Jan 14, 2026

🍪 Today's Snack

Bitcoin surged past $95K on January 13 as cooling U.S. inflation lifted risk appetite across crypto. Altcoins followed with strong moves, especially privacy coins on regulatory clarity tailwinds.

📈 24h Crypto Market Snapshot

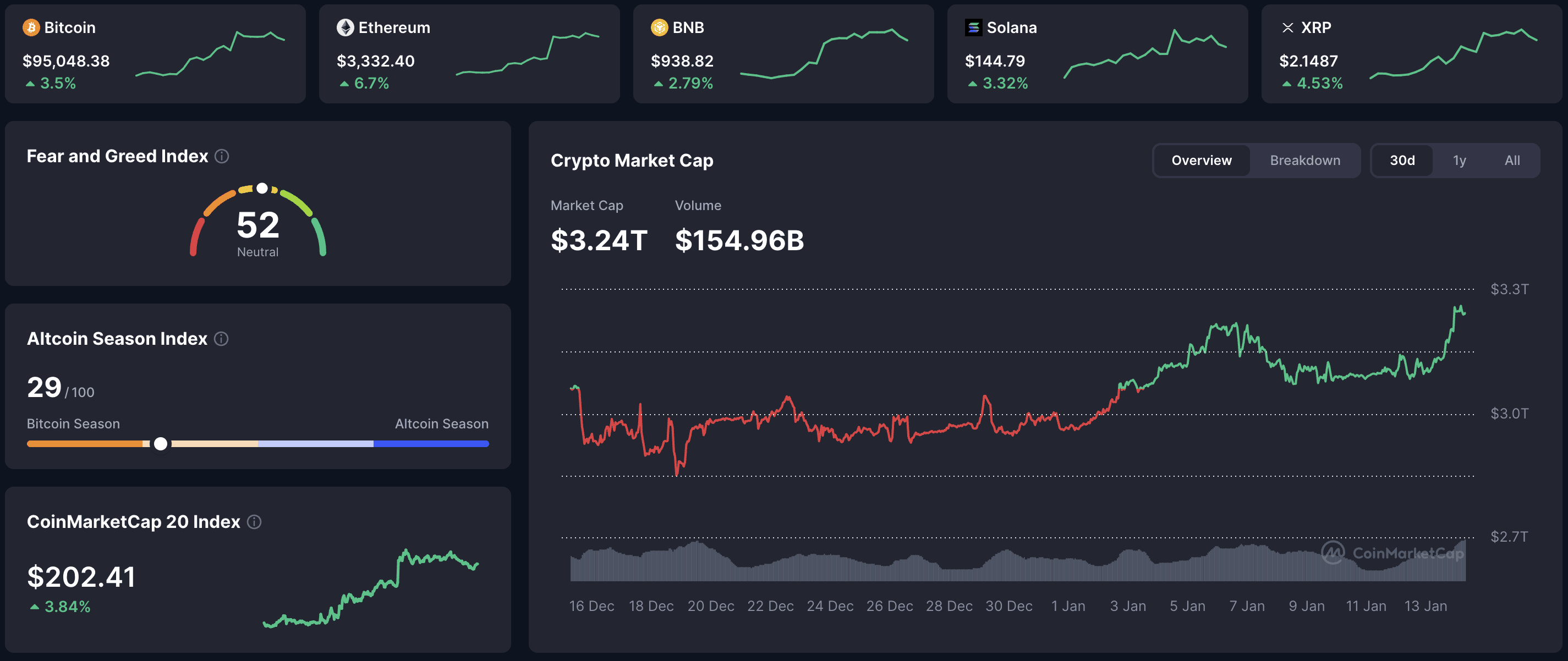

Total crypto market cap climbed to $3.24T, with the Fear & Greed Index at 52 (Neutral). Sentiment slowly improving after weeks of hesitation.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $95,048 | +3.5% | $1.89T |

ETH | $3,332 | +6.7% | $401B |

SOL | $145 | +3.3% | $81B |

BNB | $939 | +2.8% | $129B |

🔥 Top 3 Movers & Shakers

Dash (DASH) – +50-60%

Privacy-coin complex surged as traders rotated into high-beta names during risk-on. Biggest single-day jump in years.

Takeaway: Sharp moves in older privacy coins often mark speculative rotations, not structural trends – liquidity and follow-through matter more than the headline %.Monero (XMR) – +20%

Extended recent gains as investors bet on regulation differentiating compliant vs. non-compliant venues instead of outright bans.

Takeaway: When niche sectors rally on policy nuance, track whether spot and derivatives liquidity deepen or the move fades fast.Story & narrative-driven alts – double-digit gains

Smaller-cap names printed strong returns as traders hunted beta after the CPI release.

Takeaway: Best way to play narrative bursts is through liquid leaders, not chasing thinly traded names late in the move.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs saw $753M in net inflows on January 13 – the strongest single day since October 2025. Ethereum ETFs added $130M, led by BlackRock and Fidelity. These flows signal renewed institutional conviction as macro improves.

🌍 Market Context

Macro: December CPI came in benign – headline 2.7%, core 2.6% – reinforcing the soft-landing narrative and keeping rate-cut expectations alive. That's a tailwind for crypto even as equity momentum looks mixed.

On-Chain: Longer-term MVRV ratios sit in healthy accumulation zones while network activity and hash rate remain strong. Institutional behavior continues leaning long-term bullish, supporting buy-the-dip positioning rather than chase vertical spikes.

💡 Deep Dive – Inflation Relief & CLARITY Act

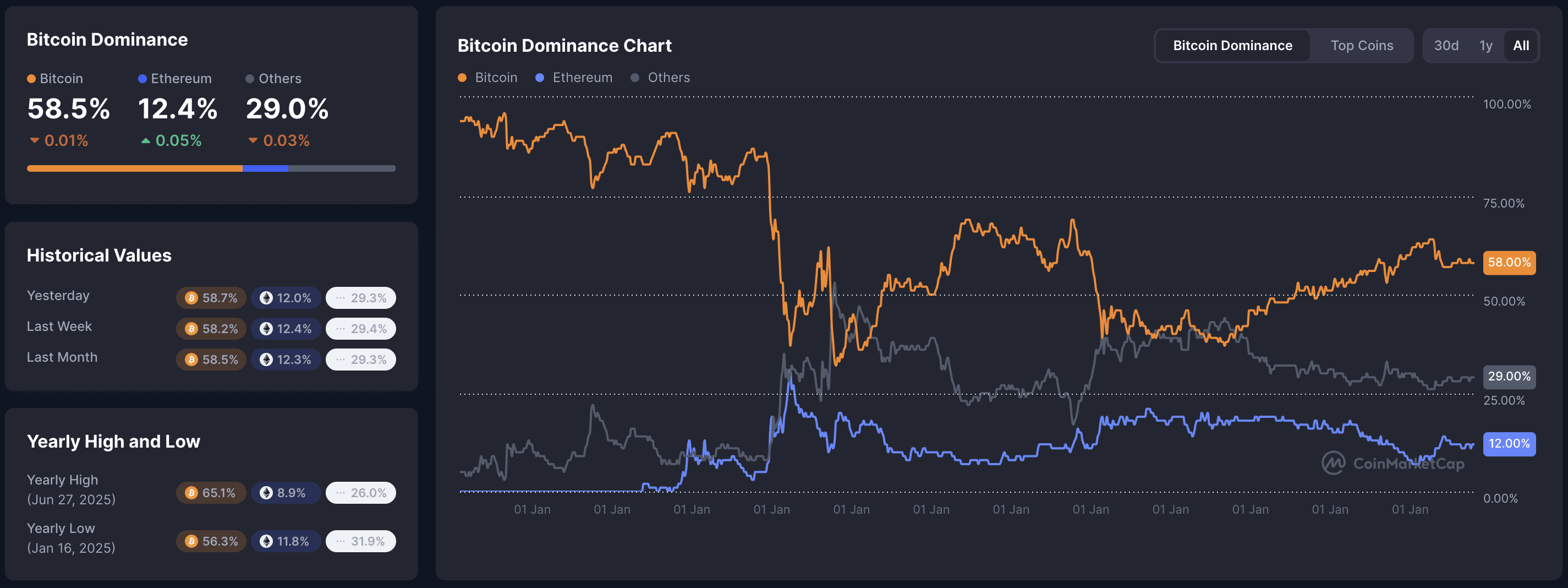

The core narrative is clear: softer inflation plus visible progress on the U.S. CLARITY Act is shifting crypto back toward risk-on. Bitcoin broke out of its recent $88.5K-$92K consolidation range as futures open interest rose above $138B, signalling positioning shifts and methodical buying rather than euphoric blow-off behaviour.

Traders now see a path where policy risk becomes about rules-of-the-road instead of existential bans, which is exactly the environment where capital reaches further out into altcoins.

📰 Top News

CPI benign, supports soft-landing: December inflation at 2.7% headline / 2.6% core keeps rate-cut expectations alive and boosts risk assets broadly.

CLARITY Act text advances: Senate Banking Committee published text, pushing toward clear market-structure rules instead of ad-hoc enforcement – medium-term positive for regulated venues.

Bitcoin breaks above $95K: BTC surged past $95K after weeks of consolidation between $88.5K-$92.5K – pattern suggests controlled positioning rather than speculative excess.

Altcoins see selective, not broad-based, rotations: Largest moves in privacy and smaller caps, showing traders adding risk selectively rather than blindly chasing beta.

📚 Education Bits

💡 Pro Tip: On macro-driven days, start prep with BTC, ETH, and total cap charts on 4h or 1d – first reaction often sets the tone for the entire session.

🔍 Did You Know? A neutral Fear & Greed reading (40-50 band) is where trend breaks become most interesting – positioning not stretched in either direction, so moves travel further before sentiment flips extreme.

📊 Daily Wrap-Up

January 13 was a controlled risk-on session: macro cooperated, regulatory headlines improved, and crypto responded with higher prices but without late-stage froth. Bitcoin's breakout above $95K and neutral sentiment suggest dry powder on sidelines, while privacy and high-beta pops show traders willing to reach for upside again.

Today's Watch List: Follow-through after inflation print, BTC behavior around $94K-$95K support zone, and CLARITY Act headlines – those shape intraday direction.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.