Jan 28, 2026

🍪 Today's Snack

Crypto pushed higher into the Fed meeting, with ETH leading and Hyperliquid staying the hottest tape. The “hard-asset” bid is still loud via tokenized gold.

📈 24h Crypto Market Snapshot

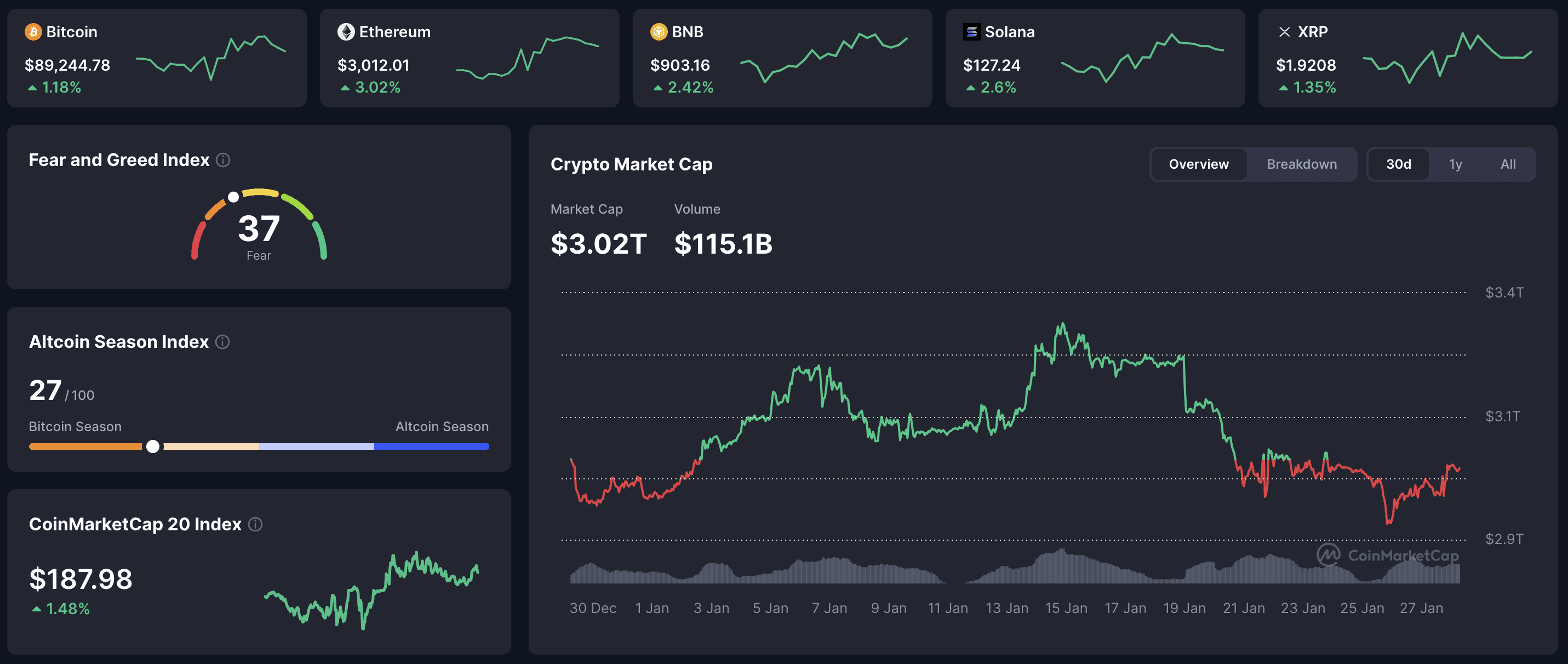

Total crypto market cap rose to $3.02T while Fear & Greed held at 37 (Fear), so this still reads like a cautious bounce.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $89,244 | +1.18% | $1.78T |

ETH | $3,012 | +3.02% | $363B |

BNB | $903 | +2.42% | $123B |

SOL | $127 | +2.60% | $72B |

HYPE | $33.76 | +24.59% | $10B |

Grind up – majors lifted steadily, but the real decision is still Powell.

🔥 Top 3 Movers & Shakers

Hyperliquid (HYPE) – +23.9%

HYPE jumped as HIP-3 hit $790M open interest and commodities activity spiked, with silver futures surging in volume.

Takeaway: If “everything perps” sticks, the fee-to-buyback flywheel stays a tailwind.River Protocol (RIVER) – -18.2%

RIVER dropped after its ATH $87.73 as emissions doubled at the “Day 90” milestone and profit-taking hit the parabolic move.

Takeaway: Higher emissions plus centralization and leverage worries keep this in binary territory.Tether Gold (XAUT) – +3.7%

XAUT rose with spot gold pushing past $5,100 as Tether disclosed additional gold purchases and larger reserves backing the token.

Takeaway: Tokenized hard assets look like the cleanest risk-off trade inside crypto rails right now.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $147M in net outflows on 2026-01-23, while Ethereum ETFs saw $63M outflows.

Flow read: Monday’s small inflow print snapped a long outflow streak, but Tuesday’s conflicting outflow report suggests institutions are still waiting for rate-path clarity.

🌍 Market Context (Macro + On-Chain)

Macro Pulse: Gold extended its run as the Fed meeting began, while resilient U.S. data kept the “no hurry to cut” vibe intact. Trump’s tariff threats returned, adding another layer of headline risk.

On-Chain Highlights: Whale accumulation showed up even as sentiment stayed in Fear, and Strategy continued buying despite the choppy tape. The split is clear: bigger players are positioning, while the crowd remains cautious.

🔍 Deep Dive – Hyperliquid’s $790M Commodities Boom: Why HYPE Surged While BTC Waits

HYPE’s move is less about “alt momentum” and more about what traded on the platform. HIP-3 open interest hit an all-time high of $790M, and silver perps became one of the most active markets, printing $1.25B in 24-hour volume and $155M in open interest.

That matters because it reframes Hyperliquid as a venue for macro hedging, not just crypto-native leverage. HIP-3 also makes expansion structural: markets can be deployed permissionlessly by locking HYPE, so the asset menu can keep widening.

The token mechanics are the other half of the story. Hyperliquid routes 97% of trading fees to the Assistance Fund for automated HYPE buybacks, with $644.64M reportedly repurchased in 2025, and validators voted to burn ~37.5M HYPE in December 2025.

What it suggests: If commodities flow remains consistent post-Fed, HYPE becomes a direct bet on “real volume” converting into token support.

📰 Top News

U.S. banks and Bitcoin: River says major U.S. banks are rolling out Bitcoin products, reinforcing the mainstream services shift.

Tether Gold (XAUT): Tether expanded XAUT’s gold-backed footprint as tokenized gold demand stayed strong.

UBS: UBS opened direct spot BTC and ETH trading for high-net-worth clients, signaling a major wealth-channel pivot.

Yield-bearing gold: Theo launched a yield-bearing tokenized gold product, pushing “gold with carry” into DeFi rails.

CLARITY Act: U.S. committees rescheduled markups, keeping regulation as a near-term sentiment lever.

📚 Education Bits

💡 Pro Tip: On event-risk days, separate “headline pumps” from “flow pumps” by watching whether open interest rises alongside spot strength.

📊 Metric Explained: Market share by open interest can reveal where price discovery is migrating, especially when non-crypto contracts start competing with majors.

📊 Daily Wrap-Up

This was a clean grind-up session led by ETH, with HYPE still trading like a standalone narrative. The big question is whether today’s post-Fed tape brings follow-through, or just another volatility reset.

Today's Watch List: The Fed decision and Powell’s press conference, plus whether commodities-led activity on Hyperliquid stays elevated after the event passes.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.