Jan 27, 2026

🍪 Today's Snack

Crypto caught a bid as the VanEck AVAX ETF headline hit, with majors ticking higher despite a still-cautious mood. It feels like relief buying, not a full-on trend reversal.

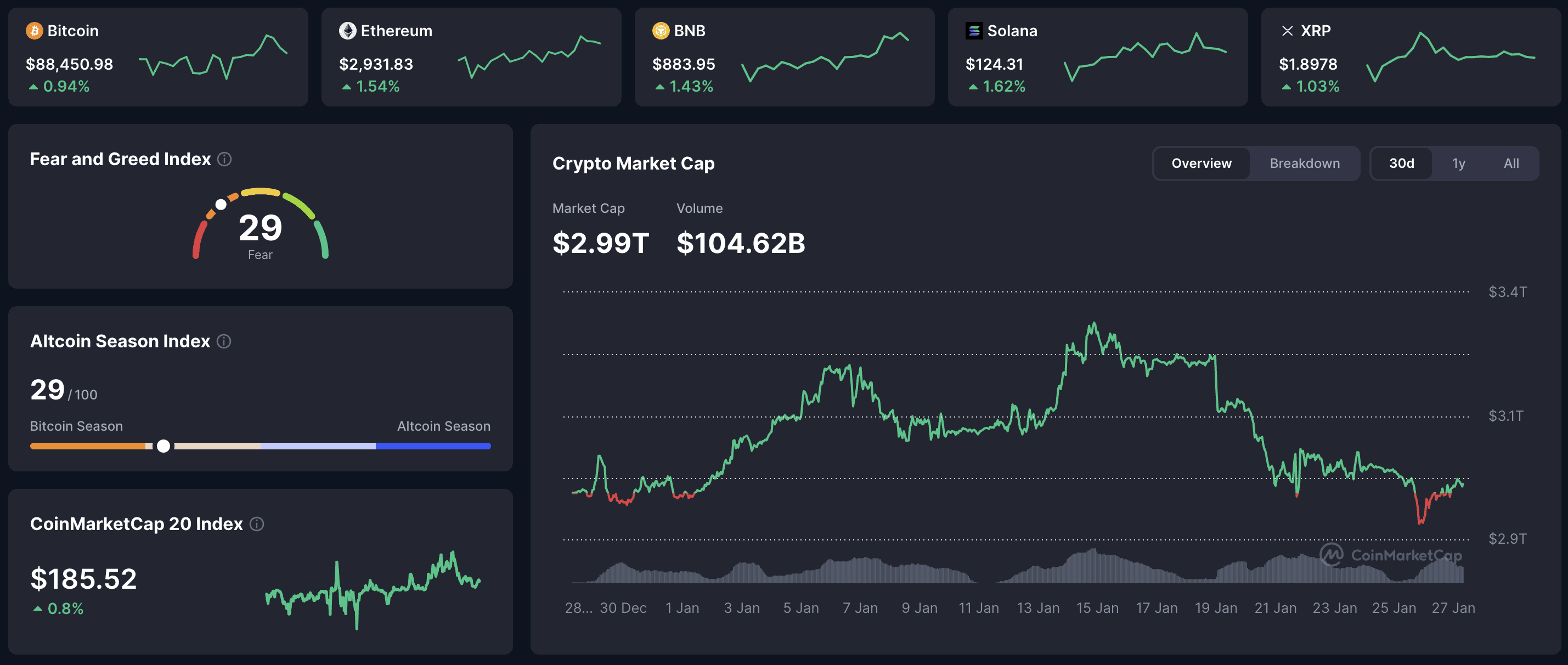

📈 24h Crypto Market Snapshot

Total crypto market cap rose to $2.99 while Fear & Greed held at 29 (Fear), keeping this bounce firmly in “risk-managed” mode.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $88,450 | +0.94% | $1.76T |

ETH | $2,931 | +1.54% | $353B |

BNB | $883 | +1.43% | $120B |

SOL | $124 | +1.62% | $70B |

BCH | $0.29 | +2.35% | $11B |

Grind up – a steady rebound in majors, with the ETF headline doing the heavy lifting.

🔥 Top 3 Movers & Shakers

Hyperliquid (HYPE) – +23.4%

HYPE jumped after the founder said Hyperliquid is now the most liquid venue for crypto price discovery, with BTC perps liquidity exceeding Binance.

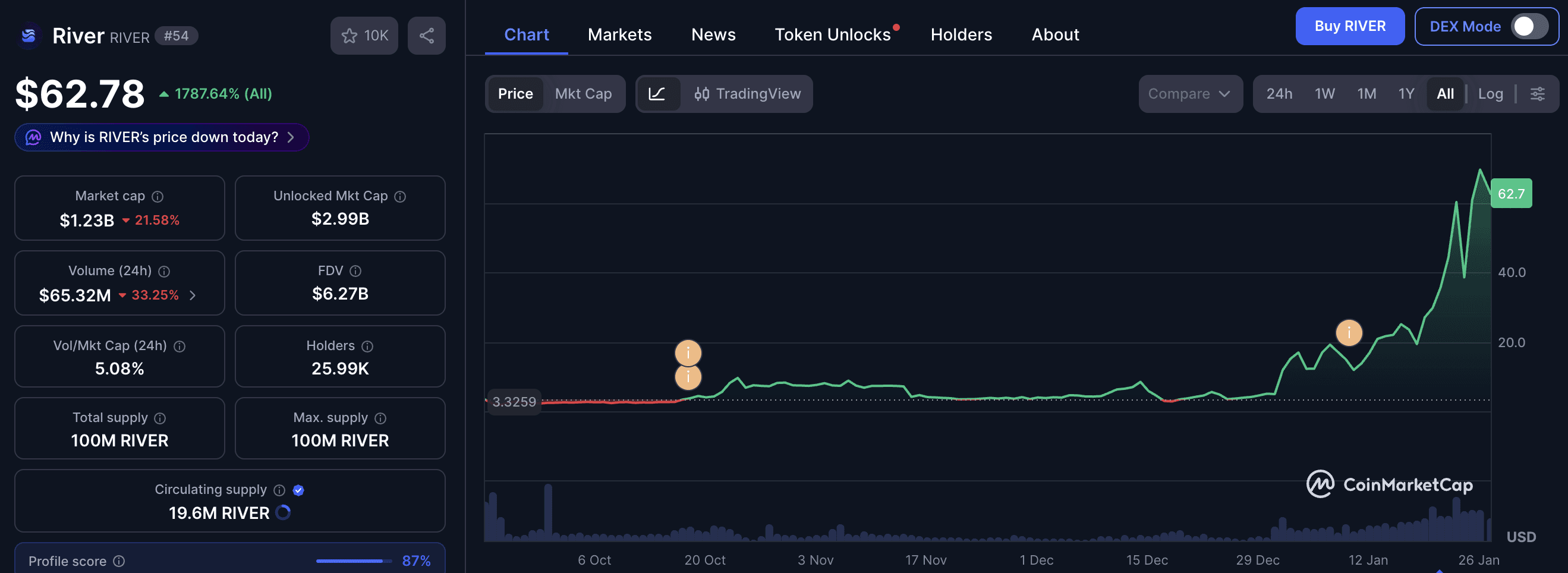

Takeaway: If the liquidity claim holds, it strengthens the “DEX perps can beat CEX” thesis – but price still needs a clean breakout.River Protocol (RIVER) – -15.6%

RIVER dropped after printing a fresh all-time high, as warnings about leverage and concentration pulled buyers back.

Takeaway: This looks binary: either it becomes real infrastructure, or the structure cracks under distribution pressure.Owlto Finance (OWL) – +11.9%

OWL rebounded even as team wallets moved $2.1M worth of tokens to new addresses, keeping traders jumpy.

Takeaway: The bid suggests “operational transfer” is the base case, but overbought conditions mean it can flip fast.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $6.8M in net inflows on 2026-01-23, while Ethereum ETFs saw $117M inflows.

Risk read: Despite that green print, the broader flow narrative you shared still leans risk-off into this week’s macro catalysts.

🌍 Market Context

Macro Pulse: The Fed’s USD/JPY “rate check” put FX intervention risk on the radar as the dollar slid and gold stayed near the post-$5,000 breakout zone. Strong U.S. growth and inflation data keeps “higher for longer” in play, so Powell’s tone is the key variable.

On-Chain Highlights: Bitcoin’s net realized losses have now persisted for 30 days, which signals stress under the surface. At the same time, stablecoin inflows plus selective whale activity suggest capital is staying on-chain and waiting.

🔍 Deep Dive – River Protocol's 1,900% Rally: DeFi Infrastructure or Coordinated Manipulation?

River’s price action is the headline: a 1,900% rally from roughly $5 in December 2025 to a January peak, plus a $12M strategic round tied to names like Justin Sun (TRON DAO) and Arthur Hayes’ Maelstrom Fund. That combination can look like “smart money validation” – and it’s exactly why retail chases it.

But the market-structure signals in your fact pack point to engineered volatility. CoinGlass warned that RIVER futures volume exceeded spot by 80×, framing the move as leverage-driven rather than organically discovered, while funding stayed negative and swung as low as -1.8% during the squeeze.

The biggest structural risk is supply + fundamentals diverging at the same time: 70% of profits concentrated in 120 wallets with only 19.6% circulating supply, a 1.5M token unlock landing near the peak, and TVL down 73% (from $605M to $161M) while price went vertical.

What it suggests: River may have real tech, but the trade is behaving like a leveraged positioning machine – and those typically reprice violently when distribution starts.

📰 Top News

VanEck Avalanche ETF: VanEck launched the first U.S. spot AVAX ETF, expanding the “altcoin ETF” playbook beyond BTC and ETH.

Japan crypto ETFs: Japan’s regulator is preparing a path to legalize crypto ETFs, signaling a slow but meaningful institutional on-ramp.

Hyperliquid: The platform claimed top-tier BTC perps liquidity, adding fuel to the “on-chain derivatives are ready” narrative.

CLARITY Act: A Senate markup hearing put U.S. crypto market structure back in the driver’s seat for near-term sentiment.

Bitwise vault: Bitwise introduced an on-chain vault built on Morpho, pushing regulated access to DeFi yield closer to the mainstream.

📚 Education Bits

💡 Pro Tip: When an asset goes parabolic, compare futures activity to spot – a futures-led move can look healthy until liquidity flips.

📊 Metric Explained: The futures-to-spot ratio is a quick “heat check” for whether leverage is driving price (higher ratio) or real buying is (lower ratio).

📊 Daily Wrap-Up

Majors bounced, but Fear-level sentiment says this still looks like relief, not euphoria. HYPE captured the upside narrative, while RIVER’s reversal reminded everyone how quickly leverage trades can turn.

Today's Watch List: Follow-through after the AVAX ETF launch, any CLARITY Act headlines, and whether BTC can keep reclaiming ground without fresh flow support.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.