Dec 17, 2025

🍪 Today’s Snack

Crypto market dipped -0.4% over 24 hours, with total cap at $2.96T. Bitcoin held relatively steady at -0.2%, while alts like ETH and SOL dropped harder amid heavy ETF outflows and macro caution from rising unemployment.

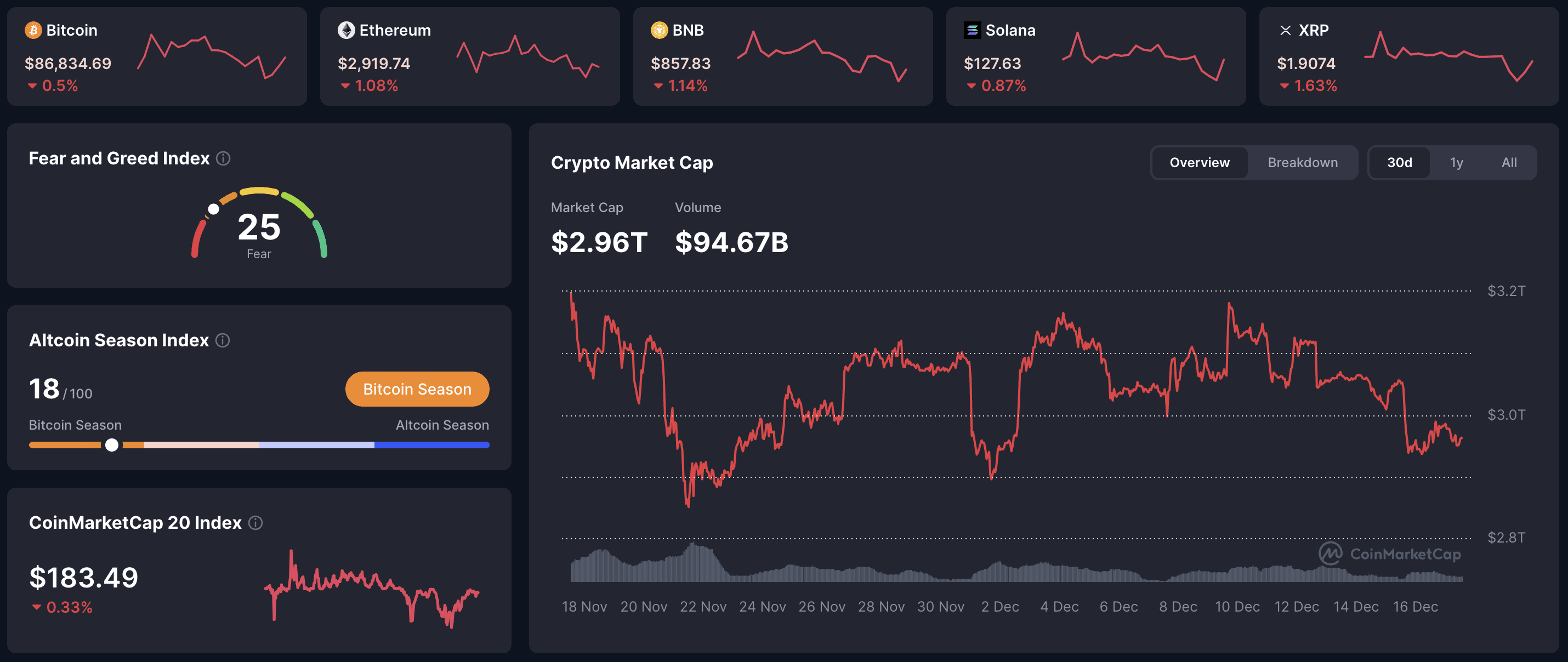

📈 24h Crypto Market Snapshot

Total crypto market cap at $2.96T, down -0.4% in 24 hours. Fear & Greed Index at 25 - fear, signaling caution and potential oversold conditions among investors.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 86900 | -0.2 | 1.72T |

ETH | 2930 | -3.2 | 353B |

SOL | 128 | -1.9 | 60B |

BNB | 865 | -1.0 | 126B |

XRP | 1.90 | -4.7 | 108B |

ADA | 0.39 | -2.0 | 14B |

What does Fear & Greed mean? The Fear & Greed Index measures crypto market sentiment from 0 (extreme fear) to 100 (extreme greed), incorporating volatility, volume, and social metrics. In trading strategies, low scores like 25 often indicate buy opportunities during oversold periods, helping investors time entries for 'crypto market sentiment analysis' and risk management.

🔥 Top 3 Movers & Shakers

Monero (XMR): +4.54% in 24 hours. Ranked top-15 with ~$8B cap, this privacy coin surged amid updates and adoption growth. Takeaway: Growth signals rising interest in secure transactions during regulatory uncertainty - watch for volume spikes as a confirmation of sustained momentum, but note privacy-focused assets often face higher scrutiny.

JUST (JST): +4.35% in 24 hours. Top-150 asset with ~$410M cap, gained on DeFi platform activity in TRON ecosystem. Takeaway: Uptrend may reflect stablecoin lending demand; consider on-chain borrowing metrics for potential continuation, though competition in DeFi could cap gains if broader market dips.

MYX Finance (MYX): +4.18% in 24 hours. Mid-top-200 coin with ~$357M cap, boosted by protocol enhancements on BNB Chain. Takeaway: Rally tied to yield farming improvements - evaluate TVL and APR trends for decision-making, but be aware of smart contract risks in newer DeFi projects during volatile periods.

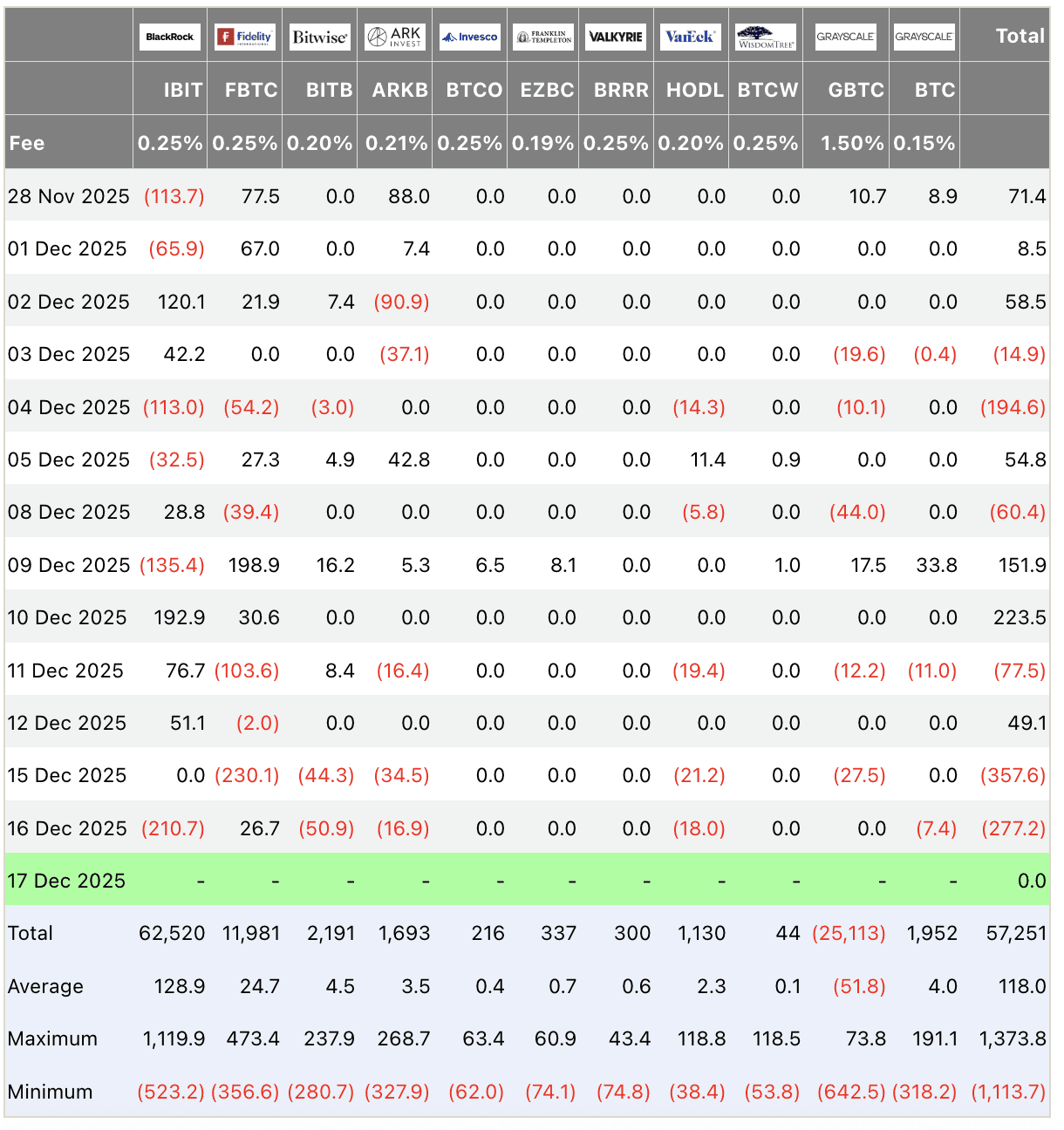

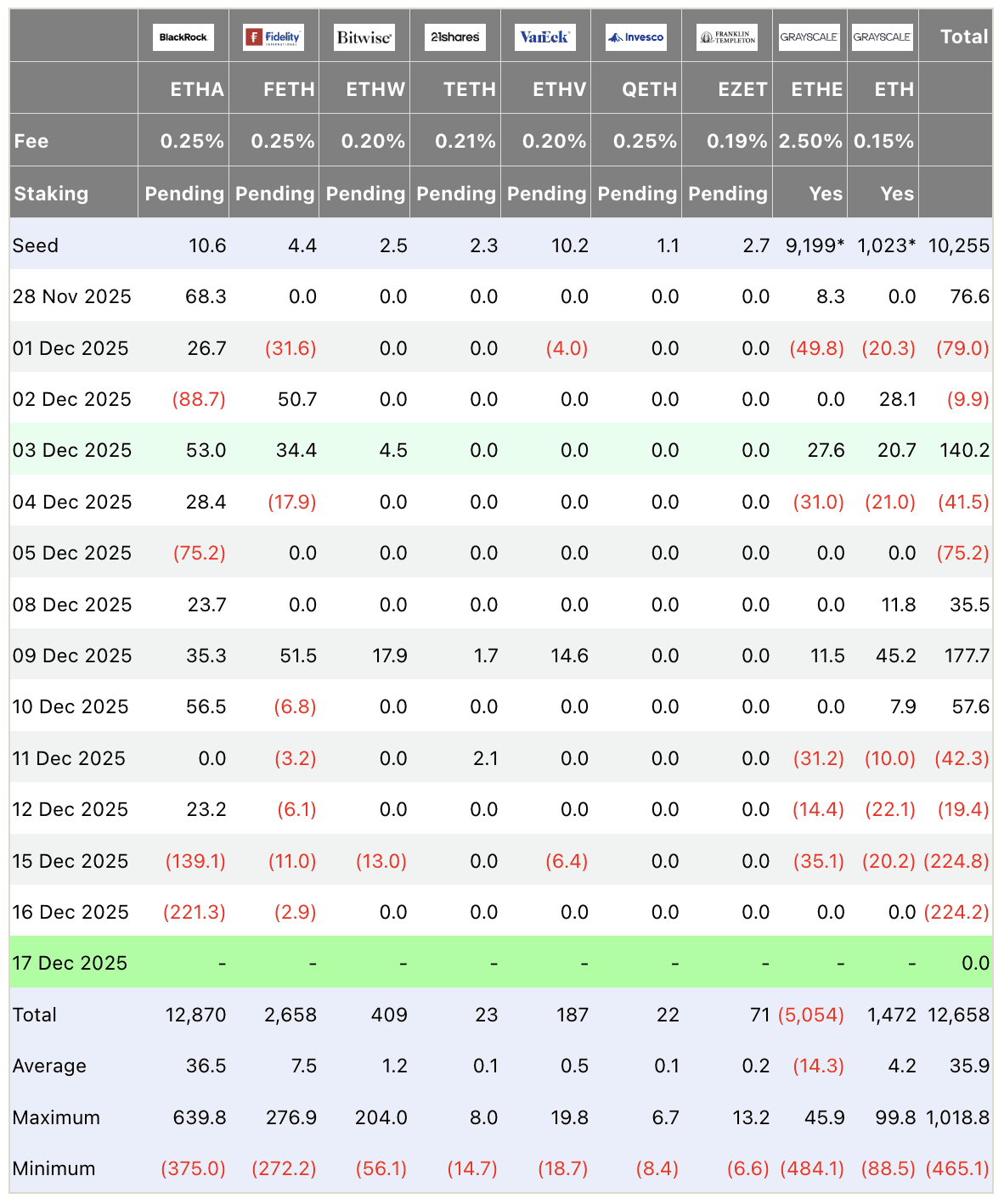

🏦 ETF & Institutional Flows

Net flows on December 16 showed heavy outflows: Bitcoin ETFs lost $318M, Ethereum ETFs $224M, marking one of the larger days since November. Weekly crypto ETP outflows around $600M reflect institutional caution amid macro risks.

Analysis: Outflows reduce liquidity and pressure prices, but historically precede rebounds on stabilization.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why track ETFs? Crypto ETFs represent 'institutional crypto investments' from big players like BlackRock, driving billions in inflows. Monitoring net flows helps predict 'Bitcoin ETF impact on price', as positive trends signal growing demand and market maturity for risk assets.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply declined to ~70% (~13.68M BTC), indicating some distribution despite dips. Mid-tier whales (100-1K BTC addresses) accumulated net ~54K BTC over 7 days, while exchange reserves hit record lows ~1.8M BTC. Funding rates averaged -0.005%, with shorts dominant. Takeaway: On-chain suggests large players buying dips, but LTH selling adds pressure.

What is on-chain? On-chain metrics pull 'blockchain data analysis' directly from networks like Bitcoin, tracking wallet activity and transactions. For 'crypto whale tracking', they reveal accumulation patterns, helping distinguish genuine demand from exchange hype in volatile markets.

🌍 Macro Pulse

Fed's rate cut to 3.50-3.75% on December 10 holds, but inflation remains above 2% due to tariffs and trade tensions, delaying further easing. Unemployment rose to 4.6% in November (highest since 2021), with +64K jobs added but downward revisions. This pressures risk assets like crypto, with S&P 500 down -0.8%.

How does Fed affect crypto? Federal Reserve policies influence 'crypto macro factors' through interest rates; cuts increase liquidity, boosting 'risk asset performance' like BTC. However, persistent inflation can lead to 'Fed rate hike expectations', causing volatility in correlated markets.

💡 Market Trend Spotlight

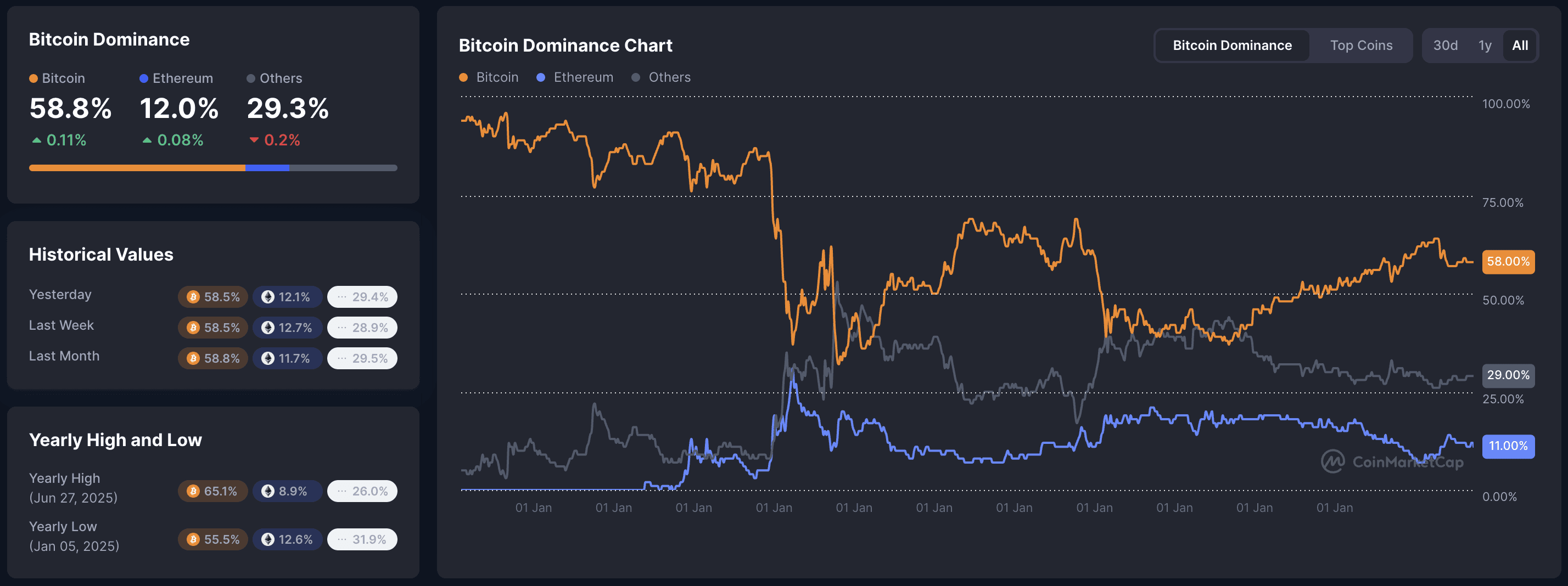

BTC dominance climbed to 58.7%, as alts lose market share by 3-6%. On-chain confirms: BTC trading volumes stable, while ETH and SOL see outflows. Observations: In fear periods, investors flock to "safe" BTC over alts; BTC volume up 4%, solidifying the trend. If dominance hits 60%, alt season may delay further.

How to read trends? Analyze 'crypto market trends' by combining volume spikes with on-chain flows for confirmation. High BTC dominance signals 'altcoin season delays', guiding strategies for portfolio rebalancing in bull or bear phases.

🚀 Quick Hits

Bitcoin dipped below $90K, testing $86K support amid low liquidity.

XRP slips to $1.90 despite Ripple’s regulatory win, support at $2 under threat.

ETH fails $3K hold with $224M outflows, showing double-digit monthly losses.

Tron among yearly leaders +22% YTD on stablecoin dominance.

MSTR buys 10K+ BTC for $980M, now holds 671K BTC at avg $75K.

JPMorgan launches tokenized money fund on Ethereum, signaling deeper crypto involvement.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.