Jan 23, 2026

🍪 Today's Snack

Crypto looked steady after the tariff reversal, but the real story stayed in flows – institutions kept pulling risk, even as headlines calmed down.

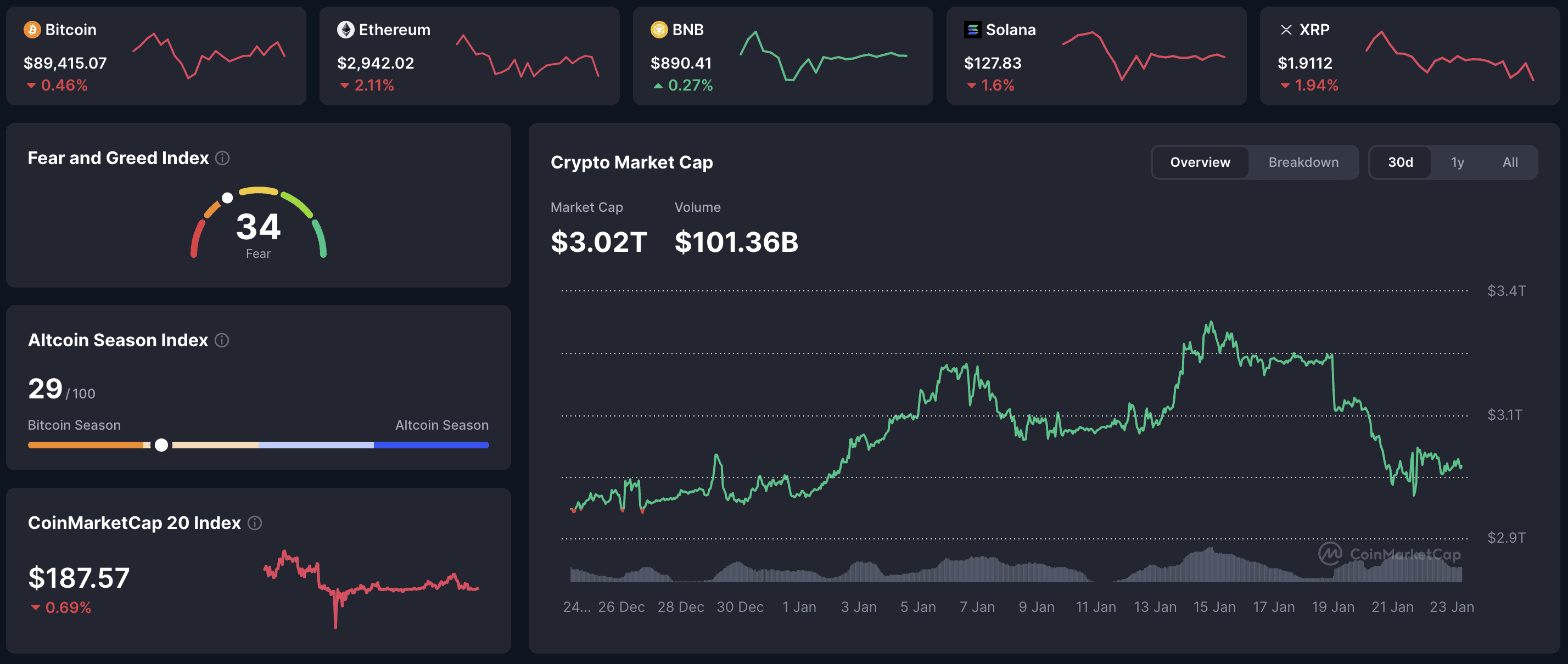

📈 24h Crypto Market Snapshot

Total crypto market cap held near $3.02 while Fear & Greed stayed at 34 (Fear), keeping positioning cautious despite the macro relief tone.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $89,415 | -0.46% | $1.78T |

ETH | $2,942 | -2.11% | $355B |

BNB | $890 | +0.27% | $121B |

SOL | $127 | -1.6% | $72B |

XRP | $1.91 | -1.96% | $116B |

Flat – Bitcoin drifted slightly lower as the tariff-reversal bounce cooled into digestion.

🔥 Top 3 Movers & Shakers

LayerZero (ZRO) – +20.56%

ZRO jumped on January 22 even after a 25.71M token unlock (6.36% of circulating supply, worth $43.96M) as demand absorbed the supply and futures Open Interest rose 32% in 24 hours.

Takeaway: Absorbing an unlock this cleanly suggests strong buying pressure, but the move still looks vulnerable to profit-taking near $2.Story Protocol (IP) – -11.21%

IP sold off on January 22 after a 22% rally on January 11 pushed RSI to 73, with traders taking profits after volume had spiked 400%+ to $198M during the run.

Takeaway: This reads like overbought mean reversion, and a healthier setup may depend on whether volume stabilizes.Rollbit (ROLL / RLB) – +17.98%

RLB rallied on January 22 as volume rose 43.3% to $746K, extending a 48% 30-day spike (+11.7% over 7 days).

Takeaway: Momentum looks like speculative rotation into crypto gambling and niche gaming, but daily volume under $1M can make volatility and execution risk much sharper.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $32.07M in net outflows yesterday, while Ethereum ETFs saw $42M outflows.

BTC ETFs have now logged four consecutive days of withdrawals, and the longer outflow trend since the October 2025 peak suggests institutions remain cautious even with risk headlines improving.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: US Q3 2025 GDP was revised higher to 4.4% and UK inflation rose to 3.4%, which leans against near-term easing. President Trump’s cancellation of a planned 10% tariff on eight European nations after a NATO Greenland framework removed an immediate headline overhang and helped risk assets breathe.

On-Chain Highlights: Exchanges saw roughly $630M in net outflows across January 20–21 during the dip, while Bitcoin realized profit/loss stayed negative for a 30-day stretch – a combo that suggests dip-buying by larger holders, but softer overall demand.

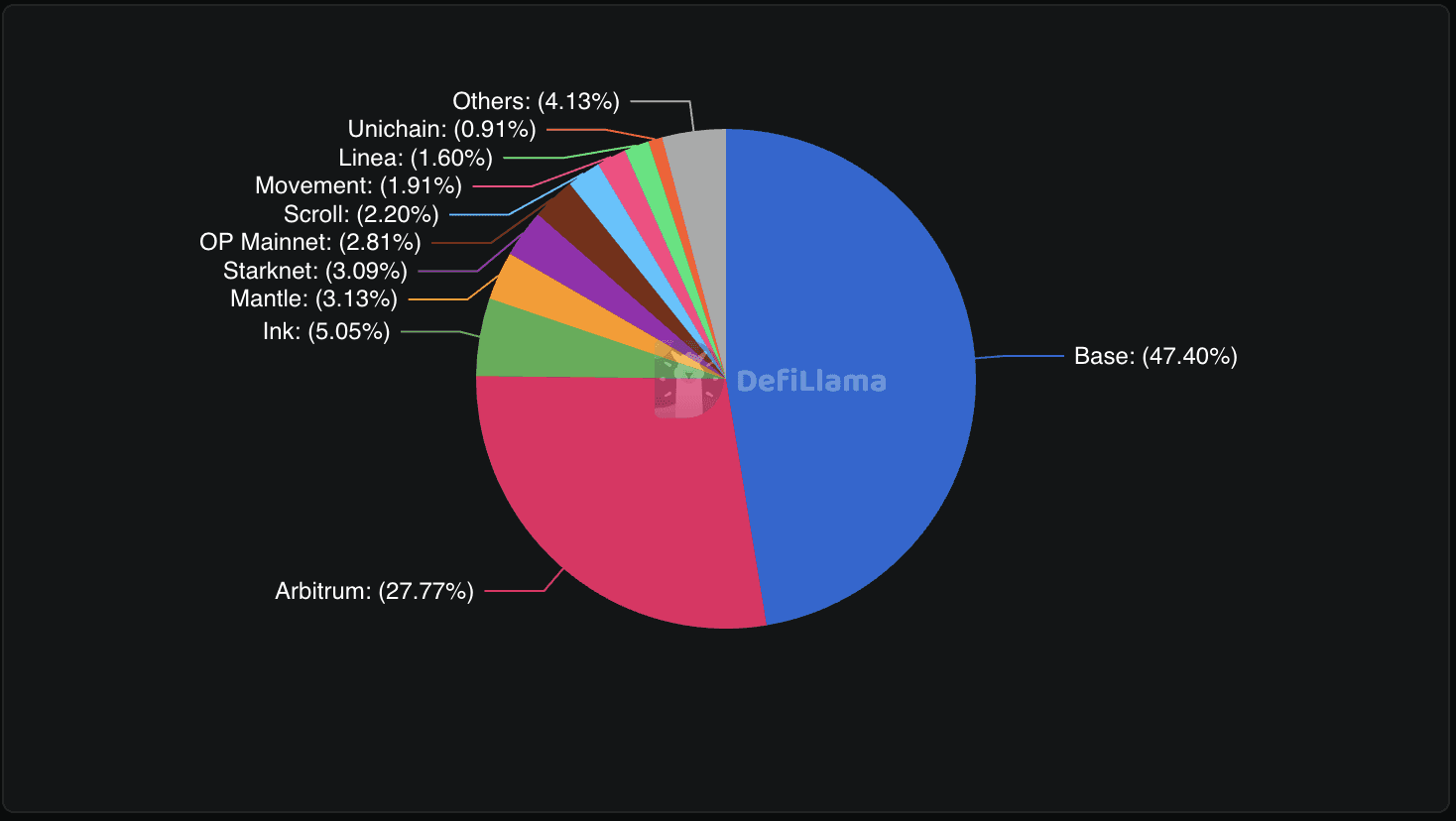

🔍 Deep Dive – Ethereum's L2 Extinction Event: How Base Captured 60% of the Market

Ethereum has 50+ Layer-2s, but 2025 increasingly looked like consolidation – and Base is the center of gravity. The core advantage isn’t purely technical; it’s distribution. Base’s direct access to Coinbase’s 9.3 million active traders creates a demand funnel that’s hard to replicate, and the revenue split shows it.

In 2025, Base generated $75.4M – 62% of total L2 ecosystem revenue ($120.7M) – and it was the only L2 to be profitable, earning about $55M. After Dencun slashed fees by 90%, the L2 market effectively entered a fee war; Base could stay profitable while rivals absorbed losses.

Usage data points the same way: Base handled 40M transactions in the last 30 days (vs Arbitrum’s 6.21M and Polygon’s 29.3M) and has 15M unique active wallets (vs Arbitrum’s 1.12M and Polygon’s 3.69M). Meanwhile, smaller rollups saw usage drop 61% since mid-2025 as incentives faded, with Blast’s TVL collapsing 97% from $2.2B to $67M.

What to watch next: Base’s daily revenue share on January 24–25, plus TVL and wallet growth gaps between the top 3 and the next tier.

📰 Top News

Strategy (MSTR) bought 22,305 BTC for $2.13B (Jan 12–19), lifting holdings to 709,715 BTC. It keeps the corporate accumulation narrative alive, even as volatility persists.

NYSE is building a 24/7 tokenized securities platform (instant settlement, stablecoin funding), pending regulatory approval. It’s another serious TradFi step toward tokenized rails.

Tether froze $182M in USDT across five Tron wallets with U.S. law enforcement. It highlights how enforceable centralized stablecoins can be.

Ethereum hit a record 2.9M daily transactions on Jan 22 while fees stayed near recent lows. That supports the “scaling is working” story.

DeFi generated a record $3.8B in revenue in 2025, with Hyperliquid cited at $800M+ annually. The sector is increasingly separating real businesses from pure narrative.

📚 Education Bits

💡 Pro Tip: After a token unlock, watch whether price holds while Open Interest rises – it can signal real demand absorbing supply, but also leverage building fast.

📊 Metric Explained: Realized profit/loss helps track when markets shift from profit-taking to loss-realization, which often changes the tone before headlines do.

📊 Daily Wrap-Up

Markets looked calmer post-tariff reversal, but the undercurrent stayed defensive: BTC barely slipped while ETH underperformed and ETF flows kept draining. That mix suggests stabilization more than a fresh impulse. Under the hood, traders still rewarded specific narratives – like ZRO absorbing a major unlock – while crowded trades like IP cooled as momentum reset.

Today's Watch List: Watch whether ETF outflows extend the current streak, and whether high ETH activity can persist without fees snapping higher.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.