Year-end stability: BTC holds $88K amid thin trading?

Year-end stability: BTC holds $88K amid thin trading?

Year-end stability: BTC holds $88K amid thin trading?

Dec 31, 2025

🍪 Today’s Snack

The crypto market closes out 2025 on a stable note with total capitalization at ~$2.99T, Bitcoin up +1% to ~$88.5K amid renewed ETF inflows, while altcoins show mixed performance in thin year-end liquidity.

📈 24h Crypto Market Snapshot

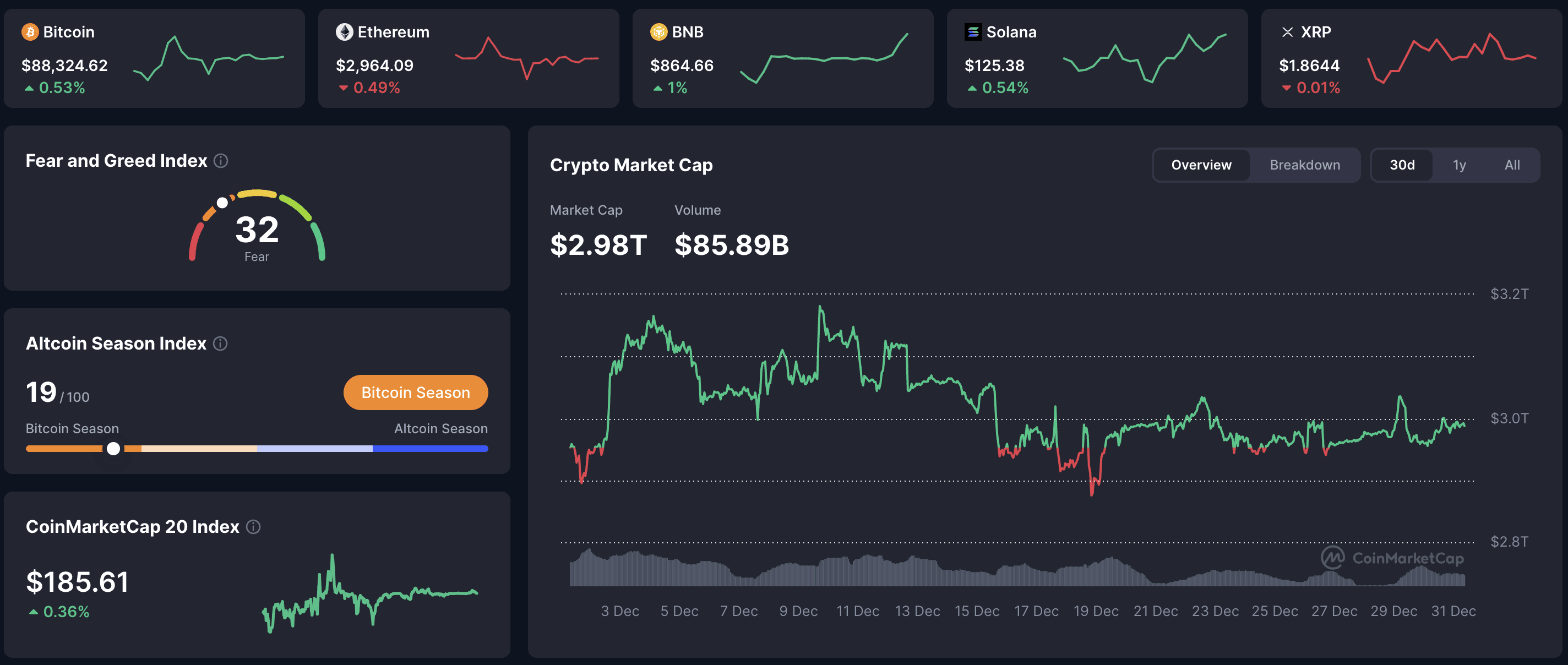

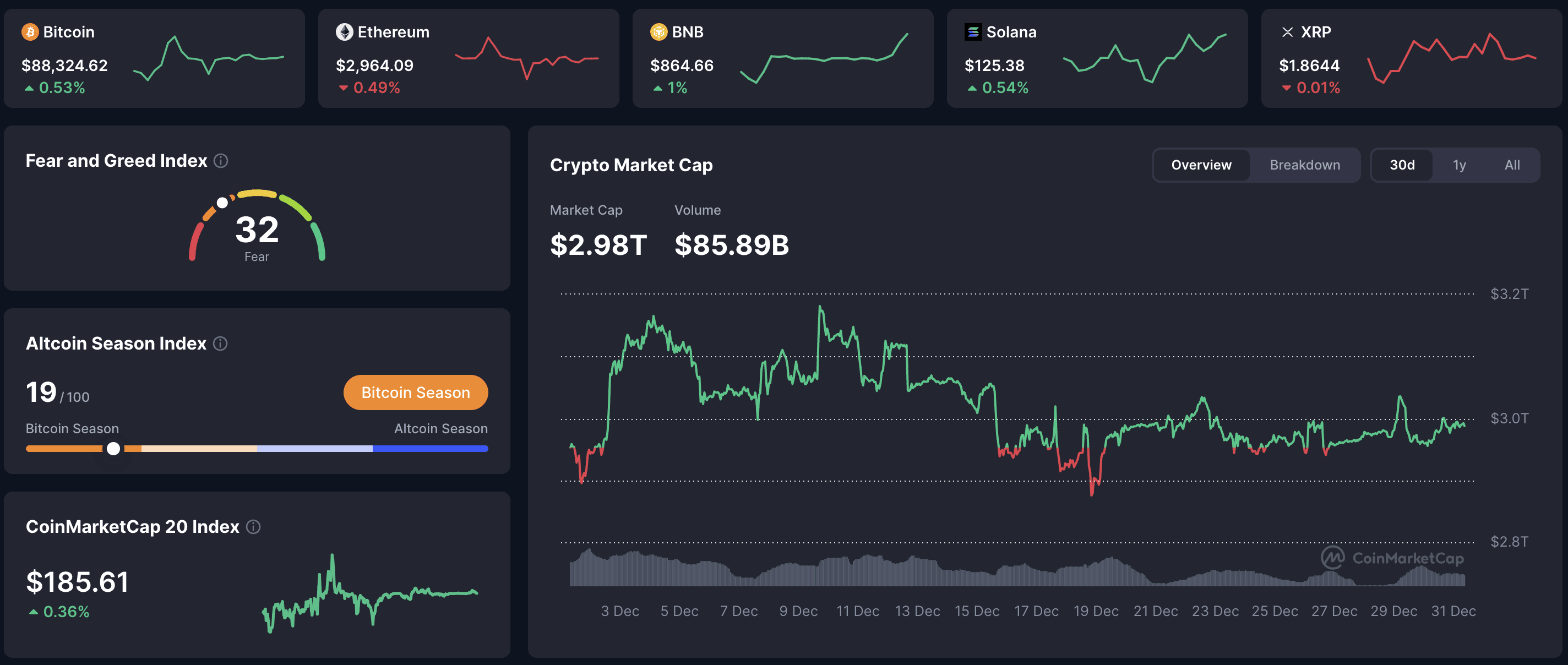

Total cryptocurrency market cap stands at $2.99T (+~0.8% over 24h per CoinMarketCap). The Fear & Greed Index is at 32 (Fear), signaling persistent caution as the year ends.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $88,324 | +0.53% | $1.77T |

ETH | $2,970 | -0.49% | $358B |

BNB | $864 | +1% | $119B |

XRP | $1.86 | -0.01% | $113B |

SOL | $125 | +0.54% | $71B |

ADA | $0.349 | +1.58% | $12.5B |

How to avoid low-liquidity traps? Year-end thin trading amplifies small moves - apply volume filters (> $50M) on CoinGecko to distinguish genuine momentum from illiquid pumps.

🔥 Top 3 Movers & Shakers

Canton (CC) +10.5%: Privacy-focused token leads year-end surge amid renewed sector interestю Takeaway: privacy narratives can decouple positively in low-vol periods.

MemeCore (M) +9.7%: Meme token with growing community volume. Takeaway: monitor social sentiment spikes for short-term alpha in thin markets.

LEO Token (LEO) +5.0%: Exchange utility token benefits from platform activity. Takeaway: utility tokens tied to major exchanges often resilient during consolidation.

Takeaway: Niche gainers (privacy/meme/utility) outperform in consolidation - screen top 100 by 24h % with volume checks to capture sustainable rotations.

🏦 ETF & Institutional Flows

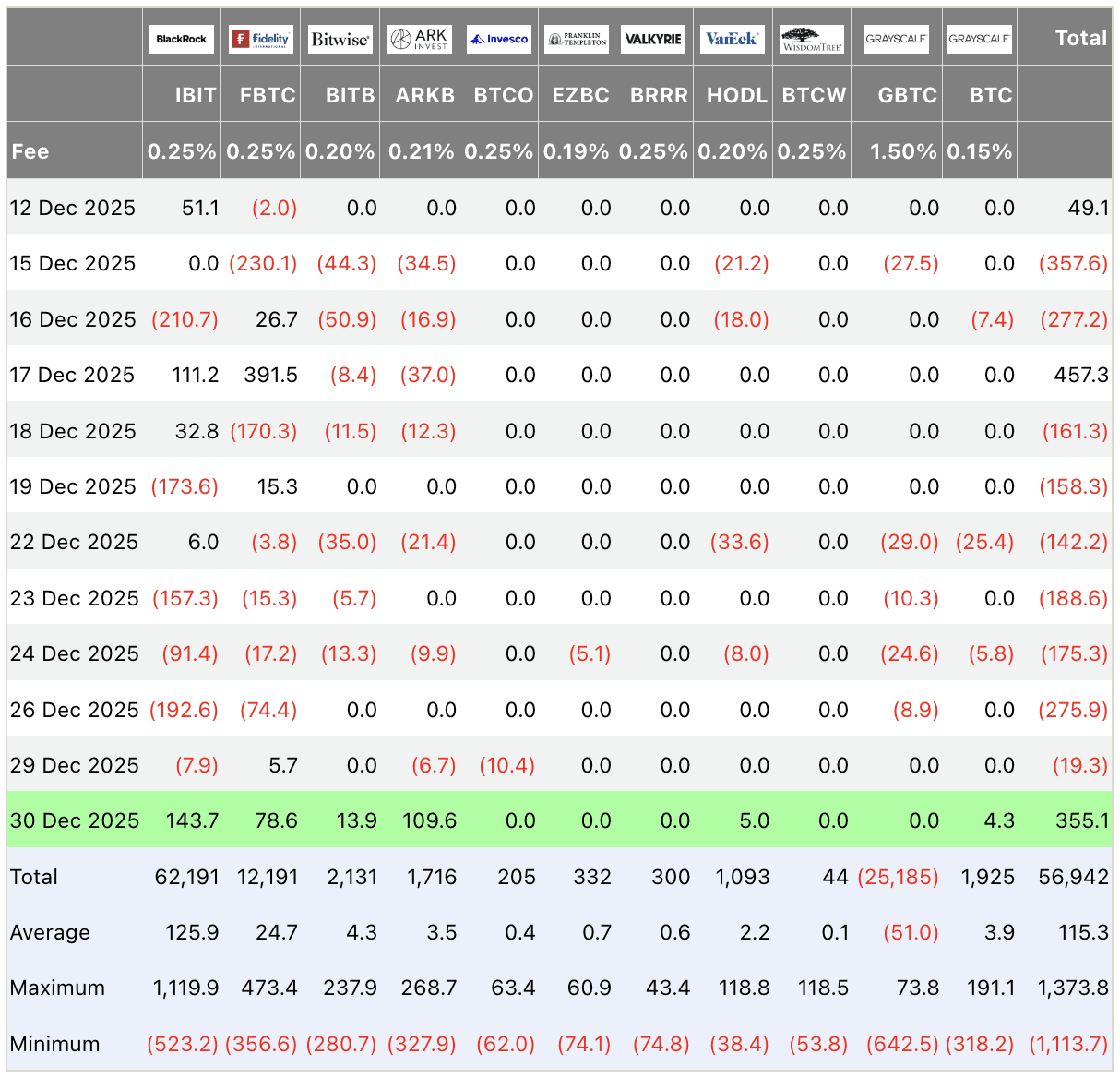

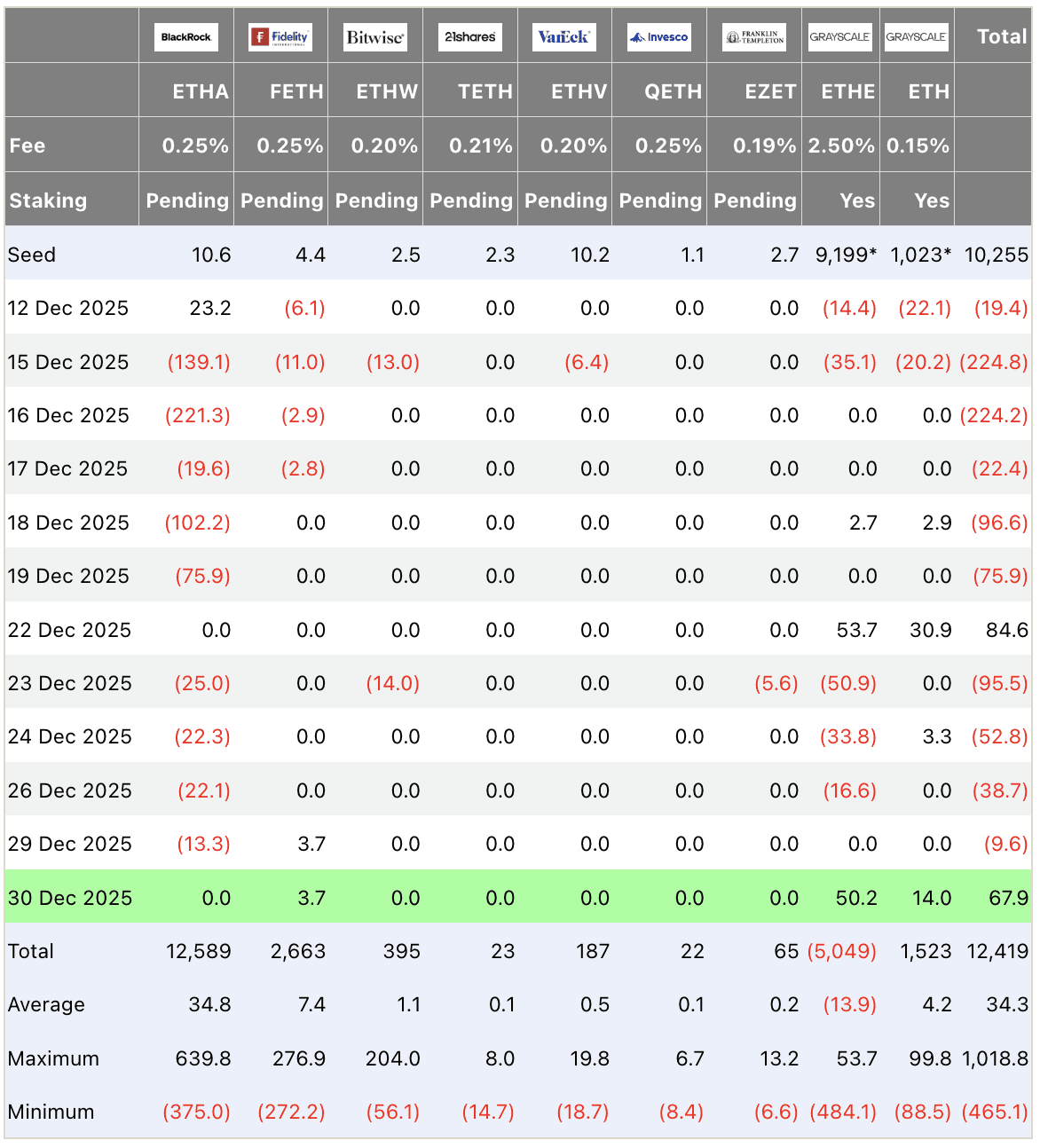

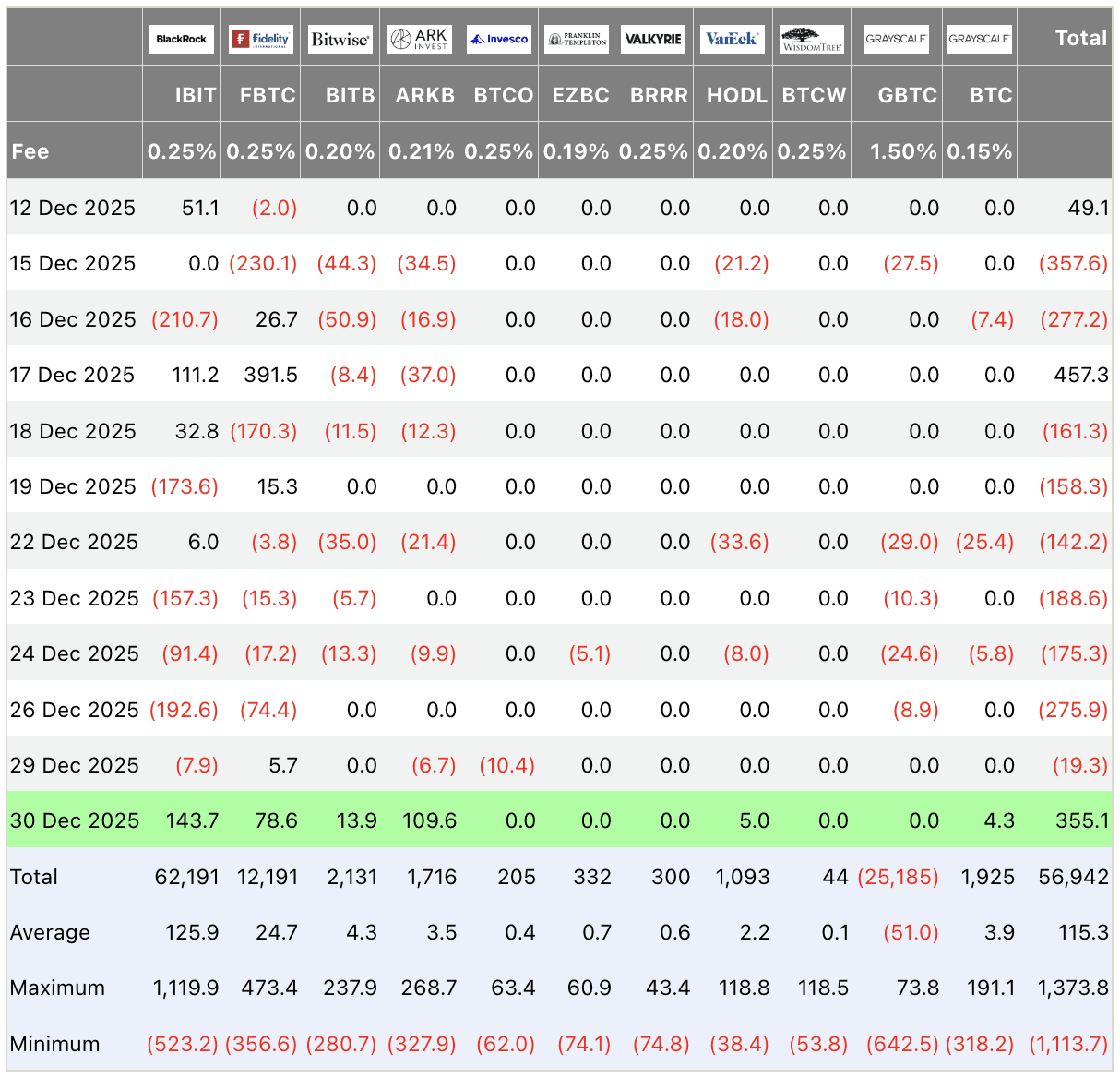

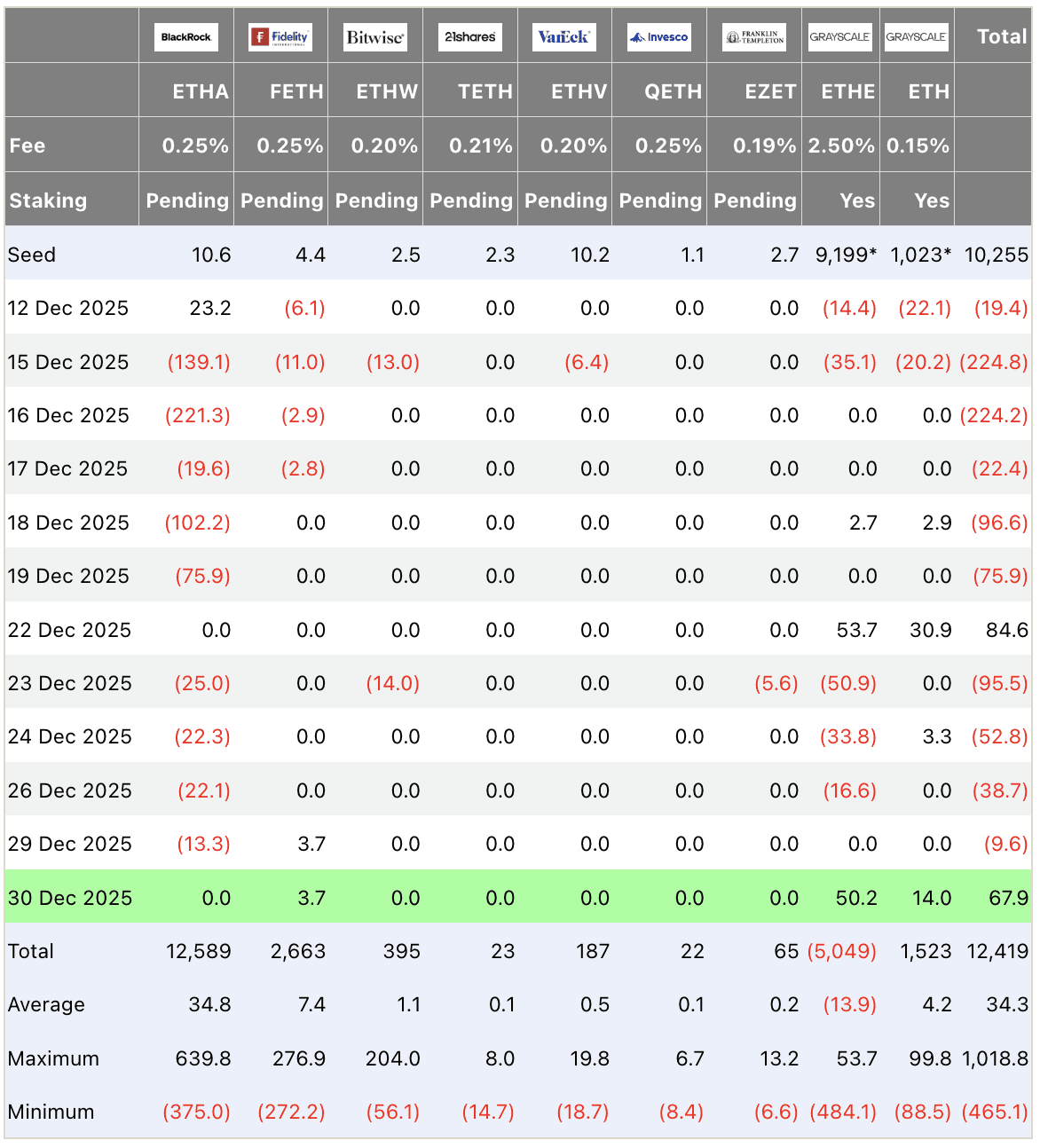

On December 30 (latest data): Bitcoin spot ETFs saw strong net inflows of +$355.1M (led by IBIT +$143.7M, ARKB +$109.6M, FBTC +$78.6M), signaling institutional dip-buying. Ethereum ETFs recorded +$67.9M net (primarily ETHE +$50.2M, ETHA minor). Positive flows counter year-end tax selling and support price stability.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why track ETF flows daily? Consistent positive inflows reflect committed institutional demand and often precede broader upside momentum - use farside.co.uk for real-time signals.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves remain stable with no sharp spikes, indicating limited selling pressure. Whale accumulation continues around $80-88K levels, while long-term holders show minimal realization. Hash rate holds steady post-halving adjustments. Overall: market in accumulation mode with low capitulation signals heading into 2026.

Takeaway: Stable reserves + whale buying = low capitulation risk. Monitor exchange netflows (CryptoQuant/Glassnode) - negative flows are classically bullish.

🌍 Macro Pulse

Year-end macro remains mixed: Fed minutes highlight divisions on further rate cuts amid persistent inflation (core PCE ~2.8%), with tariffs contributing gradual price pressures but less aggressively than feared. Unemployment edged to ~4.6%, jobs growth slowed, yet tax cuts and AI investments provide tailwinds for risk assets in 2026. Impact on crypto: softer monetary policy supportive, but tariff-related inflation caps aggressive upside.

How does macro influence crypto? Rate cut expectations drive risk appetite - fewer projected cuts (dot plot) can pressure upside, while strong jobs support stability.

💡 Market Trend Spotlight

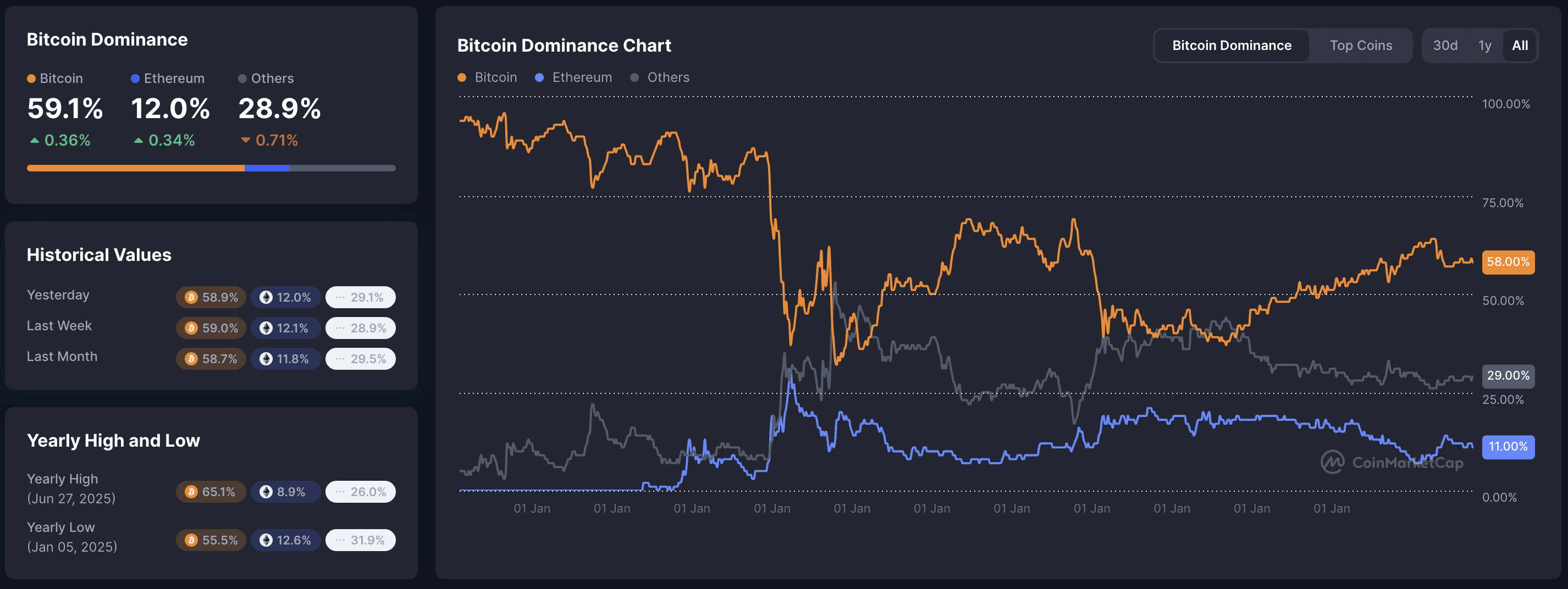

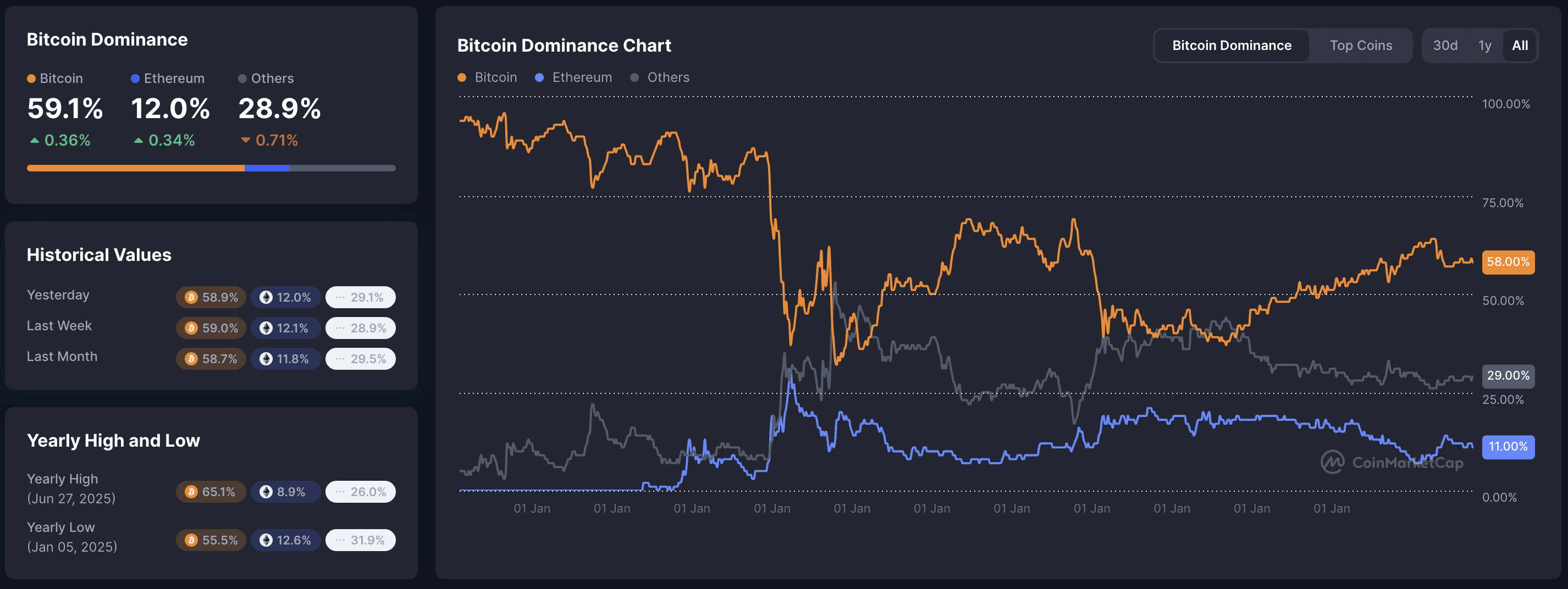

Trend of the day: Year-end consolidation with institutional accumulation. BTC dominance at 59.1% reflects flight to quality, price holding key $80-88K support amid compressed volatility. ETF inflows and corporate treasury buys signal preparation for potential January effect, while Fear at 32 mirrors classic pre-rally setups. Metrics: realized vol ~45% (below yearly avg), institutional holdings rising.

How to navigate consolidation? Focus on accumulation signals (flows, funding rates) - positive perpetual funding often precedes breakouts in range-bound markets.

📰 Top News

Bitcoin ETFs record +$355M inflows Dec 30: institutions buying year-end dip amid thin trading.

Privacy & meme tokens lead late-2025 gains: Canton +10.5%, sector rotation evident.

BTC dominance climbs to 59.1%: altcoins lag as capital rotates to Bitcoin safety.

Macro uncertainty lingers: Fed divided on cuts as tariffs drive muted inflation impact.

Corporate treasuries active: ongoing DAT accumulation supports BTC floor.

📊 Daily Wrap-Up

Crypto ends 2025 in quiet consolidation: modest BTC gains, strong ETF inflows, and on-chain accumulation point to resilient demand despite macro headwinds and thin liquidity. Key drivers - institutional flows and niche sector strength -set stage for potential fresh momentum in 2026. Mood: cautious but constructive, watch for January catalysts.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

🍪 Today’s Snack

The crypto market closes out 2025 on a stable note with total capitalization at ~$2.99T, Bitcoin up +1% to ~$88.5K amid renewed ETF inflows, while altcoins show mixed performance in thin year-end liquidity.

📈 24h Crypto Market Snapshot

Total cryptocurrency market cap stands at $2.99T (+~0.8% over 24h per CoinMarketCap). The Fear & Greed Index is at 32 (Fear), signaling persistent caution as the year ends.

Asset | Price (USD) | 24h Change | Market Cap (USD) |

|---|---|---|---|

BTC | $88,324 | +0.53% | $1.77T |

ETH | $2,970 | -0.49% | $358B |

BNB | $864 | +1% | $119B |

XRP | $1.86 | -0.01% | $113B |

SOL | $125 | +0.54% | $71B |

ADA | $0.349 | +1.58% | $12.5B |

How to avoid low-liquidity traps? Year-end thin trading amplifies small moves - apply volume filters (> $50M) on CoinGecko to distinguish genuine momentum from illiquid pumps.

🔥 Top 3 Movers & Shakers

Canton (CC) +10.5%: Privacy-focused token leads year-end surge amid renewed sector interestю Takeaway: privacy narratives can decouple positively in low-vol periods.

MemeCore (M) +9.7%: Meme token with growing community volume. Takeaway: monitor social sentiment spikes for short-term alpha in thin markets.

LEO Token (LEO) +5.0%: Exchange utility token benefits from platform activity. Takeaway: utility tokens tied to major exchanges often resilient during consolidation.

Takeaway: Niche gainers (privacy/meme/utility) outperform in consolidation - screen top 100 by 24h % with volume checks to capture sustainable rotations.

🏦 ETF & Institutional Flows

On December 30 (latest data): Bitcoin spot ETFs saw strong net inflows of +$355.1M (led by IBIT +$143.7M, ARKB +$109.6M, FBTC +$78.6M), signaling institutional dip-buying. Ethereum ETFs recorded +$67.9M net (primarily ETHE +$50.2M, ETHA minor). Positive flows counter year-end tax selling and support price stability.

Bitcoin ETF Flow (US$m)

Ethereum ETF Flow (US$m)

Why track ETF flows daily? Consistent positive inflows reflect committed institutional demand and often precede broader upside momentum - use farside.co.uk for real-time signals.

⛓️ On-Chain Metrics Today

Bitcoin exchange reserves remain stable with no sharp spikes, indicating limited selling pressure. Whale accumulation continues around $80-88K levels, while long-term holders show minimal realization. Hash rate holds steady post-halving adjustments. Overall: market in accumulation mode with low capitulation signals heading into 2026.

Takeaway: Stable reserves + whale buying = low capitulation risk. Monitor exchange netflows (CryptoQuant/Glassnode) - negative flows are classically bullish.

🌍 Macro Pulse

Year-end macro remains mixed: Fed minutes highlight divisions on further rate cuts amid persistent inflation (core PCE ~2.8%), with tariffs contributing gradual price pressures but less aggressively than feared. Unemployment edged to ~4.6%, jobs growth slowed, yet tax cuts and AI investments provide tailwinds for risk assets in 2026. Impact on crypto: softer monetary policy supportive, but tariff-related inflation caps aggressive upside.

How does macro influence crypto? Rate cut expectations drive risk appetite - fewer projected cuts (dot plot) can pressure upside, while strong jobs support stability.

💡 Market Trend Spotlight

Trend of the day: Year-end consolidation with institutional accumulation. BTC dominance at 59.1% reflects flight to quality, price holding key $80-88K support amid compressed volatility. ETF inflows and corporate treasury buys signal preparation for potential January effect, while Fear at 32 mirrors classic pre-rally setups. Metrics: realized vol ~45% (below yearly avg), institutional holdings rising.

How to navigate consolidation? Focus on accumulation signals (flows, funding rates) - positive perpetual funding often precedes breakouts in range-bound markets.

📰 Top News

Bitcoin ETFs record +$355M inflows Dec 30: institutions buying year-end dip amid thin trading.

Privacy & meme tokens lead late-2025 gains: Canton +10.5%, sector rotation evident.

BTC dominance climbs to 59.1%: altcoins lag as capital rotates to Bitcoin safety.

Macro uncertainty lingers: Fed divided on cuts as tariffs drive muted inflation impact.

Corporate treasuries active: ongoing DAT accumulation supports BTC floor.

📊 Daily Wrap-Up

Crypto ends 2025 in quiet consolidation: modest BTC gains, strong ETF inflows, and on-chain accumulation point to resilient demand despite macro headwinds and thin liquidity. Key drivers - institutional flows and niche sector strength -set stage for potential fresh momentum in 2026. Mood: cautious but constructive, watch for January catalysts.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime. © Web Snack 2025.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved

Web Snack

© 2026 Web Snack. All rights reserved