Jan 19, 2026

🍪 Today's Snack

Bitcoin fell 3% over the weekend, dropping to $93K after President Trump's surprise $TRUMP memecoin launch sparked controversy and profit-taking across crypto markets.

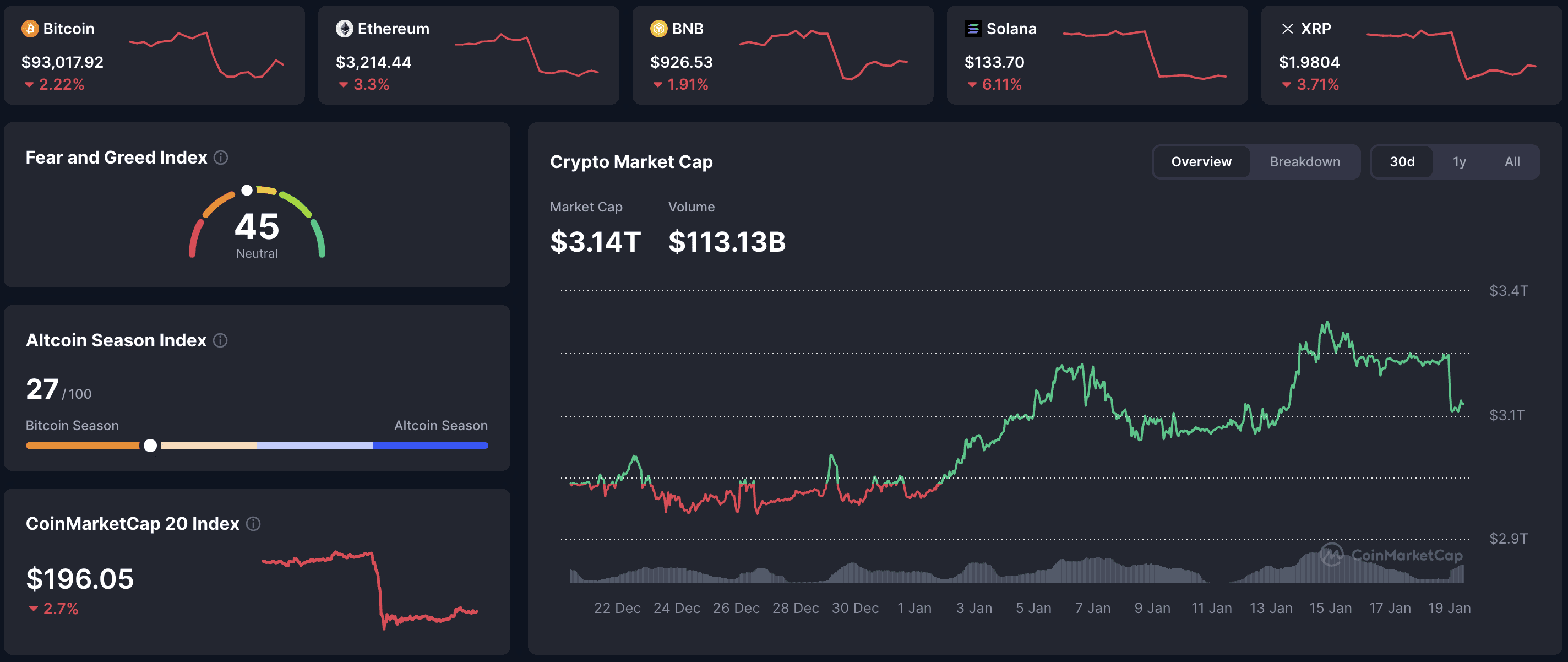

📈 24h Crypto Market Snapshot

Total crypto market cap eased to $3.14T, down 3% from Friday's highs. Fear & Greed Index dropped to 45 (Neutral), reflecting caution after the memecoin frenzy.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $93,018 | -2.22% | $1.85T |

ETH | $3,214 | -3.3% | $387B |

BNB | $927 | -1.91% | $134B |

SOL | $134 | -6.11% | $76B |

🔥 Top 3 Movers & Shakers

Trump ($TRUMP) – peaked at $14B, crashed 65%

Trump's Solana-based memecoin surged to $14B market cap on launch, then crashed as critics slammed tokenomics (80% owned by Trump entities) and ethics concerns mounted.

Takeaway: Presidential memecoins are peak conflict-of-interest – high volatility, zero utility, and regulatory risk make these pure speculation plays.Melania ($MELANIA) – launched Sunday, hit $2B then tanked

First Lady's token followed Trump's playbook, briefly reaching $2B valuation before collapsing alongside $TRUMP.

Takeaway: Copycat launches during hype cycles rarely sustain – insiders dump on retail.Monero (XMR) – +52% weekly, held gains

Privacy king maintained strength from prior week's rally, consolidating near $700 as sector momentum persisted.

Takeaway: Privacy coins show genuine demand resilience – unlike memecoins, sustained volume suggests real adoption.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs saw -$394.7M in net outflows on Friday January 16 – first negative day in five sessions as traders took profits after the prior week's $1.7B cumulative inflows. Ethereum ETFs recorded +$4.7M, staying modestly positive.

🌍 Market Context

Regulatory: Trump's memecoin launch three days before inauguration triggered ethics backlash. Critics argued the president profiting from crypto while shaping policy creates massive conflicts of interest, overshadowing previous regulatory optimism.

Macro: Bitcoin held $95K Friday but weekend profit-taking accelerated after memecoin controversy. Correlation with tech stocks remained weak as crypto faced sector-specific headwinds.

🔍 Deep Dive – Trump Memecoin Fiasco

Trump launched $TRUMP on January 17 via Truth Social and X, three days before inauguration. The Solana-based token hit $14B market cap within hours, briefly valuing Trump's 80% stake at over $11B. But tokenomics showed 800M of 1B total supply locked to Trump-owned CIC Digital entities, with only 200M available to the public.

Ethics experts condemned the move as an unprecedented presidential conflict of interest – Trump stands to profit from crypto policy while holding massive token positions. The memecoin narrative shifted from "pro-crypto president" to "grift," triggering selloffs across the broader market.

By Sunday, both $TRUMP and copycat $MELANIA had crashed 60%+, and Bitcoin lost $95K support as traders reassessed regulatory clarity hopes.

📰 Top News

Trump launches $TRUMP memecoin: Token hit $14B market cap before crashing 65%, sparking ethics controversy over presidential conflicts of interest.

Bitcoin ETF outflows return: -$394.7M flowed out of BTC ETFs on Jan 16 after five straight days of inflows, as traders took profits before weekend.

Bitcoin loses $95K support: BTC dropped to $93K over weekend as memecoin drama overshadowed inauguration optimism.

📚 Education Bits

💡 Pro Tip: When political figures launch tokens days before taking office, watch tokenomics and vesting schedules – concentrated insider ownership (80%+ in Trump's case) signals dump risk.

🔍 Did You Know? Memecoin market caps are misleading – $TRUMP's "$14B valuation" assumed all tokens tradable, but only 20% were public, meaning real liquidity was closer to $3B.

📊 Daily Wrap-Up

The weekend erased Bitcoin's post-CPI rally as Trump's memecoin launch backfired spectacularly. What started as "pro-crypto presidency" euphoria turned into ethics scandal, with critics slamming presidential conflicts of interest. Friday's ETF outflows showed institutional caution, while retail sentiment soured on memecoin drama. Bitcoin now tests $93K support heading into inauguration week.

Today's Watch List: Can BTC reclaim $95K, or does weekend weakness extend into Monday? Watch for Trump inauguration policy announcements and whether institutional ETF flows reverse.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.