Dec 18, 2025

🍪 Today’s Snack

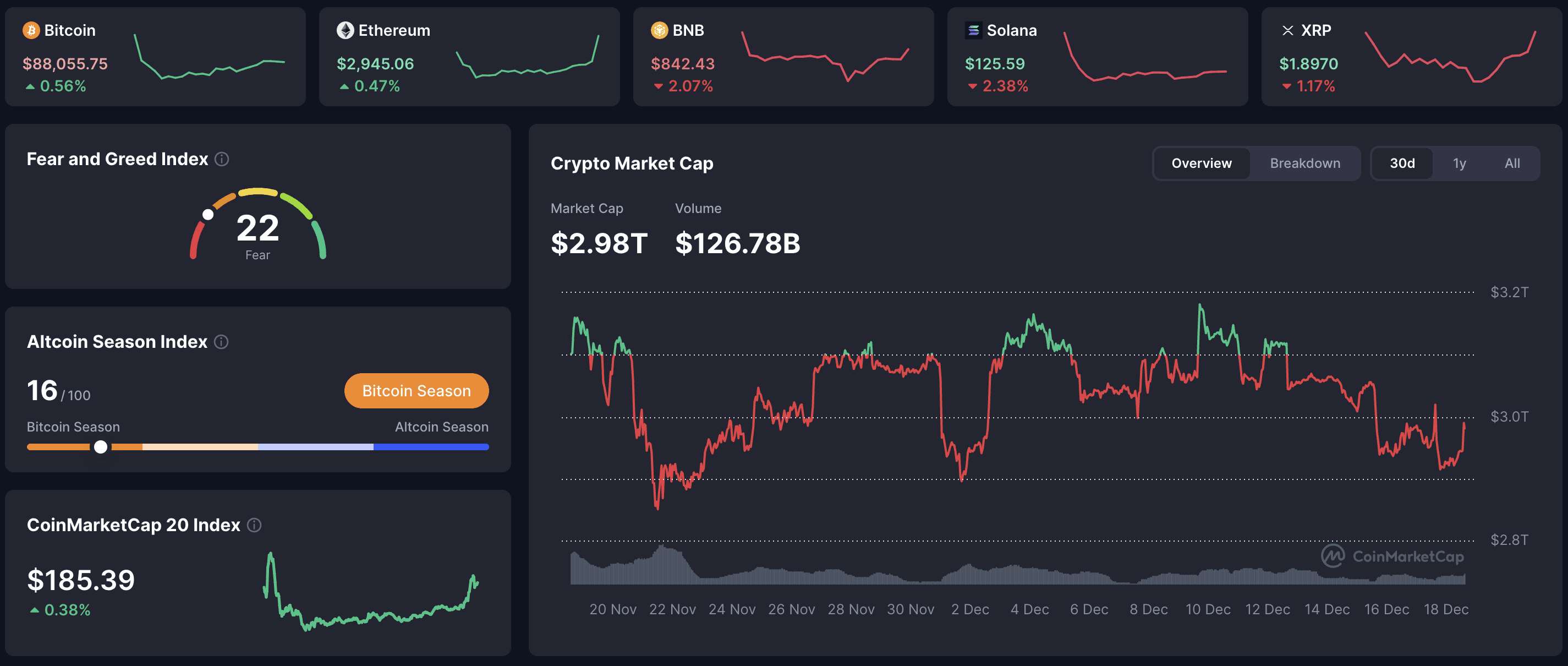

Crypto market gained +0.8% over 24 hours, reaching total cap of $3T. Bitcoin rose +0.9%, leading the advance with strong ETF inflows, while alts showed varied performance in a cautious environment.

📈 24h Crypto Market Snapshot

Total crypto market cap hit $3T, up +0.8% in 24 hours. Fear & Greed Index at 22 - fear, reflecting lingering caution but slight easing, suggesting room for gradual recovery.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 88476 | +0.90 | 1.76T |

ETH | 2957 | +0.40 | 356B |

SOL | 126 | +2.67 | 60B |

BNB | 846 | +1.89 | 123B |

XRP | 1.89 | +1.14 | 107B |

DOGE | 0.1285 | +1.91 | 19B |

What does market cap mean? Total crypto market capitalization sums the value of all coins, reflecting overall sector size and investor interest. In 'crypto market cap analysis', milestones like $3T often signal renewed demand and potential turning points.

🔥 Top 3 Movers & Shakers

UNUS SED LEO (LEO): +28.87% in 24 hours. Established exchange utility token with long history, surged on high trading volumes. Takeaway: Platform-linked tokens rally on activity spikes - monitor exchange metrics for clues on sustainability versus short squeezes.

Hyperliquid (HYPE): +9.78% in 24 hours. DeFi protocol token with growing cap, gained from TVL and user expansion. Takeaway: Perpetual platforms draw capital in volatile times - check open interest and funding for risk of quick reversals.

Cardano (ADA): +3.09% in 24 hours. Research-oriented chain since 2017 with solid community, rose on updates and staking. Takeaway: Fundamentals-based projects catch up in recoveries - track wallet activity for real engagement signals.

How to spot sustainable gainers? Beyond raw percentage, check trading volume against cap in 'crypto top gainers analysis' - unsupported spikes frequently reverse in choppy markets.

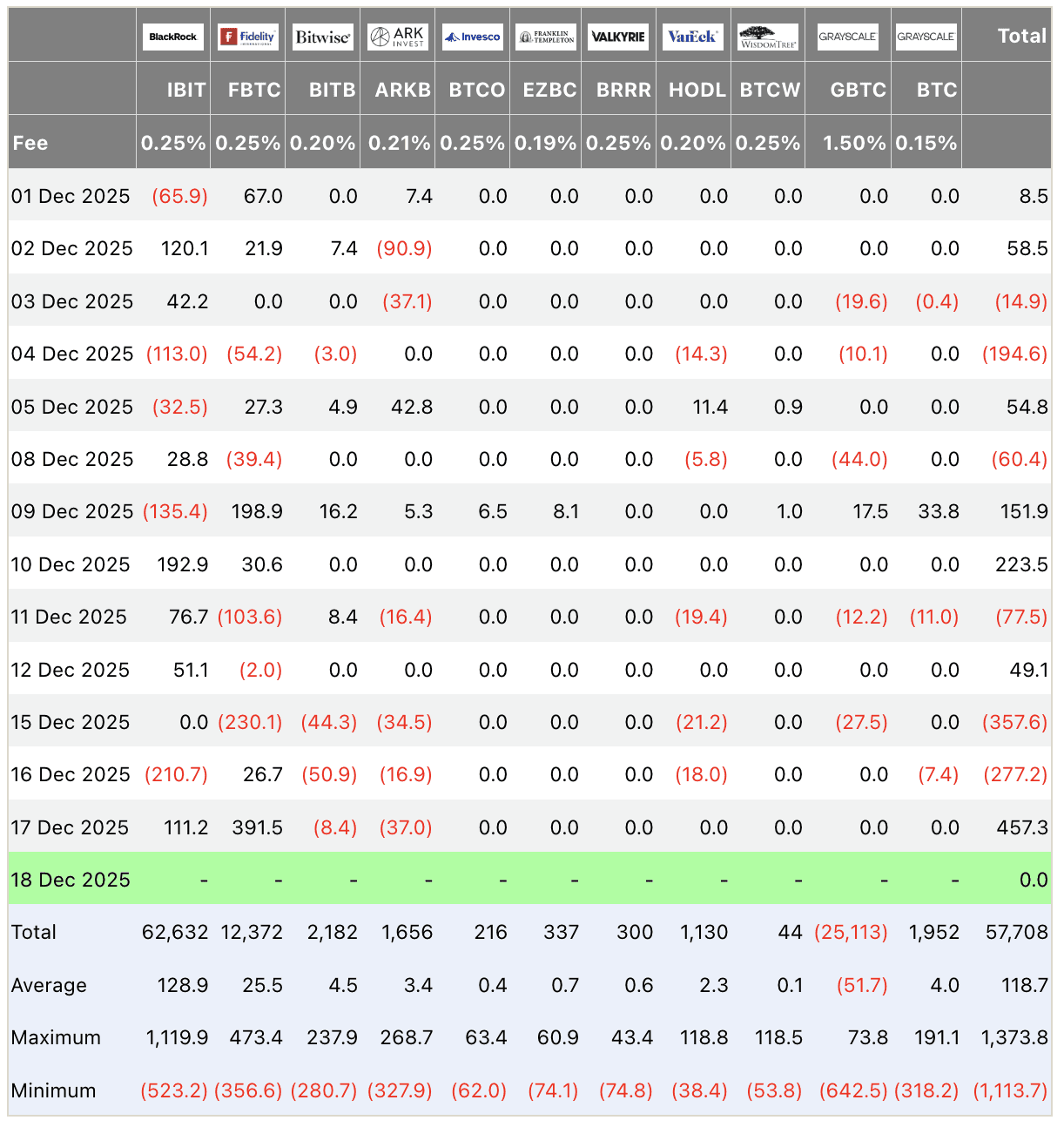

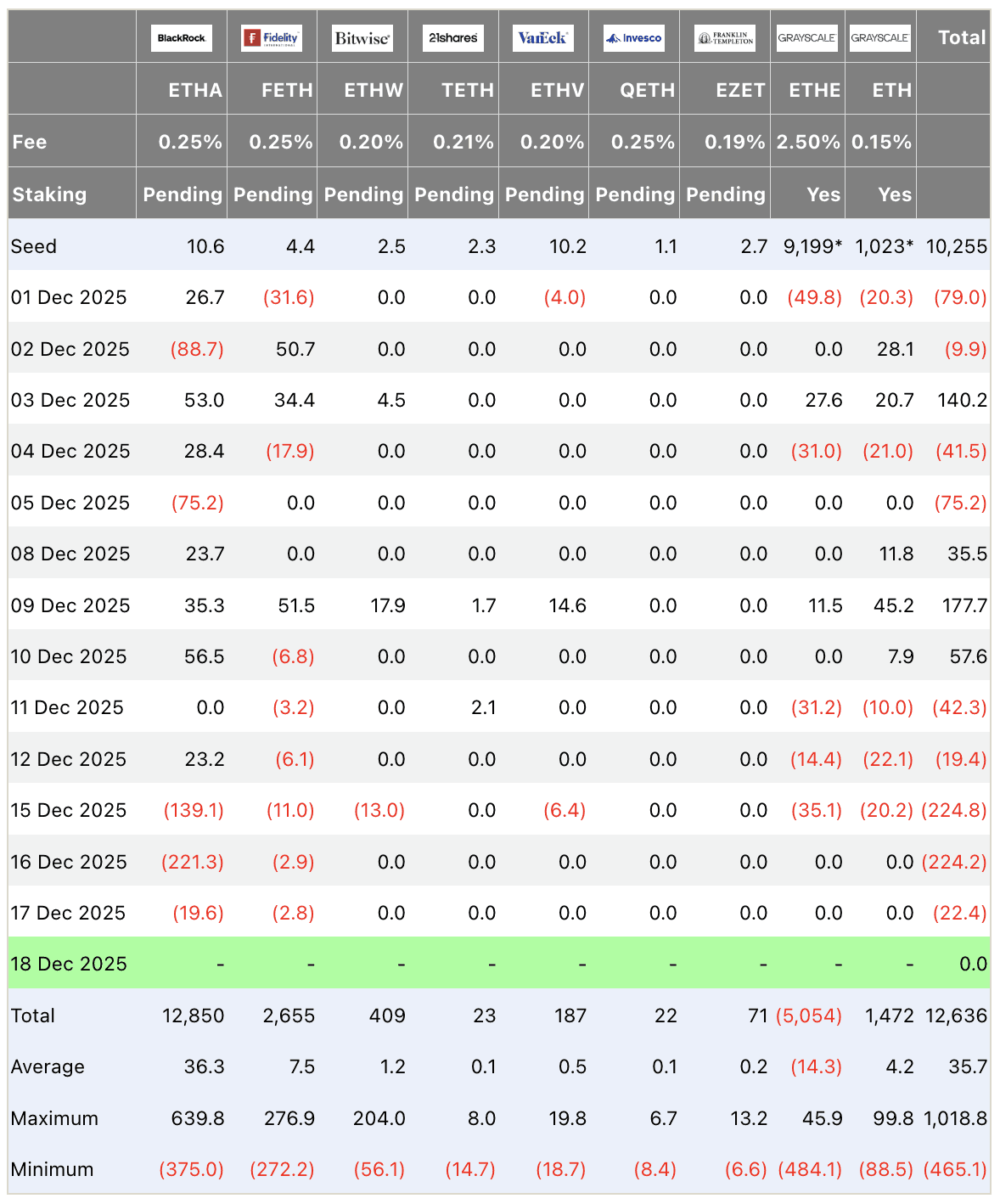

🏦 ETF & Institutional Flows

Net flows on December 17 turned positive for BTC: Bitcoin ETFs +$457M (Fidelity +$391M dominant), Ethereum ETFs -$22M. Strongest BTC day in weeks, reversing prior outflows.

Analysis: BTC inflows add liquidity and upward pressure, highlighting selective institutional preference.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF inflows matter? Spot ETFs provide 'regulated crypto access' for institutions, with flows directly influencing supply and 'Bitcoin ETF price dynamics' in evolving markets.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply held steady at ~70%, minimal selling pressure. Mid-tier whales accumulated, exchange reserves low. Funding rates neutral. Takeaway: On-chain calm supports price resilience during sentiment dips.

What is on-chain? Data straight from blockchains reveals actual holder actions, bypassing exchange noise. Essential for distinguishing real accumulation from hype in 'on-chain crypto insights'.

🌍 Macro Pulse

Fed steady post-cut, monitoring inflation stickiness from tariffs. Unemployment stable, growth outlook moderate. Neutral backdrop supports risk assets, but trade risks remain.

How does Fed affect crypto? Policy shifts impact 'crypto macro ties' - steady rates preserve liquidity for assets like BTC, though delays in easing introduce volatility.

💡 Market Trend Spotlight

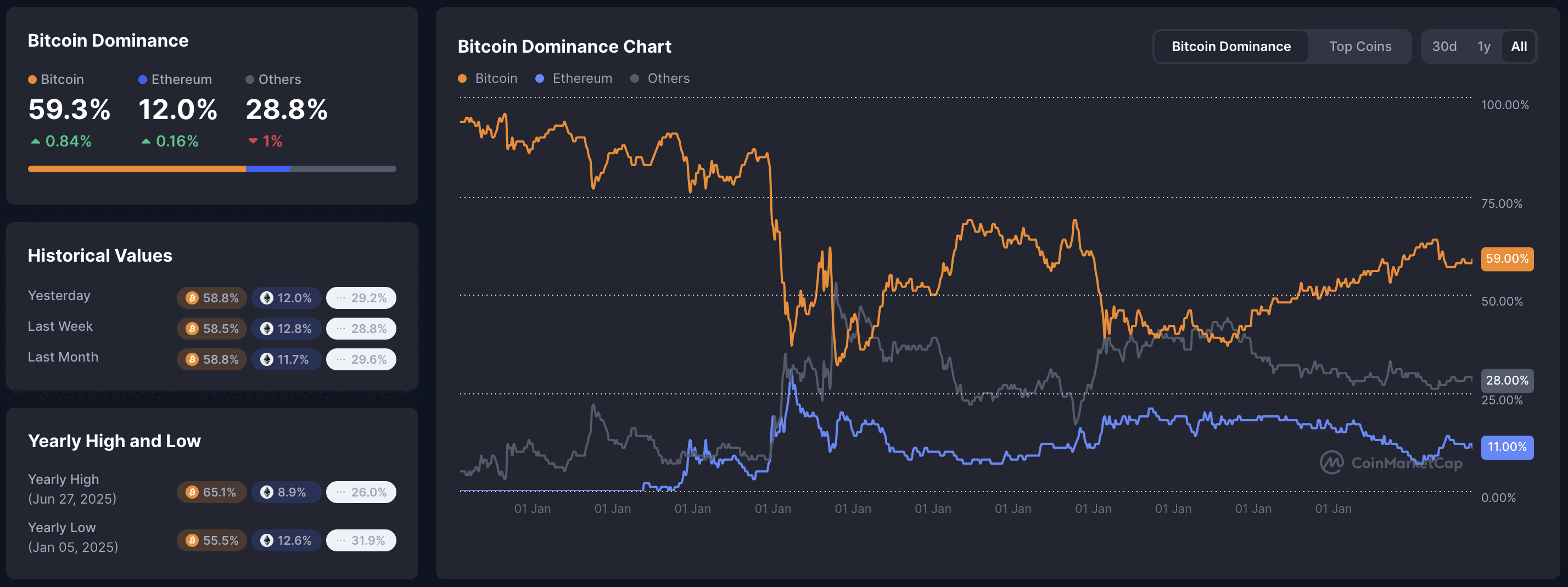

BTC +0.9% drove market gain, dominance edging higher as capital favors leaders. Observations: Rotation to BTC common in fear - inflows reinforce trend, likely capping near-term alt upside until broader shift.

How to read trends? Combine volume surges with on-chain flows for validation. BTC leadership often precedes wider market moves in 'crypto trend cycles'.

📰 Top News

Bitcoin ETFs attract $457M inflows, Fidelity leading: Reverses outflow streak, directly bolstering BTC supply dynamics.

Grayscale predicts new highs for BTC/ETH/SOL in 2026 on ETF growth: Reinforces institutional bullishness beyond short-term noise.

Texas pushes forward Bitcoin reserve plan: Advances government adoption, strengthening BTC narrative.

US Senate delays crypto legislation to 2026: Prolongs uncertainty, weighing on sentiment temporarily.

JPMorgan scales tokenization initiatives: Bridges TradFi and Web3, expanding real-world use cases.

📊 Daily Wrap-Up

Market crossed $3T on BTC-led gains, fueled by robust ETF inflows signaling institutional return. Fear at 22 keeps tone cautious, with dominance rise favoring Bitcoin safety. Monitor sustained flows and regulatory updates - on-chain steadiness provides underlying floor.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.