Jan 20, 2026

🍪 Today's Snack

Bitcoin plunged 4% to $91K on January 19 after President Trump announced sweeping tariffs on eight European nations, triggering a risk-off selloff that wiped $763M in leveraged long positions within 12 hours.

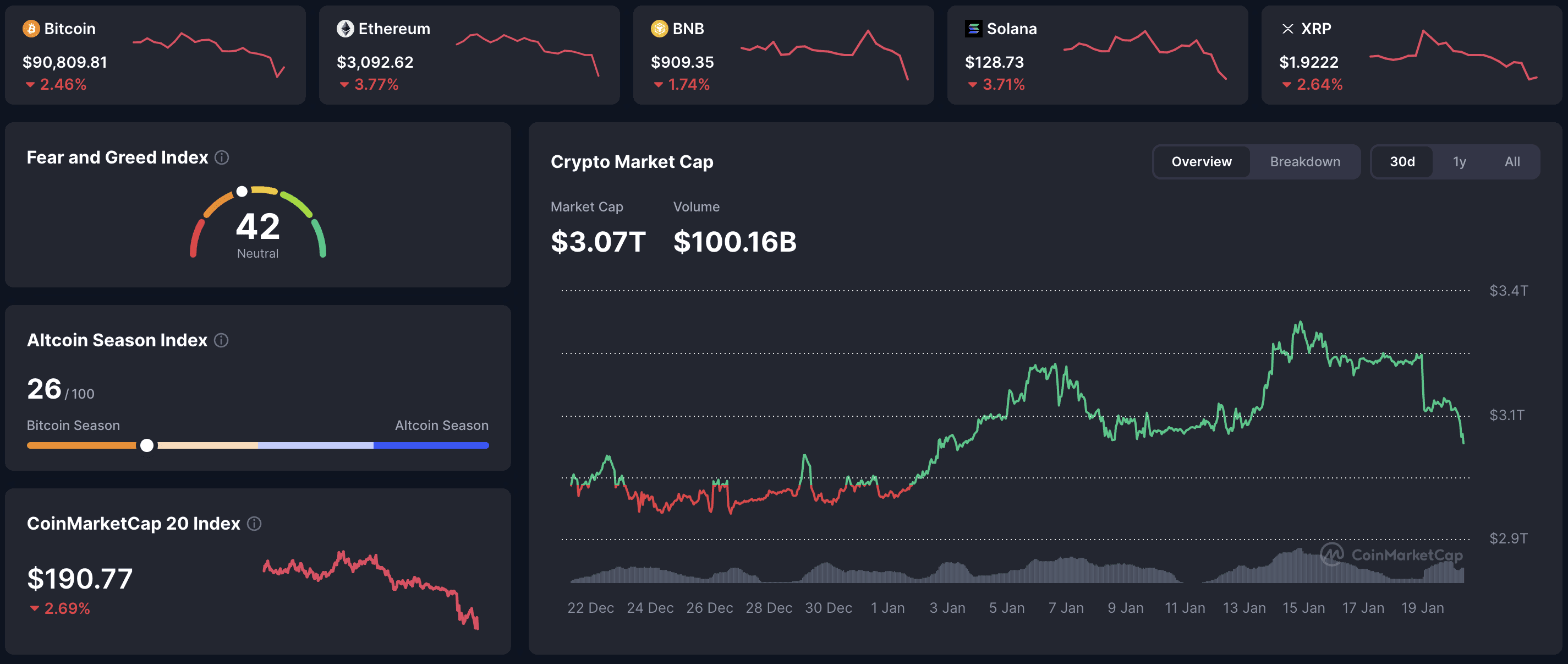

📈 24h Crypto Market Snapshot

Total crypto market cap fell to $3.07T, down 3% as macro fears dominated. Fear & Greed Index dropped to 42 (Neutral), reflecting mounting caution ahead of Trump's inauguration.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $90,809 | -2.46% | $1.81T |

ETH | $3,092 | -3.77% | $373B |

BNB | $909 | -1.74% | $124B |

SOL | $128 | -3.71% | $72B |

Sunday trading saw amplified volatility as institutional participants remained offline, leaving crypto exposed to pure retail flows.

🔥 Top 3 Movers & Shakers

Solana (SOL) – -8.6%, $129

Led altcoin selloff as leveraged positions unwound on macro fears. Steeper losses than BTC and ETH reflect higher beta sensitivity.

Takeaway: High-beta L1s amplify downside in risk-off environments – reduce exposure or hedge before major macro catalysts.Dogecoin (DOGE) – -7.7%, $0.13

Memecoins took heaviest hits as retail capitulated on tariff headlines. Low liquidity magnified selling pressure.

Takeaway: Memecoins are first to dump in selloffs – avoid leveraged positions when macro uncertainty rises.Dash (DASH) – +9.3%, $83

Only top-100 gainer as privacy momentum from prior weeks persisted despite broader selloff.

Takeaway: Sector-specific narratives can decouple from macro – privacy demand remained resilient through volatility.

🌍 Market Context

Regulatory/Geopolitical: Trump announced 10% tariffs on eight EU nations (Denmark, Norway, Sweden, France, Germany, UK, Netherlands, Finland) starting February 1, escalating to 25% by June unless Europe agrees to U.S. acquisition of Greenland. European leaders condemned the move as "blackmail," triggering risk-off across global markets.

Macro: Gold surged to record $4,670 on safe-haven demand. Bitcoin's correlation with gold hit +0.7 – highest since October 2025 – as traders fled risk assets. Weekend trading exposed crypto to pure sentiment without traditional market buffers.

Derivatives: $763M in long positions liquidated within 12 hours, with total liquidations reaching $871M. Cascading stops amplified selling as overleveraged traders faced margin calls.

🔍 Deep Dive – Tariff-Driven Perfect Storm

January 19 marked crypto's sharpest selloff of 2026, driven by a toxic mix of geopolitical shocks and overleveraged positioning. Trump's tariff threats against NATO allies over Greenland reignited trade-war fears just hours before his inauguration, sending investors scrambling for safe havens.

The timing was brutal: weekend trading meant crypto absorbed the full brunt of risk-off sentiment without traditional market stabilizers. Bitcoin's 3.8% initial plunge triggered cascading liquidations as $763M in long positions unwound, forcing exchanges to sell into thin liquidity.

On-chain data showed institutional holders quietly reducing exposure, signaling "smart money" lost confidence in bullish narratives. The selloff wasn't panic – it was calculated positioning ahead of macro uncertainty.

📰 Top News

Trump tariff shock: Announced 10-25% levies on eight EU nations unless they agree to Greenland purchase, triggering global risk-off selloff.

Bitcoin drops to $91K: BTC fell 4% as leveraged positions unwound, with $763M in long liquidations within 12 hours.

Gold hits record high: Safe-haven demand pushed gold to $4,670, with Bitcoin's correlation to gold reaching +0.7 – highest since October 2025.

European markets tumble: Stoxx 600 fell 1.2%, with automakers and luxury stocks hit hardest on trade war fears.

📚 Education Bits

💡 Pro Tip: Weekend crypto trading carries higher volatility risk – avoid holding leveraged positions when institutional liquidity dries up and retail flows dominate.

🔍 Did You Know? Bitcoin's rising correlation with gold (+0.7) signals it's trading as a macro risk asset, not a safe haven – in true risk-off, both BTC and equities fall while gold rises.

📊 Daily Wrap-Up

January 19 delivered crypto's worst day of 2026 as Trump's tariff threats against Europe triggered a leveraged flush. Bitcoin fell 4% to $91K, with $763M in long positions liquidated in 12 hours. The selloff wasn't retail panic – institutional holders quietly reduced exposure as geopolitical risks mounted ahead of inauguration. Weekend trading amplified volatility, exposing structural fragility in overleveraged positioning.

Today's Watch List: Can BTC reclaim $93K after inauguration, or does trade-war escalation push lower? Watch for Trump's Day One crypto executive orders and whether institutional flows stabilize markets.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.