BTC +0.8% to $93.8K: Strong ETF inflows kick off 2026?

BTC +0.8% to $93.8K: Strong ETF inflows kick off 2026?

BTC +0.8% to $93.8K: Strong ETF inflows kick off 2026?

Jan 6, 2026

🍪 Today’s Snack

Crypto market builds momentum into 2026: total cap hits $3.21T with broad gains led by Bitcoin +0.8% to $93.8K and XRP +11%, fueled by robust ETF inflows and easing year-end caution.

📈 24h Crypto Market Snapshot

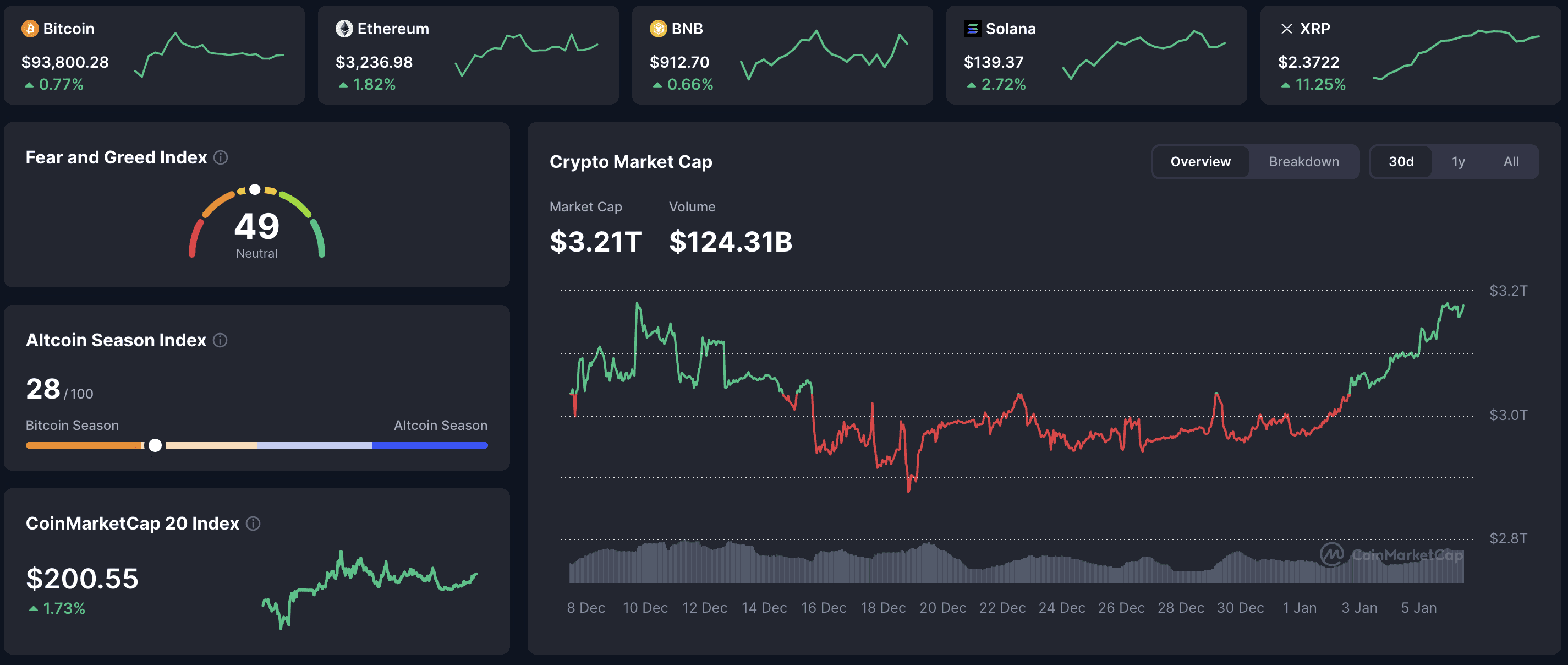

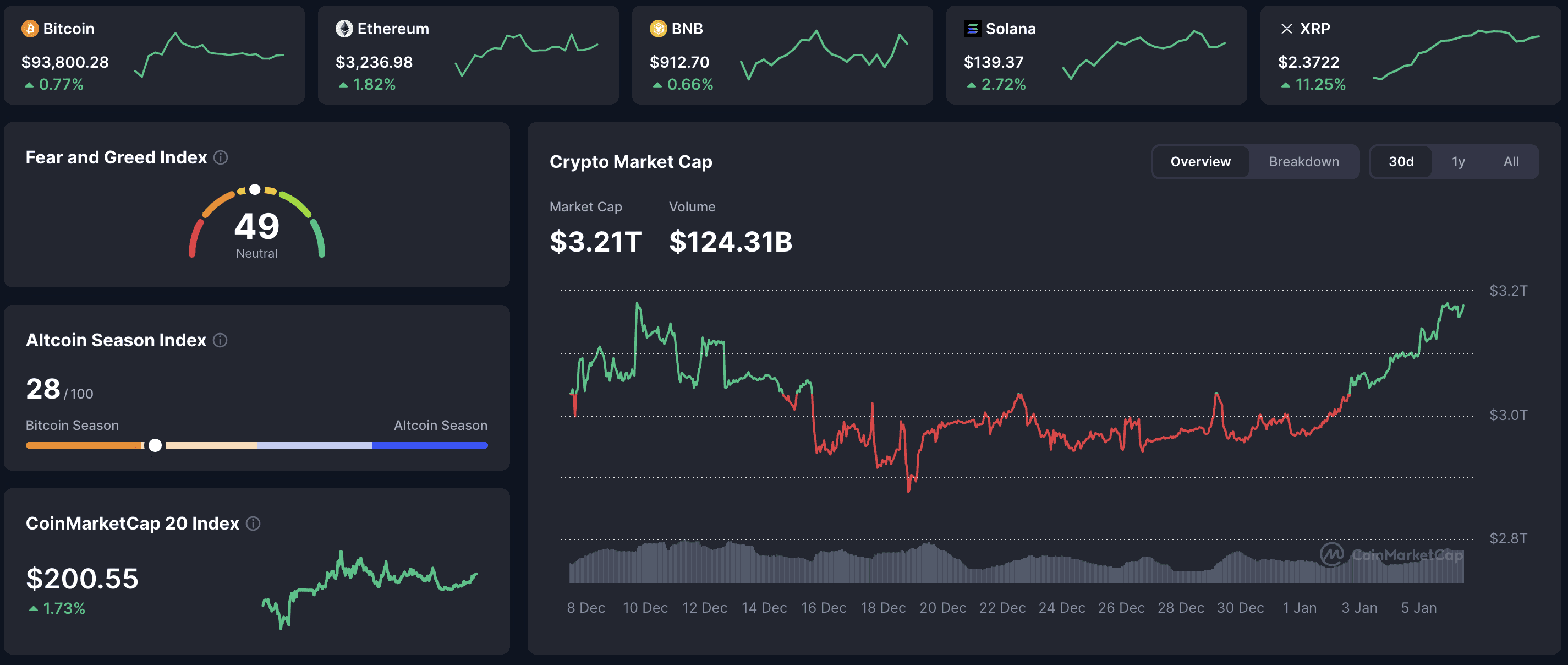

Total cryptocurrency market cap stands at $3.21T (+~2.1% over 24h per CoinMarketCap). The Fear & Greed Index is at 49 (Neutral), marking shift from fear toward balanced sentiment.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $93,800 | +0.77% | $1.87T |

ETH | $3,237 | +1.82% | $390B |

BNB | $913 | +0.66% | $126B |

XRP | $2.37 | +11.25% | $144B |

SOL | $139 | +2.72% | $78B |

TRX | $0.291 | -0.29% | $27.6B |

Why watch sentiment shifts? Neutral readings often precede volatility expansion - pair index levels with volume for timing entries.

🔥 Top 3 Movers & Shakers

Render (RENDER) - +22.2%: AI/GPU rendering token surges on renewed sector interest and ecosystem updates.

Takeaway: AI infrastructure plays lead rotations - track GPU demand metrics for continuation signals.

Sui (SUI) - +17.5%: Layer-1 blockchain gains traction with high TVL growth and developer activity.

Takeaway: Emerging L1s capture flow in bull phases - monitor daily active users for adoption strength.

Rain (RAIN) - +12.6%: Prediction market protocol benefits from speculation revival post-holidays.

Takeaway: Niche narratives ignite quickly - use social trend tools to catch early momentum.

Pro tip: Filter gainers by market cap rank and 24h volume ratio to separate sustainable moves from pumps.

🏦 ETF & Institutional Flows

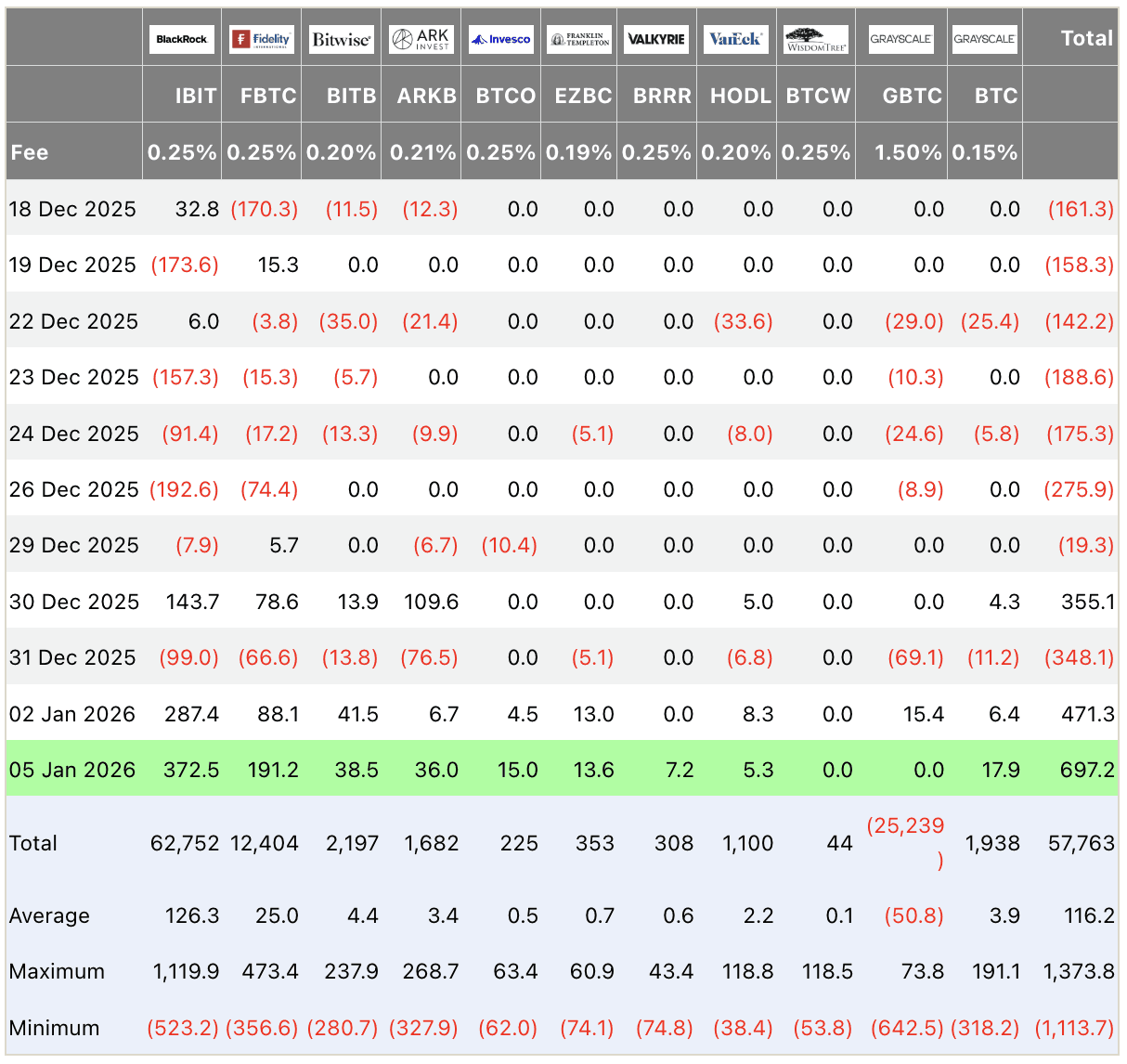

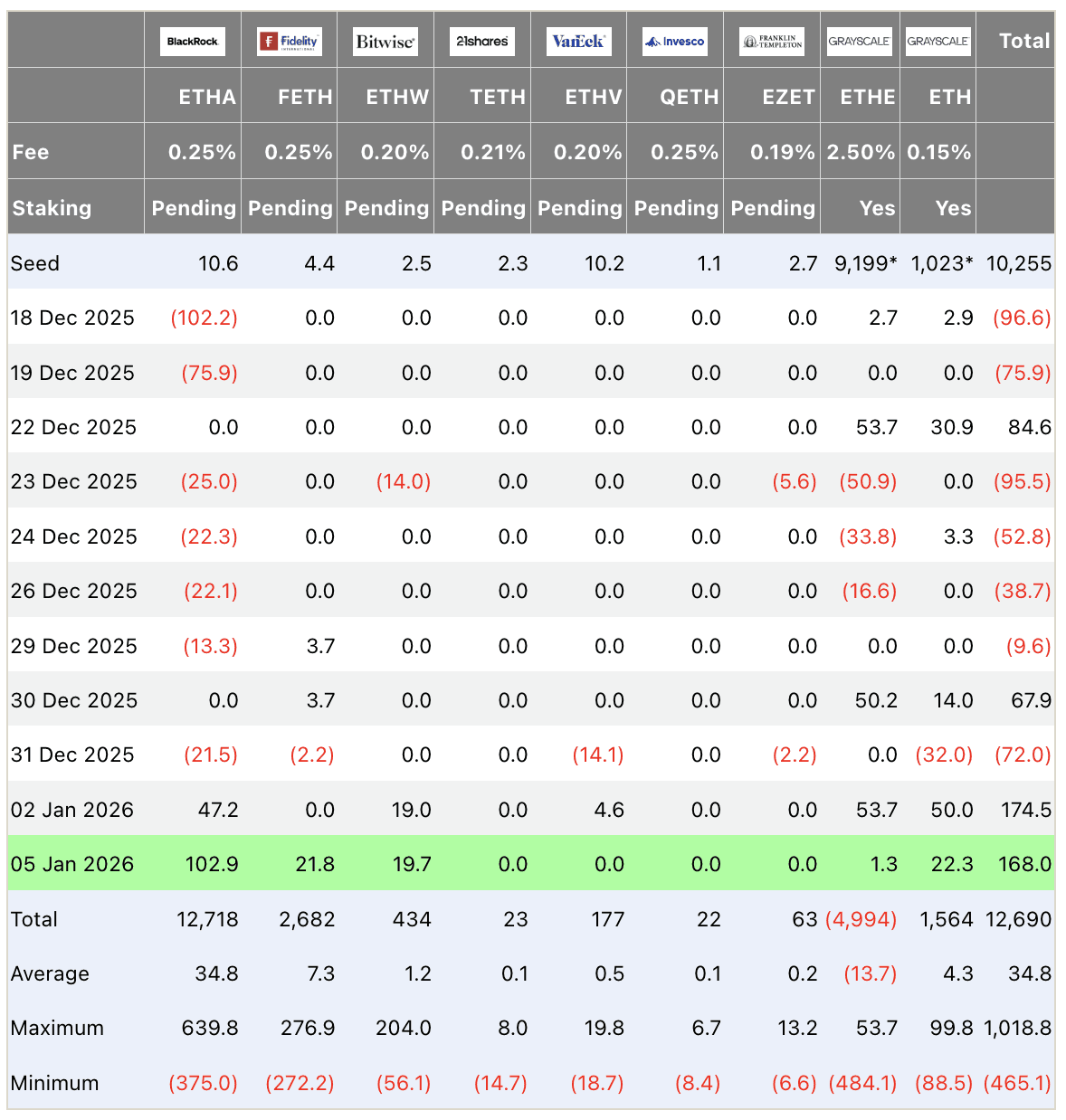

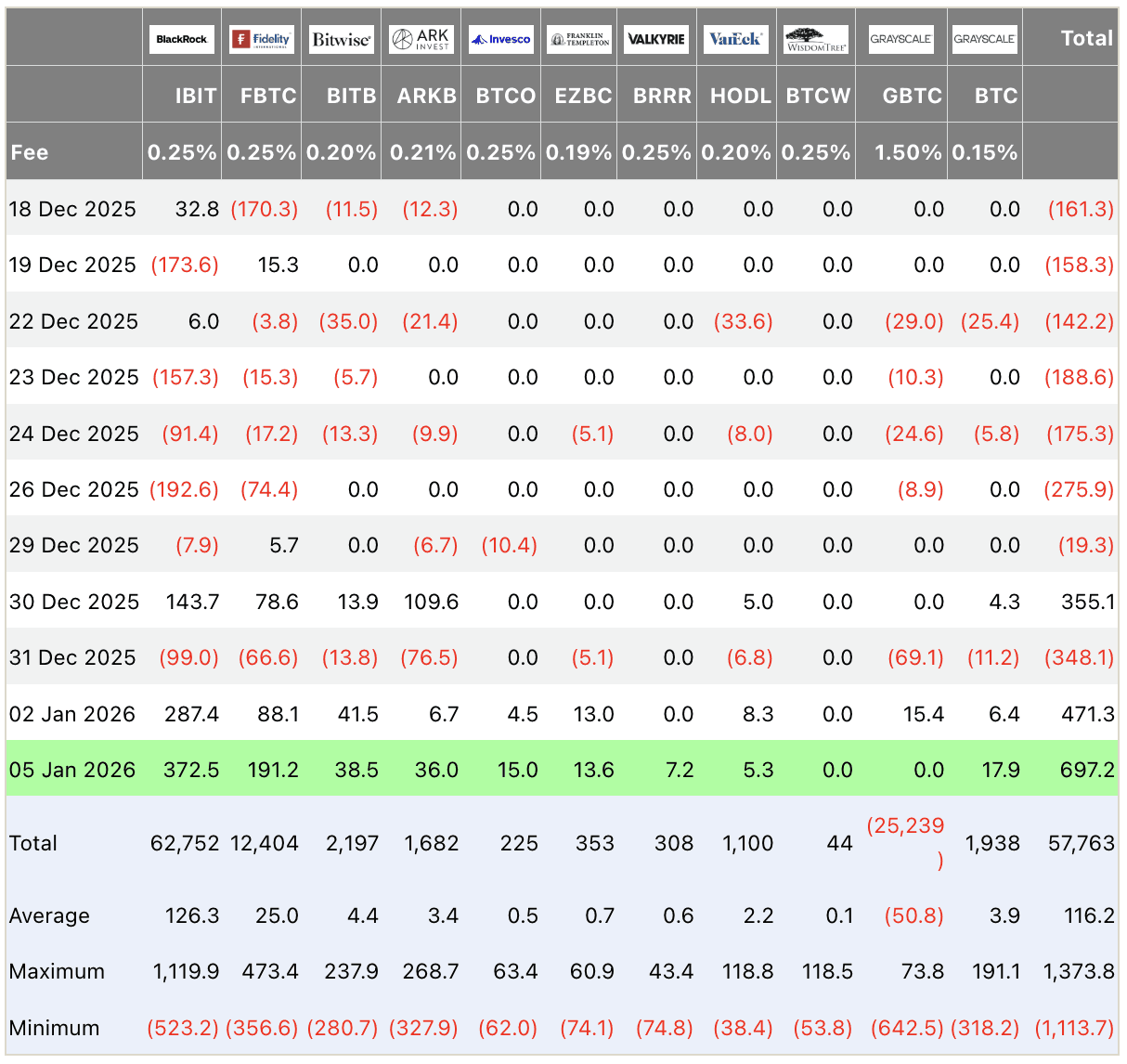

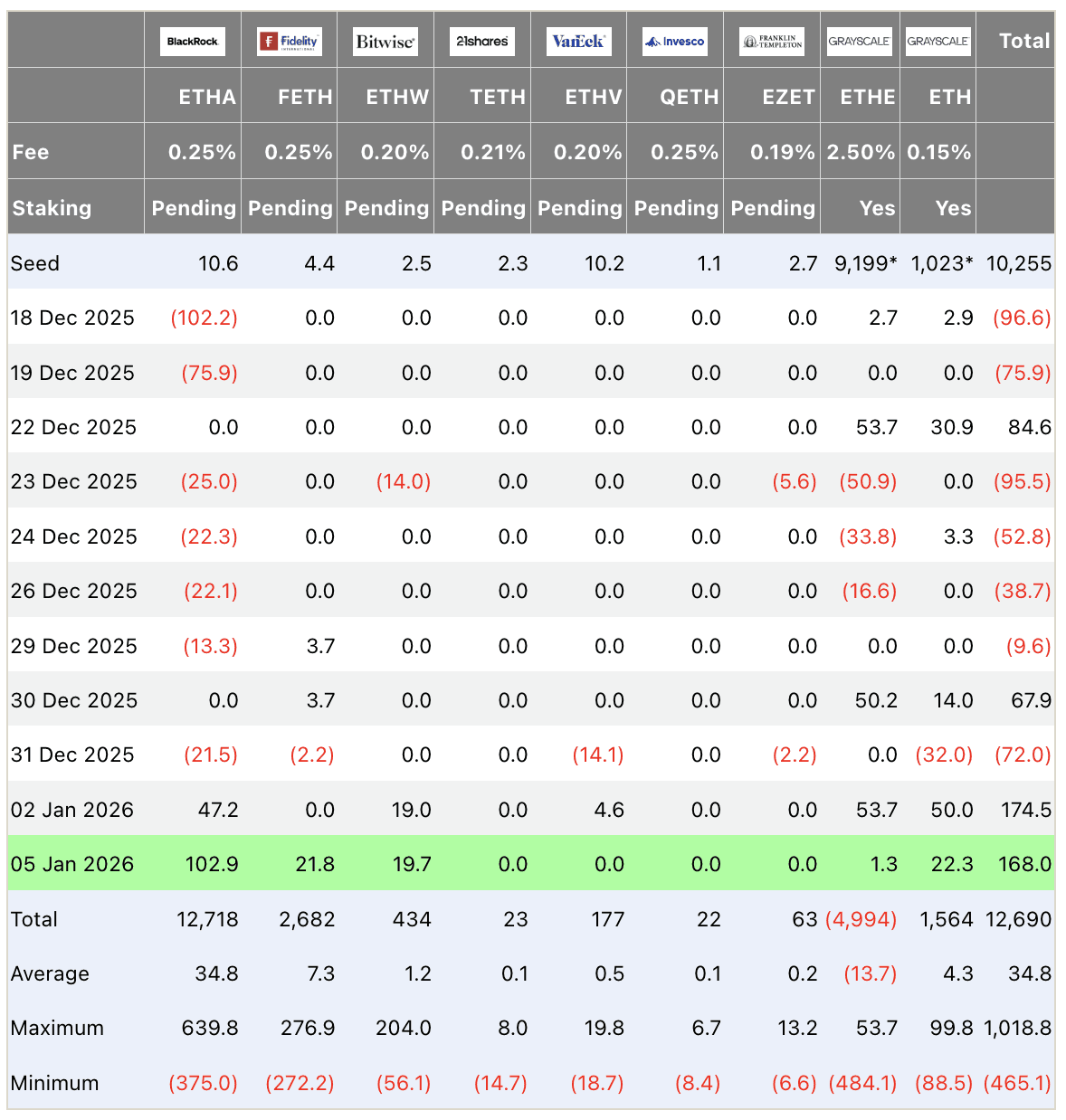

On January 5: Bitcoin spot ETFs record strong net inflows of +$697.2M (led by IBIT +372.5M, FBTC +191.2M, ARKB +150M). Ethereum ETFs +$168M (ETHA +102.9M dominant). Reversal from year-end outflows signals institutional accumulation accelerating into new year.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

How to interpret inflow spikes? Large single-day prints reflect portfolio rebalancing - sustained positives build structural demand.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves dip further with continued outflows to cold storage, reinforcing HODL trend. Whale transfers stable without distribution pressure. Hash rate at record levels despite price consolidation. Overall: tightening supply dynamics support upside bias.

Why track reserves closely? Multi-year downtrends reduce available sell-side liquidity - combine with flow data for conviction.

🌍 Macro Pulse

SF Fed research suggests 2025 tariff shocks may ultimately lower inflation via reduced activity and uncertainty, countering initial fears. Minneapolis Fed's Kashkari notes persistent tariff effects could delay cuts while unemployment risks rise. Broader outlook: gradual easing expected but divisions on pace amid transitory pressures.

What if tariffs surprise lower? Downward inflation impulse could accelerate cuts - watch PCE revisions for policy clues.

💡 Market Trend Spotlight

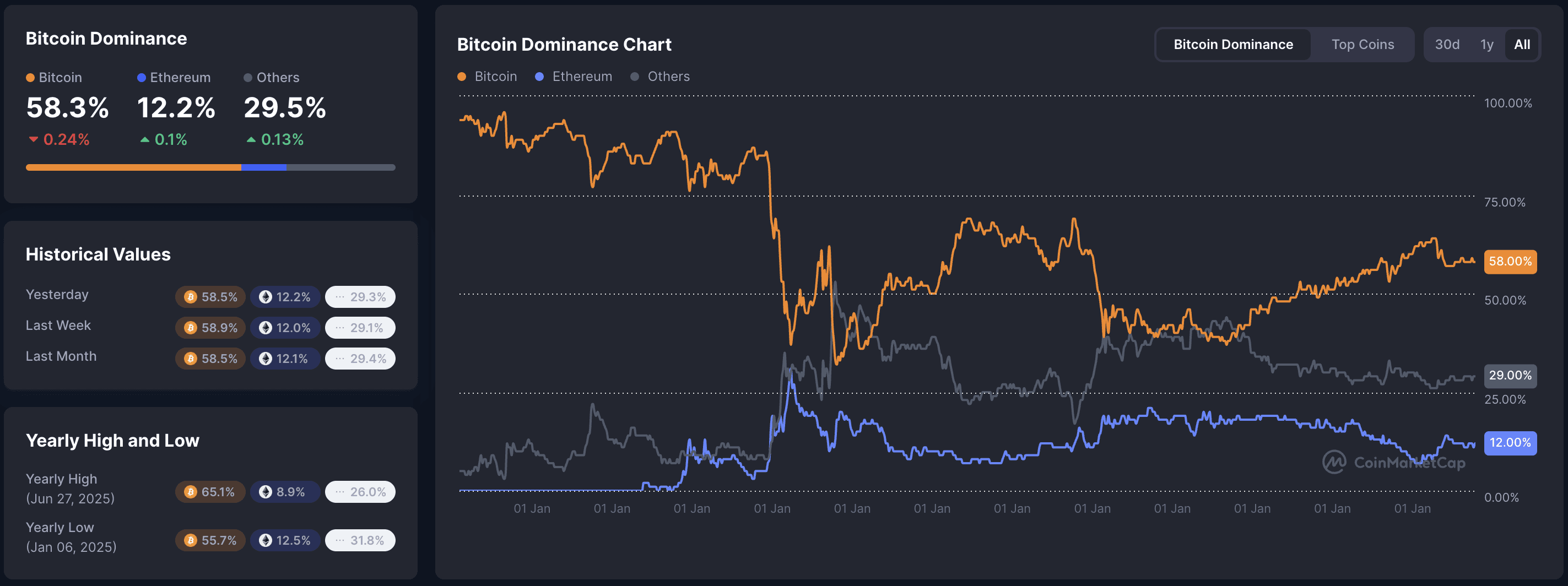

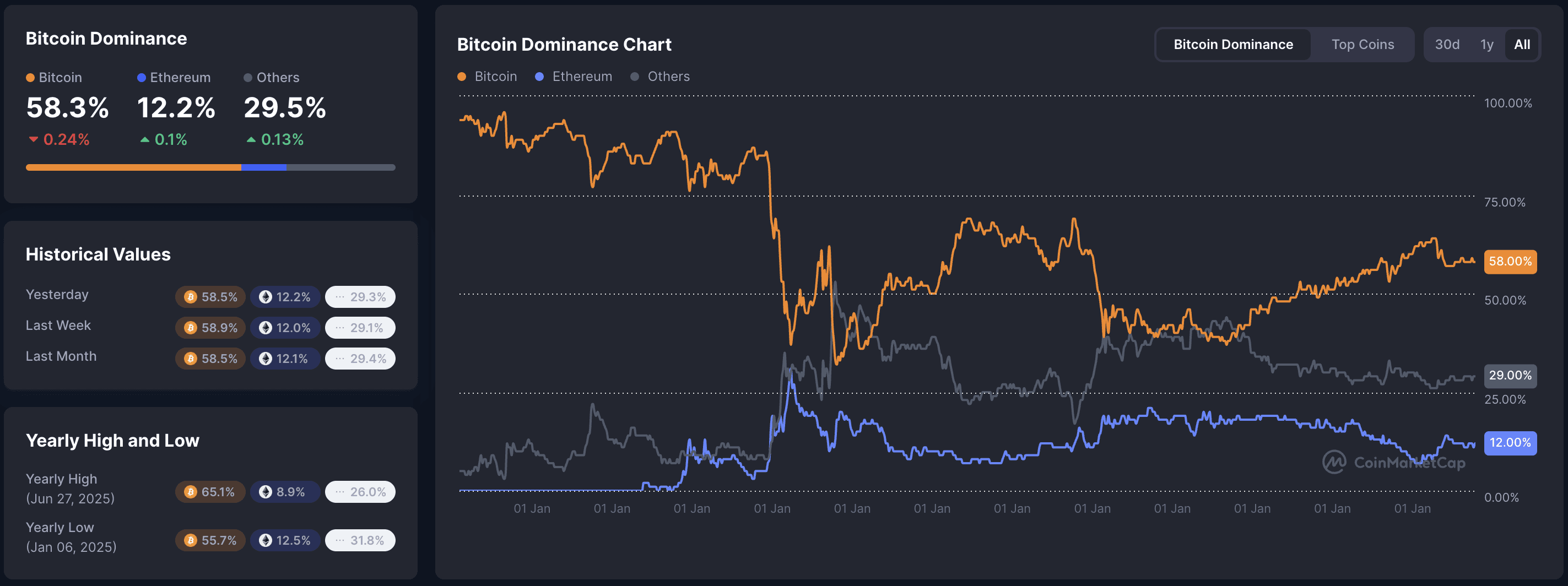

Trend of the day: Institutional inflow rebound with sector rotation. BTC dominance slips to 58.3% as alts outperform (XRP +11%, AI/L1 leaders), price breaks $93K resistance. Neutral sentiment + record volume indicate risk-on shift post-holidays. Metrics: ETF AUM rising, alt season index climbing.

Pro tip: Dominance breakdowns signal alt strength - target high-beta sectors when BTC stabilizes.

📰 Top News

ETF inflows surge Jan 5: +$697M BTC, +$168M ETH - institutions load up post-tax harvesting.

Render +22%, Sui +17.5%: AI and L1 narratives lead daily gainers.

Market cap tops $3.2T: broad recovery with XRP flipping positions.

SF Fed: Tariffs may reduce inflation long-term - via uncertainty and slower growth.

Fear & Greed hits neutral 49: sentiment warms amid early-year optimism.

📊 Daily Wrap-Up

Market shows resilient strength on Jan 5: hefty ETF inflows, alt outperformance, and neutral sentiment underscore constructive reset into 2026 despite macro debates. Key drivers - institutional demand and niche rotations - favor cautious optimism. Watch dominance and flow sustainability for next leg.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

🍪 Today’s Snack

Crypto market builds momentum into 2026: total cap hits $3.21T with broad gains led by Bitcoin +0.8% to $93.8K and XRP +11%, fueled by robust ETF inflows and easing year-end caution.

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $3.21T (+~2.1% over 24h per CoinMarketCap). The Fear & Greed Index is at 49 (Neutral), marking shift from fear toward balanced sentiment.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $93,800 | +0.77% | $1.87T |

ETH | $3,237 | +1.82% | $390B |

BNB | $913 | +0.66% | $126B |

XRP | $2.37 | +11.25% | $144B |

SOL | $139 | +2.72% | $78B |

TRX | $0.291 | -0.29% | $27.6B |

Why watch sentiment shifts? Neutral readings often precede volatility expansion - pair index levels with volume for timing entries.

🔥 Top 3 Movers & Shakers

Render (RENDER) - +22.2%: AI/GPU rendering token surges on renewed sector interest and ecosystem updates.

Takeaway: AI infrastructure plays lead rotations - track GPU demand metrics for continuation signals.

Sui (SUI) - +17.5%: Layer-1 blockchain gains traction with high TVL growth and developer activity.

Takeaway: Emerging L1s capture flow in bull phases - monitor daily active users for adoption strength.

Rain (RAIN) - +12.6%: Prediction market protocol benefits from speculation revival post-holidays.

Takeaway: Niche narratives ignite quickly - use social trend tools to catch early momentum.

Pro tip: Filter gainers by market cap rank and 24h volume ratio to separate sustainable moves from pumps.

🏦 ETF & Institutional Flows

On January 5: Bitcoin spot ETFs record strong net inflows of +$697.2M (led by IBIT +372.5M, FBTC +191.2M, ARKB +150M). Ethereum ETFs +$168M (ETHA +102.9M dominant). Reversal from year-end outflows signals institutional accumulation accelerating into new year.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

How to interpret inflow spikes? Large single-day prints reflect portfolio rebalancing - sustained positives build structural demand.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves dip further with continued outflows to cold storage, reinforcing HODL trend. Whale transfers stable without distribution pressure. Hash rate at record levels despite price consolidation. Overall: tightening supply dynamics support upside bias.

Why track reserves closely? Multi-year downtrends reduce available sell-side liquidity - combine with flow data for conviction.

🌍 Macro Pulse

SF Fed research suggests 2025 tariff shocks may ultimately lower inflation via reduced activity and uncertainty, countering initial fears. Minneapolis Fed's Kashkari notes persistent tariff effects could delay cuts while unemployment risks rise. Broader outlook: gradual easing expected but divisions on pace amid transitory pressures.

What if tariffs surprise lower? Downward inflation impulse could accelerate cuts - watch PCE revisions for policy clues.

💡 Market Trend Spotlight

Trend of the day: Institutional inflow rebound with sector rotation. BTC dominance slips to 58.3% as alts outperform (XRP +11%, AI/L1 leaders), price breaks $93K resistance. Neutral sentiment + record volume indicate risk-on shift post-holidays. Metrics: ETF AUM rising, alt season index climbing.

Pro tip: Dominance breakdowns signal alt strength - target high-beta sectors when BTC stabilizes.

📰 Top News

ETF inflows surge Jan 5: +$697M BTC, +$168M ETH - institutions load up post-tax harvesting.

Render +22%, Sui +17.5%: AI and L1 narratives lead daily gainers.

Market cap tops $3.2T: broad recovery with XRP flipping positions.

SF Fed: Tariffs may reduce inflation long-term - via uncertainty and slower growth.

Fear & Greed hits neutral 49: sentiment warms amid early-year optimism.

📊 Daily Wrap-Up

Market shows resilient strength on Jan 5: hefty ETF inflows, alt outperformance, and neutral sentiment underscore constructive reset into 2026 despite macro debates. Key drivers - institutional demand and niche rotations - favor cautious optimism. Watch dominance and flow sustainability for next leg.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved