Jan 12, 2026

🍪 Today’s Snack

Crypto market consolidates over Jan 9-11 weekend: total cap at $3.13T with Bitcoin up +1.1% to ~$91.6K amid ETF outflows, while privacy tokens like Monero lead gains +19% on rotation and regulatory hedge flows.

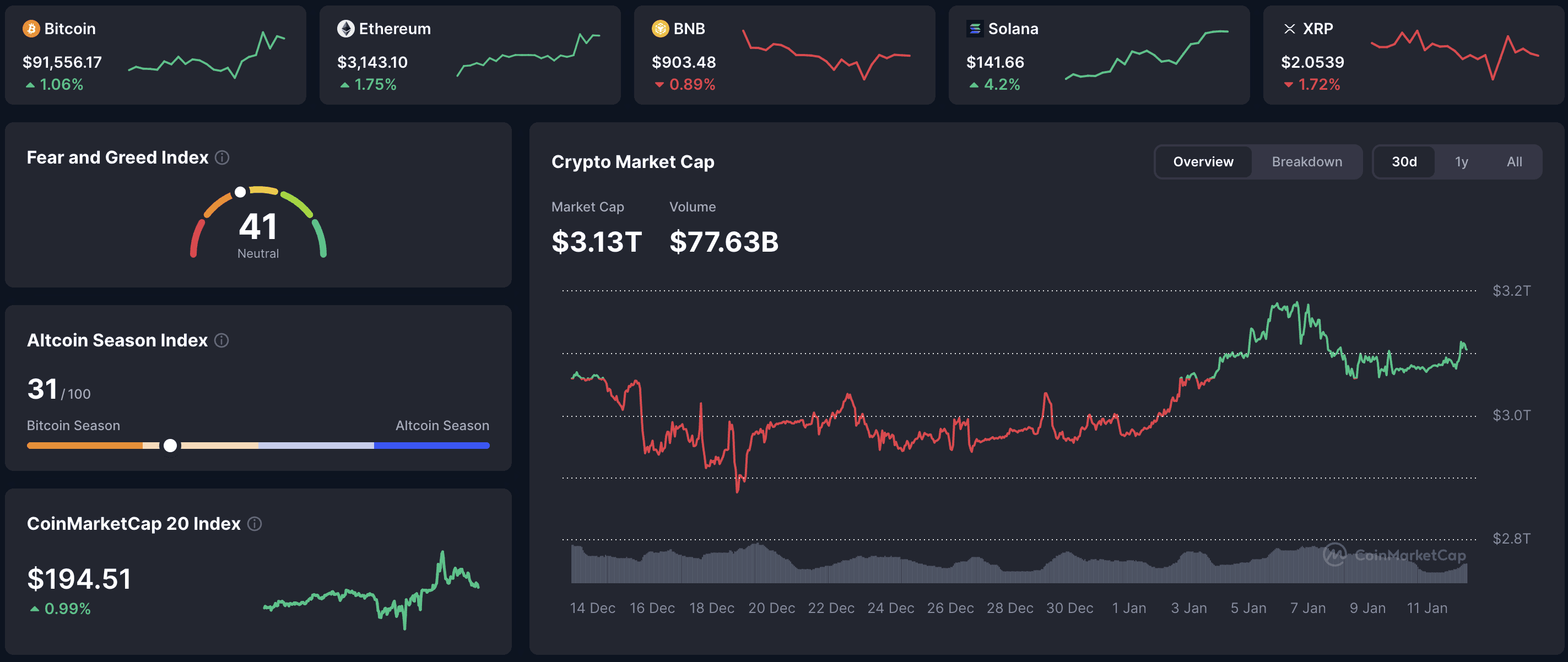

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $3.13T (+~0.5% over period per CoinMarketCap). The Fear & Greed Index is at 41 (Neutral), indicating steady sentiment amid post-holiday adjustments.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $91,556 | +1.06% | $1.82T |

ETH | $3,143 | +1.75% | $378B |

BNB | $903 | -0.89% | $124B |

XRP | $2.05 | -1.72% | $124B |

SOL | $141 | +4.22% | $79B |

ADA | $0.398 | -0.18% | $14B |

Why aggregate weekend data? Holiday-thin trading amplifies moves - review multi-day flows to filter noise from trends.

🔥 Top 3 Movers & Shakers

Monero (XMR) - +18.9%: Leading privacy coin rallies on renewed focus amid regulatory scrutiny and hedge demand.

Takeaway: Privacy assets spike in uncertainty - monitor delisting risks for contrarian plays.

Canton (CC) - +13.3%: Emerging privacy token gains traction from sector momentum and community hype.

Takeaway: Niche privacy upstarts follow leaders - check social volume for viral potential.

MYX Finance (MYX) - +11.8%: DeFi protocol surges on yield farming revival and liquidity incentives.

Takeaway: Yield-focused DeFi rebounds post-correction - evaluate APY sustainability vs. impermanent loss.

How to spot weekend outliers? Low-volume pumps require cross-checks with fundamentals - prioritize cap-weighted % for real rotation.

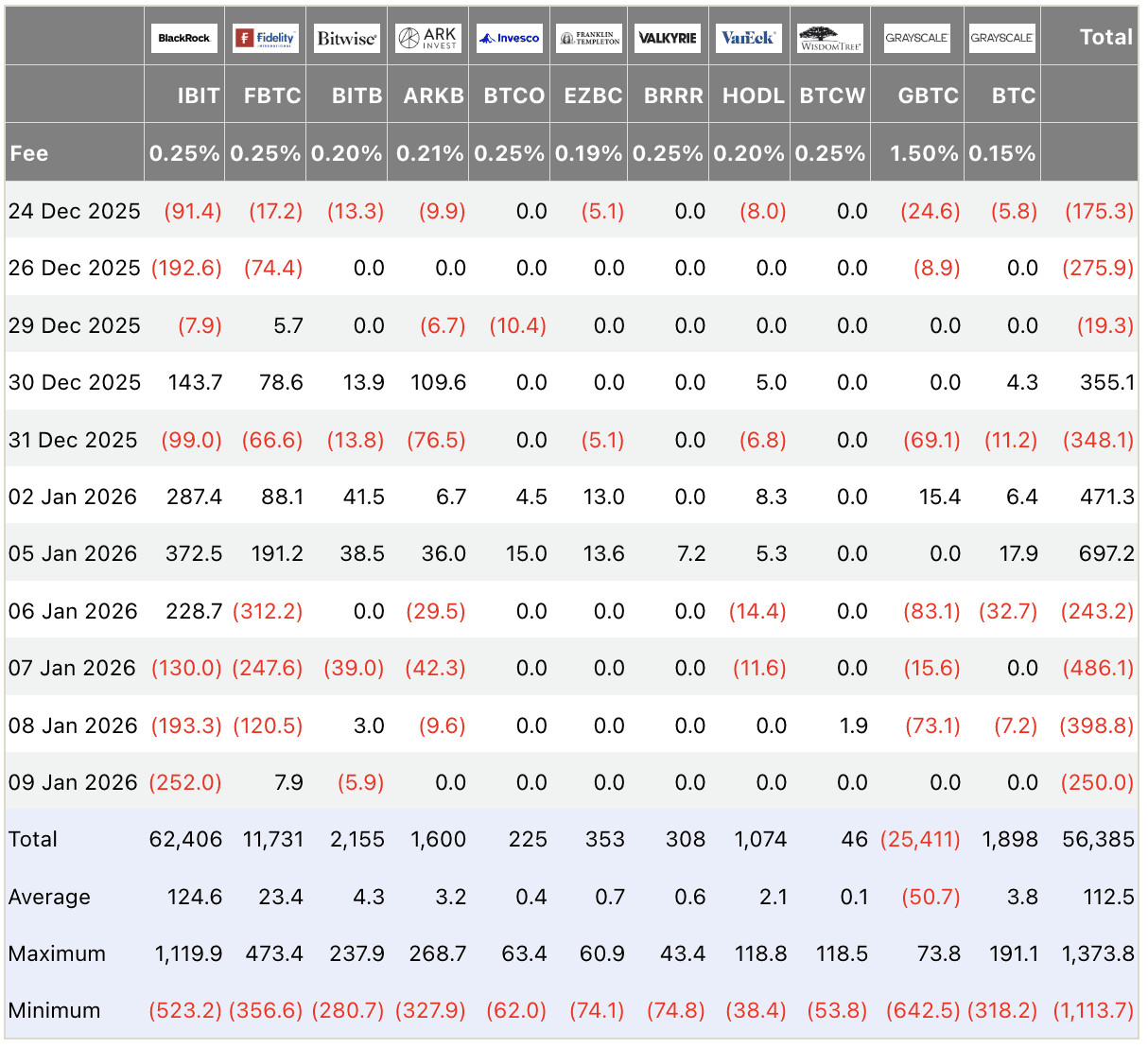

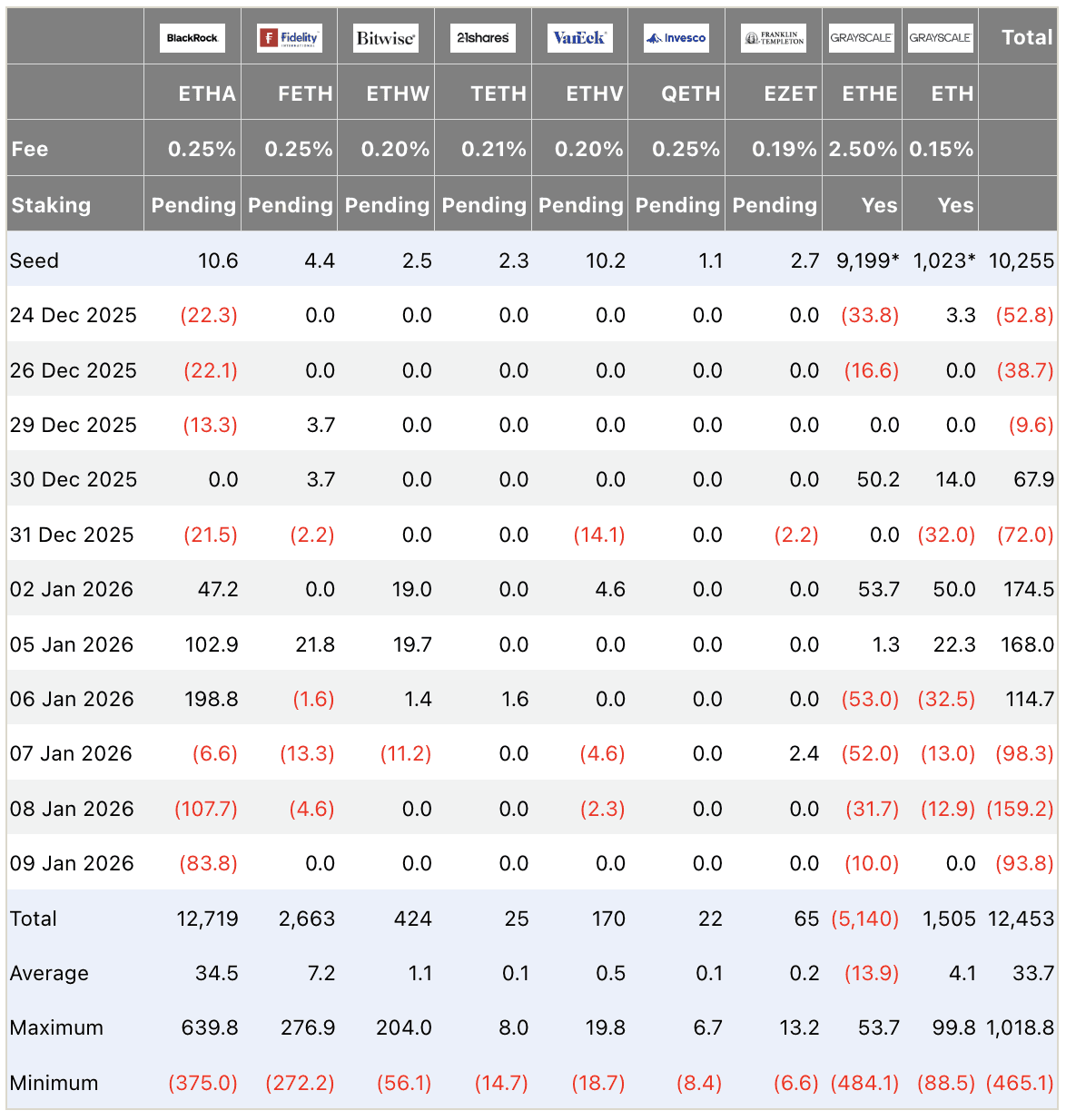

🏦 ETF & Institutional Flows

Over Jan 9-11: Bitcoin spot ETFs net outflows -$250M on Jan 9, with weekend estimates adding -$94M total (led by IBIT/FBTC rebalancing). Ethereum ETFs -$93.8M Jan 9, extended mildly. Cumulative outflows reflect profit-taking after early-year surge, but no panic signals amid stable volumes.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

What weekend flows reveal? Thin holiday activity exaggerates swings - annualize weekly nets for true institutional pulse.

⛓️ On-Chain Metrics Today

Bitcoin reserves edge higher from minor inflows, but LTH supply unchanged. Whale transfers balanced without dumps. Hash rate near ATH. Overall: weekend digestion shows resilience, supply dynamics intact.

Pro tip: Weekend reserve fluctuations often revert - use 7-day averages to smooth holiday distortions.

🌍 Macro Pulse

Fed debates tariff long-run effects: deflationary growth drag could accelerate easing, countering short-term inflation fears. Officials divided on Q1 2026 cuts amid firm unemployment data. Crypto navigates mixed signals with focus on liquidity tailwinds.

Why tariff narratives evolve? Shifting views from inflationary to neutral/deflationary impact policy odds - track official speeches for hawk/dove shifts.

💡 Market Trend Spotlight

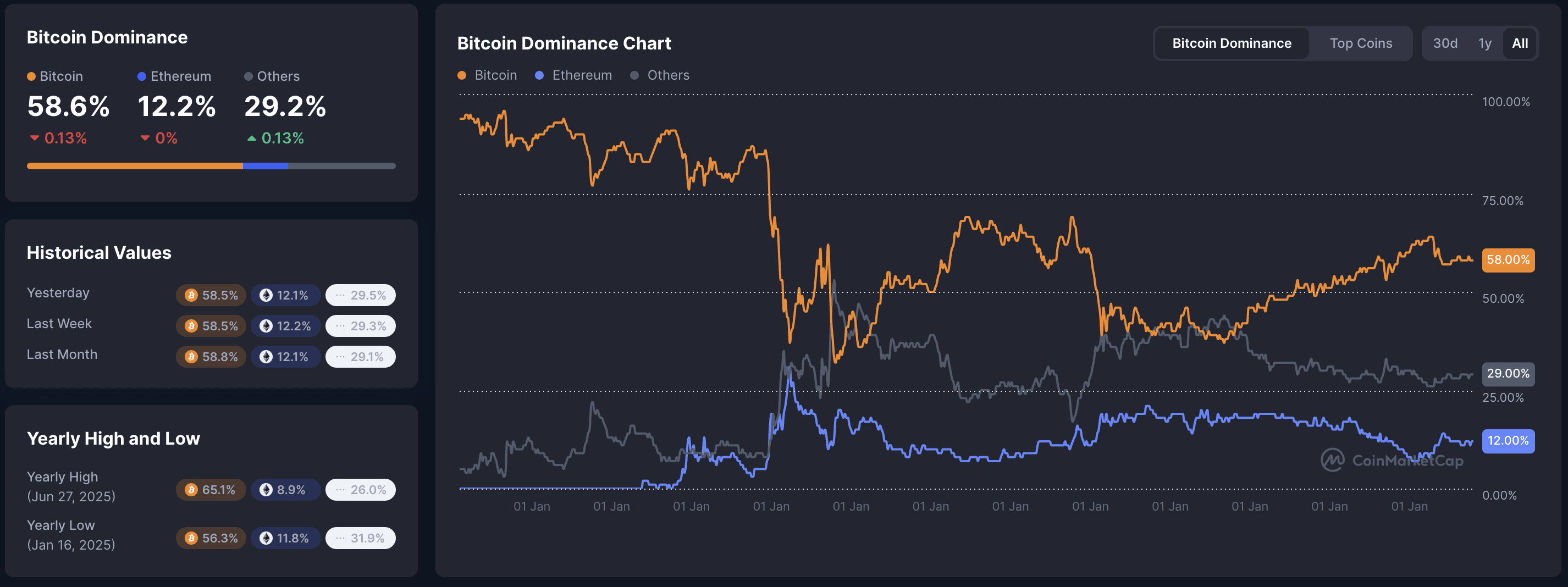

Trend over period: Privacy rotation amid ETF digestion. BTC dominance at 58.6% stable as privacy surges (Monero +19%), price retests $91K. Neutral sentiment + weekend gains suggest selective buying. Metrics: privacy vol elevated, alt index ~30 holding.

How weekends shape trends? Reduced liquidity tests supports - positive closes signal underlying demand post-correction.

📰 Top News

ETF outflows over Jan 9-11: -$344M BTC/ETH combined - rebalancing extends from early-week profit-taking.

Privacy tokens dominate: Monero +19%, Canton CC +13% - hedge demand amid regulatory talks.

Tom Lee forecasts Ether to $9,000 early 2026 - implies 177% upside on institutional tailwinds.

a16z on crypto future: Beyond blockchains, 2026 turns for cryptographic proofs in non-crypto sectors.

Lawmakers push crypto bill: Senate hearings Jan 8-11 on stablecoins, DeFi, official profiting bans.

📊 Daily Wrap-Up

Jan 9-11 period highlights selective resilience: BTC modest gains offset outflows, with privacy surge underscoring defensive flows amid macro debates. Key drivers - rebalancing pressure and niche rotations - maintain neutral but opportunistic tone. Watch inflow resumption and tariff clarity for momentum.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.