Jan 29, 2026

🍪 Today's Snack

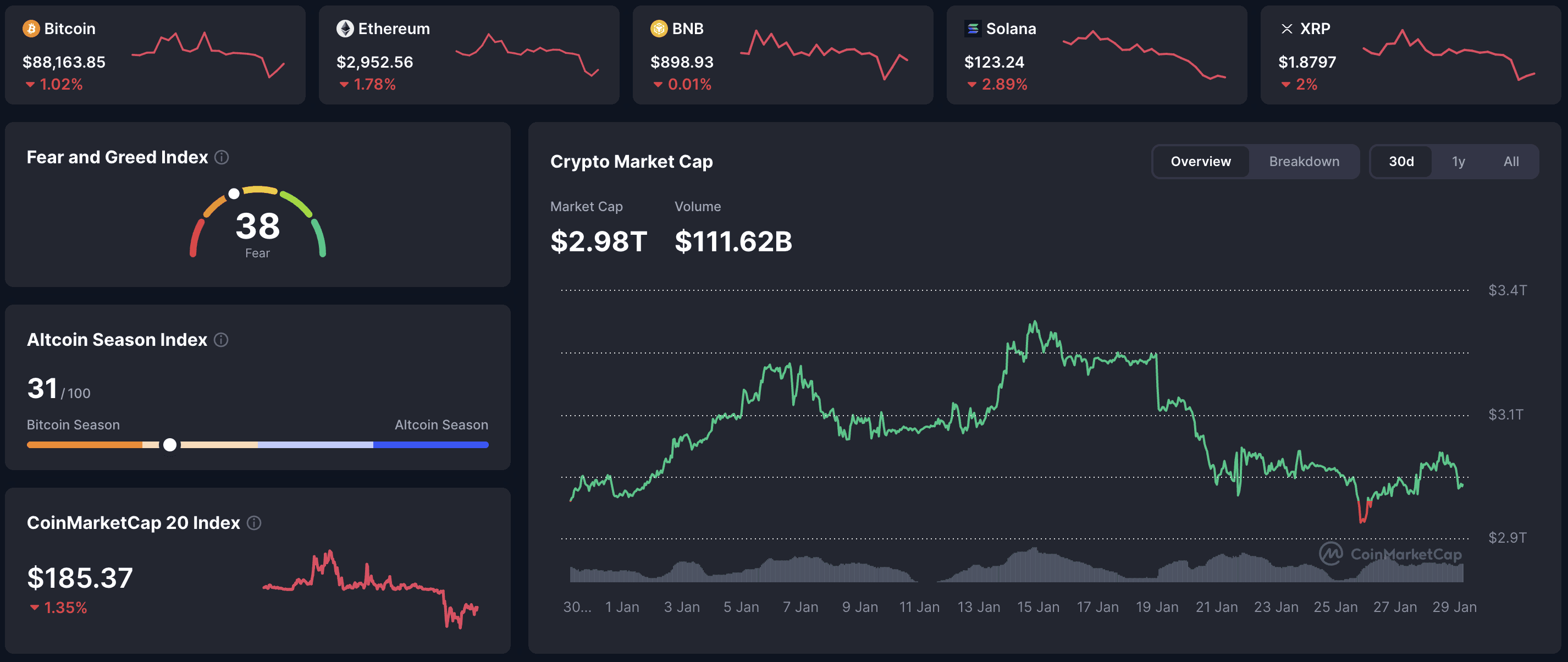

Crypto slipped after the Fed held rates steady, with dollar weakness lifting gold more than Bitcoin. Sentiment stayed in Fear, and flows still look tentative.

📈 24h Crypto Market Snapshot

Total crypto market cap slipped to $2.98T while Fear & Greed ticked to 38 (Fear), keeping the mood cautious.

Asset | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

BTC | $88,163 | -1.02% | $1.76T |

ETH | $2,952 | -1.78% | $356B |

BNB | $898 | -0.01% | $122B |

SOL | $123 | -2.89% | $69B |

ADA | $0.35 | -1.83% | $12B |

Selloff – a controlled risk-off fade as Fed + DXY crosscurrents kept buyers hesitant.

🔥 Top 3 Movers & Shakers

Worldcoin (WLD) – +12%

WLD jumped on reports OpenAI may explore biometric verification, including Worldcoin’s Orb, for a bot-resistant social network.

Takeaway: Proof-of-personhood is back in focus, but this move looks headline-driven without confirmed terms.Zcash (ZEC) – -6.9%

ZEC fell after 200,000 ZEC was unshielded and a whale moved $35.75M worth of ZEC to Binance.

Takeaway: Unshielding often precedes selling, hinting at distribution pressure despite the SEC closing its Zcash review without enforcement action on January 14.FIGHT – -12.9%

FIGHT dropped as post-airdrop selling followed its January 22 Binance Alpha listing, with extreme turnover after the launch pump.

Takeaway: Classic post-listing distribution, with low circulating supply and high velocity keeping swings sharp.

🏦 ETF & Institutional Flows

Bitcoin spot ETFs recorded $19M in net outflows on 2026-01-23, while Ethereum ETFs saw $28M inflows.

Flow read: Modest interest after a brutal selloff, with institutions testing support but conviction still fragile after the five-day exodus you noted.

🌍 Market Context

Macro Pulse: The Fed held rates at 3.5%–3.75% as equities pushed higher and gold hit a new ATH above $5,300 on a weaker dollar. Trump’s dollar comments and tariff noise kept macro uncertainty elevated.

On-Chain Highlights: BTC exchange reserves rose 0.20% over January 21–27 while stablecoin supply kept contracting, which points to tighter liquidity and more “sell-side availability” on exchanges.

🔍 Deep Dive – Crypto crime is shifting to ops failures

2025’s biggest crypto losses are increasingly about custody and operational security, not just smart-contract bugs. TRM Labs says illicit crypto volume hit $158B in 2025, with sanctions volume now the majority, while Chainalysis estimates at least $154B (up 162% YoY) driven mainly by sanctioned entities.

Losses also concentrated: TRM says $2.87B was stolen across nearly 150 hacks, with the Bybit breach at $1.46B (51% of the total). And it’s not just exchanges – on January 28, Reuters reported the U.S. Marshals Service is investigating a possible breach of government digital-asset accounts, after an on-chain investigator alleged over $60M was stolen from seizure wallets in late 2025.

What it suggests: The main attack surface is now key management and the human/process layer, where one failure can dominate an entire year.

📰 Top News

Fed + markets: The Fed held rates while equities stayed strong, but crypto faded and gold kept leading the hard-asset trade.

Tether + gold: Tether said it will allocate 10%–15% of its portfolio to gold (and 10% to Bitcoin), reinforcing tokenized-gold momentum.

Stablecoins: ERC-20 stablecoin supply fell over the past week, signaling tighter on-chain liquidity.

U.S. government wallets: The U.S. Marshals Service is probing a possible breach of government digital-asset accounts, raising custody questions.

📚 Education Bits

💡 Pro Tip: When DXY drops and BTC doesn’t respond, treat it as a sentiment tell – the market may be pricing “risk-off” over “debasement.”

📊 Metric Explained: In privacy coins, “unshielding” is an early signal because it turns private balances into transparent ones that can be sent to exchanges.

📊 Daily Wrap-Up

Crypto took a step back even as equities held up and the dollar weakened, which kept gold in the driver’s seat. With stablecoin supply shrinking and flows still mixed, upside likely needs a clearer liquidity tailwind.

Today's Watch List: Watch whether DXY weakness finally translates into BTC strength, and whether stablecoin contraction continues or stabilizes.

Read more on websnack.org – free daily alpha in under 5 minutes.

P.S. 4-6 min read. Free daily alpha. Unsubscribe anytime.

© Web Snack 2026.

This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research and make independent decisions.