Jan 13, 2026

🍪 Today’s Snack

Crypto market trades sideways with selective gains: total cap holds at $3.13T, Bitcoin up +1.76% to ~$92.1K on steady inflows, while privacy coins like Monero surge +17% amid regulatory hedge demand and broader stagnation.

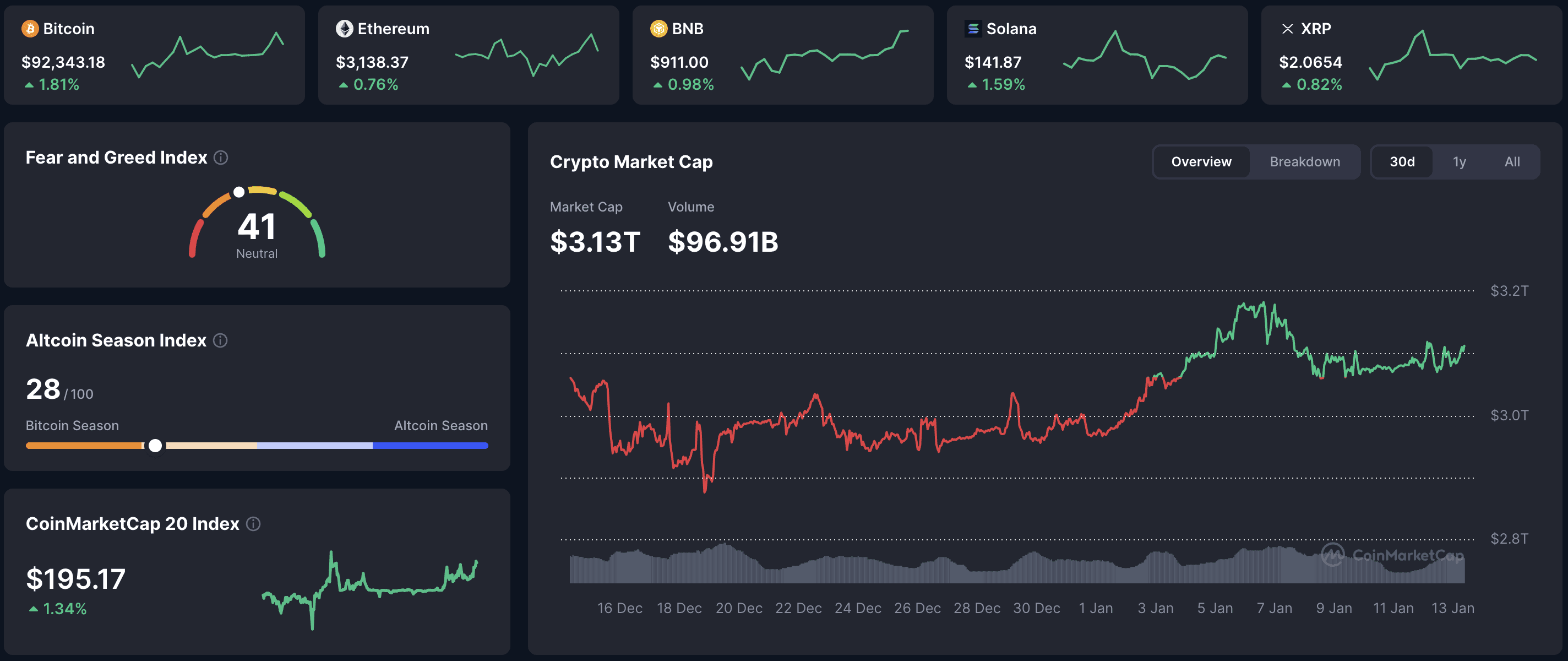

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $3.13T (+~0.3% over 24h per CoinMarketCap). The Fear & Greed Index is at 41 (Neutral), reflecting cautious balance amid tariff debates and metals rally.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $92,343 | +1.81% | $1.84T |

ETH | $3,138 | +0.76% | $378B |

BNB | $911 | +0.98% | $125B |

XRP | $2.06 | +0.82% | $125B |

SOL | $141 | +1.59% | $79B |

DOGE | $0.139 | +2.22% | $23B |

How to read flat markets? Sideways action post-volatility often builds bases - monitor breakout volumes for directional clues.

🔥 Top 3 Movers & Shakers

Story IP (IP) - +21.3%: Intellectual property token surges on narrative revival and potential partnerships.

Takeaway: IP-focused projects capture attention in bull phases - track patent integrations for value.

Monero (XMR) - +17.1%: Privacy leader rallies amid regulatory scrutiny and hedge flows.

Takeaway: Privacy coins thrive on uncertainty - watch delistings for contrarian entries.

MYX Finance (MYX) - +14.2%: DeFi lending protocol gains from yield demand rebound.

Takeaway: Lending platforms lead recoveries - compare borrow rates across chains.

Pro tip: High-gainers in flat days signal pockets - cross with fundamentals to avoid traps.

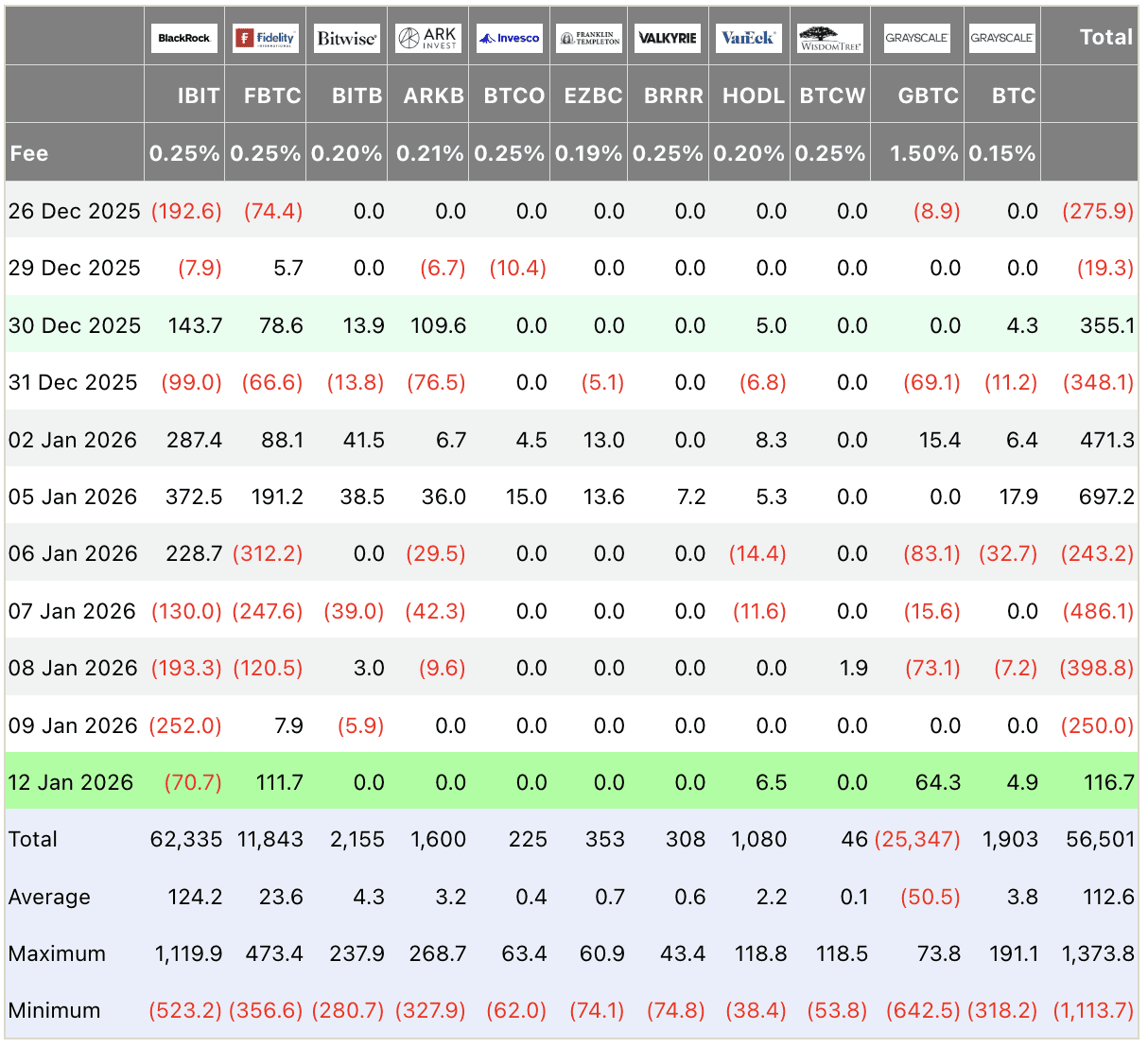

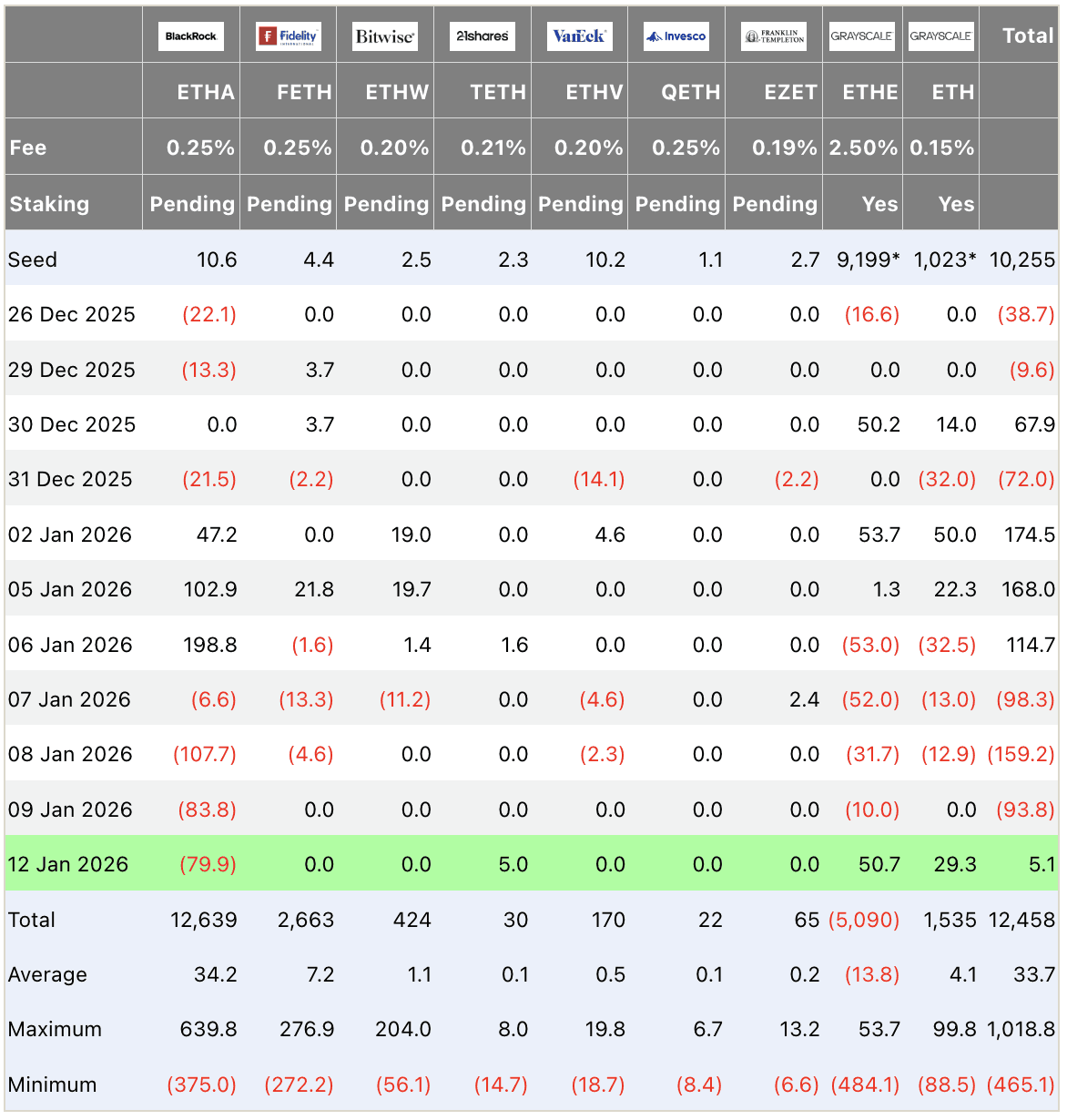

🏦 ETF & Institutional Flows

On January 12: Bitcoin spot ETFs net inflows +$116.7M (FBTC +111.7M, GBTC +64.3M offset IBIT -70.7M). Ethereum ETFs +$5.1M (ETHE +50.7M leading). Steady positives amid broader outflows trend suggest selective buying, countering tariff uncertainty.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why inflows in stagnation? Tactical accumulation builds floors - weekly nets reveal true demand.

⛓️ On-Chain Metrics Today

Bitcoin reserves stable with minor outflows, LTH holdings firm. Whale activity low-key. Hash rate at peaks. Overall: no supply shock, market poised for catalysts.

Takeaway: Stable metrics in sideways favor bulls - pair with sentiment for timing.

🌍 Macro Pulse

Fed views tariffs as potentially deflationary long-term via growth drag, easing cut concerns. Officials divided on pace amid stable jobs. Metals rally (gold/silver highs) draws safe-haven flows from crypto, amplifying stagnation.

How metals influence crypto? Correlation spikes in uncertainty - tariff resolutions could redirect capital.

💡 Market Trend Spotlight

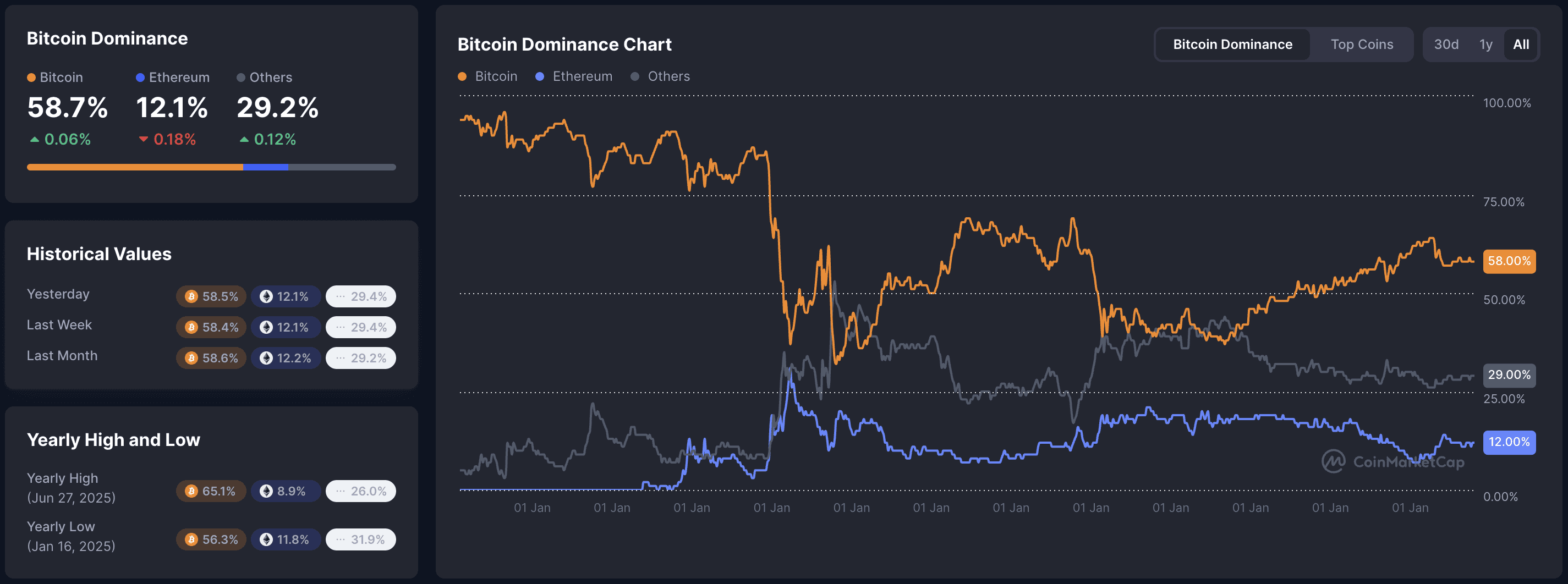

Trend of the day: Privacy surge in flat market. BTC dominance at 58.7% steady as privacy outperforms (Monero +17%), price tests $92K resistance. Neutral sentiment + inflows indicate digestion phase. Metrics: privacy vol up, alt index ~31.

How to trade rotations? Sector leaders in lulls often precede broader moves - use RSI divergences.

📰 Top News

Bitcoin stalls below $93K: privacy coins rally as tariffs loom - Trump 25% on Iran traders impacts sentiment.

ETF inflows Jan 12: +$117M BTC/ETH - steady amid weekly declines.

Stablecoin launches accelerate: US firms push products, Ethereum ETF stakes rewards.

M&A crypto boom: expected >$37B in 2026, per Binance update.

Senate delays crypto markup: Boozman cites bipartisan progress on market structure bill.

📊 Daily Wrap-Up

Jan 12 reflects cautious stability: BTC mild gains meet inflows and privacy surge, offsetting tariff/macro headwinds and metals competition. Key drivers - selective rotation and steady demand - maintain neutral outlook. Watch policy talks and flows for breakout signals.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.