Jan 9, 2026

🍪 Today’s Snack

Crypto market pauses with light gains in spots: total cap at $3.11T with Bitcoin up +0.4% to ~$90.7K despite ETF outflows, as privacy and L2 tokens like POL (ex-MATIC) surge +17% on rotation flows.

📈 24h Crypto Market Snapshot

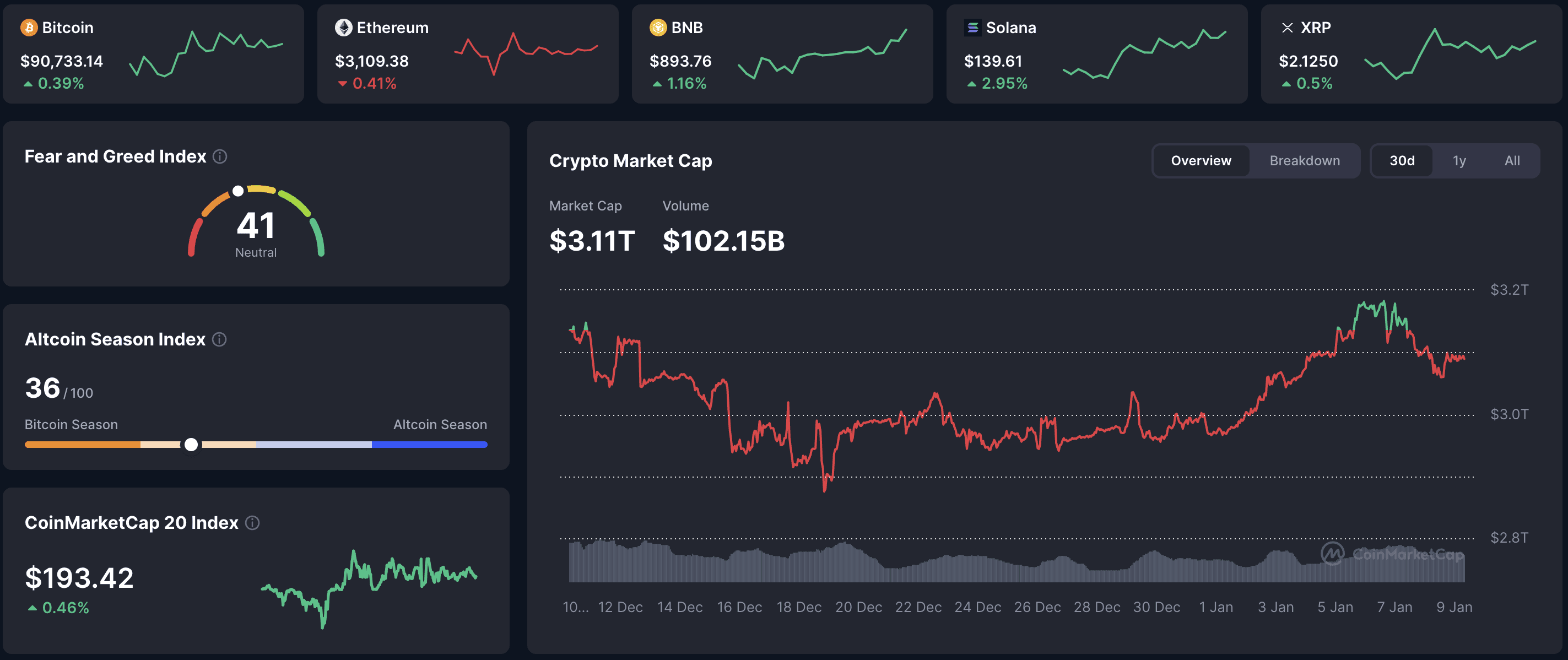

Total cryptocurrency market cap stands at $3.11T (+~0.3% over 24h per CoinMarketCap). The Fear & Greed Index is at 41 (Neutral), signaling cautious equilibrium after recent volatility.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $90,733 | +0.39% | $1.80T |

ETH | $3,109 | -0.41% | $374B |

BNB | $893 | +1.16% | $122B |

XRP | $2.12 | +0.5% | $128B |

SOL | $139 | +2.95% | $78B |

ADA | $0.398 | +0.57% | $14.2B |

How to spot subtle rotations? Gains in niches during flat days reveal flow shifts - use relative % vs. BTC for early detection.

🔥 Top 3 Movers & Shakers

POL (ex-MATIC) (POL) - +17.2%: Polygon rebrand token rallies on completed migration and L2 optimism.

Takeaway: Rebrands can reignite interest - monitor chain activity post-upgrade for follow-through.

Monero (XMR) - +3.9%: Privacy stalwart advances on hedge demand amid market uncertainty.

Takeaway: Defensive privacy plays stabilize portfolios - track wallet growth for usage trends.

Solana (SOL) - +3.0%: Fast L1 climbs with DeFi revival and ecosystem volume.

Takeaway: High-speed chains attract in upticks - compare fees and speed vs. competitors.

Pro tip: Outliers in gainers list highlight themes - filter by cap and vol for actionable ideas.

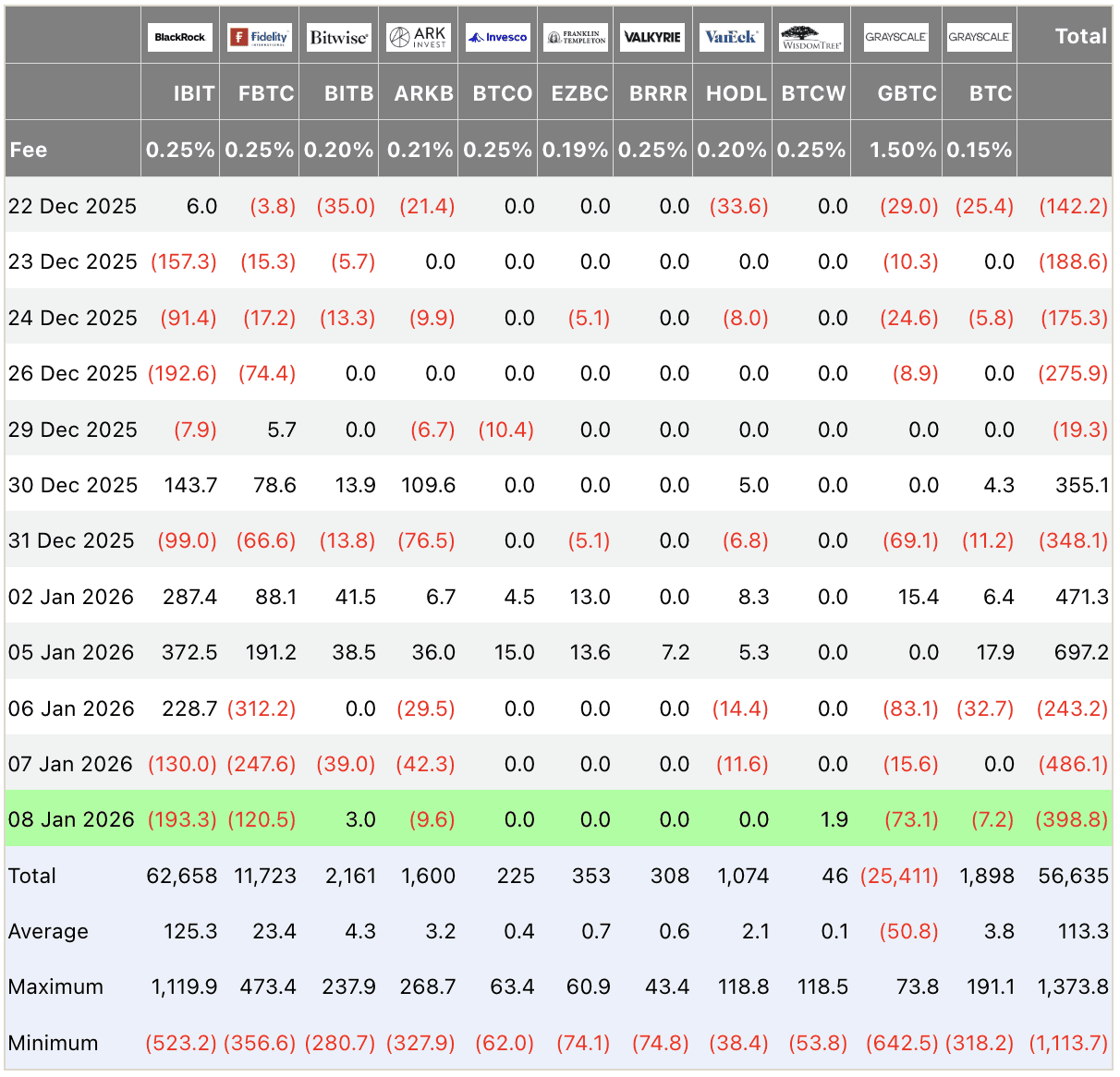

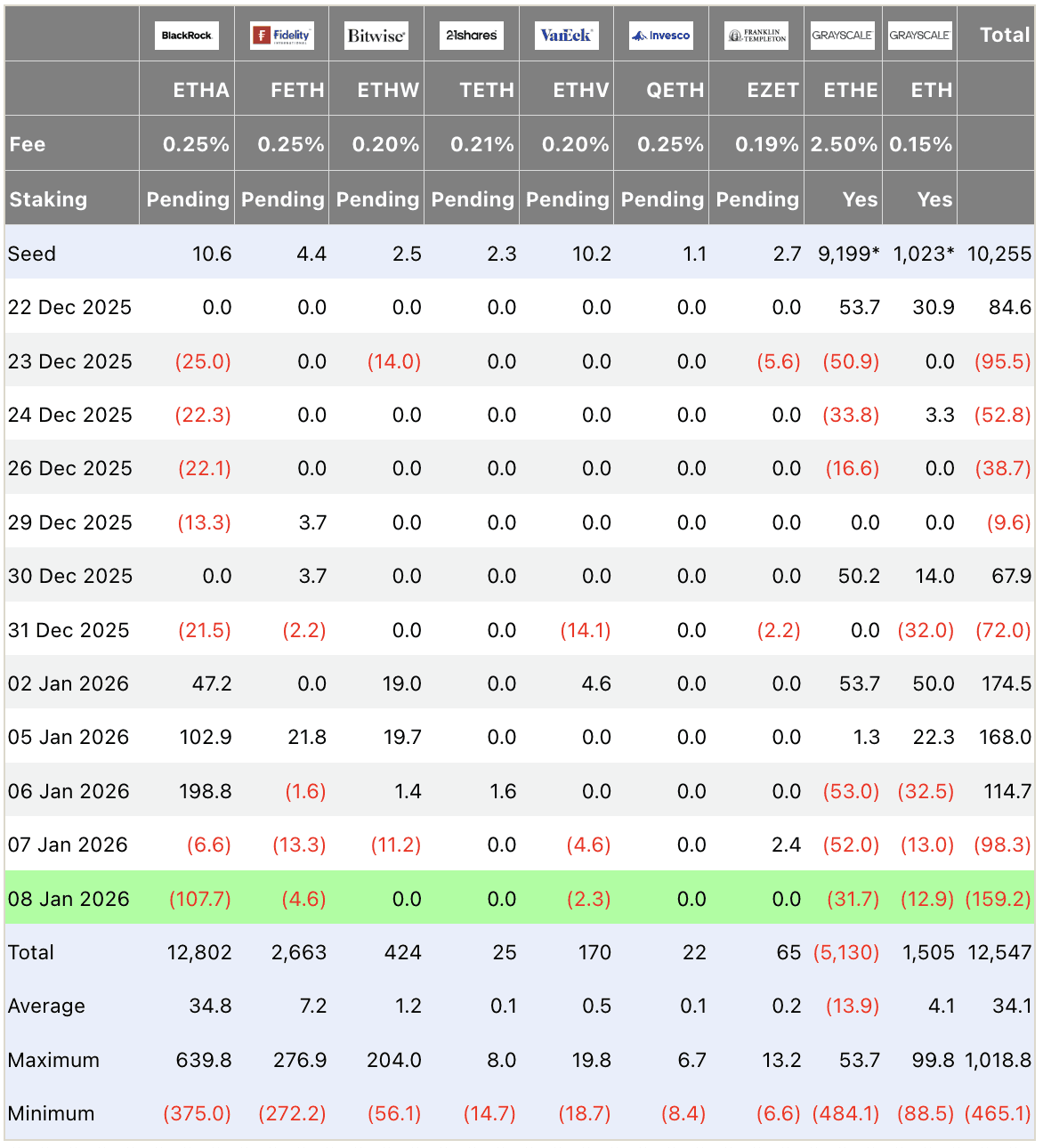

🏦 ETF & Institutional Flows

On January 8 (latest data): Bitcoin spot ETFs record net outflows of -$398.8M (led by IBIT -193.3M, FBTC -120.5M). Ethereum ETFs -$159.2M (ETHA -107.7M dominant). Continued rebalancing and profit-taking extend from prior sessions, pressuring near-term momentum.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why outflows persist mid-week? Tactical resets common post-holidays - monitor for Friday reversals as sentiment stabilizes.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves hold steady with minor adjustments, no sharp sell-offs. Whale positions balanced. Hash rate robust at highs. Overall: no capitulation signals, market in wait-and-see mode.

Takeaway: Steady metrics in outflows suggest temporary pressure - watch for reserve drops signaling rebound.

🌍 Macro Pulse

Fed analysis weighs tariff scenarios: long-term deflationary via reduced growth vs. immediate inflation bumps delaying easing. Divisions on cut timing amid firm jobs data. Crypto absorbs risk sentiment without breakdown.

How does policy uncertainty affect? Delayed cuts cap risk-on - favorable data could shift dovish.

💡 Market Trend Spotlight

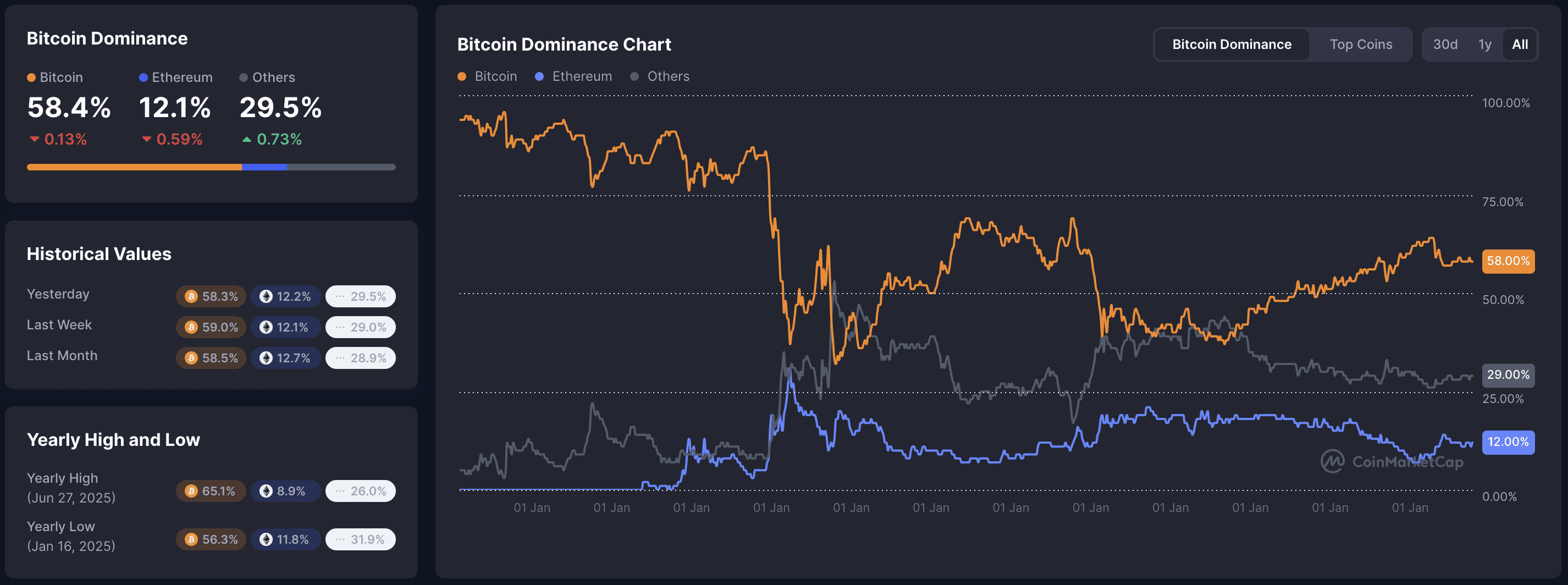

Trend of the day: Niche rotation amid outflow digestion. BTC dominance at 58.4% steady as privacy/L2 outperform, price tests $90K without break. Neutral sentiment + selective gains indicate selective flows. Metrics: privacy vol up, alt index ~30.

What builds rotation momentum? Volume in leaders during dips - signals capital reallocating strategically.

📰 Top News

ETF outflows continue Jan 8: -$399M BTC, -$159M ETH - rebalancing weighs on recovery.

POL (ex-MATIC) +17%, Monero +3.9% - L2 and privacy themes resilient.

MSCI confirms crypto treasury inclusion - boosts legitimacy for corporate adoption.

Fed sees tariffs potentially deflationary long-run - growth slowdown eases pressures.

Market cap $3.11T holds: light gains signal pause, not reversal.

📊 Daily Wrap-Up

Jan 8 reflects ongoing digestion: modest BTC gains offset by outflows and neutral mood, with niche sectors providing bright spots. Key drivers - rebalancing pressure and selective rotations - keep tone watchful. Focus on flow turnaround and macro clarity ahead.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.