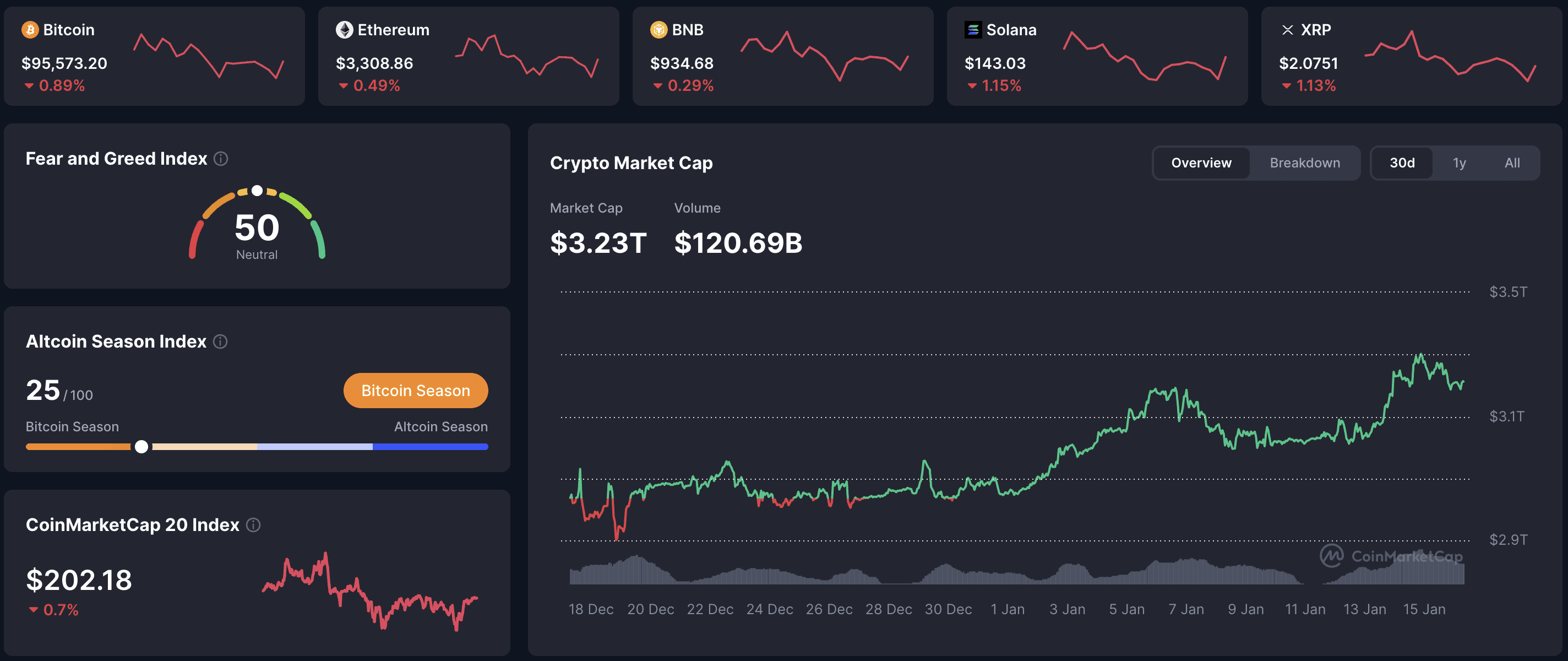

📈 24h Crypto Market Snapshot

Total crypto market cap eased to $3.23T, down slightly from recent highs. Fear & Greed Index held at 50 (Neutral), signaling cautious sentiment after the regulatory setback.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $95,573 | -0.89% | $1.90T |

ETH | $3,308 | -0.49% | $398B |

BNB | $934 | -0.29% | $127B |

SOL | $143 | -1.15% | $80B |

🔥 Top 3 Movers & Shakers

Tea-Fi (TEA) – +322%

Explosive gain on low liquidity and narrative-driven rotation.

Takeaway: Triple-digit moves on thin volume rarely sustain – watch for profit-taking within 24-48h.Dash (DASH) – +42%, $82

Extended privacy-coin rally on Alchemy Pay integration momentum.

Takeaway: Multi-day rallies in legacy names often mark late-stage sector rotation – set tight stops.Internet Computer (ICP) – +33%, $4.75

DFINITY upgrades and DeFi activity drove renewed interest.

Takeaway: Upgrade-driven pumps can extend if accompanied by on-chain activity growth.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $100.2M in net inflows on January 15 – sharply lower than prior days but still positive. Ethereum ETFs saw $164.4M in net inflows. Three-day cumulative BTC flows topped $1.7 billion, the strongest stretch since October.

🌍 Market Context

Regulatory: Clarity Act markup postponed after Coinbase CEO withdrew support, citing stablecoin yield bans and DeFi restrictions that would favor banks over crypto innovation.

Macro: U.S. stocks mixed on earnings concerns. Bitcoin decoupled slightly, sliding on crypto-specific regulatory headlines rather than broader risk-off.

🔍 Deep Dive – Clarity Act Collapse

Coinbase publicly opposed the revised Clarity Act draft over stablecoin yield restrictions, which directly compete with bank savings accounts. Banking lobby influence is now explicit – the vote cancellation signals U.S. crypto firms no longer accept bad regulation at any cost, especially with ETF approvals and institutional backing already secured.

Market shrugged off initial news, with BTC holding above $96K intraday, but selling built as traders unwound positions tied to regulatory optimism. Three-day ETF inflows of $1.7B kept sentiment from collapsing entirely.

📰 Top News

Clarity Act vote canceled: Senate postponed markup after Coinbase CEO withdrew support over stablecoin yield bans and DeFi restrictions.

Bitcoin slides below $96K: BTC dropped to $95.5K after hitting $97.8K on Wednesday, ending four-day rally on regulatory uncertainty.

ETF inflows slow but stay positive: Three-day cumulative BTC flows reached $1.7B – strongest since October, despite slowdown on Jan 15.

Bank stocks tumble on earnings: Wells Fargo -4.6%, BofA -3.7%, Citi -3.3% on weak results and Trump's credit card rate cap proposal.

📚 Education Bits

💡 Pro Tip: When regulatory headlines drive selloffs, watch ETF flows the next day – if institutions keep buying despite noise, the dip is usually shallow and short-lived.

🔍 Did You Know? Stablecoins that pay yield directly compete with bank savings accounts – which is why banking lobbies pushed to ban them in the Clarity Act draft.

📊 Daily Wrap-Up

January 15 marked a sharp reversal: Bitcoin fell below $96K as the Senate canceled its Clarity Act vote following Coinbase's opposition. The setback exposed banking industry pressure to limit crypto competition, particularly around stablecoin yields. ETF inflows slowed but stayed positive, preventing deeper losses. Sentiment neutral, traders waiting for regulatory clarity.

Today's Watch List: Can BTC defend $94K-$95K support? Watch for Senate Banking Committee updates on revised Clarity Act language and whether regulatory sentiment shifts.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.