Fear & Greed rises to 27: Sentiment improving?

Fear & Greed rises to 27: Sentiment improving?

Fear & Greed rises to 27: Sentiment improving?

Dec 19, 2025

🍪 Today’s Snack

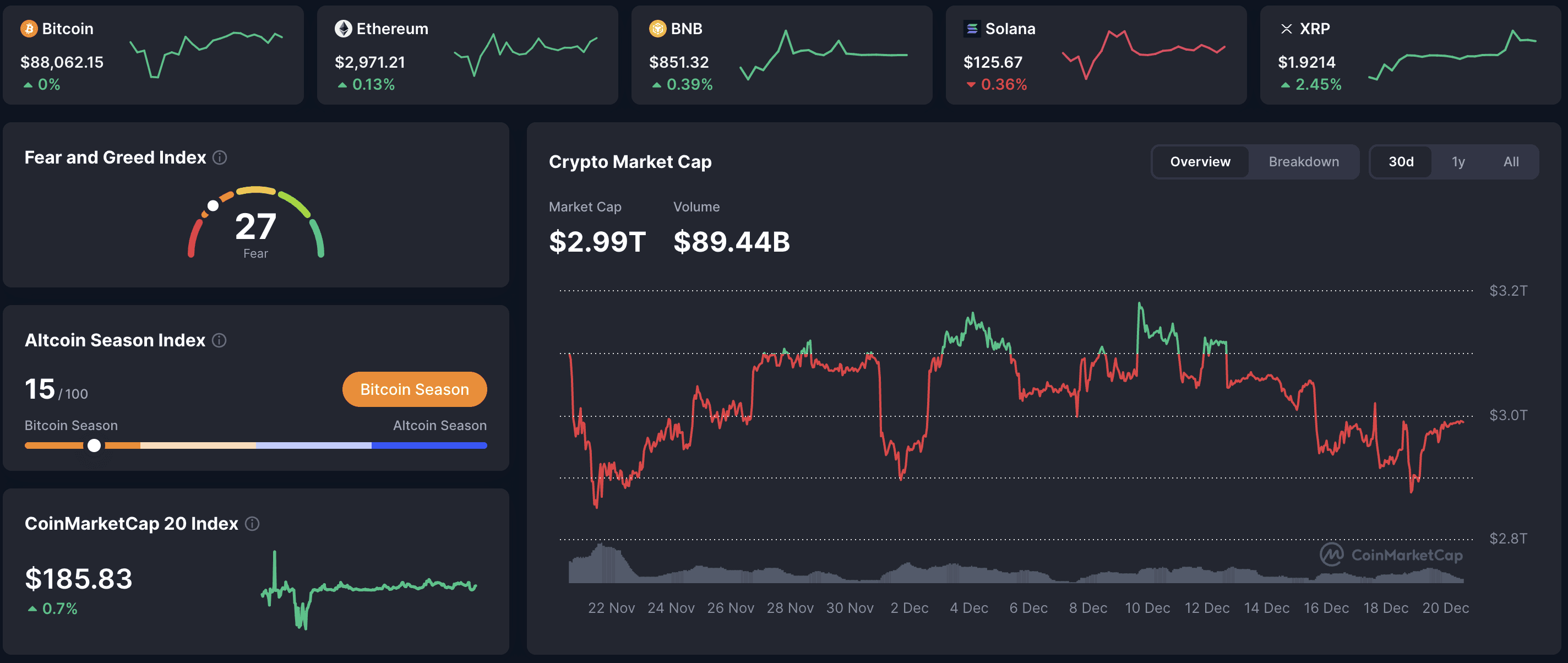

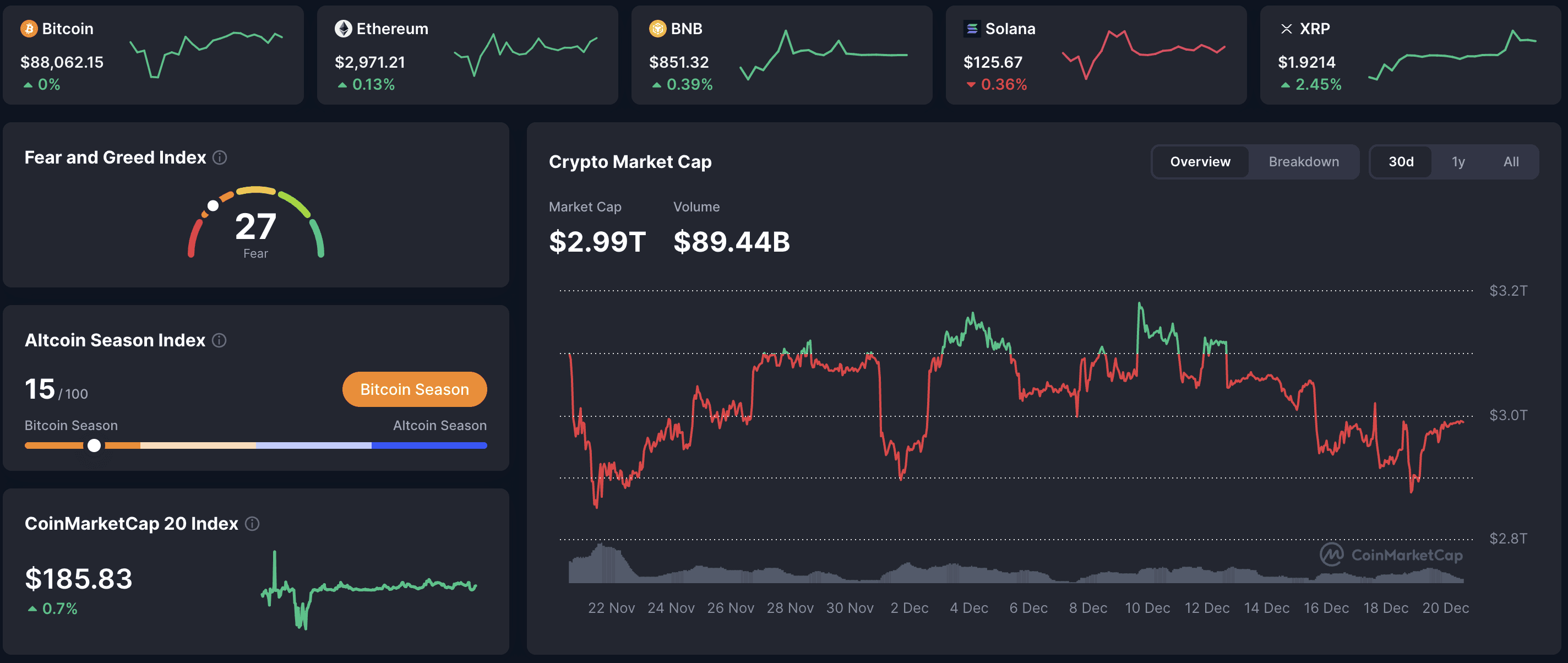

Crypto market edged +0.7% over 24 hours, with total cap at $2.98T. Bitcoin stable near $88K, supported by positive ETF inflows, while alts mixed amid improving but still fearful sentiment.

📈 24h Crypto Market Snapshot

Overview of key assets and capitalization

Total crypto market cap at $2.98T, up +0.7% in 24 hours. Fear & Greed Index at 27 - fear, up from recent lows, indicating slight sentiment recovery and possible oversold bounce.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 88055 | +0.56 | ~1.75T |

ETH | 2945 | +0.47 | ~355B |

BNB | 842 | -2.07 | ~123B |

SOL | 126 | -2.38 | ~60B |

XRP | 1.90 | -1.77 | ~108B |

DOGE | 0.183 | +0.38 | ~27B |

What does market cap mean? Total crypto market capitalization aggregates all coin values, acting as sector gauge in 'crypto market cap analysis'. Levels near $3T highlight resilience despite fear.

🔥 Top 3 Movers & Shakers

Canton CC (CC): +33.0% in 24 hours. Niche token (likely small cap, not in top-100 cap), growth tied to hype around community-driven projects or new exchange listings. Takeaway: Such spikes often come from pump-and-dump - check volume ($369M) and on-chain transfers to separate speculation from real interest; high short-term risks.

LEO Token (LEO): +15.3% in 24 hours. Utility token of Bitfinex (in top-100 cap, ~$5.6B). Growth from platform updates, fee reductions, and rebound from oversold levels (volume $2.5M). Takeaway: Exchange tokens rally on liquidity boosts - check Bitfinex trading activity and burn mechanisms to assess sustainability; more stable than small caps, but tied to exchange health.

Midnight (NIGHT): +10.7% in 24 hours. Small cap privacy-focused project (not in top-100 cap, cap ~$200M). Growth from protocol announcements and privacy narrative revival (volume $2.75M). Takeaway: Privacy coins flare up on regulatory news - analyze wallet growth and darknet adoption, but volatility is high and corrections are common.

How to spot sustainable gainers? Look at volume relative to cap and project fundamentals in 'crypto top gainers analysis' - unsupported spikes frequently reverse in volatile markets.

🏦 ETF & Institutional Flows

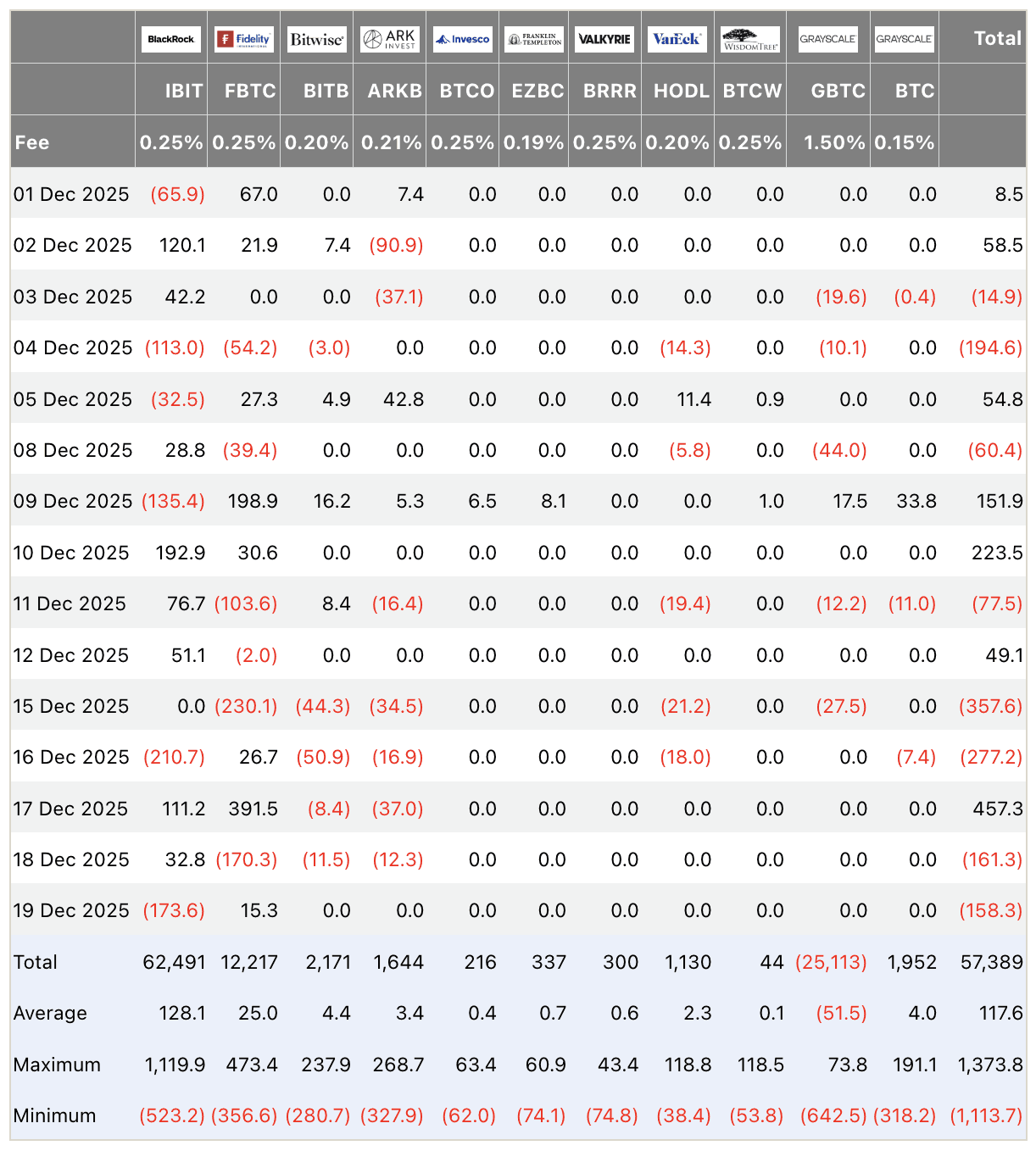

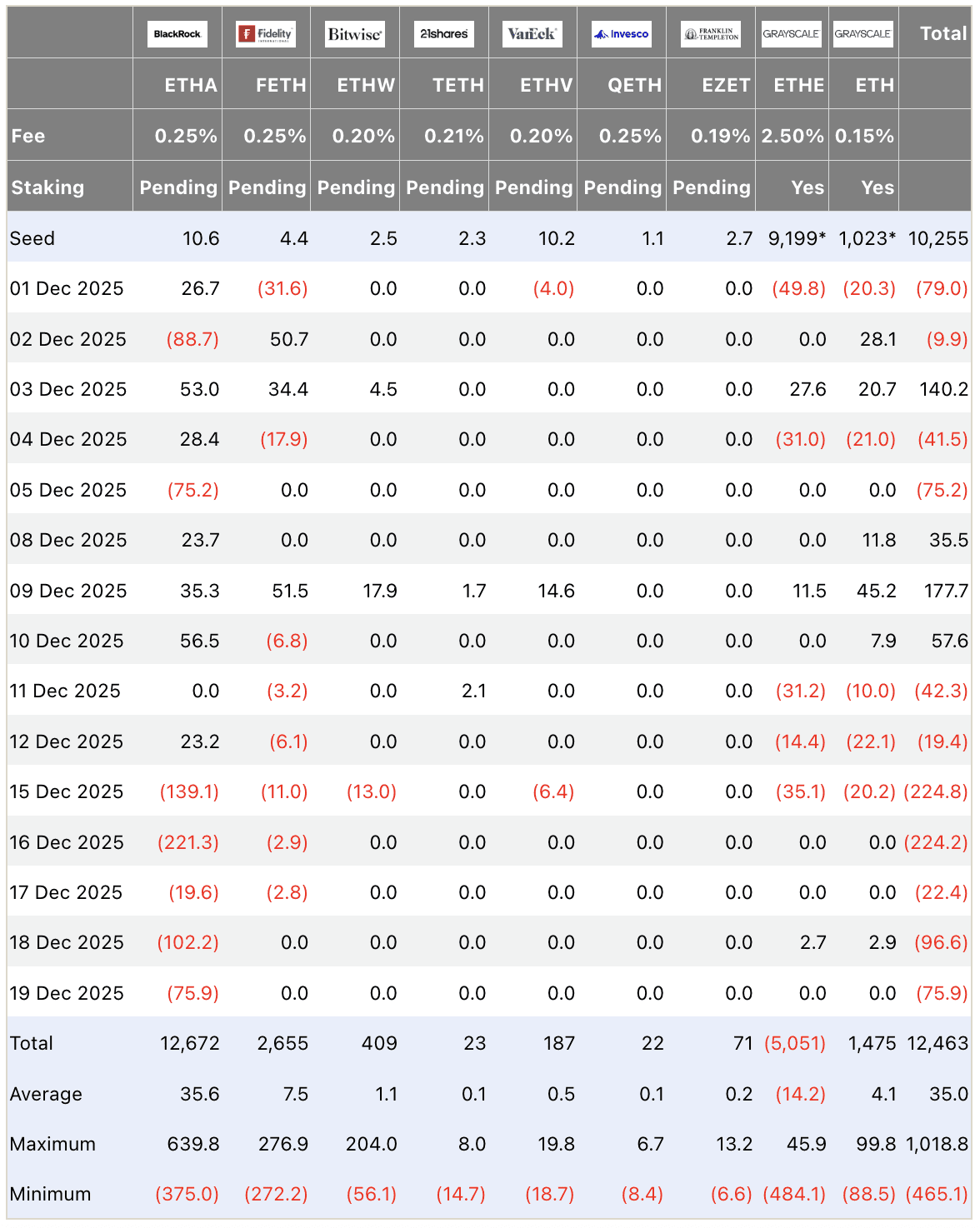

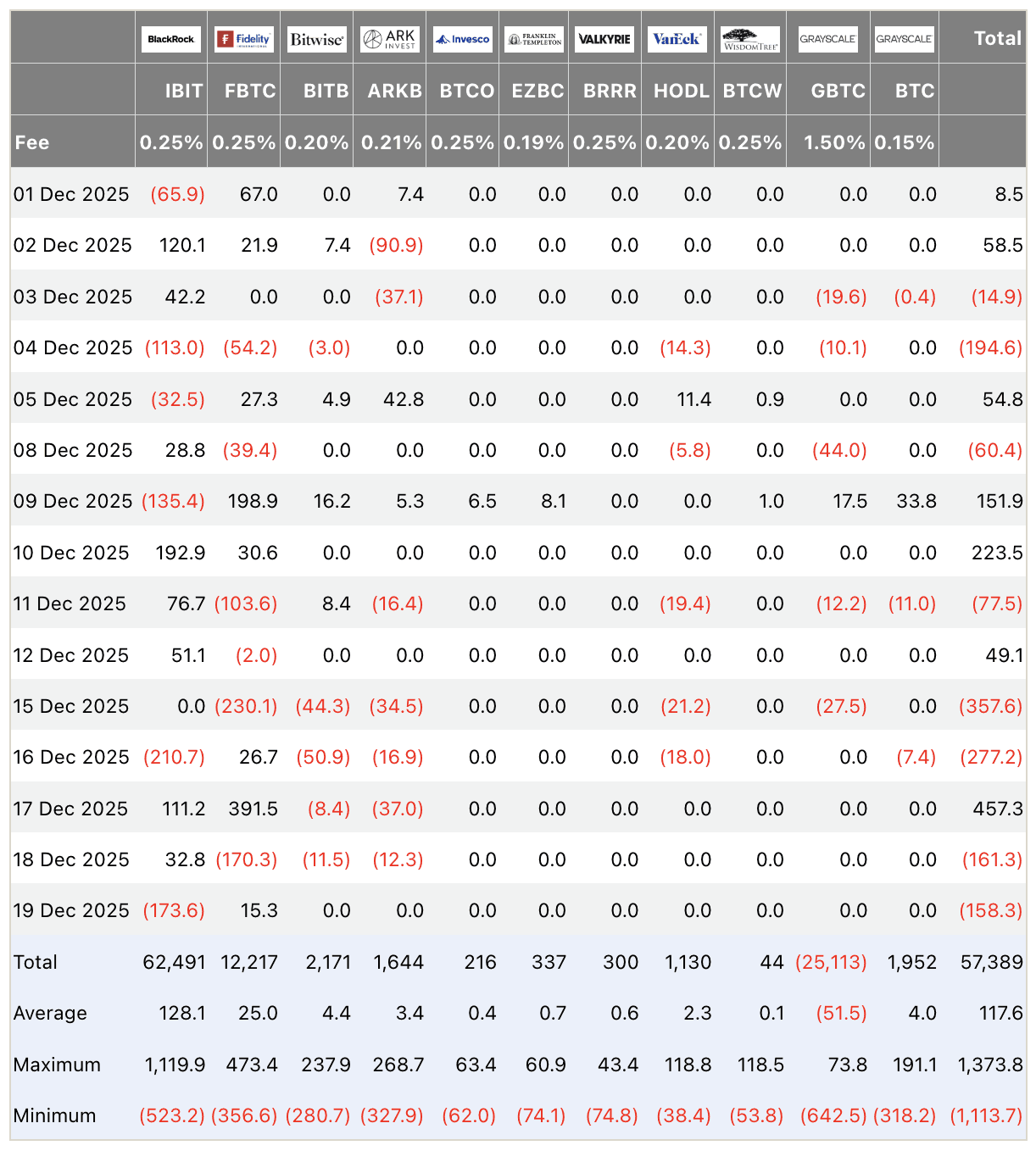

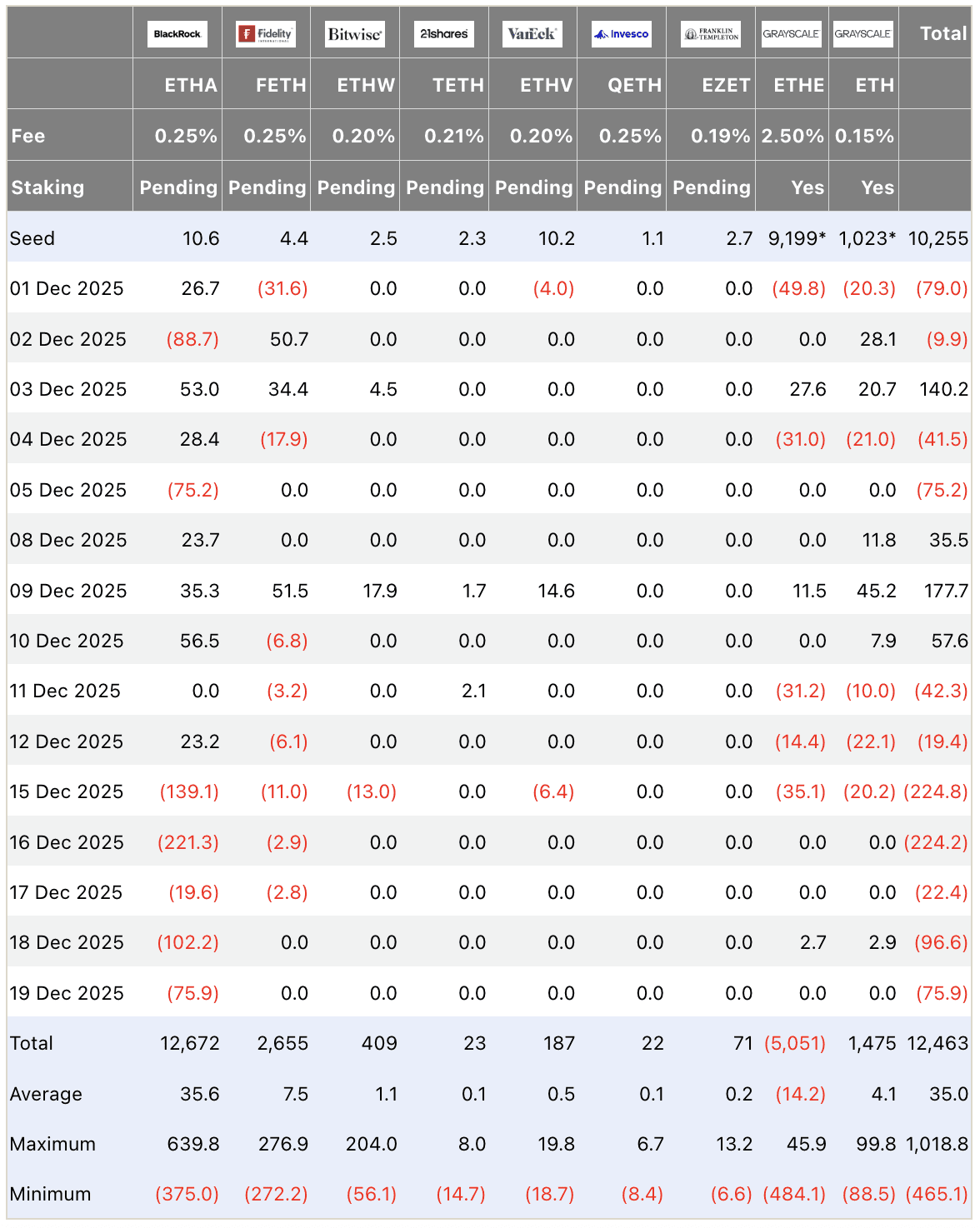

Net flows on December 18 mixed: Bitcoin ETFs - $158M (BlackRock outflow dominant), Ethereum ETFs - $76M. Pullback after prior rebound, reflecting selective caution. Analysis: BTC outflows pressure short-term, but overall 2025 inflows remain positive.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF inflows matter? Spot ETFs channel 'institutional crypto investments', with flows shaping liquidity and 'Bitcoin ETF price dynamics' in regulated markets.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply stable at ~70%, limited distribution. Whale activity quiet, reserves low. Funding rates neutral.

Takeaway: On-chain steadiness provides base support in low-action day.

What is on-chain? Blockchain data tracks real transactions and holdings, cutting through hype for 'on-chain crypto insights'.

🌍 Macro Pulse

Fed steady after recent cut, monitoring inflation above target from tariffs. Unemployment stable around 4.6%, growth moderate. Neutral backdrop with trade risks lingering.

How does Fed affect crypto? Rate holds preserve liquidity for 'crypto macro ties' - supportive for BTC, though easing pauses create volatility.

💡 Market Trend Spotlight

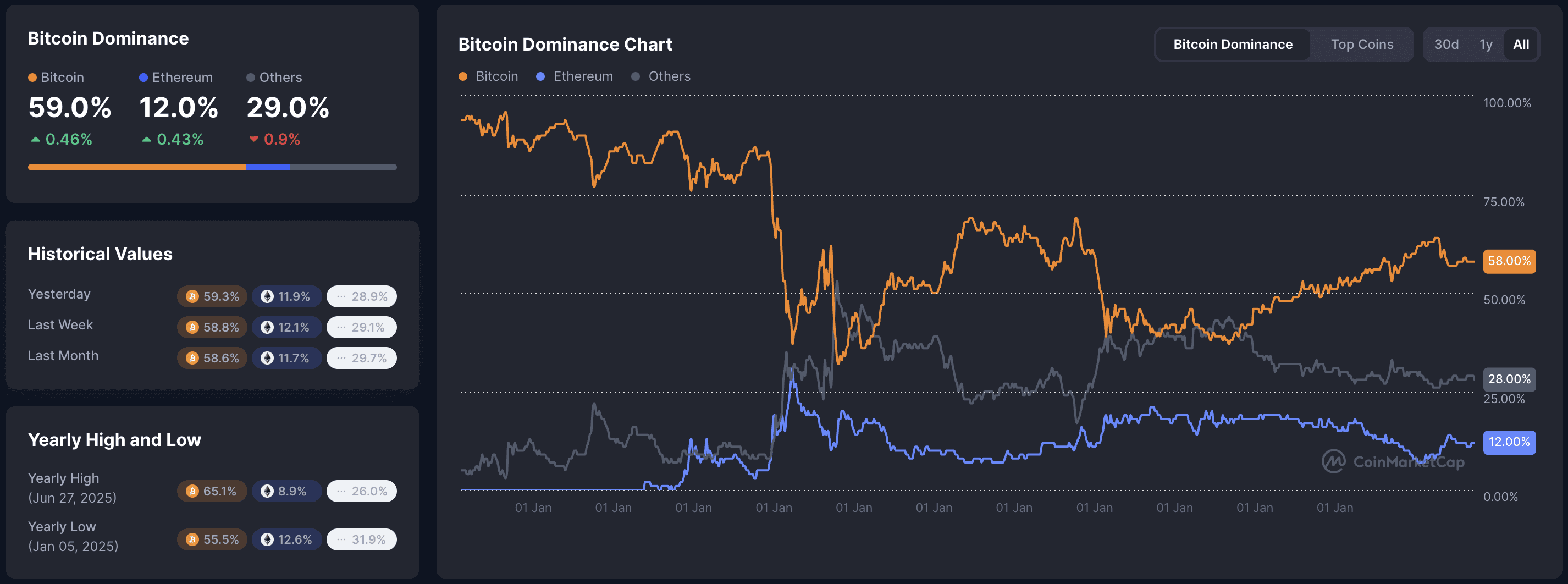

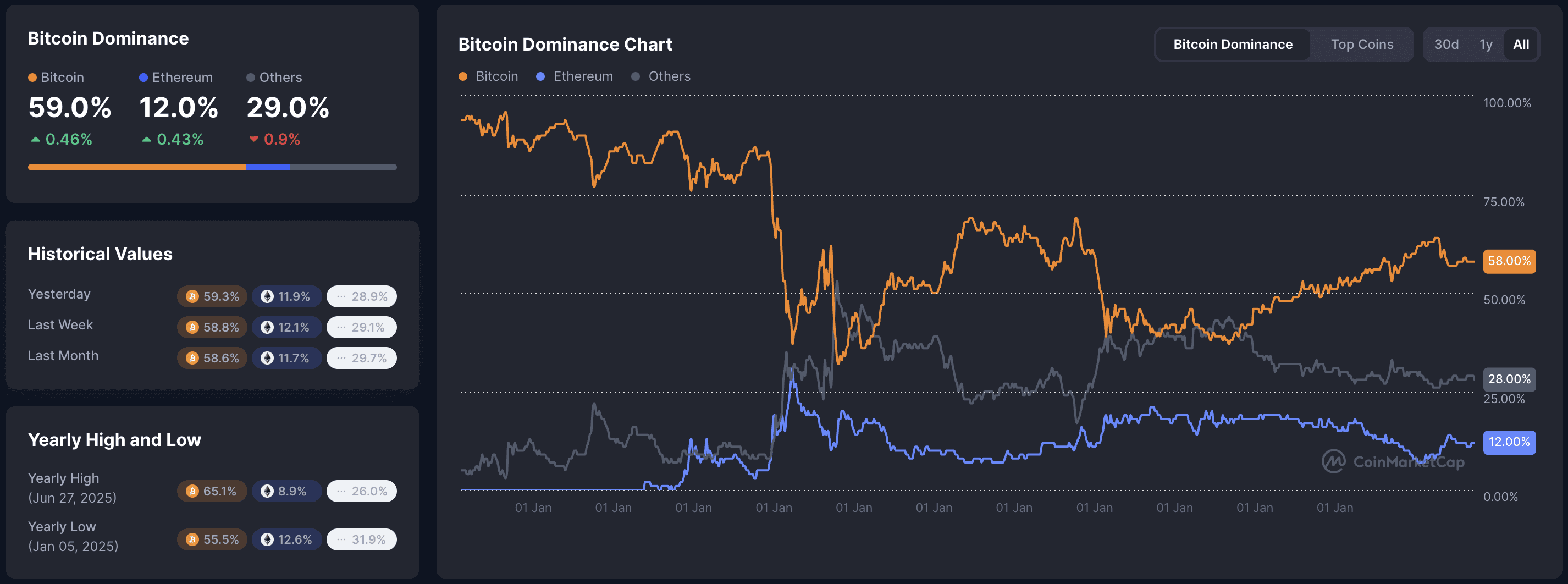

Bitcoin dominance at 59.3%.

BTC share steady high at 59%, alts mixed with some trending spikes. Observations: Capital prefers BTC stability - dominance levels signal caution, potential alt delay until broader recovery.

How to read trends? Volume and sentiment shifts drive 'crypto trend cycles' - high dominance often consolidates before broader moves.

📰 Top News

Citi raises BTC target to $143K citing ETF and regulation: Boosts long-term institutional outlook.

Texas Bitcoin reserve advances: Strengthens government adoption narrative.

JPMorgan expands tokenization funds: Deepens TradFi-Web3 integration.

Senate crypto bill delayed to 2026: Extends uncertainty, temporary sentiment hit.

Privacy and exchange tokens trend amid volatility: Highlights niche demand pockets.

📊 Daily Wrap-Up

Market posted quiet gains to $2.98T, BTC stable with trending tokens adding color. Mixed ETF flows show institutional selectivity, fear at 27 easing slowly. Watch regulation updates and flow reversals - on-chain calm anchors amid macro neutrality.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

🍪 Today’s Snack

Crypto market edged +0.7% over 24 hours, with total cap at $2.98T. Bitcoin stable near $88K, supported by positive ETF inflows, while alts mixed amid improving but still fearful sentiment.

📈 24h Crypto Market Snapshot

Overview of key assets and capitalization

Total crypto market cap at $2.98T, up +0.7% in 24 hours. Fear & Greed Index at 27 - fear, up from recent lows, indicating slight sentiment recovery and possible oversold bounce.

Asset | Price (USD) | 24h Change (%) | Cap (USD) |

|---|---|---|---|

BTC | 88055 | +0.56 | ~1.75T |

ETH | 2945 | +0.47 | ~355B |

BNB | 842 | -2.07 | ~123B |

SOL | 126 | -2.38 | ~60B |

XRP | 1.90 | -1.77 | ~108B |

DOGE | 0.183 | +0.38 | ~27B |

What does market cap mean? Total crypto market capitalization aggregates all coin values, acting as sector gauge in 'crypto market cap analysis'. Levels near $3T highlight resilience despite fear.

🔥 Top 3 Movers & Shakers

Canton CC (CC): +33.0% in 24 hours. Niche token (likely small cap, not in top-100 cap), growth tied to hype around community-driven projects or new exchange listings. Takeaway: Such spikes often come from pump-and-dump - check volume ($369M) and on-chain transfers to separate speculation from real interest; high short-term risks.

LEO Token (LEO): +15.3% in 24 hours. Utility token of Bitfinex (in top-100 cap, ~$5.6B). Growth from platform updates, fee reductions, and rebound from oversold levels (volume $2.5M). Takeaway: Exchange tokens rally on liquidity boosts - check Bitfinex trading activity and burn mechanisms to assess sustainability; more stable than small caps, but tied to exchange health.

Midnight (NIGHT): +10.7% in 24 hours. Small cap privacy-focused project (not in top-100 cap, cap ~$200M). Growth from protocol announcements and privacy narrative revival (volume $2.75M). Takeaway: Privacy coins flare up on regulatory news - analyze wallet growth and darknet adoption, but volatility is high and corrections are common.

How to spot sustainable gainers? Look at volume relative to cap and project fundamentals in 'crypto top gainers analysis' - unsupported spikes frequently reverse in volatile markets.

🏦 ETF & Institutional Flows

Net flows on December 18 mixed: Bitcoin ETFs - $158M (BlackRock outflow dominant), Ethereum ETFs - $76M. Pullback after prior rebound, reflecting selective caution. Analysis: BTC outflows pressure short-term, but overall 2025 inflows remain positive.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why ETF inflows matter? Spot ETFs channel 'institutional crypto investments', with flows shaping liquidity and 'Bitcoin ETF price dynamics' in regulated markets.

⛓️ On-Chain Metrics Today

Bitcoin long-term holder supply stable at ~70%, limited distribution. Whale activity quiet, reserves low. Funding rates neutral.

Takeaway: On-chain steadiness provides base support in low-action day.

What is on-chain? Blockchain data tracks real transactions and holdings, cutting through hype for 'on-chain crypto insights'.

🌍 Macro Pulse

Fed steady after recent cut, monitoring inflation above target from tariffs. Unemployment stable around 4.6%, growth moderate. Neutral backdrop with trade risks lingering.

How does Fed affect crypto? Rate holds preserve liquidity for 'crypto macro ties' - supportive for BTC, though easing pauses create volatility.

💡 Market Trend Spotlight

Bitcoin dominance at 59.3%.

BTC share steady high at 59%, alts mixed with some trending spikes. Observations: Capital prefers BTC stability - dominance levels signal caution, potential alt delay until broader recovery.

How to read trends? Volume and sentiment shifts drive 'crypto trend cycles' - high dominance often consolidates before broader moves.

📰 Top News

Citi raises BTC target to $143K citing ETF and regulation: Boosts long-term institutional outlook.

Texas Bitcoin reserve advances: Strengthens government adoption narrative.

JPMorgan expands tokenization funds: Deepens TradFi-Web3 integration.

Senate crypto bill delayed to 2026: Extends uncertainty, temporary sentiment hit.

Privacy and exchange tokens trend amid volatility: Highlights niche demand pockets.

📊 Daily Wrap-Up

Market posted quiet gains to $2.98T, BTC stable with trending tokens adding color. Mixed ETF flows show institutional selectivity, fear at 27 easing slowly. Watch regulation updates and flow reversals - on-chain calm anchors amid macro neutrality.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved