Jan 21, 2026

🍪 Today's Snack

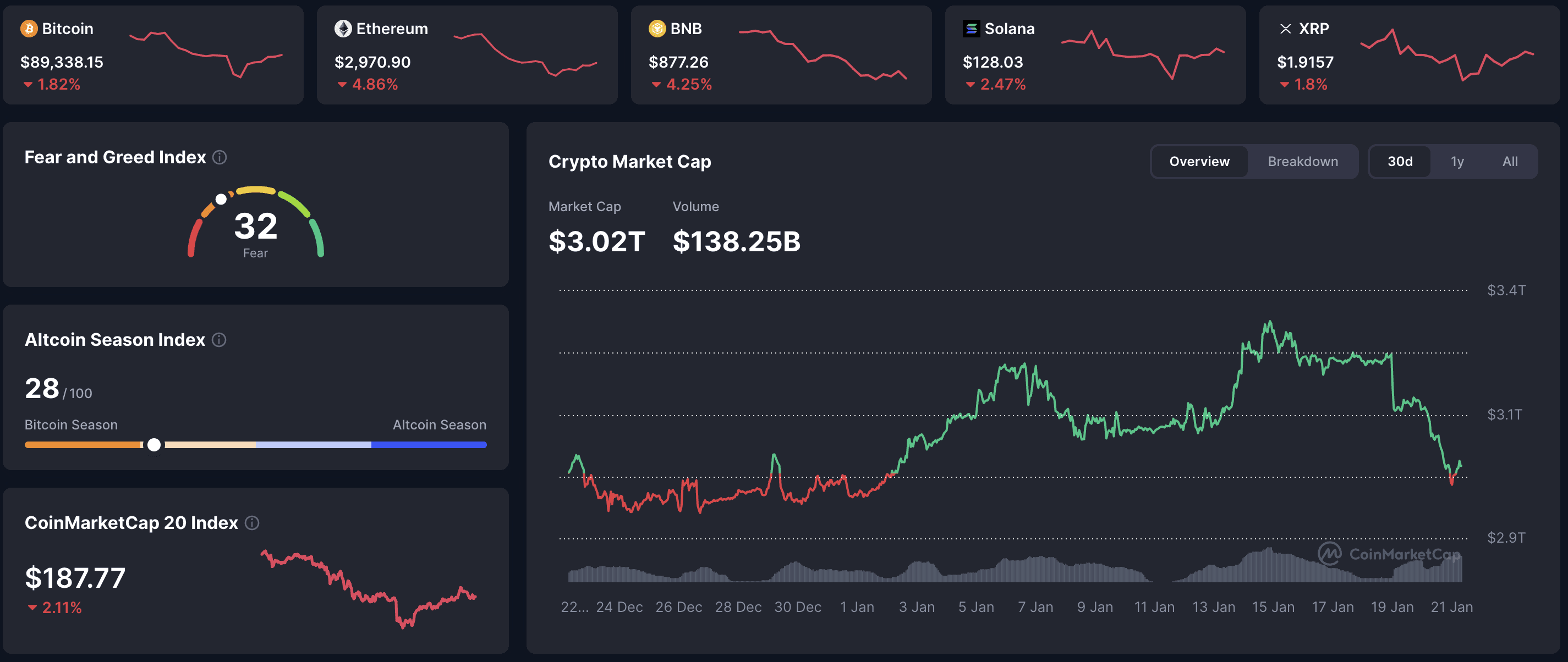

Bitcoin extended losses below $90K while Ethereum crashed through $3,000 support on January 20, marking a sixth consecutive down day. Total crypto market cap fell 3% to $3.02T with 95 of the top 100 coins posting red - but privacy coins bucked the trend, with Monero's recent surge reflecting demand for transaction anonymity.

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $3.02T (down around 3% over the last day). The Fear & Greed Index is at 32 (Fear), signaling cautious sentiment after a sharp multi‑day selloff.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $89,338 | -1.82% | $1.78T |

ETH | $2,970 | -4.86% | $357B |

BNB | $877 | -4.25% | $119B |

SOL | $128 | -2.47% | $72B |

Ethereum led losses after breaking $3,200 support - sharpest drop since December. Bitcoin dipped below $90K for first time since January 9. Selling pressure intensified across major altcoins as defensive positioning dominated.

🔥 Top 3 Movers & Shakers

Axie Infinity (AXS) - +30.17%

Gaming token bounced from oversold levels on speculative positioning.

Takeaway: Gaming sector remains highly volatile - excellent short-term trades, poor holds.Ethereum (ETH) - -7.30%

Critical support break triggered cascading stops; next support at $2,880-$2,900.

Takeaway: Wait for confirmed bounce before entering - avoid catching falling knives.Monero (XMR) - -17.26% (pullback from ATH)

Corrected after surging 57% to $800, but still massive vs. $200 levels mid-2024.

Takeaway: Privacy coins gaining institutional attention; volatility extreme but demand signals shift in use cases.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $479.7M in net outflows on January 20, the largest single-day exodus since early January, while Ethereum ETFs saw $230M in outflows - signaling sustained risk-off sentiment. Combined $710M in institutional selling pressure reflects macro uncertainty and profit-taking after recent volatility.

🌍 Market Context (Macro + On-Chain)

Macro Pulse:

January 20 marked one year since Trump's second inauguration, but Bitcoin trades 17% below that day's high. Markets remain risk-off amid Fed policy uncertainty (next meeting January 28, hold expected) and core inflation above 2%.

On-Chain Highlights:

Whale accumulation continued despite weakness - addresses holding 10-10K BTC added 36,000 BTC ($3.2B) Jan 10-19, while retail sold 132 BTC. Strategy purchased $2.13B more Bitcoin (22,305 BTC) Jan 12-19, bringing total to 709,715 BTC.

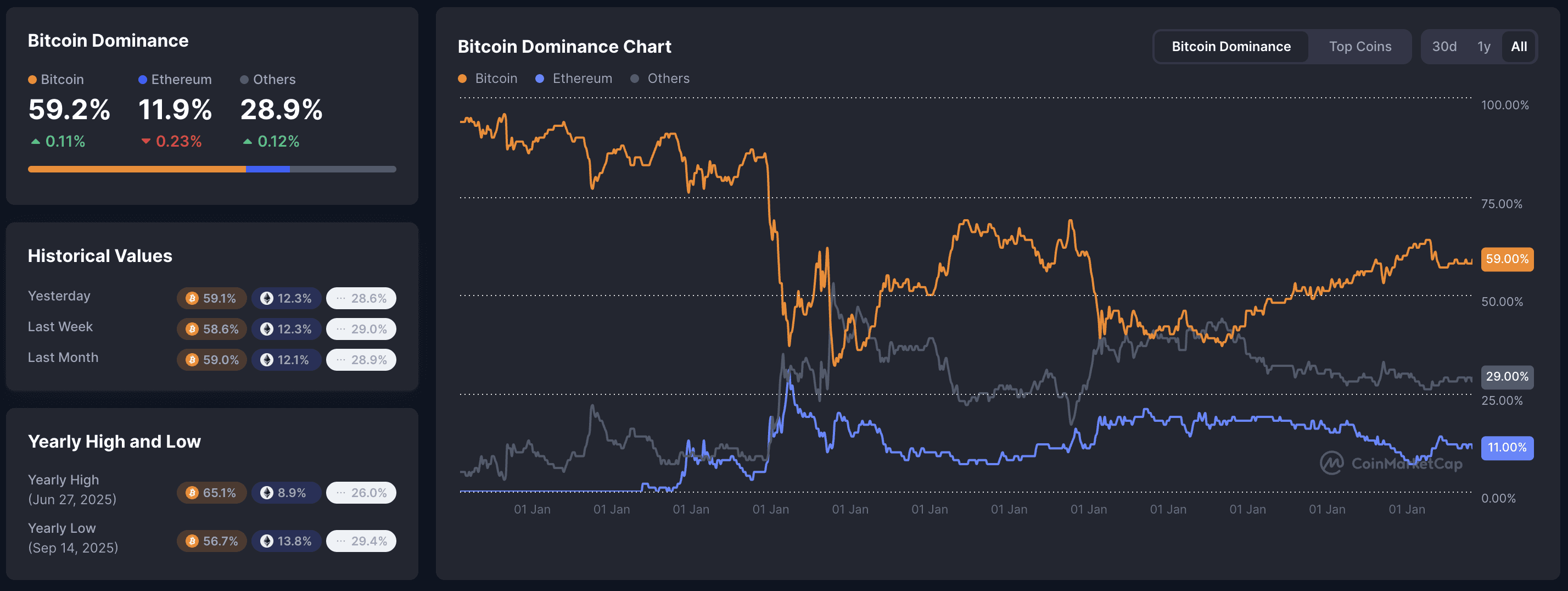

🔍 Deep Dive - Bitcoin Dominance Holds: Altseason Delayed

Bitcoin dominance remains at 59% despite Altcoin Season Index reaching 28 - historically, dominance below 57% triggers altcoin rotation. This cycle differs: $26B in BTC ETF inflows created institutional structure that doesn't naturally rotate into broader crypto.

For true altseason, three conditions must align: BTC dominance below 57%, Altcoin Season Index above 75, and strong fundamentals. Currently only the third trends upward with DeFi TVL approaching $150B.

Takeaway: Dominance stability creates bifurcated markets - strong altcoins rally on merit, but broad "altseason" mania won't trigger until dominance breaks below 57% for weeks.

📰 Top News

Strategy Buys $2.13B BTC: MicroStrategy purchased 22,305 BTC Jan 12-19, now holds 709,715 BTC - corporate conviction despite stock pressure.

Wyoming Stablecoin Goes Live: FRNT (backed 102% by US Treasuries) launched on 7 blockchains - landmark moment for government-issued digital currency.

Polygon Selected for Wyoming Stablecoin: POL surged 46% after infrastructure win.

Monero Hits $800 ATH: Privacy coin leader surged 57%, breaking 2018 peak amid anonymity demand.

Congress Advances Stablecoin Bill: Bipartisan federal licensing framework expected mid-2026, unlocking mainstream adoption.

📚 Education Bits

💡 Pro Tip: When major support breaks, wait for confirmed bounce before entering. Use volume and orderbook depth to confirm exhaustion vs. continuation.

🔍 Did You Know? Bitcoin dominance at 59% creates bifurcated markets where institutional capital concentrates in BTC/ETH while speculative capital rotates selectively - opposite of past cycles where dominance drops triggered broad mania.

📊 Daily Wrap-Up

Crypto markets closed in defensive mode with 95 of top 100 coins red, extending a sixth down day. Bitcoin tested $90K while Ethereum broke $3,000, pushing market cap down 3% to $3.02T.

Institutional flows turned sharply negative with $710M combined ETF outflows - largest exodus in weeks. Whale accumulation vs. retail selling typically precedes bottoms, but macro headwinds keep direction unclear.

Today's Watch List:

Watch Bitcoin reclaim $92K - failure keeps pressure toward $85-87K. Ethereum must hold above $2,900 to prevent cascade to $2,700. Monitor Fed commentary ahead of January 28 meeting and ETF flows for capitulation signs.

Read more on websnack.org - free daily alpha in under 5 minutes.

P.S. 5-min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.