Jan 15, 2026

🍪 Today's Snack

Bitcoin surged past $97K on January 14, hitting a two-month high as record ETF inflows and regulatory optimism fueled the strongest rally since October. Privacy coins exploded, with Monero reaching a new all-time high above $797.

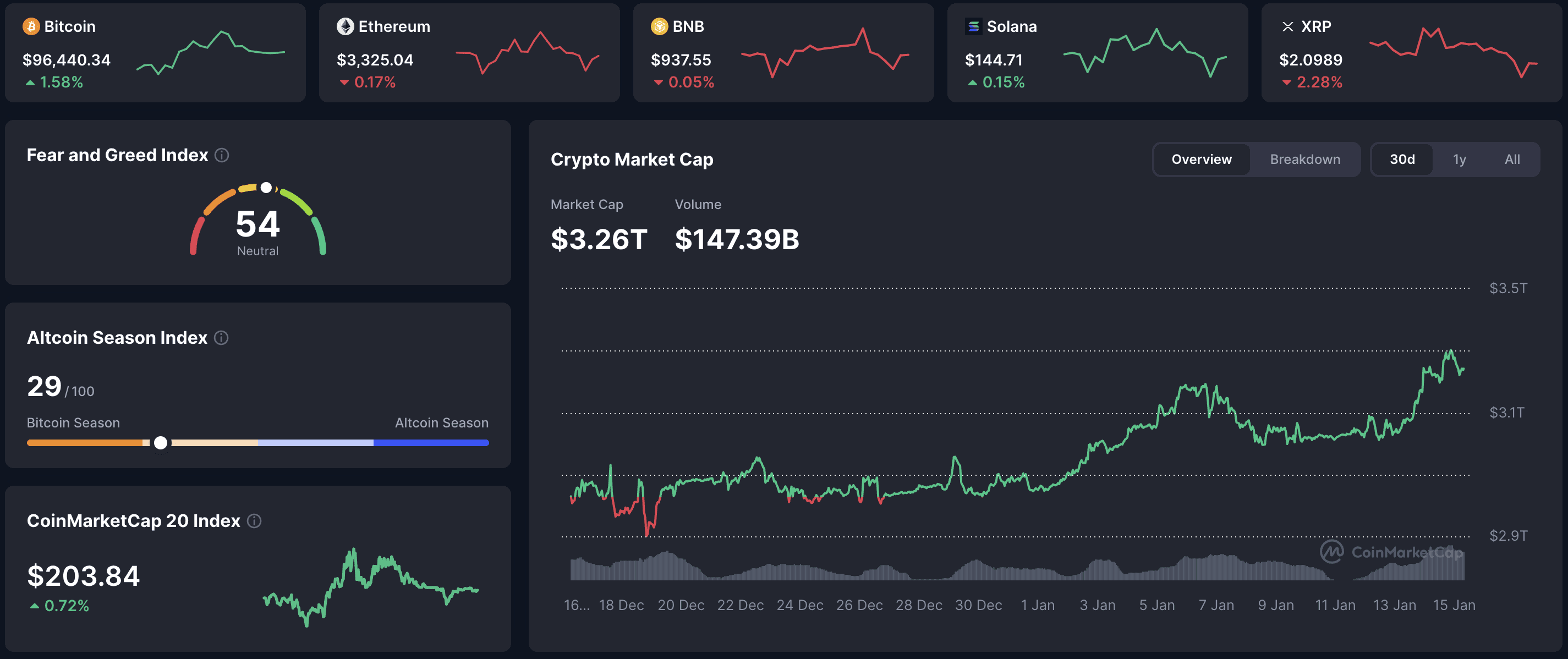

📈 24h Crypto Market Snapshot

Total crypto market cap climbed to $3.26T, with the Fear & Greed Index rising to 54 (Neutral). Sentiment improving as macro tailwinds and regulatory clarity converge.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $96,440 | +1.58% | $1.92T |

ETH | $3,325 | -0.17% | $402B |

BNB | $937 | -0.05% | $129B |

SOL | $144 | +0.15% | $82B |

🔥 Top 3 Movers & Shakers

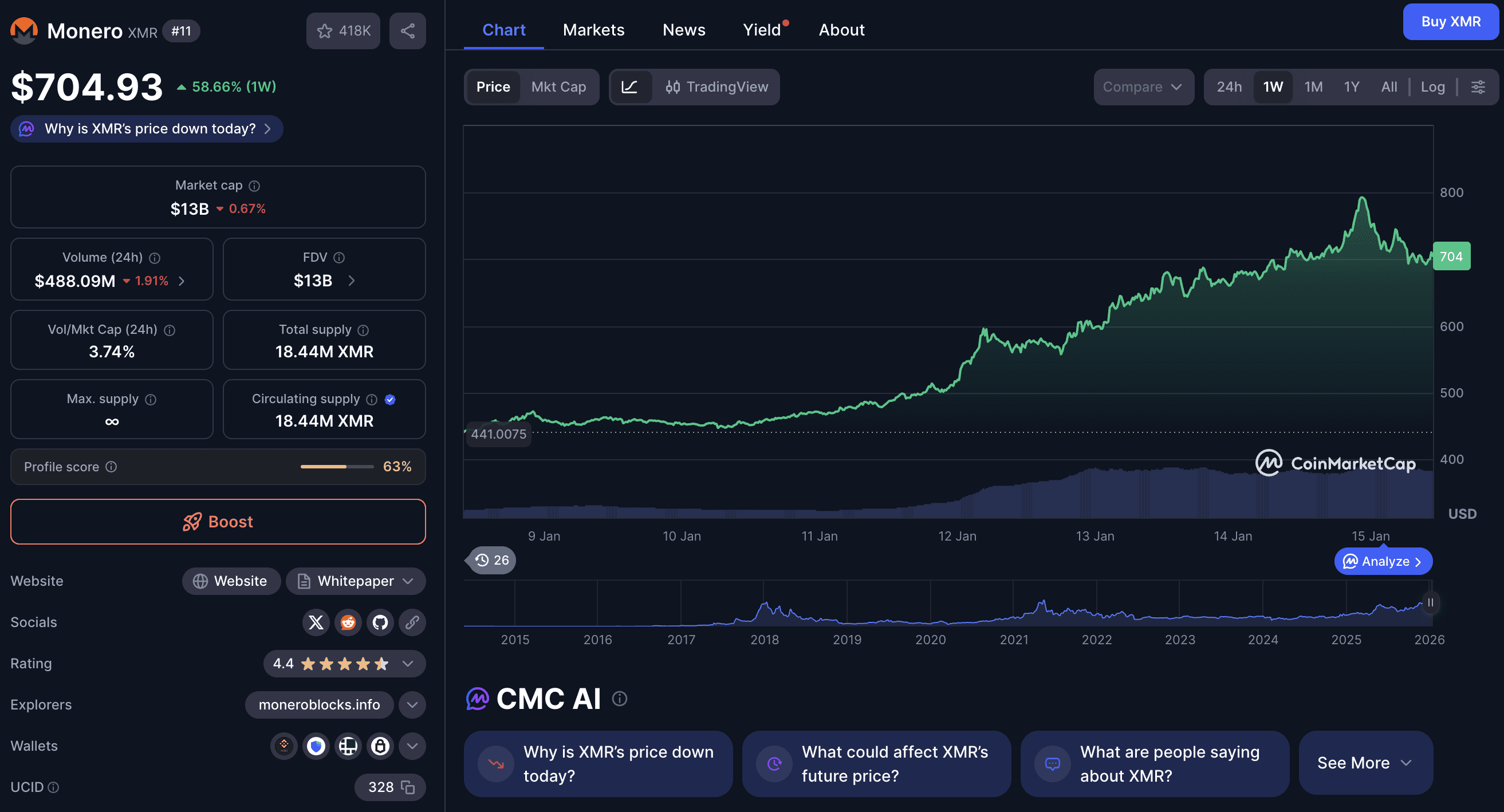

Monero (XMR) – +60% (weekly), ATH $797

Privacy king hit new all-time high as demand surged amid tightening KYC regulations. Capital rotated from Zcash following governance collapse.

Takeaway: When sectors rally on utility shifts, track whether institutional flows follow or the move fades on regulatory risk.Dash (DASH) – +54%, $86

Led privacy complex with Alchemy Pay integration across 173 countries driving speculative "privacy season" narrative.

Takeaway: Parabolic moves in high-beta names often mark late-stage rotations – watch volume exhaustion.Ethereum (ETH) – +6% (intraday peak $3,332)

Surged as ETF flows turned positive and traders positioned for altcoin breakout.

Takeaway: When major L1s outperform BTC on relief days, it suggests expanding risk appetite – early altcoin rotation signal.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $840.6M in net inflows on January 14 – strongest single day since October. Ethereum ETFs saw $175.1M in net inflows. These flows absorbed more than 100% of daily mined BTC supply and signal renewed institutional conviction.

🌍 Market Context

Macro: Benign CPI kept rate-cut expectations alive. Gold and silver hit record highs, underscoring demand for inflation hedges.

Regulatory: CLARITY Act progress lifted sentiment, though Coinbase CEO pulled support over stablecoin yield provisions. Market shrugged off drama as broader trajectory remains constructive.

On-Chain: BTC futures open interest rose above $138B. $700M in shorts liquidated, forcing spot buying. Positioning suggests controlled accumulation, not euphoric leverage.

🔍 Deep Dive – Privacy Coin Breakout

Privacy sector exploded on January 14, with Monero hitting ATH above $797. Rally reflects fundamental shift: as regulators tighten KYC/AML in Dubai, EU, and other markets, users rotate into coins hiding wallet balances and transaction data.

Monero benefited from Zcash governance collapse after core team resigned January 7. Seven-day Dash volume surged 525% to $1.29B. XMR market cap crossed $13B, briefly placing it in top 15.

📰 Top News

Bitcoin breaks $97K: Hit $97,694 intraday – highest since November 14. Polymarket gives 73% odds BTC reaches $100K in January.

Record ETF inflows: $840.6M into Bitcoin ETFs, $175.1M into Ethereum ETFs – biggest combined inflows since October.

Monero ATH: XMR surged past $797 on privacy demand and Zcash governance collapse.

CLARITY Act drama: Senate markup postponed after Coinbase CEO pulled support. Bill's passage uncertain.

📚 Education Bits

💡 Pro Tip: When short liquidations exceed $500M in 24h, expect 1-2 sessions of follow-through as exchanges cover in spot markets.

🔍 Did You Know? Privacy coins like Monero use ring signatures and stealth addresses to hide sender, receiver, and amounts – fundamentally different from Bitcoin's public ledger.

📊 Daily Wrap-Up

January 14 delivered crypto's strongest rally since October: Bitcoin broke multi-month resistance, ETF inflows hit records, privacy coins went parabolic. Sentiment improved from fear to neutral without euphoria. CLARITY Act drama adds uncertainty, but macro and flows remain supportive.

Today's Watch List: Can BTC hold $95K and push toward $100K? Watch ETF flow follow-through, Senate Banking Committee updates, and privacy-coin momentum sustainability.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.