Meme revival: PEPE +25% leads early 2026 pumps?

Meme revival: PEPE +25% leads early 2026 pumps?

Meme revival: PEPE +25% leads early 2026 pumps?

Jan 2, 2026

🍪 Today’s Snack

Crypto kicks off 2026 with modest gains: total cap reaches $3.01T, Bitcoin up ~1.6% to $88.9K on renewed risk appetite, while meme coins explode higher in thin holiday liquidity.

📈 24h Crypto Market Snapshot

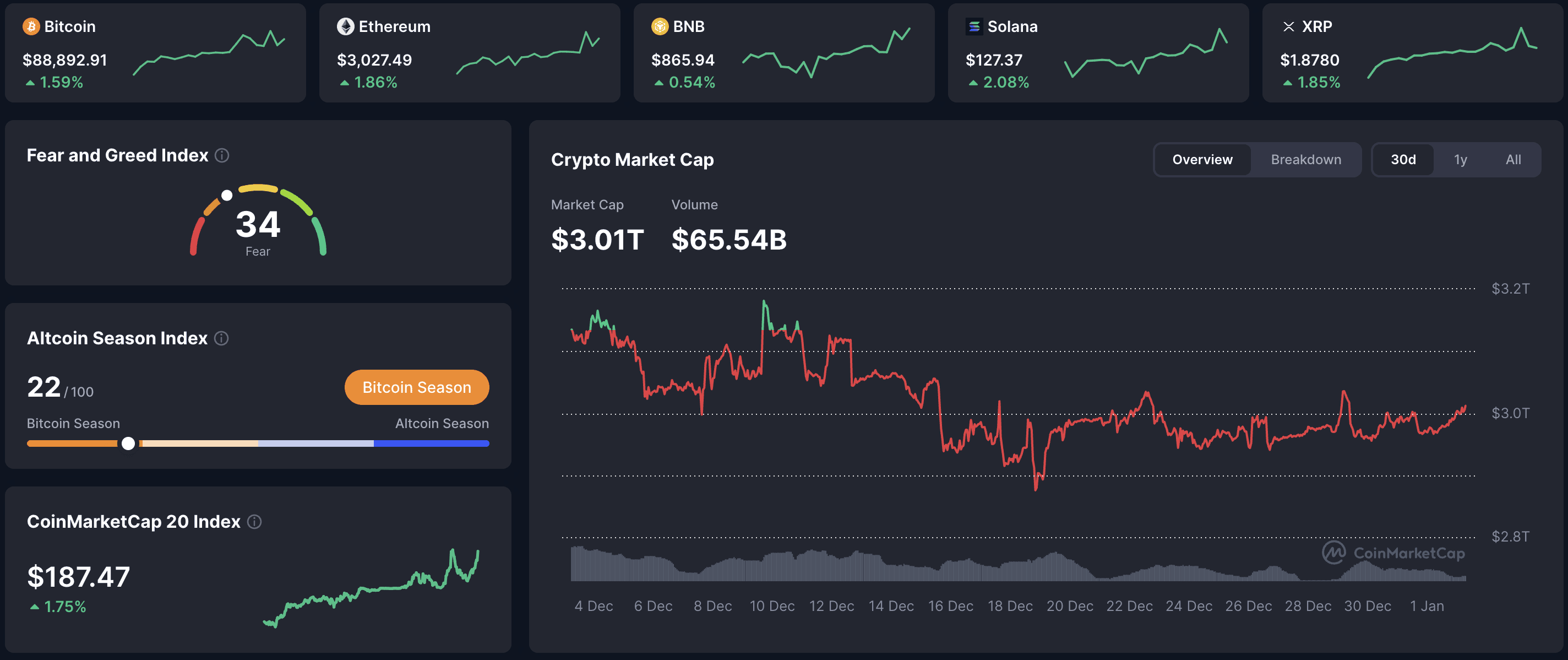

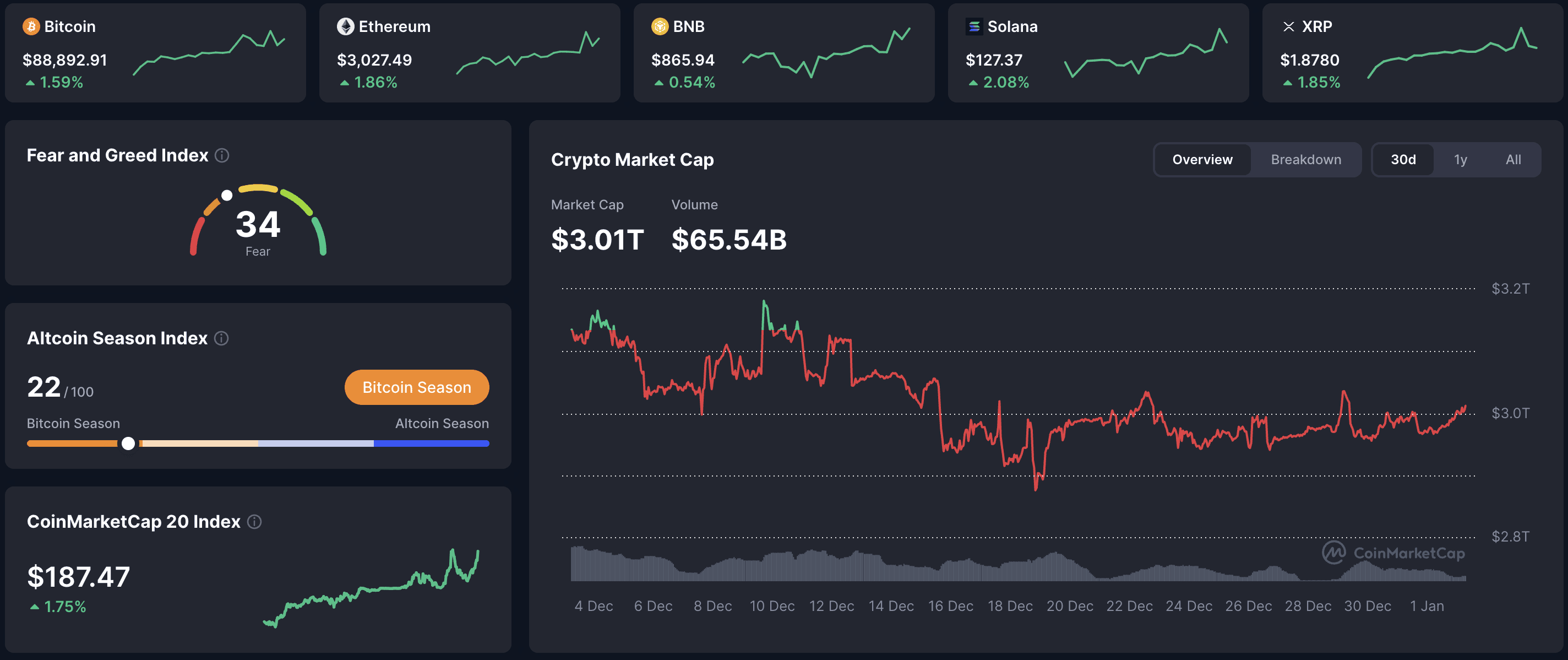

Total cryptocurrency market cap stands at $3.01T (+~1.5% over 24h per CoinMarketCap). The Fear & Greed Index is at 34 (Fear), reflecting lingering caution despite early-year optimism.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $88,892 | +1.59% | $1.77T |

ETH | $3,027 | +1.86% | $365B |

BNB | $866 | +0.54% | $119B |

XRP | $1.88 | +1.85% | $113B |

SOL | $127 | +2.08% | $71B |

ADA | $0.358 | +1.75% | $12.8B |

Pro tip: Early-year pumps often start in low-liquidity periods - check daily volume spikes to confirm if momentum is building sustainably.

🔥 Top 3 Movers & Shakers

Pepe (PEPE) - +25.0%: Iconic meme token leads New Year surge on renewed community hype and rotation into high-beta assets.

Takeaway: Meme coins thrive on sentiment shifts - watch social volume for early signs of viral pumps.

Pump.fun (PUMP) - +13.9%: Solana-based launchpad token benefits from meme frenzy and platform activity.

Takeaway: Launchpad ecosystems capture upside in meme seasons - track new token deployments for flow indicators.

Filecoin (FIL) - +13.0%: Decentralized storage token gains on sector rotation and utility narrative revival.

Takeaway: Utility plays can outperform memes in rotations - monitor TVL growth for sustained interest.

How to identify rotation winners? Cross-reference 24h gainers with on-chain transfers and exchange inflows to spot smart money moves early.

🏦 ETF & Institutional Flows

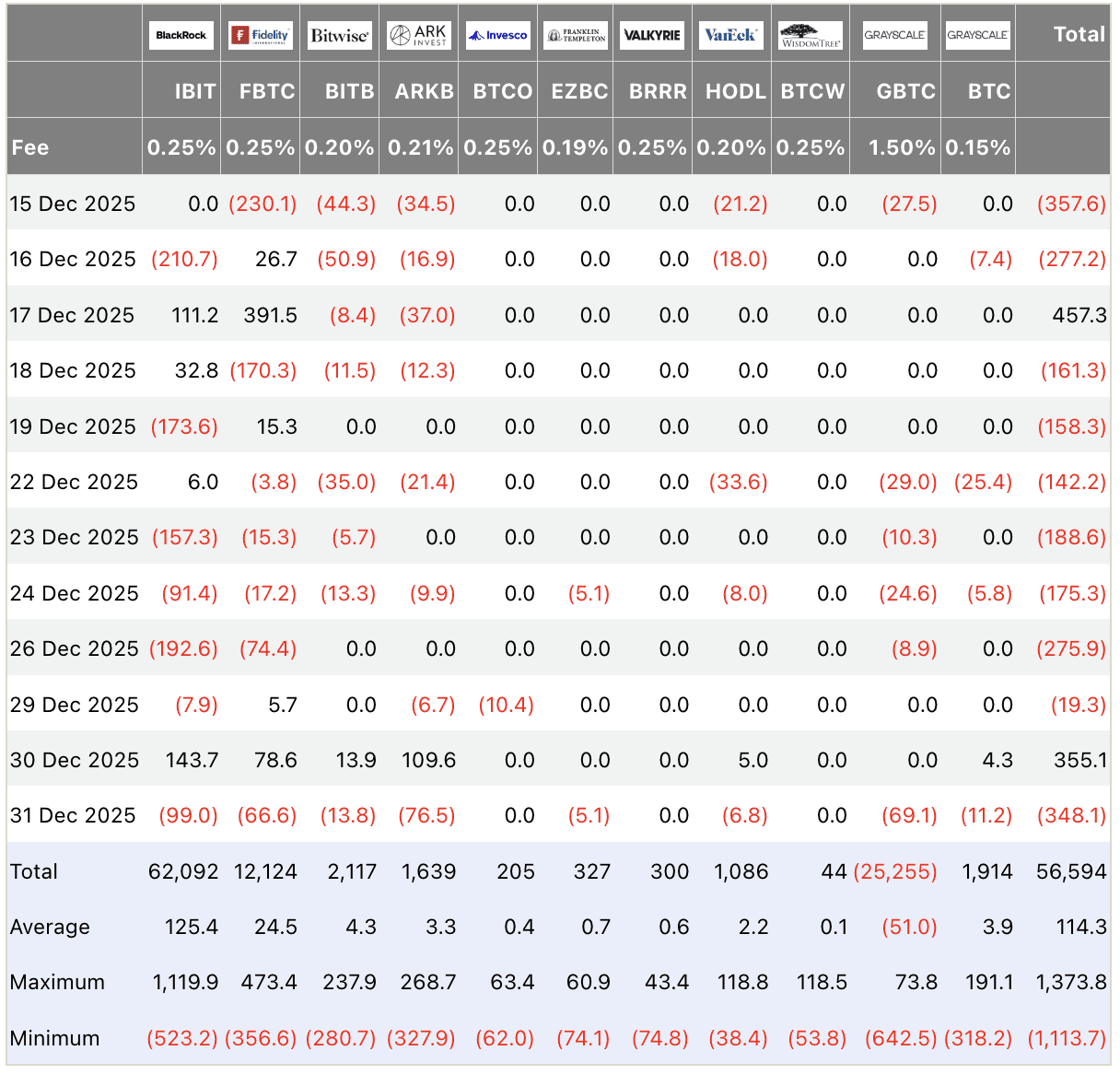

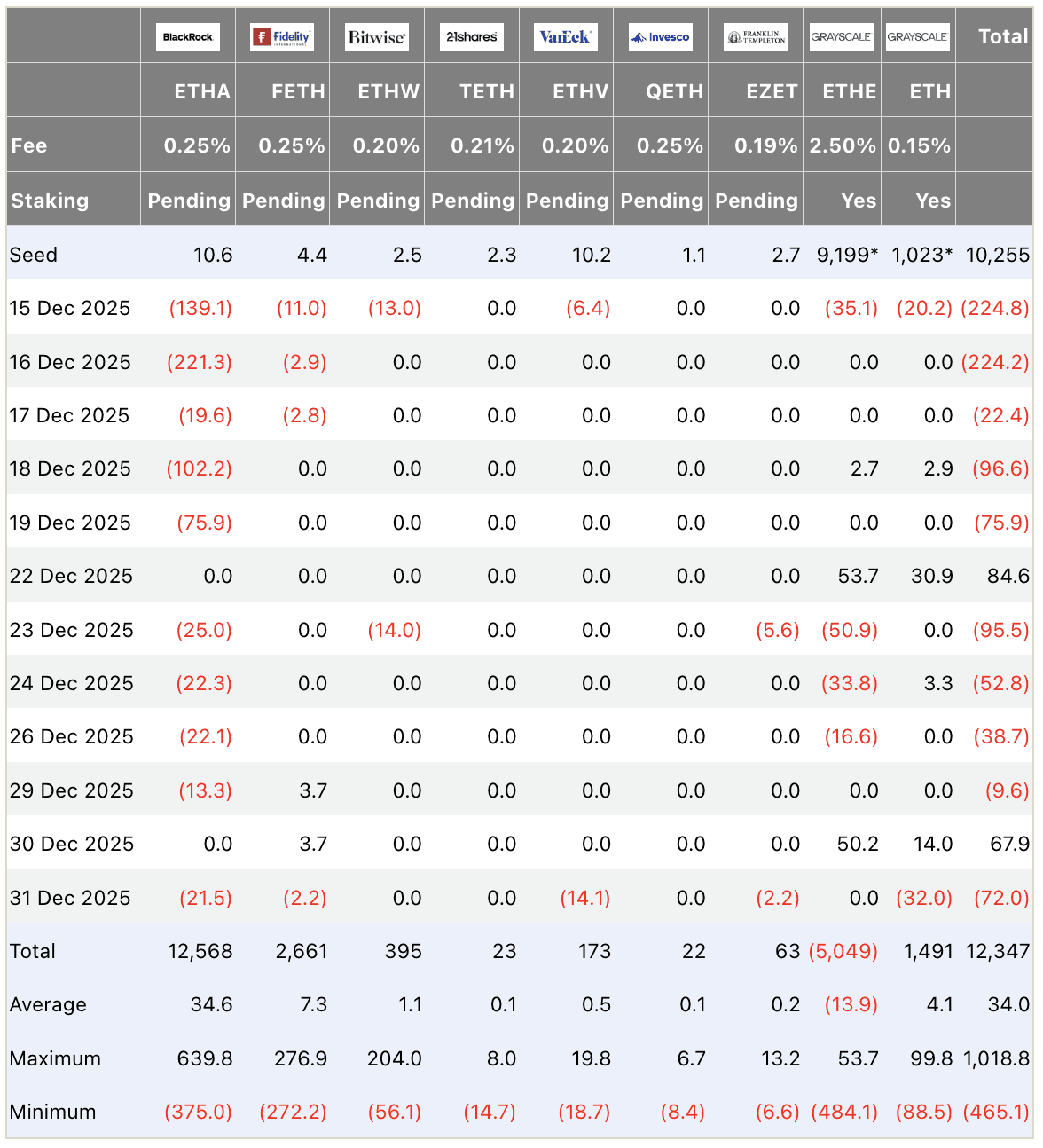

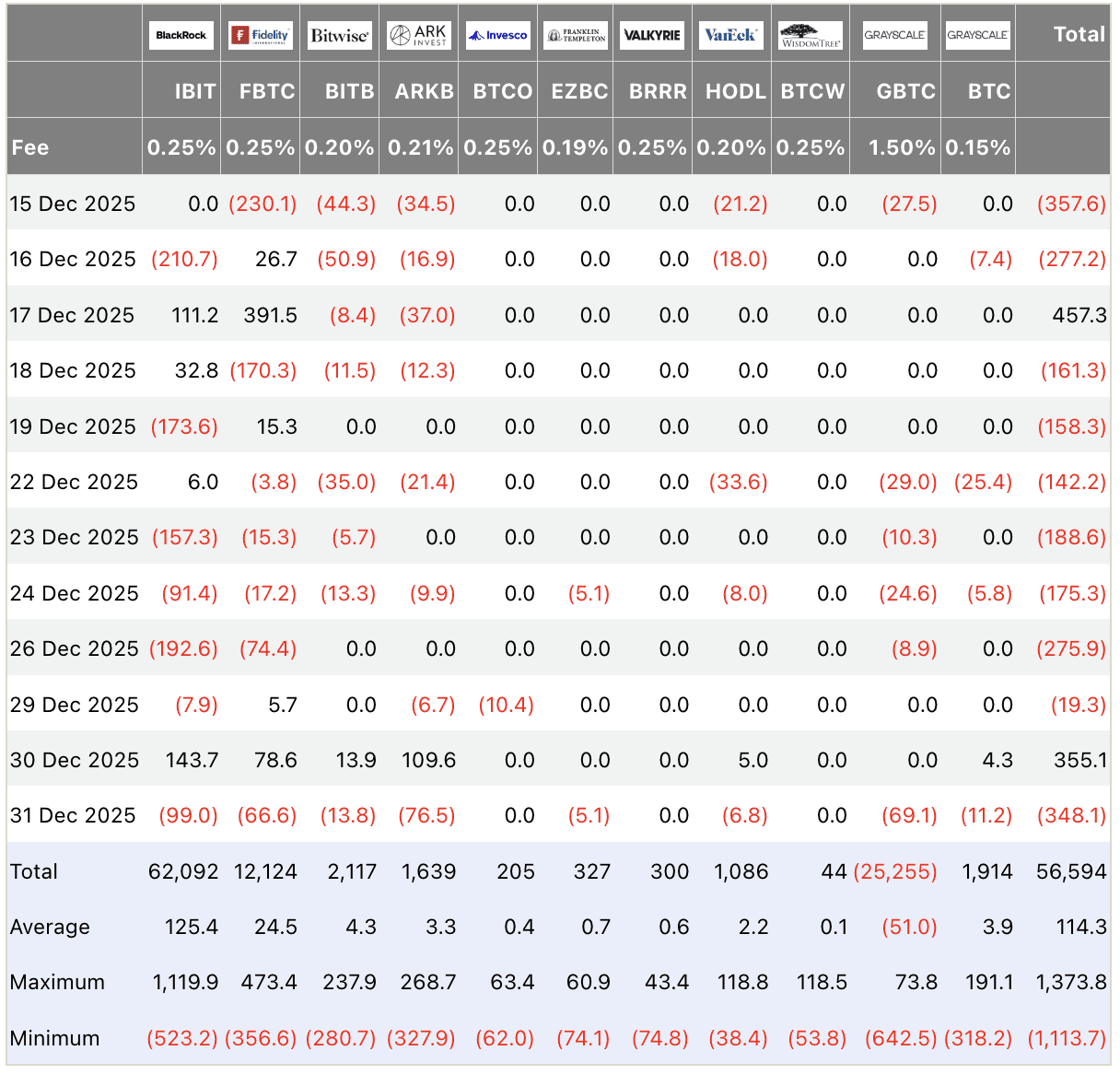

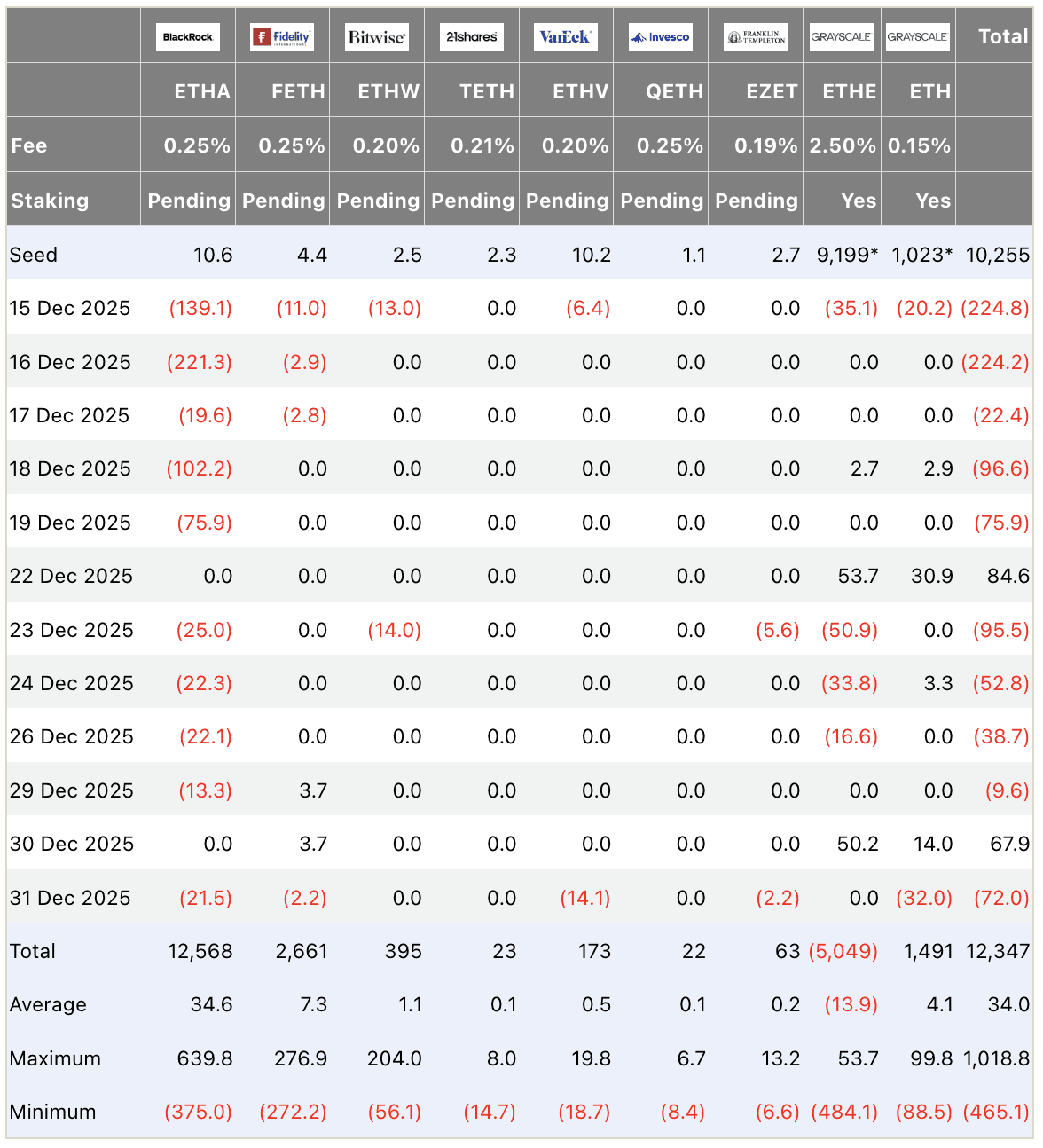

Latest data (Dec 31): Bitcoin spot ETFs saw net outflows of -$348.1M amid year-end rebalancing (IBIT -99M, ARKB -76.5M, GBTC -69.1M). Ethereum ETFs -72M (ETHA -21.5M, ETH -32M). Holiday thin trading amplified tax-loss harvesting, but early 2026 sentiment points to potential inflow rebound.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why do year-end outflows happen? Tax strategies and portfolio resets dominate December - positive January flows historically signal fresh institutional commitment.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves continue multi-year decline with outflows to self-custody, signaling HODL behavior. Whale wallets show mixed activity but no major distribution spikes. Hash rate remains elevated post-adjustments. Overall: supply tightening supports floor, accumulation phase intact into new year.

Pro tip: Declining reserves reduce sell pressure over time - pair with whale wallet tracking for distribution warnings.

🌍 Macro Pulse

Fed minutes reveal ongoing debate on rate path: tariffs seen pushing temporary inflation higher into Q1 2026, but most officials view impact as transitory. Unemployment stable near 4.6%, jobs growth moderating. Broader risk assets supported by expected gradual easing, though divisions persist on cut pace.

Why watch tariff effects closely? Short-term price pressures may delay cuts - monitor core PCE for persistent vs. transient signals.

💡 Market Trend Spotlight

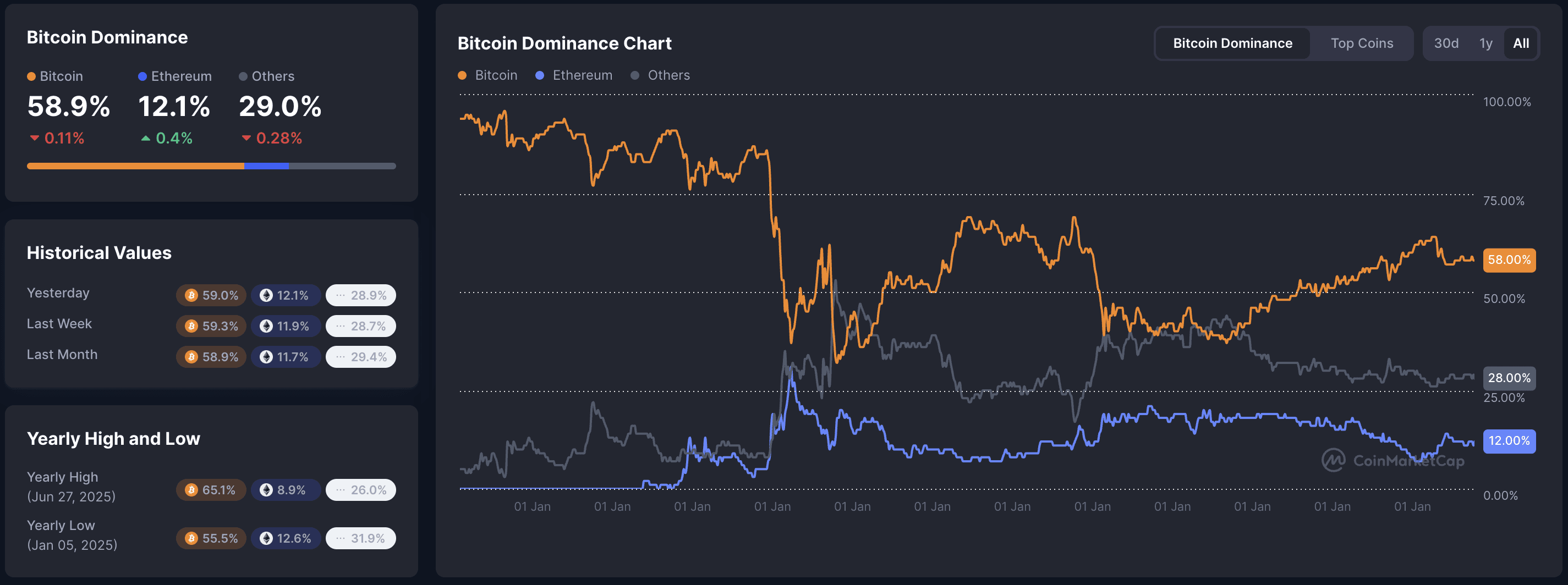

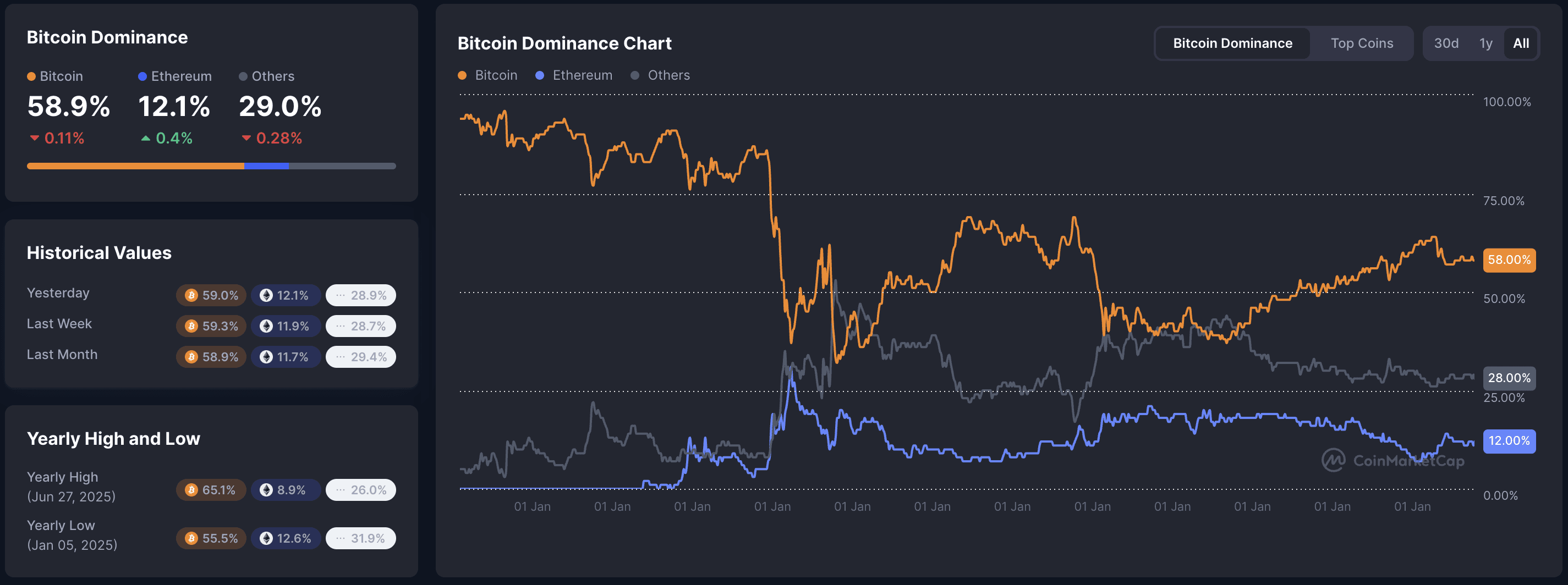

Trend of the day: Early 2026 meme rotation amid Bitcoin stability. BTC dominance dips slightly to 58.9% as capital flows to high-risk memes, price holds above $88K support. Compressed vol post-holidays + Fear at 34 create setup for volatility expansion. Metrics: alt season index rising, meme volume surging.

How to position for rotations? Use dominance breaks as triggers - falling BTC dom often precedes alt outperformance phases.

📰 Top News

Meme coins ignite 2026 start: PEPE +25%, Pump.fun +14% on speculative flows.

BTC ETFs post year-end outflows: -$348M Dec 31 on tax harvesting - watch for January reversal.

Bitcoin dominance slips to 58.9%: early signs of capital rotating to alts.

Fed divided on tariffs: inflation bump expected temporary - no aggressive cuts soon.

Market cap crosses $3T: modest gains signal cautious optimism post-2025 consolidation.

📊 Daily Wrap-Up

Crypto starts 2026 on positive footing: BTC stability + explosive meme gains highlight rotation potential, despite year-end ETF outflows and macro caution. Key drivers - holiday liquidity squeeze and sentiment rebound - set watchful tone. Focus ahead on inflow resumption and dominance trends for direction.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

🍪 Today’s Snack

Crypto kicks off 2026 with modest gains: total cap reaches $3.01T, Bitcoin up ~1.6% to $88.9K on renewed risk appetite, while meme coins explode higher in thin holiday liquidity.

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $3.01T (+~1.5% over 24h per CoinMarketCap). The Fear & Greed Index is at 34 (Fear), reflecting lingering caution despite early-year optimism.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $88,892 | +1.59% | $1.77T |

ETH | $3,027 | +1.86% | $365B |

BNB | $866 | +0.54% | $119B |

XRP | $1.88 | +1.85% | $113B |

SOL | $127 | +2.08% | $71B |

ADA | $0.358 | +1.75% | $12.8B |

Pro tip: Early-year pumps often start in low-liquidity periods - check daily volume spikes to confirm if momentum is building sustainably.

🔥 Top 3 Movers & Shakers

Pepe (PEPE) - +25.0%: Iconic meme token leads New Year surge on renewed community hype and rotation into high-beta assets.

Takeaway: Meme coins thrive on sentiment shifts - watch social volume for early signs of viral pumps.

Pump.fun (PUMP) - +13.9%: Solana-based launchpad token benefits from meme frenzy and platform activity.

Takeaway: Launchpad ecosystems capture upside in meme seasons - track new token deployments for flow indicators.

Filecoin (FIL) - +13.0%: Decentralized storage token gains on sector rotation and utility narrative revival.

Takeaway: Utility plays can outperform memes in rotations - monitor TVL growth for sustained interest.

How to identify rotation winners? Cross-reference 24h gainers with on-chain transfers and exchange inflows to spot smart money moves early.

🏦 ETF & Institutional Flows

Latest data (Dec 31): Bitcoin spot ETFs saw net outflows of -$348.1M amid year-end rebalancing (IBIT -99M, ARKB -76.5M, GBTC -69.1M). Ethereum ETFs -72M (ETHA -21.5M, ETH -32M). Holiday thin trading amplified tax-loss harvesting, but early 2026 sentiment points to potential inflow rebound.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why do year-end outflows happen? Tax strategies and portfolio resets dominate December - positive January flows historically signal fresh institutional commitment.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves continue multi-year decline with outflows to self-custody, signaling HODL behavior. Whale wallets show mixed activity but no major distribution spikes. Hash rate remains elevated post-adjustments. Overall: supply tightening supports floor, accumulation phase intact into new year.

Pro tip: Declining reserves reduce sell pressure over time - pair with whale wallet tracking for distribution warnings.

🌍 Macro Pulse

Fed minutes reveal ongoing debate on rate path: tariffs seen pushing temporary inflation higher into Q1 2026, but most officials view impact as transitory. Unemployment stable near 4.6%, jobs growth moderating. Broader risk assets supported by expected gradual easing, though divisions persist on cut pace.

Why watch tariff effects closely? Short-term price pressures may delay cuts - monitor core PCE for persistent vs. transient signals.

💡 Market Trend Spotlight

Trend of the day: Early 2026 meme rotation amid Bitcoin stability. BTC dominance dips slightly to 58.9% as capital flows to high-risk memes, price holds above $88K support. Compressed vol post-holidays + Fear at 34 create setup for volatility expansion. Metrics: alt season index rising, meme volume surging.

How to position for rotations? Use dominance breaks as triggers - falling BTC dom often precedes alt outperformance phases.

📰 Top News

Meme coins ignite 2026 start: PEPE +25%, Pump.fun +14% on speculative flows.

BTC ETFs post year-end outflows: -$348M Dec 31 on tax harvesting - watch for January reversal.

Bitcoin dominance slips to 58.9%: early signs of capital rotating to alts.

Fed divided on tariffs: inflation bump expected temporary - no aggressive cuts soon.

Market cap crosses $3T: modest gains signal cautious optimism post-2025 consolidation.

📊 Daily Wrap-Up

Crypto starts 2026 on positive footing: BTC stability + explosive meme gains highlight rotation potential, despite year-end ETF outflows and macro caution. Key drivers - holiday liquidity squeeze and sentiment rebound - set watchful tone. Focus ahead on inflow resumption and dominance trends for direction.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved