Jan 22, 2026

🍪 Today's Snack

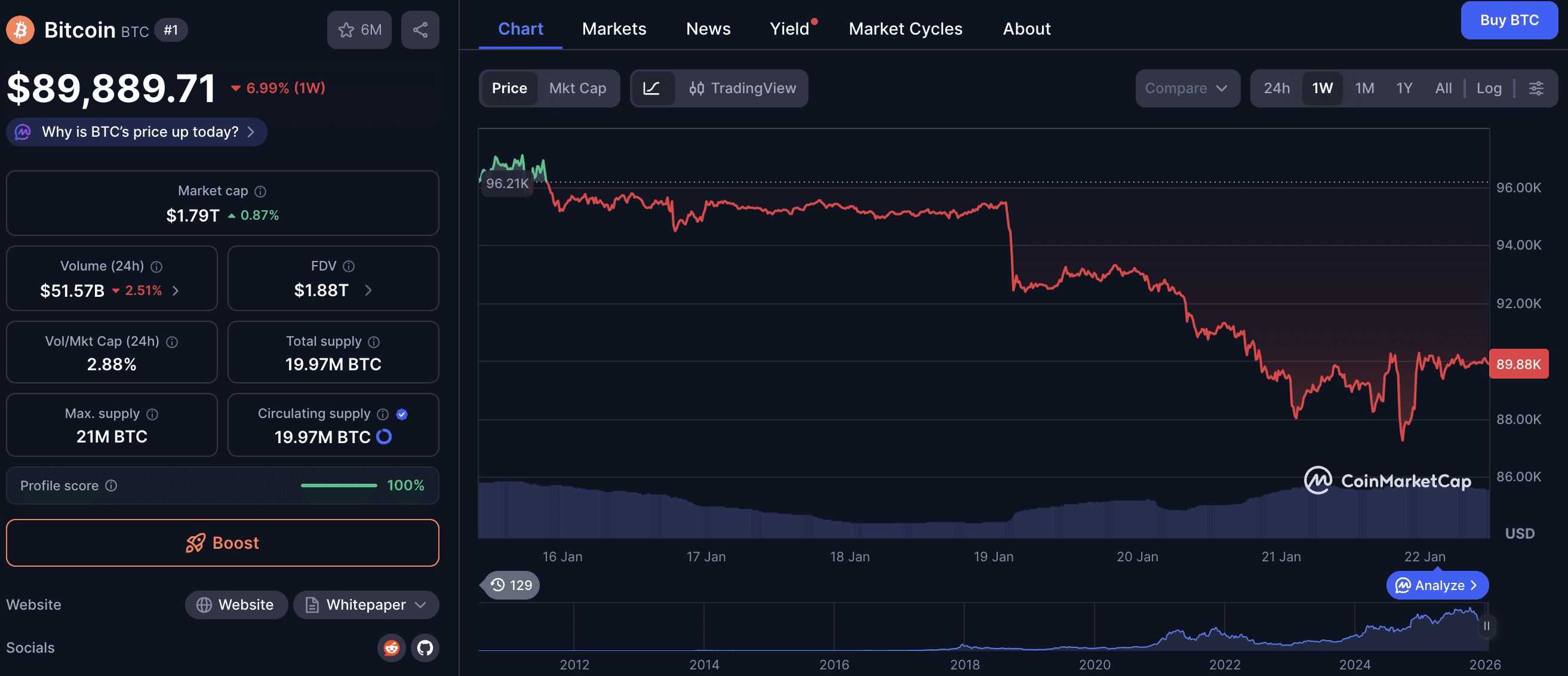

Bitcoin crashed to $87K on January 21 as Trump's first full day in office delivered no promised crypto executive orders, triggering record $709M Bitcoin ETF outflows and pushing 92 of the top 100 cryptos into the red.

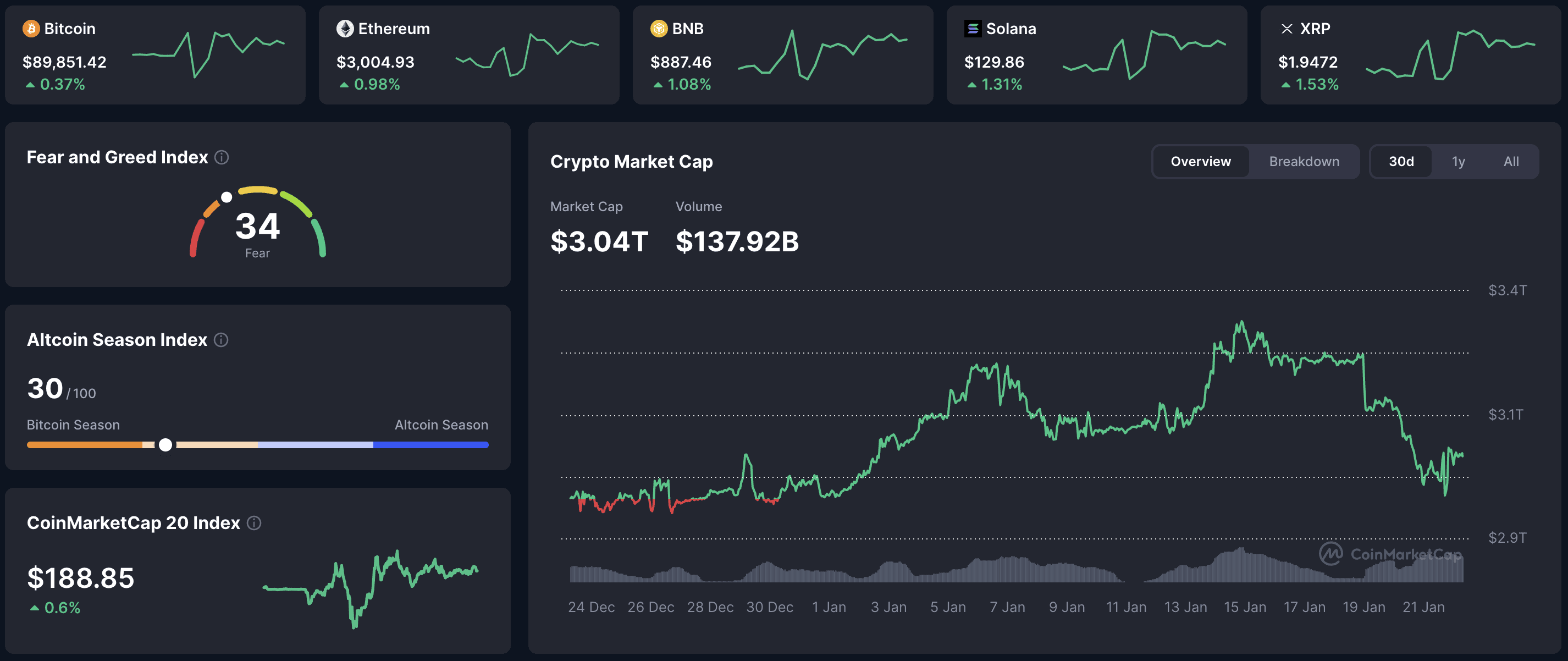

📈 24h Crypto Market Snapshot

Total crypto market cap fell to $3.04T, down 2.4% as disappointment over absent inauguration crypto policy drove mass exits. Fear & Greed Index plunged to 34 (Fear), marking the lowest reading since early December 2025.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $89,851 | +0.37% | $1.79T |

ETH | $3,004 | +0.98% | $362B |

BNB | $887 | +1.08% | $121B |

SOL | $129 | +1.31% | $73B |

Modest Tuesday recovery after Monday's 5% plunge, but damage already done – Bitcoin briefly erased all 2026 YTD gains.

🔥 Top 3 Movers & Shakers

Monero (XMR) – -15.2%, $648

Privacy king suffered worst single-day loss in weeks as leveraged long positions unwound across altcoins. Prior month's +60% rally fully reversed.

Takeaway: Parabolic rallies in niche sectors rarely hold without fundamental catalysts – profit-taking accelerates when macro turns.Hyperliquid (HYPE) – -8.2%, $21.27

DeFi protocol tokens led altcoin selloff as risk appetite evaporated on macro uncertainty.

Takeaway: Low-liquidity DeFi names amplify downside in risk-off – avoid holding through major policy events.Provenance Blockchain (HASH) – +4.9%, $0.027

One of only eight top-100 gainers, riding institutional blockchain adoption narrative despite broader selloff.

Takeaway: Enterprise blockchain plays can decouple from retail sentiment when B2B momentum persists.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded -$708.7M in net outflows on January 21 – the largest single-day exit since launch. BlackRock's IBIT led with -$356.6M, Fidelity's FBTC shed -$287.7M. Ethereum ETFs saw -$287.0M in outflows, led by BlackRock's -$250.3M. Combined $996M exodus signals institutional capitulation after Trump's Day One crypto policy no-show.

🌍 Market Context

Regulatory: Trump's inauguration omitted expected crypto executive orders, with Day One priorities document containing no mention of digital assets. Industry leaders expressed frustration at policy vacuum.

Macro: U.S. stocks fell sharply (S&P -2.06%, Nasdaq -2.12%) on renewed tariff threats. Gold hit $4,720 while Bitcoin failed to decouple, trading as risk asset rather than safe haven.

Derivatives: Options skew turned deeply negative at -3% as traders paid premiums for downside protection. 30% probability BTC falls below $80K by June.

🔍 Deep Dive – Inauguration Day Letdown

Trump's first full day delivered no crypto policy despite campaign promises. Bitcoin crashed 5% from $109K to $87K as his 26 Day One executive orders and 100-day priorities document omitted digital assets entirely.

Institutional investors didn't wait. ETF outflows hit $996M combined – worst day since launch. Industry insiders who paid $2M for inauguration access felt blindsided by the gap between Trump's personal TRUMP memecoin launch and absent actionable policy.

📰 Top News

Record ETF outflows: $709M fled Bitcoin ETFs, $287M exited Ethereum funds on Jan 21 – worst day since launch as institutions lost patience.

Trump's crypto no-show: Inauguration Day priorities document omitted digital assets; 26 executive orders contained no crypto policy.

Bitcoin erases 2026 gains: BTC briefly fell below $88K, wiping all YTD returns as Fear & Greed index hit 34 (Fear zone).

SEC task force announcement: Acting Chair Mark Uyeda launched crypto task force Jan 23, but too late to prevent Monday's panic.

📚 Education Bits

💡 Pro Tip: When political promises drive rallies, watch for "sell the news" events – inauguration euphoria often precedes policy reality checks.

🔍 Did You Know? ETF outflows above $500M in a single day historically precede 7-10 day consolidation periods before institutional flows stabilize.

📊 Daily Wrap-Up

January 21 delivered crypto's harshest reality check of Trump's second term: Bitcoin crashed 5% to $87K as inauguration euphoria evaporated into policy vacuum. Record $996M combined ETF outflows showed institutions weren't waiting for Trump's delayed crypto executive orders. The gap between campaign promises ("crypto capital of the world") and Day One actions (zero crypto policy) triggered capitulation across markets. Fear & Greed index hit 34 – lowest since December – as 92 of top 100 cryptos bled red.

Today's Watch List: Can BTC hold $88K-$90K range, or does institutional exit accelerate? Watch for Trump's delayed crypto executive order timing and whether SEC task force announcements stabilize sentiment.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.