Jan 26, 2026

🍪 Today's Snack

Crypto stayed risk-off as gold pushed through $5,000 and ETF flows kept leaking. The mood feels defensive – more “protect capital” than “chase upside.”

📈 24h Crypto Market Snapshot

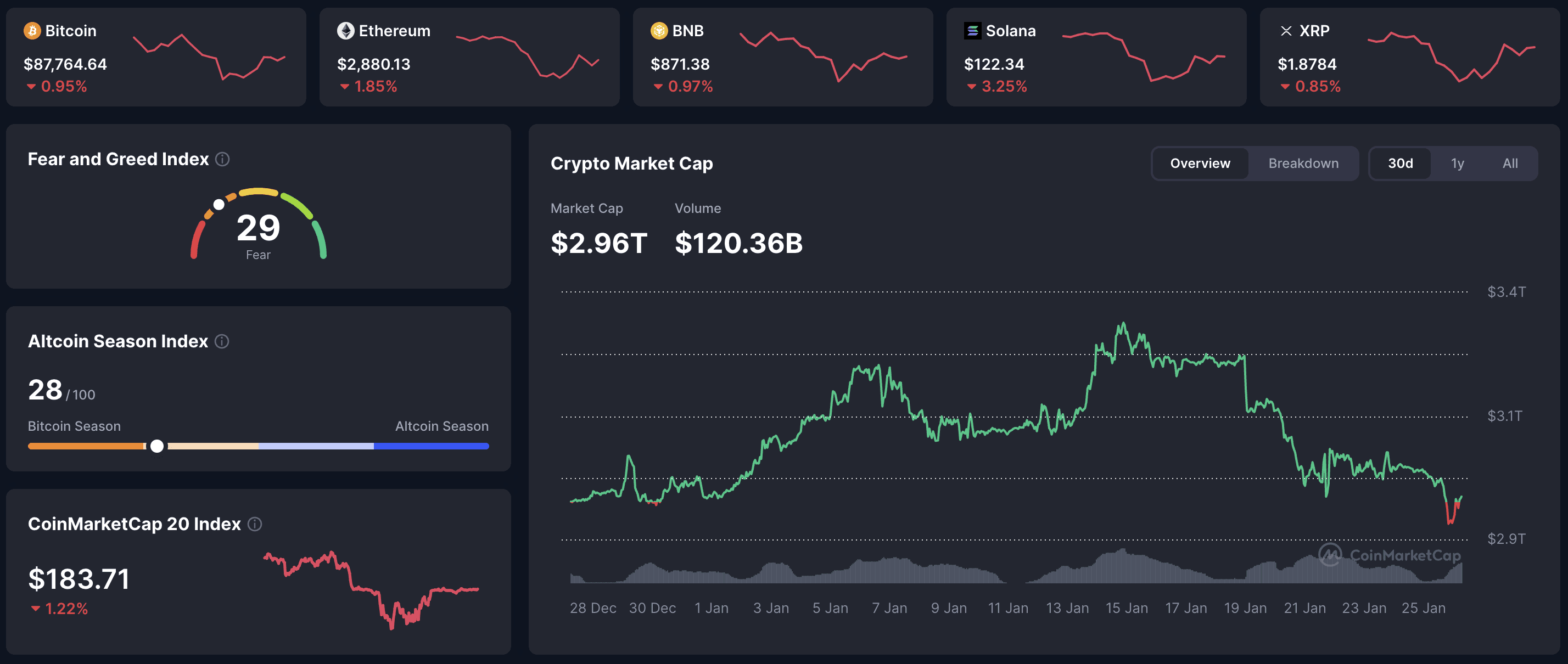

Total crypto market cap held near $2.96 while Fear & Greed fell to 29 (Fear), matching the broader risk-off tone.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $87,764 | -0.95% | $1.75T |

ETH | $2,880 | -1.85% | $347B |

BNB | $871 | -0.97% | $118B |

SOL | $122 | -3.25% | $69B |

TRX | $0.29 | +0.49% | $28B |

Selloff – a controlled drift lower as gold’s breakout dominated the macro narrative.

🔥 Top 3 Movers & Shakers

River Protocol (RIVER) – +33.36%

RIVER ran on January 22–25 after a $8M strategic investment tied to TRON integration for satUSD, plus a Coinone listing and a smooth 1.5M token unlock (4.32% of supply).

Takeaway: Big narrative + liquidity tailwinds, but heavy upcoming emissions and sharp intraday swings make timing and sizing tricky.MYX Finance (MYX) – -11.69%

MYX pulled back on January 24–25 after an earlier move tied to its V2 “zero slippage” perpetual DEX upgrade, while holding the $4.80–$5.00 support area.

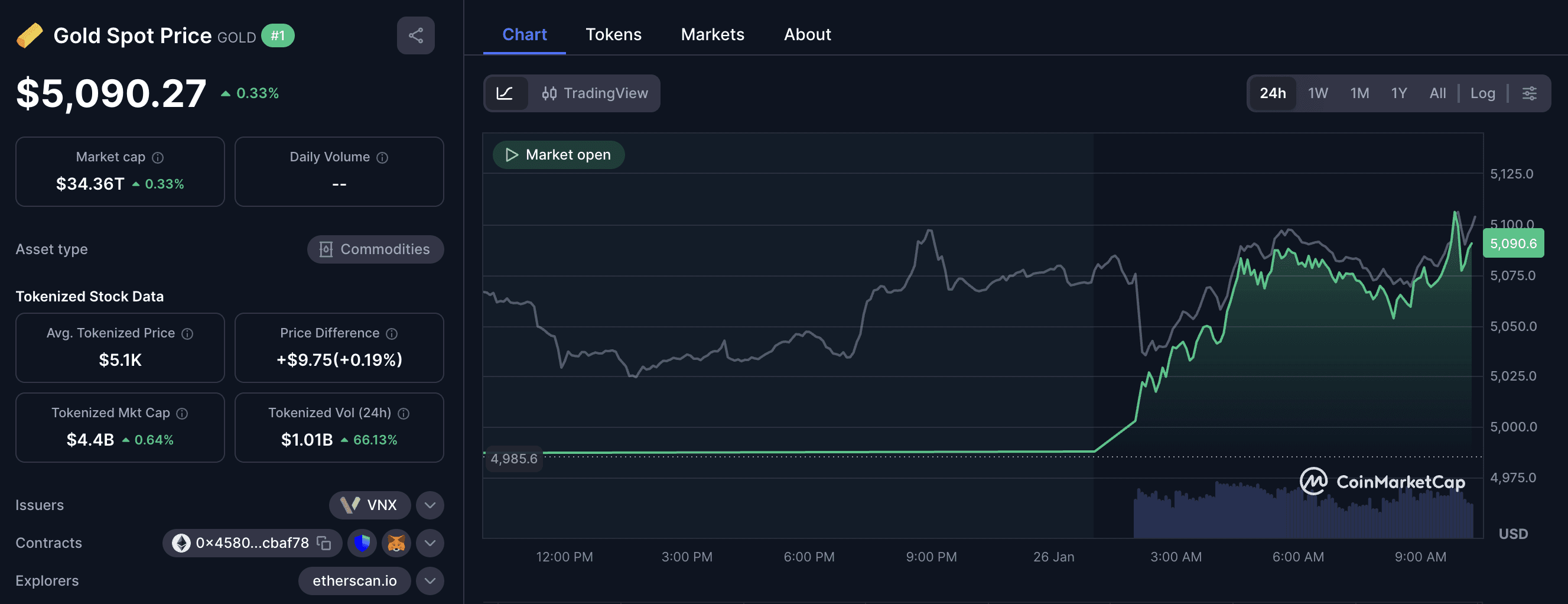

Takeaway: Looks like a technical reset, with $7.20–$7.50 as the next “prove it” zone.Pax Gold (PAXG) – +0.00%

PAXG was flat on the day but hit an all-time high of $5,122 in January 2026 as spot gold surged past $5,000 and safe-haven demand rose.

Takeaway: Tokenized physical gold is behaving like the clean hedge inside crypto rails, unlike BTC’s current “digital gold” tape.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $103M in net outflows on 2026-01-23, while Ethereum ETFs saw $41M outflows.

Risk read: With BTC seeing its largest weekly ETF outflow since Feb 2025 and gold breaking out, flows still look like flight-to-safety rather than fresh risk-taking.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: Gold above $5,000 is the headline, and strong U.S. data kept the “no landing” framing alive as markets pushed out rate-cut expectations. The Fed’s January 28 meeting is expected to hold, so Powell’s tone is the real catalyst.

On-Chain Highlights: Bitcoin entered its first 30-day streak of net realized losses since October 2023, while stablecoin supply grew strongly in mid-January – suggesting stress in risk, but also capital staying on-chain in a defensive posture.

🔍 Deep Dive – Gold at $5,000 Exposes Bitcoin's “Digital Gold” Narrative Crisis

Gold’s move above $5,000 is forcing an uncomfortable comparison: in true risk-off conditions, institutions still appear to trust physical gold more than “digital gold.” Gold hit $5,071 on January 25 (intraday high $5,092.71) while Bitcoin printed $86,548 on January 26 and remained down year-over-year versus January 2025.

The divergence shows up in flows and positioning. Spot Bitcoin ETFs saw $1.33B in net outflows for the week ending January 23 (including a $709M single-day exit), while central bank buying and rising Western gold ETF holdings point to a strong bid for traditional safe havens. On-chain, BTC shifted into a net realized loss phase again, with about 69,000 BTC in cumulative realized losses since December 23.

The irony is that “gold on-chain” is working: PAXG hit an all-time high as gold surged, showing the demand may be for gold exposure – not necessarily for Bitcoin’s hedge narrative.

What to watch next: Gold’s follow-through after $5,000, BTC’s $84,000 support, and whether weekly ETF outflows cool in the next flow read.

📰 Top News

Bitcoin ETFs: Spot BTC ETFs saw $1.33B in net outflows for the week ending January 23, reversing the prior week’s $1.42B inflows and pulling a key support lever.

Stablecoins: Stablecoin market cap hit a new all-time high of $311.332B on January 18, signaling defensive rotation into on-chain dollars.

Regulation (CLARITY Act): A Senate Agriculture Committee markup hearing is set for January 27 after updated text dropped January 21, keeping U.S. market structure in focus.

DeFi upgrades: Aave v4, Ethereum’s Glamsterdam, and Solana’s Alpenglow upgrades are lined up for early 2026, underscoring that infrastructure progress is continuing through the drawdown.

Gold: Gold broke above $5,000/oz on January 25, driven by geopolitical tension and central bank buying, tightening the squeeze on risk assets.

📚 Education Bits

💡 Pro Tip: In risk-off weeks, track what people buy instead of what they sell – flows into stablecoins, gold proxies, or “cash-like” assets often tell the cleaner story.

📊 Metric Explained: Realized loss phases matter because they show when holders are actually locking in pain, which can either mark capitulation – or just a slow bleed.

📊 Daily Wrap-Up

Crypto stayed heavy as majors drifted lower and gold dominated the macro tape. ETF outflows and realized losses suggest positioning is still under pressure, even if price action looks “orderly.” Meanwhile, stablecoin growth hints capital is waiting on-chain rather than fully exiting.

Today's Watch List: Powell’s tone on January 28, the CLARITY Act markup on January 27, and whether BTC holds $84,000 as ETF flow data resets.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.